Tennessee Garnishment (Fieri Facias)

Description

How to fill out Tennessee Garnishment (Fieri Facias)?

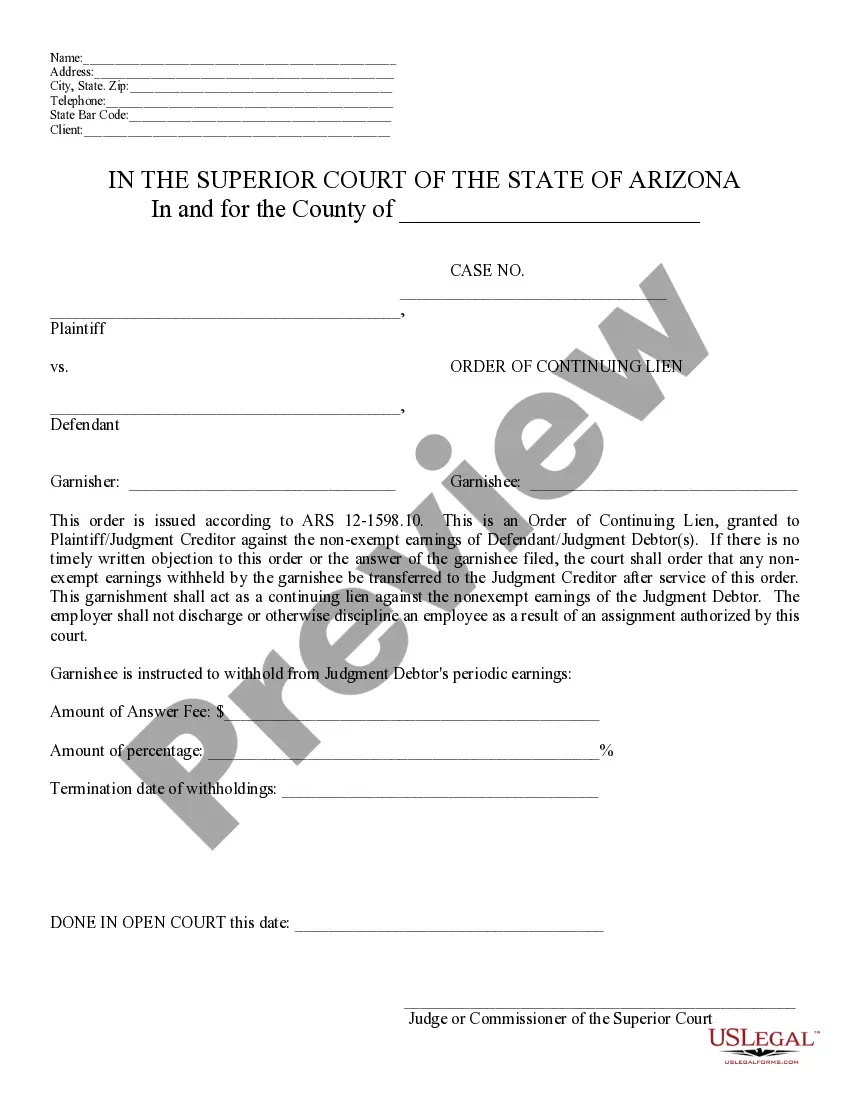

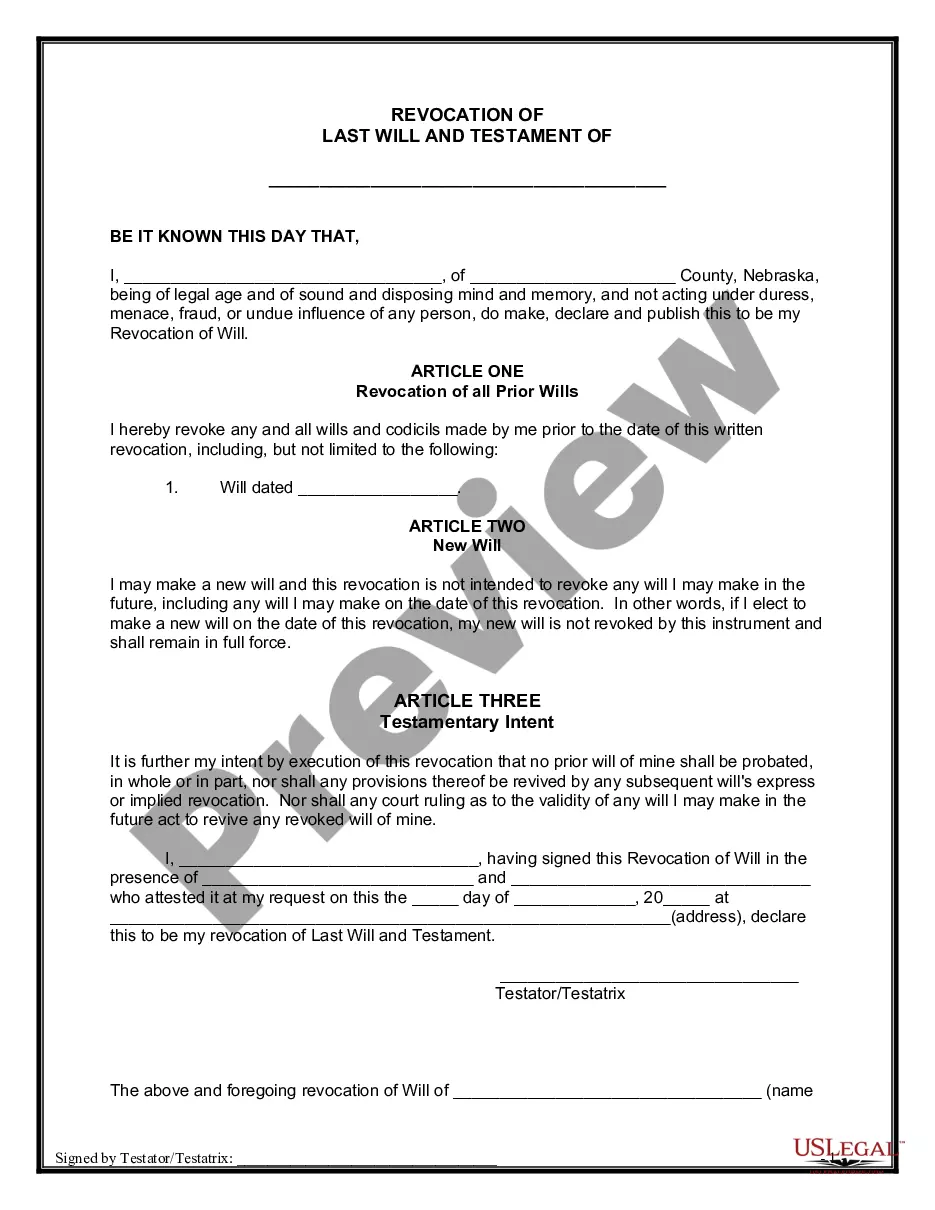

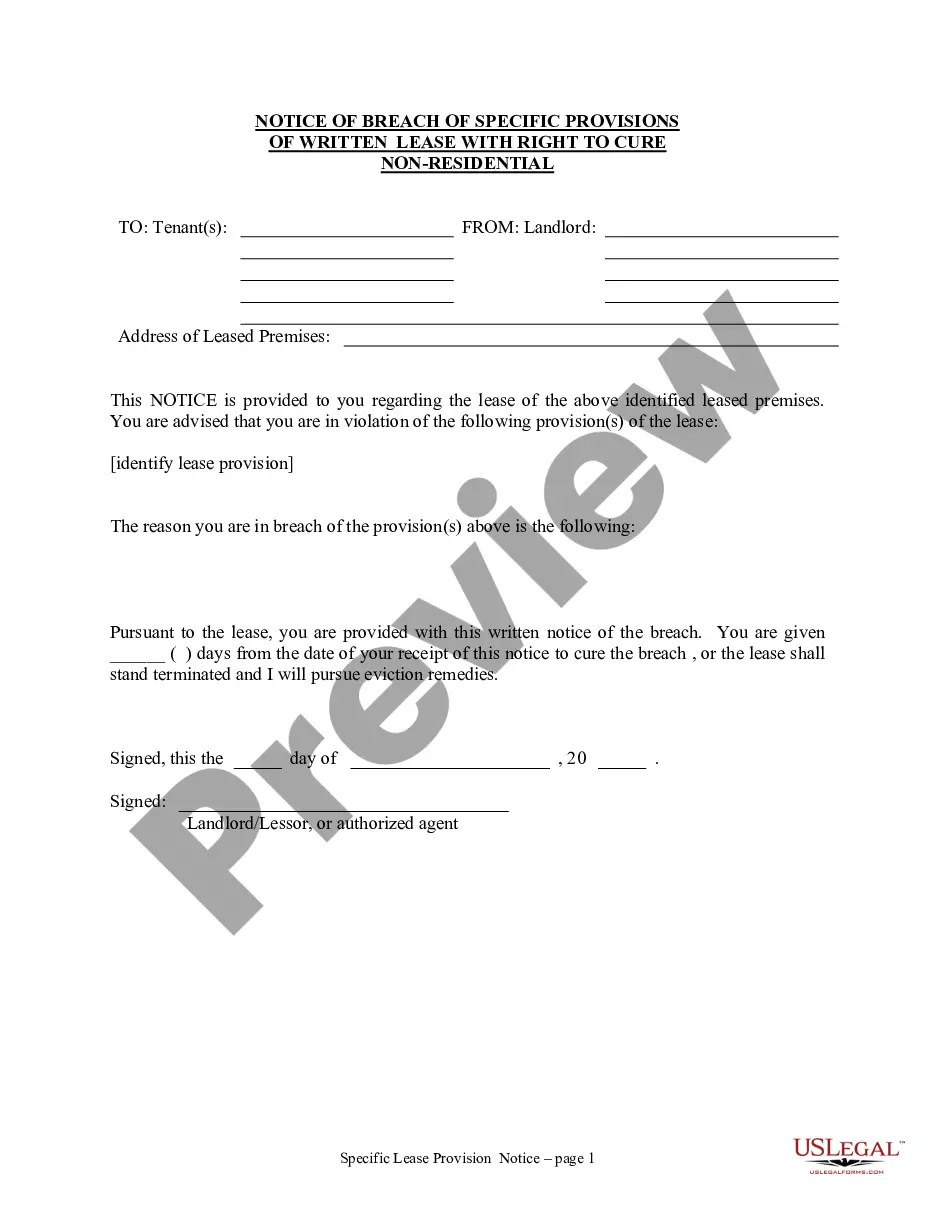

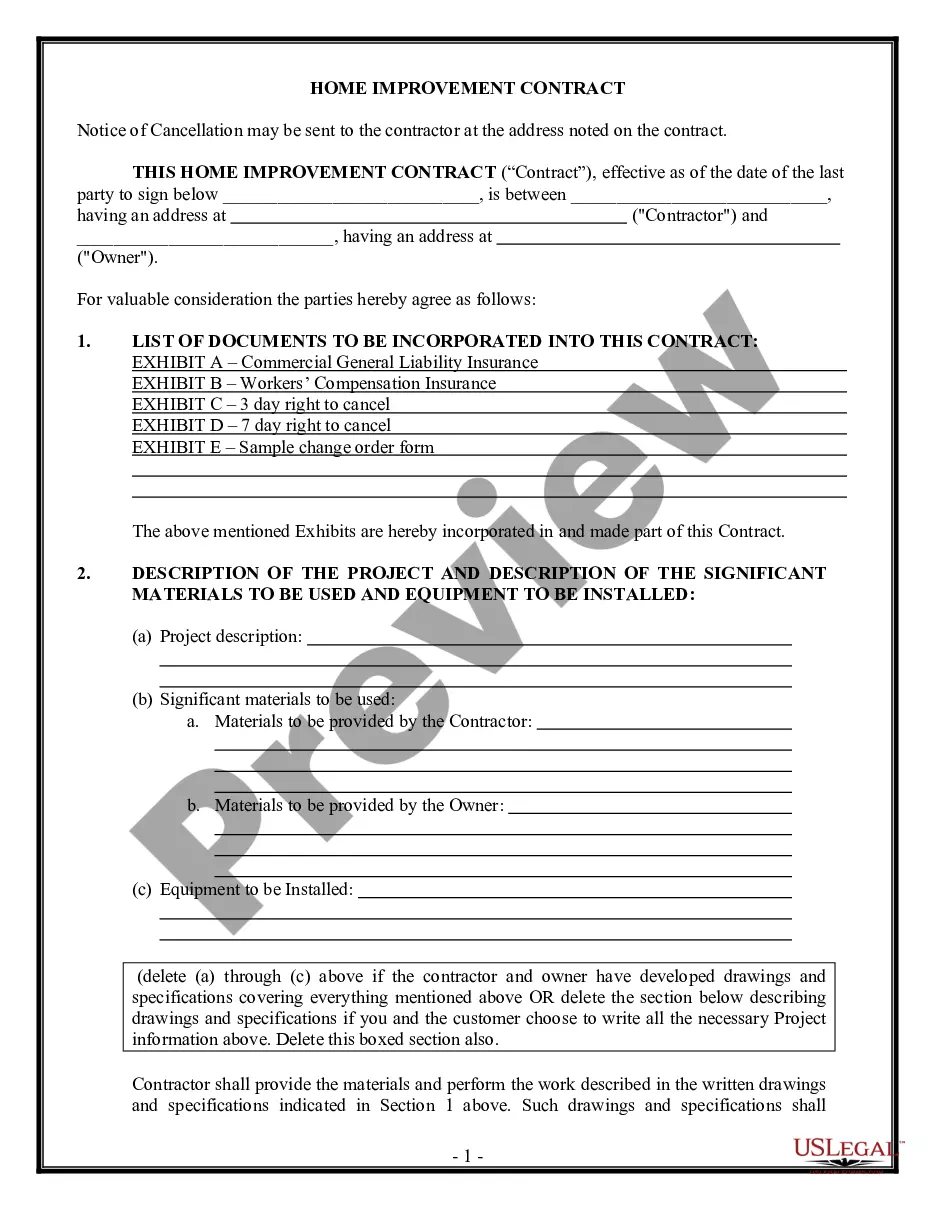

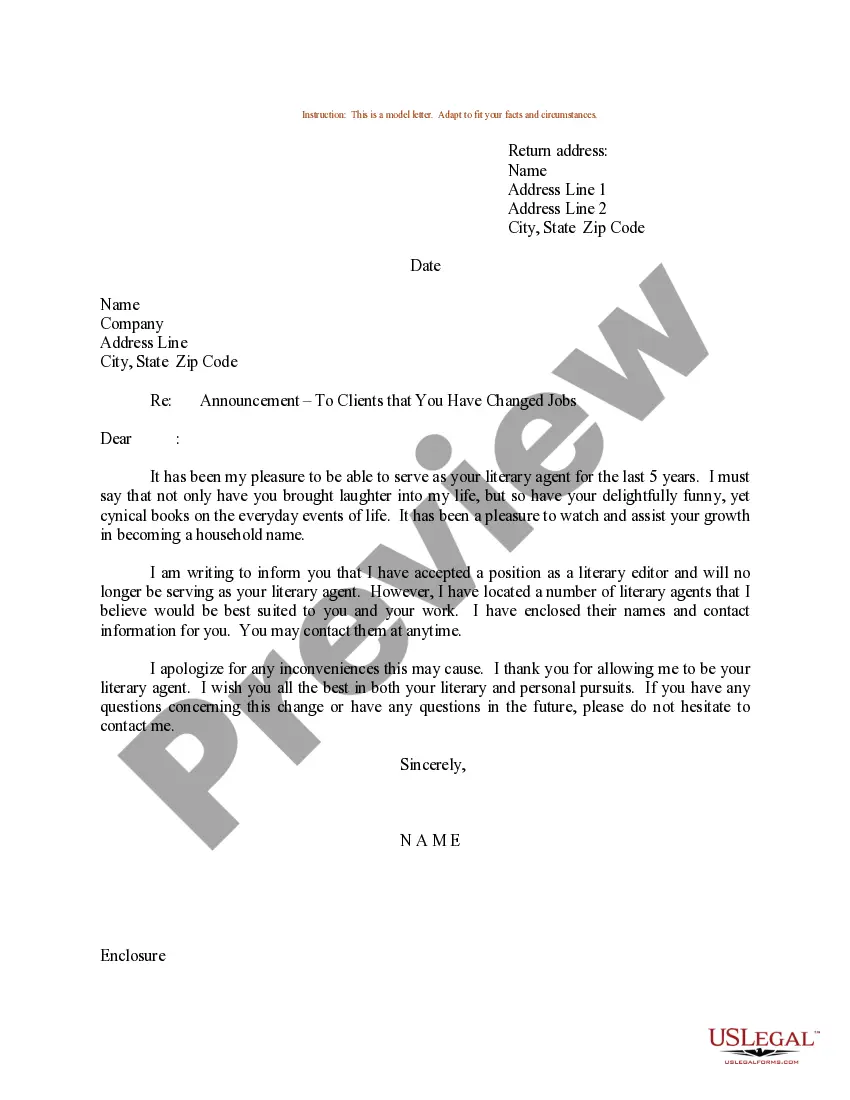

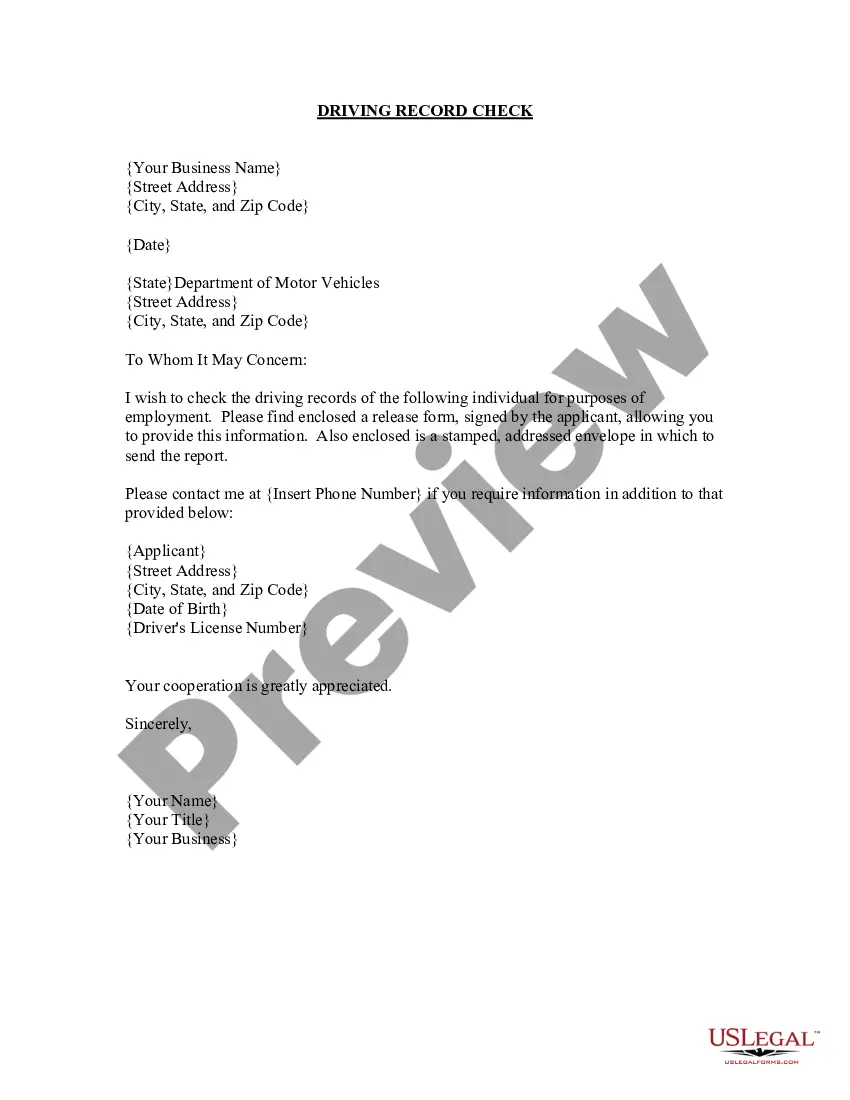

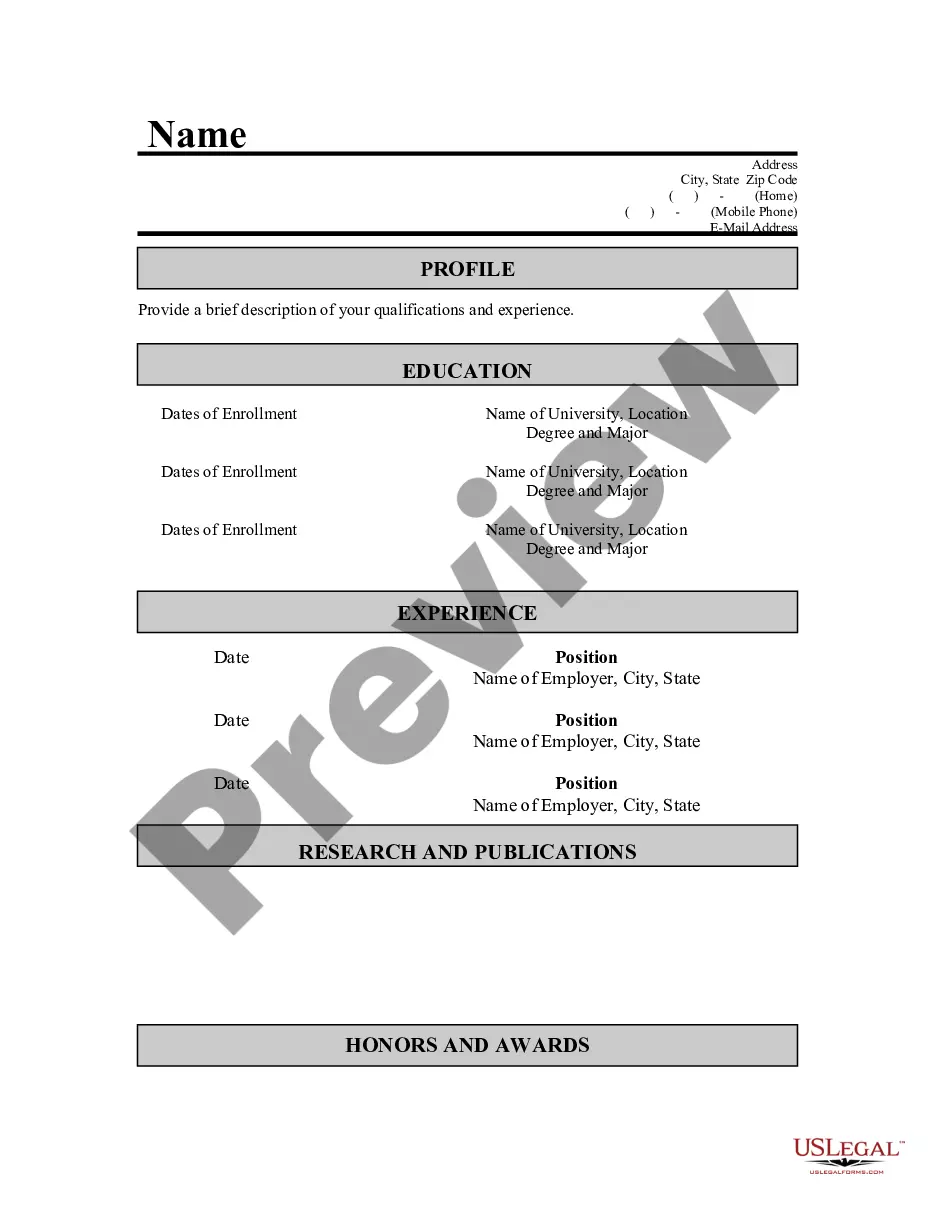

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state laws and are verified by our experts. So if you need to prepare Tennessee Garnishment (Fieri Facias), our service is the best place to download it.

