Elizabeth New Jersey Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out New Jersey Dissolution Package To Dissolve Limited Liability Company LLC?

We consistently strive to reduce or evade legal repercussions when handling intricate legal or financial matters.

To achieve this, we seek legal services that are typically very expensive.

Nonetheless, not every legal issue is of equal complexity. Many of them can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it in the My documents section. The process is equally simple if you're unfamiliar with the website! You can create your account in just a few minutes.

- Our library empowers you to manage your affairs without hiring an attorney.

- We offer access to legal document templates that are not always available to the public.

- Our templates are specific to states and regions, which greatly eases the search process.

- Take advantage of US Legal Forms whenever you need to locate and download the Elizabeth New Jersey Dissolution Package to Dissolve Limited Liability Company LLC or any other document swiftly and securely.

Form popularity

FAQ

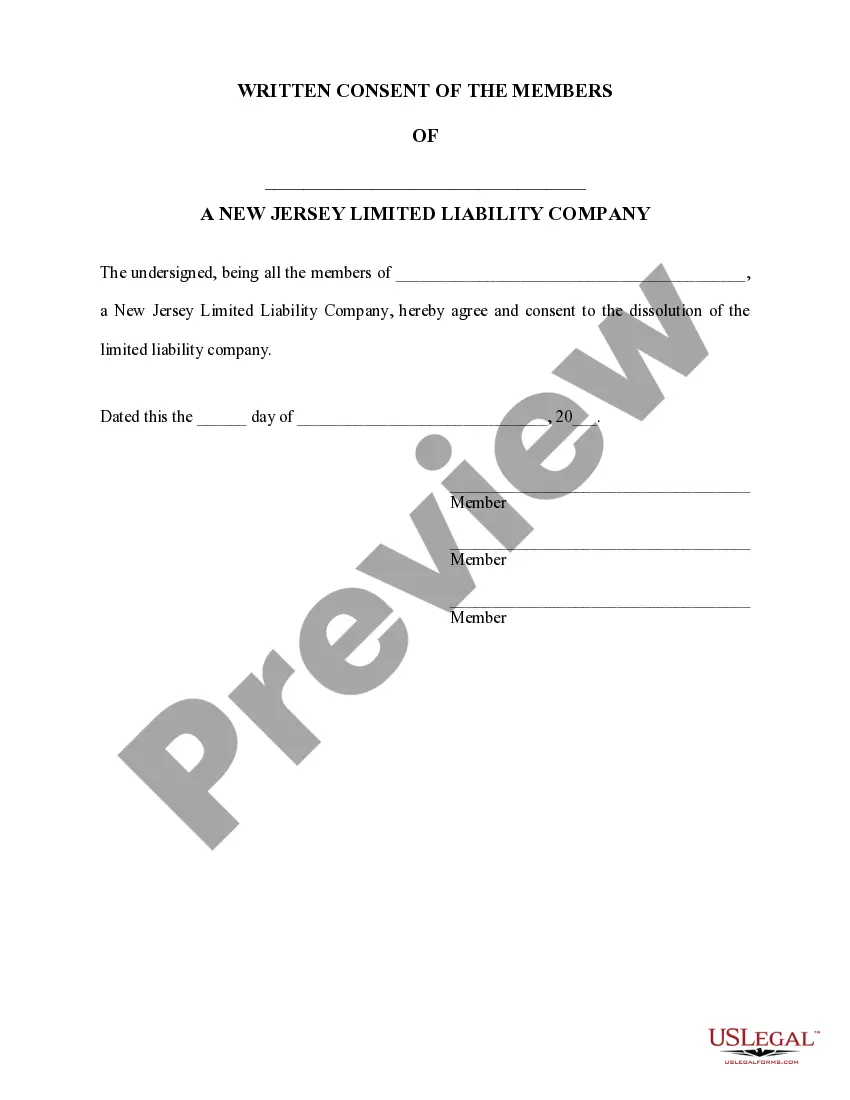

To dissolve your LLC in New Jersey, you will need to follow a specific process. First, gather the necessary documents and make sure all members agree to the dissolution. Then, file the appropriate paperwork with the New Jersey Division of Revenue and Enterprise Services. For a smooth process, consider using the Elizabeth New Jersey Dissolution Package to Dissolve Limited Liability Company LLC from uslegalforms, which provides step-by-step guidance and ensures that all legal requirements are met.

Dissolving an LLC has a few drawbacks that you should consider. It may limit your ability to conduct any business activities or retain rights to the company name in the future. Additionally, you must fulfill all obligations, including notifying creditors and filing final tax returns, which can be complicated. The Elizabeth New Jersey Dissolution Package to Dissolve Limited Liability Company LLC simplifies these processes, making it easier for you to navigate the dissolution.

Deciding whether to dissolve your LLC or leave it inactive depends on your future plans for the business. If you have no intention of reopening, dissolving your LLC is often the better choice to avoid unnecessary fees. Alternatively, if you think you might resume operations, keeping the LLC inactive can save time. The Elizabeth New Jersey Dissolution Package to Dissolve Limited Liability Company LLC can guide you through the steps to make an informed decision.

You should dissolve your LLC after filing your taxes for the year in which you operated the business. This approach allows for a complete financial overview and ensures that all tax obligations are met. Handling taxes first may help prevent confusion and complications during the dissolution process. Utilize the Elizabeth New Jersey Dissolution Package to Dissolve Limited Liability Company LLC for efficient management of your business closure.

Yes, you must notify the IRS if you close your LLC. It is important to file your final tax return and indicate that it is your last return for the business. By doing this, you will ensure that the IRS understands your business status and can manage your tax records accordingly. For a seamless process, consider using the Elizabeth New Jersey Dissolution Package to Dissolve Limited Liability Company LLC.

Dissolving an LLC may have tax implications that you need to consider. When you dissolve your LLC, you must file a final tax return and report any gains or losses from the sale of company assets. Additionally, any remaining profits will need to be distributed to members before dissolution, which can also impact personal taxes. Utilizing the Elizabeth New Jersey Dissolution Package to Dissolve Limited Liability Company LLC can help you navigate these complexities and ensure compliance with tax laws.

To dissolve an LLC partnership in NJ, first, review your operating agreement for any specific dissolution procedures. Once you have that information, you need to file a Certificate of Dissolution with the New Jersey Division of Revenue and Enterprise Services. Additionally, you should notify any creditors and settle all outstanding debts. Using the Elizabeth New Jersey Dissolution Package to Dissolve Limited Liability Company LLC can simplify this process and ensure you meet all legal requirements.

Before dissolving your LLC, take the time to review any existing contracts, settle debts, and notify members and stakeholders about the decision. It is crucial to wrap up any ongoing business affairs to ensure a clean break. Additionally, filing final tax returns can help you avoid future liabilities. The Elizabeth New Jersey Dissolution Package to Dissolve Limited Liability Company LLC can provide you with essential tools to navigate this important process effectively.

To dissolve an LLC in New Jersey, you must first file a Certificate of Dissolution with the New Jersey Division of Revenue and Enterprise Services. This document notifies the state that your LLC is no longer in business. Be sure to settle any outstanding debts and obligations before filing. For a smooth process, consider using the Elizabeth New Jersey Dissolution Package to Dissolve Limited Liability Company LLC, which guides you every step of the way.