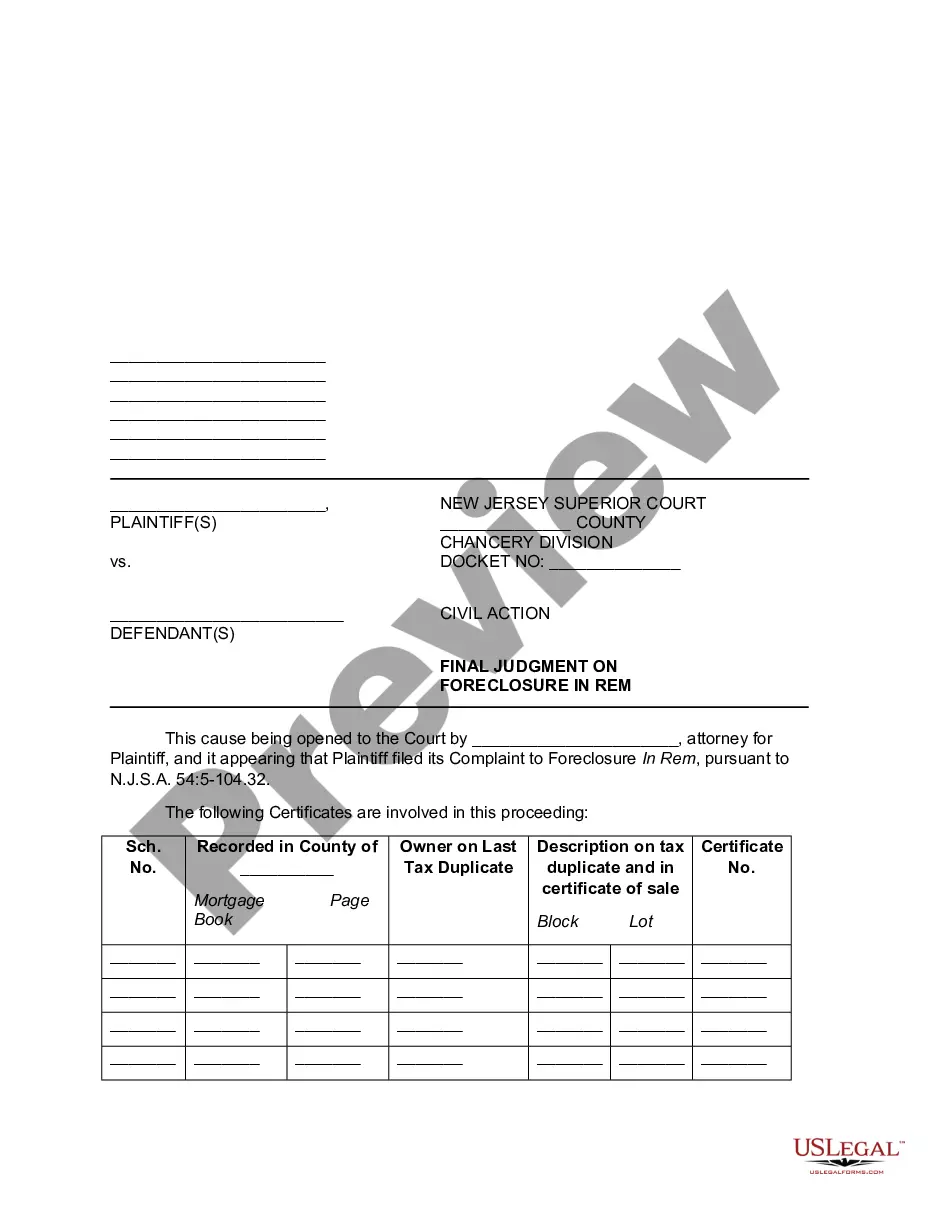

Paterson New Jersey Final Judgment on Foreclosure In Rem

Description

How to fill out New Jersey Final Judgment On Foreclosure In Rem?

Regardless of social or occupational position, completing law-related documentation is an unfortunate requirement in the current professional landscape.

