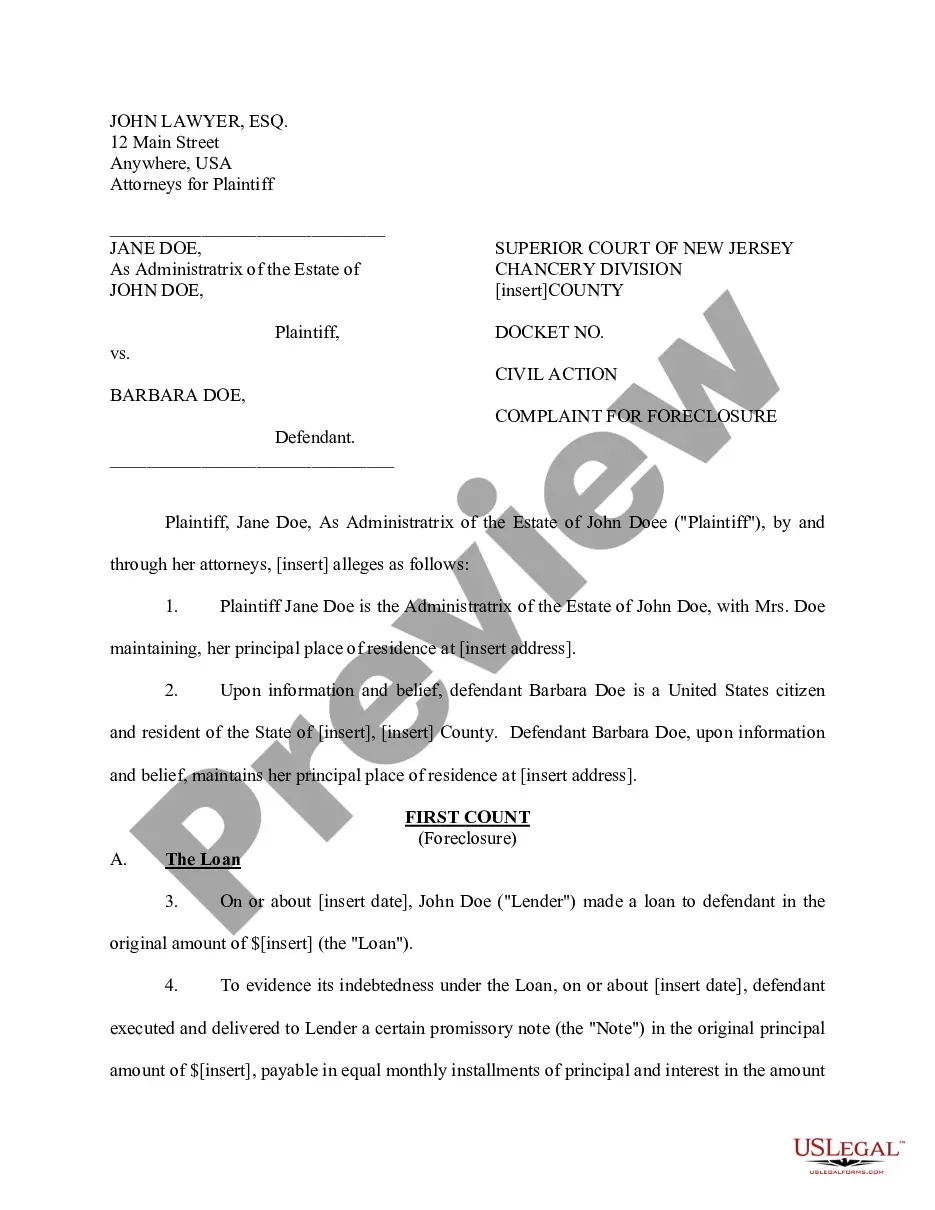

This form is a Complaint to Foreclose on a Residential Mortgage for use in foreclosure proceedings within the state of New Jersey.

Jersey City New Jersey Complaint to Foreclose Residential Mortgage

Description

How to fill out New Jersey Complaint To Foreclose Residential Mortgage?

Regardless of social or professional standing, completing legal documents is a regrettable requirement in today's society.

It is often nearly impossible for individuals without legal expertise to draft such documents from the ground up, largely due to the complex terminology and legal subtleties involved.

This is where US Legal Forms proves to be beneficial.

Ensure that the template you have selected is appropriate for your area, as the regulations of one state or county may not apply to another.

Review the document and consult a brief overview (if available) of the situations for which the form can be utilized.

