Jersey City New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

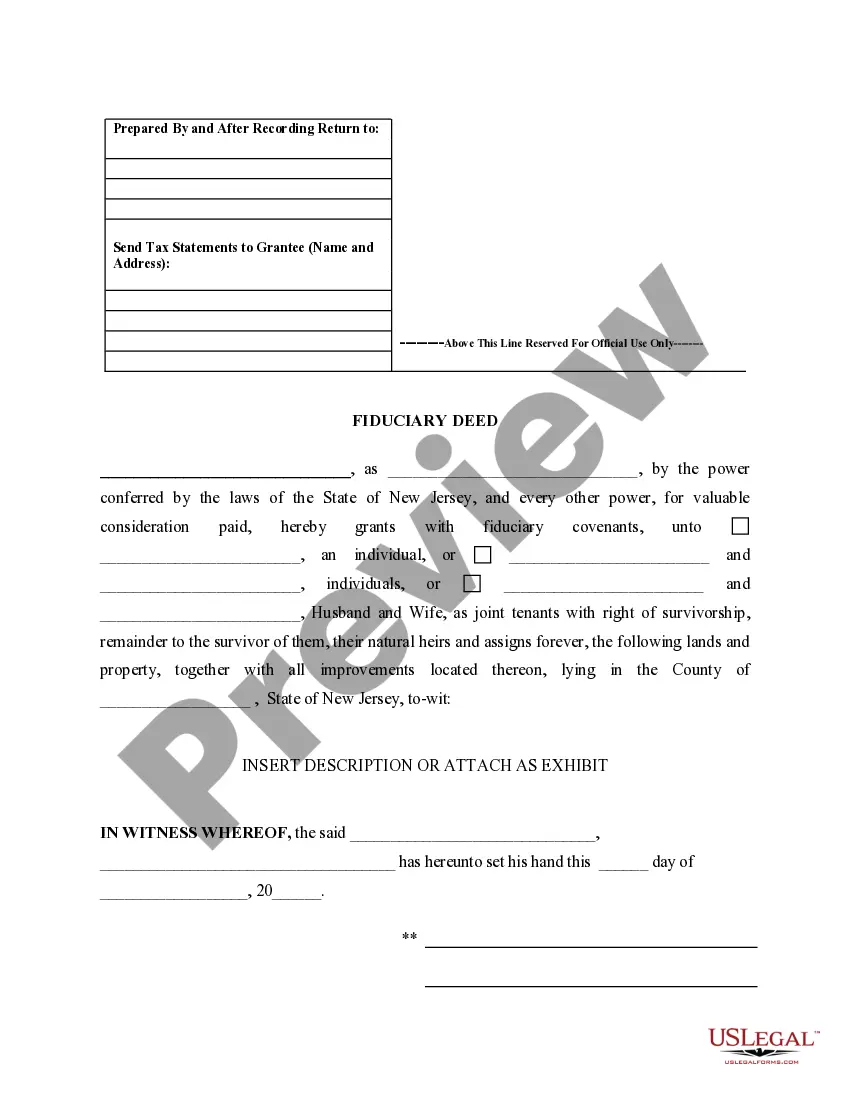

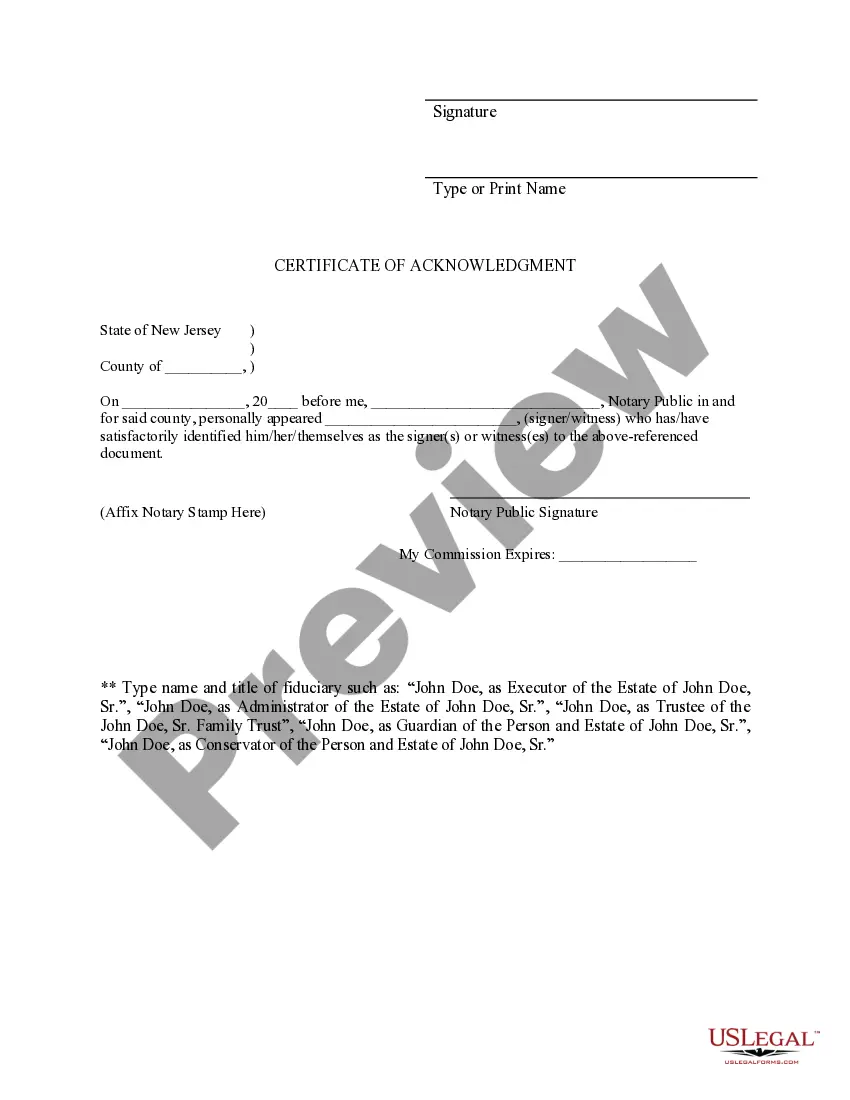

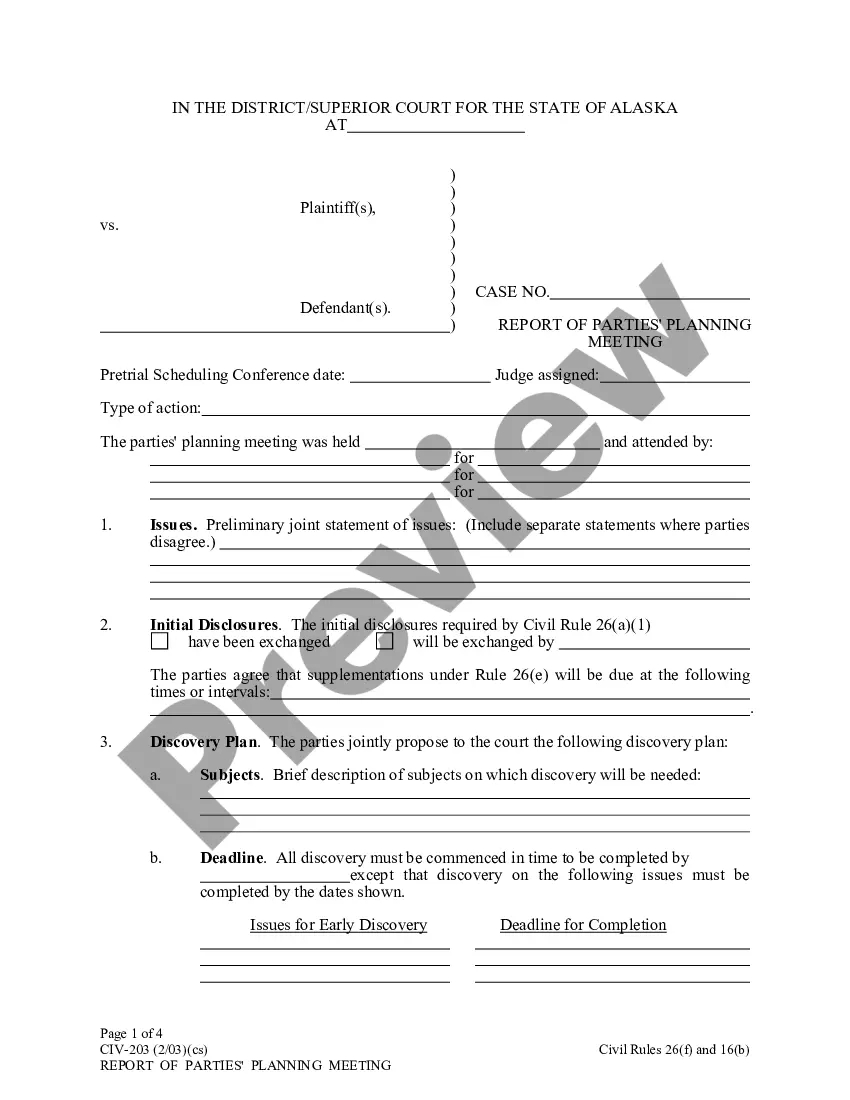

How to fill out New Jersey Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Regardless of social or occupational standing, finalizing legal documents is a regrettable requirement in modern society.