Obtaining your Tennessee Garnishment (Fieri Facias) from our library is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button after they locate the correct template. Afterwards, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick instruction for you:

- Document compliance verification. You should attentively review the content of the form you want and ensure whether it suits your needs and complies with your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now once you see the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Tennessee Garnishment (Fieri Facias) and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673).

You may apply to the court at the clerk's office shown below within twenty (20) days from any improper withholding of your wages for a motion to stop the garnishment. The court clerk identified below shall provide you with a form for making such a motion, or may have supplied a form motion on the back of this notice.

Execution.? every process or writ whereby the judgments and decrees of Courts are enforced.? (an Encyclopedia of Tennessee Law) says: ?An execution issues, as a matter of course, upon a judgment for a specific sum of money, without any order awarding or directing its issuance in express terms.?

Specifically, Rule 69.04 of the Tennessee Rules of Civil Procedure provides that: Within ten years from the entry of a judgment, the creditor whose judgment remains unsatisfied may file a motion to extend the judgment for another ten years.

Within ten days of service, the garnishee shall file a written answer with the court accounting for any property of the judgment debtor held by the garnishee. Within thirty days of service, the garnishee shall file with the court any money or wages (minus statutory exemptions) otherwise payable to the judgment debtor.

Limitations on garnishment Under the law, the most that can be garnished from your paycheck is the larger of: 25 percent of your disposable weekly earnings (i.e. earnings after deductions for taxes and other expenses); or. The amount by which your weekly disposable earnings exceeds 30 times the federal minimum wage.

You may apply to the court at the clerk's office shown below within twenty (20) days from any improper withholding of your wages for a motion to stop the garnishment. The court clerk identified below shall provide you with a form for making such a motion, or may have supplied a form motion on the back of this notice.

Both state and federal laws limit the amount of money that may be withheld from your weekly pay. The state and federal exemptions are nearly identical. Both Tennessee law and federal wage garnishment law limit the amount that can be garnished from a week's pay to the lesser of: 25% of your weekly disposable income.