- Our platform offers an extensive repository of over 85,000 ready-to-use state-specific templates that cater to nearly every legal situation.

- US Legal Forms serves as an outstanding tool for associates or legal advisors who wish to save time by utilizing our DIY documents.

- Whether you require the Jersey City New Jersey Complaint to Foreclose Residential Mortgage or any other form that fits your state or county, US Legal Forms has everything at your disposal.

- Here’s how to obtain the Jersey City New Jersey Complaint to Foreclose Residential Mortgage swiftly using our dependable service.

- If you are an existing subscriber, you can simply Log In to your account to download the desired document.

- However, if you are new to our site, please follow these instructions before downloading the Jersey City New Jersey Complaint to Foreclose Residential Mortgage.

Form popularity

FAQ

The process of foreclosure in Jersey City, New Jersey, typically unfolds in six distinct phases. Initially, the lender sends a notice of default to the homeowner, signaling the start of the delinquency period. Next, the lender files a Jersey City New Jersey Complaint to Foreclose Residential Mortgage, moving the case to court. After this, the court may issue a judgment, allowing the lender to proceed with a sales notice. Following that, a public auction is held to sell the property and recover the owed amount. Lastly, the new owner takes possession, and the previous homeowner may have a short window to vacate the property. For those facing such challenges, USLegalForms can help navigate the foreclosure process legally and effectively.

In New Jersey, a notice of intent to foreclose is a formal document sent to homeowners indicating that the lender plans to initiate foreclosure proceedings on their residential mortgage. This notice typically comes after missed payments and serves as a warning to the homeowner. Understanding the Jersey City New Jersey Complaint to Foreclose Residential Mortgage is essential, as this document outlines the next steps and gives the homeowner an opportunity to address the issue. By utilizing resources like Uslegalforms, you can access forms and guidance tailored to navigate this complex process effectively.

Responding to a motion related to a Jersey City New Jersey Complaint to Foreclose Residential Mortgage requires careful attention to the details of the motion. You must file your response with the court before the deadline specified in the motion. It’s essential to articulate your position clearly and substantiate your arguments with evidence. Legal resources can provide guidance on how to structure your response effectively.

Yes, you can dispute a Jersey City New Jersey Complaint to Foreclose Residential Mortgage if you believe the lender has not followed proper legal procedures or if there are inaccuracies in the claim. Prepare your dispute by collecting evidence and addressing any errors in the complaint. Legal support can be valuable during this process, so consider reaching out to experts who can help you challenge the foreclosure effectively.

To file an answer to a foreclosure complaint in Jersey City, you must prepare your documents according to court requirements. Clearly state your defenses and any counterclaims you may have. After filing at the court, send a sealed copy to the plaintiff, typically the lender. Familiarizing yourself with the process can ease navigation through these legal waters.

Filing an answer to a Jersey City New Jersey Complaint to Foreclose Residential Mortgage involves drafting a formal response that addresses each point in the complaint. You need to file this answer with the court where the case is pending and serve a copy to the lender or their attorney. Make sure to adhere to local rules regarding formatting and deadlines to ensure your response is valid.

To defend a Jersey City New Jersey Complaint to Foreclose Residential Mortgage, you must first review the complaint carefully. Gather evidence to support your defense, such as payment records and correspondence with your lender. It’s crucial to respond within the required timeframe and consider seeking legal assistance to navigate the complexities of your defense.

Filing a foreclosure in New Jersey involves preparing and submitting a Jersey City New Jersey Complaint to Foreclose Residential Mortgage to the court. This process requires gathering necessary documentation, including proof of debt and ownership details. Ensuring that all paperwork is correct can streamline the process. Legal platforms like UsLegalForms can provide templates and guidance to help you file accurately and efficiently.

The New Jersey Fair Foreclosure Act provides protections for homeowners facing foreclosure. This act ensures that borrowers receive adequate notice and opportunities to respond to foreclosure proceedings. Understanding this act can equip you with the necessary knowledge to navigate a Jersey City New Jersey Complaint to Foreclose Residential Mortgage with confidence. Utilizing platforms dedicated to legal assistance can also guide you through each step.

A complaint in a mortgage foreclosure is a formal legal document filed by the lender against the borrower. This document initiates the foreclosure process and outlines the debt owed, along with the lender's intention to reclaim the property. Responding promptly to this complaint is crucial for the borrower to protect their interests. Engaging with experienced legal resources can be beneficial in formulating a response.