Frequently, it is nearly unfeasible for an individual without legal training to construct such documents from scratch, primarily because of the complex language and legal subtleties they involve.

This is where US Legal Forms proves to be beneficial.

However, if you are not familiar with our platform, be sure to follow these instructions before downloading the Paterson New Jersey Final Judgment on Foreclosure In Rem.

Verify that the form you have located is valid for your region since the regulations of one state or county do not apply to another state or county.

- Our platform offers an extensive collection with over 85,000 state-specific forms that are applicable for virtually any legal situation.

- US Legal Forms also acts as a valuable asset for associates or legal advisors who seek to save time using our DIY forms.

- Whether you need the Paterson New Jersey Final Judgment on Foreclosure In Rem or any other document that is authorized in your jurisdiction, with US Legal Forms, everything is conveniently accessible.

- Here’s how to obtain the Paterson New Jersey Final Judgment on Foreclosure In Rem swiftly using our reliable service.

- If you are already a subscriber, you can proceed to Log In to your account to access the necessary form.

Form popularity

FAQ

Filing a foreclosure in New Jersey involves several steps, starting with submitting a complaint to the court. You must detail the reasons for foreclosure and provide evidence of the mortgage default. After the complaint is filed, you will receive a court date where parties can argue their cases. For assistance in preparing the necessary documents, consider using platforms like UsLegalForms to ensure you meet all legal requirements related to a final judgment on foreclosure in rem.

A motion for final judgment of foreclosure is a legal request made by the lender to formally finalize the foreclosure process. In Paterson, this motion is crucial, as it resolves disputes and paves the way for the property to be sold. Once a court grants this motion, the lender can recover the owed debt through the sale of the property. It's important for homeowners to understand this motion’s implications and seek guidance, especially when dealing with a final judgment on foreclosure in rem.

Foreclosure in Paterson, New Jersey occurs when a lender takes back a property due to missed mortgage payments. The process generally begins with the lender sending a notice of default, followed by an opportunity for you to catch up on payments. If not resolved, the lender files for a final judgment on foreclosure in rem, allowing them to sell the property. You should seek legal assistance or consult resources like UsLegalForms to understand your options.

In Paterson, New Jersey, a bank can initiate the foreclosure process as soon as you default on your mortgage. Typically, it can take several months before a bank finalizes the foreclosure, but in some cases, it may move more quickly. Understanding the timeline is crucial, especially when a final judgment on foreclosure in rem is at stake. Staying informed and addressing concerns promptly can help you navigate this challenging process.