Frequently, it’s nearly impossible for someone lacking legal expertise to create this type of documentation from the ground up, primarily due to the intricate terminology and legal nuances involved.

This is where US Legal Forms steps in to assist.

Ensure the template you have located is appropriate for your region, as the laws of one state or county may not be applicable to another.

Preview the document and review a brief summary (if available) of scenarios for which the document can be utilized.

- Our service provides an extensive library with over 85,000 pre-prepared state-specific documents suitable for nearly any legal scenario.

- US Legal Forms also serves as an excellent tool for associates or legal advisors seeking to enhance their efficiency by utilizing our DIY papers.

- Whether you require the Jersey City New Jersey Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries or any other documentation applicable in your jurisdiction, US Legal Forms has you covered.

- Here’s how to swiftly obtain the Jersey City New Jersey Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries using our reliable service.

- If you are already a registered customer, you can go ahead to Log In to your account to access the relevant form.

- However, if you are new to our platform, make sure to follow these instructions before downloading the Jersey City New Jersey Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

Form popularity

FAQ

Yes, trusts can be subject to New Jersey inheritance tax, depending on the trust's beneficiaries and configuration. Generally, if the trust benefits certain classes of beneficiaries, such as siblings or friends, the inheritance tax may apply. In contrast, transfers to close relatives are typically exempt. Understanding this aspect is crucial when handling the Jersey City New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, as it influences estate planning strategies.

The 1041 form in New Jersey is the U.S. Income Tax Return for Estates and Trusts. It reports income, deductions, and tax liabilities for estates or trusts, specifically for those that have generated income during their fiscal year. Executors, trustees, and other fiduciaries involved in administering the estate must ensure they file this form accurately. This requirement is vital when dealing with the Jersey City New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, as it ensures compliance with tax obligations.

The requirements for a trust in New Jersey include having a written document that outlines the trust's terms and conditions, appointing a trustee, and defining beneficiaries with their rights. Additionally, the trust document must comply with state laws to be legally binding. Properly funding the trust and maintaining good records are also crucial. Engaging with the Jersey City New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can provide insights on fulfilling these requirements successfully.

To establish a trust, you must meet several prerequisites, such as having a clear intention to create the trust, a designated trustee, and identifiable beneficiaries. Furthermore, assets need to be included in the trust to make it effective. It is also beneficial to have documentation that reflects these details securely. Leveraging the Jersey City New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can ensure that these requirements are met appropriately.

Yes, in New Jersey, certain trusts may be subject to inheritance tax. The tax typically depends on the relationship between the deceased and the beneficiaries, as well as the value of the assets. It’s essential to understand which assets are included to avoid surprises. The Jersey City New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries may provide guidance on navigating these tax responsibilities.

The NJ 1041SB is a supplemental return for a New Jersey estate or trust that includes specific details about taxable income. This form allows fiduciaries to report special circumstances or additional income not covered in the standard NJ 1041. Completing this form accurately ensures compliance with state regulations, thereby avoiding complications. Utilizing the Jersey City New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can streamline compliance.

In New Jersey, the NJ 1041 is required to be filed for estates or trusts that have gross income exceeding $1,000. Executors and trustees must gather the necessary documentation and submit this form within the appropriate tax filing period. Failing to file can result in penalties and interest, so it’s wise to be diligent. Understanding the implications of a Jersey City New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can help fulfill this requirement efficiently.

One major mistake parents make is failing to fund the trust appropriately. Simply establishing a trust does not automatically transfer assets into it, leading to potential complications later. It's essential to actively retitle assets and update beneficiary designations. Using the Jersey City New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can facilitate this process.

In New Jersey, a trust must be created in writing and clearly outline the grantor's intentions regarding their assets. It's crucial that the trustee administers the trust according to these terms. Additionally, beneficiaries must be clearly identified, ensuring they receive their rightful benefits. For those involved, understanding the Jersey City New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can clarify responsibilities.

Executor misconduct in New Jersey may include improperly handling estate assets, favoritism among beneficiaries, or failing to file necessary tax documents. Failing to keep beneficiaries informed can also qualify as misconduct. Such actions can jeopardize the executor's standing and result in legal consequences, emphasizing the importance of maintaining integrity.