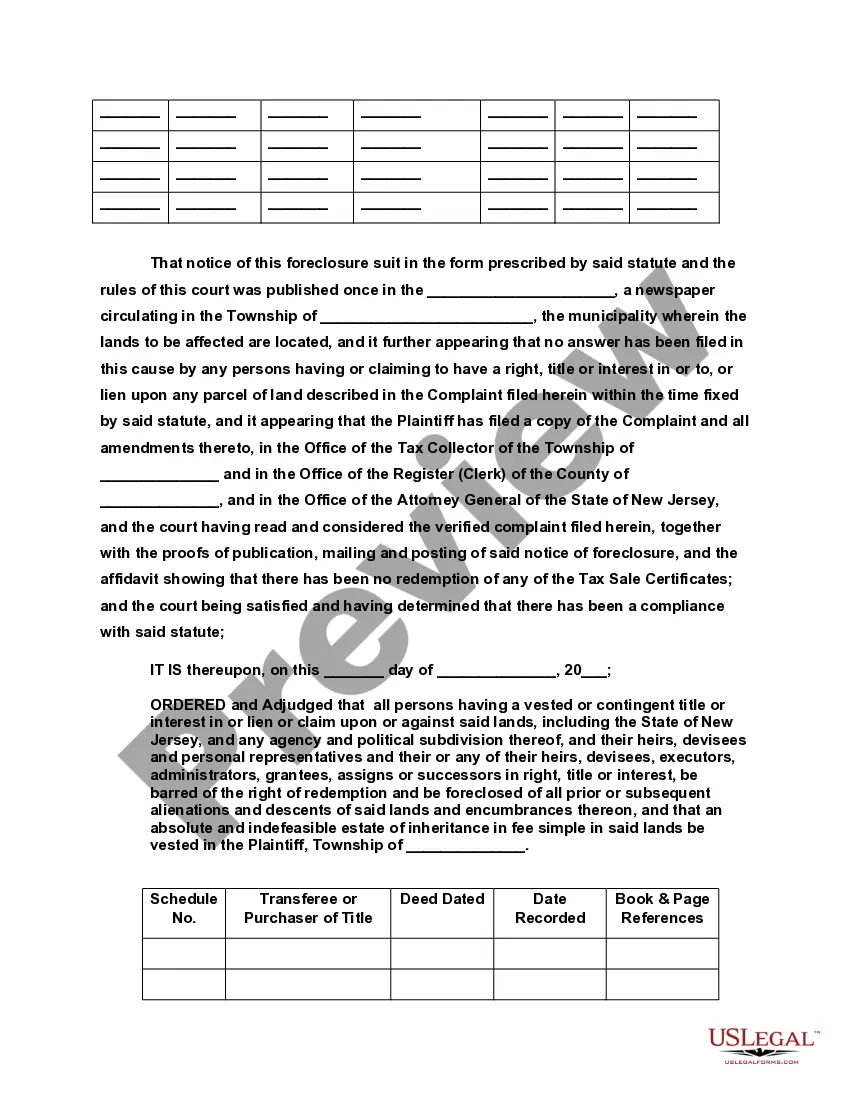

A judicial in REM foreclosure is a legal process that directly relates to the property itself rather than the borrower. In this scenario, the court recognizes the lender's claim against the property under the Paterson New Jersey Final Judgment on Foreclosure In Rem. This approach ensures that the lender obtains rightful ownership through court proceedings, often leading to a quicker resolution. For those dealing with a foreclosure situation, consider using uslegalforms to understand your options and protect your interests.

A default final judgment of foreclosure occurs when a borrower fails to respond to a foreclosure complaint, leading the court to rule in favor of the lender. This judgment allows the lender to proceed with the foreclosure process, effectively giving them the right to sell the property to recover owed amounts. The Paterson New Jersey Final Judgment on Foreclosure In Rem is an example of this process, emphasizing the importance of responding to legal notices. Engaging with uslegalforms can help you navigate these complex legal waters effectively.

After a foreclosure in New Jersey, you typically have 10 days to vacate the property once the court issues a Paterson New Jersey Final Judgment on Foreclosure In Rem. This judgment provides the bank with the legal right to take possession of the property. However, it's important to consult legal advice for your specific situation since timelines can vary based on individual circumstances. If you're facing this challenge, uslegalforms can guide you through the necessary steps.

'In rem' in foreclosure refers to a legal action directed against the property itself, not the individual who owns it. This allows lenders to obtain a judgment on the property in question, enabling them to proceed with foreclosure once the owner defaults. Such proceedings ensure that the legal process focuses on regaining the property, facilitating a more streamlined resolution. If you're navigating this in Paterson, New Jersey, it's beneficial to familiarize yourself with these terms and consult resources provided by uslegalforms.

In mortgage terms, REM stands for 'Remedial,' often referring to actions taken to remedy a default or to address issues related to property ownership. In the context of foreclosure, this can involve legal steps to recover the amount owed or reclaim the property. This term underscores the legal remedies available to lenders facing defaults in a foreclosure situation. For those dealing with a final judgment on foreclosure in Paterson, New Jersey, it's crucial to understand these terms.

An in rem proceeding is a legal action taken against a property rather than against a specific person. This type of proceeding is common in foreclosure cases, where the lender seeks to reclaim the property based on the mortgage default. The objective is to render judgment on the property itself to permit its sale or transfer. In the context of Paterson, New Jersey, understanding in rem proceedings can clarify your options during a foreclosure.