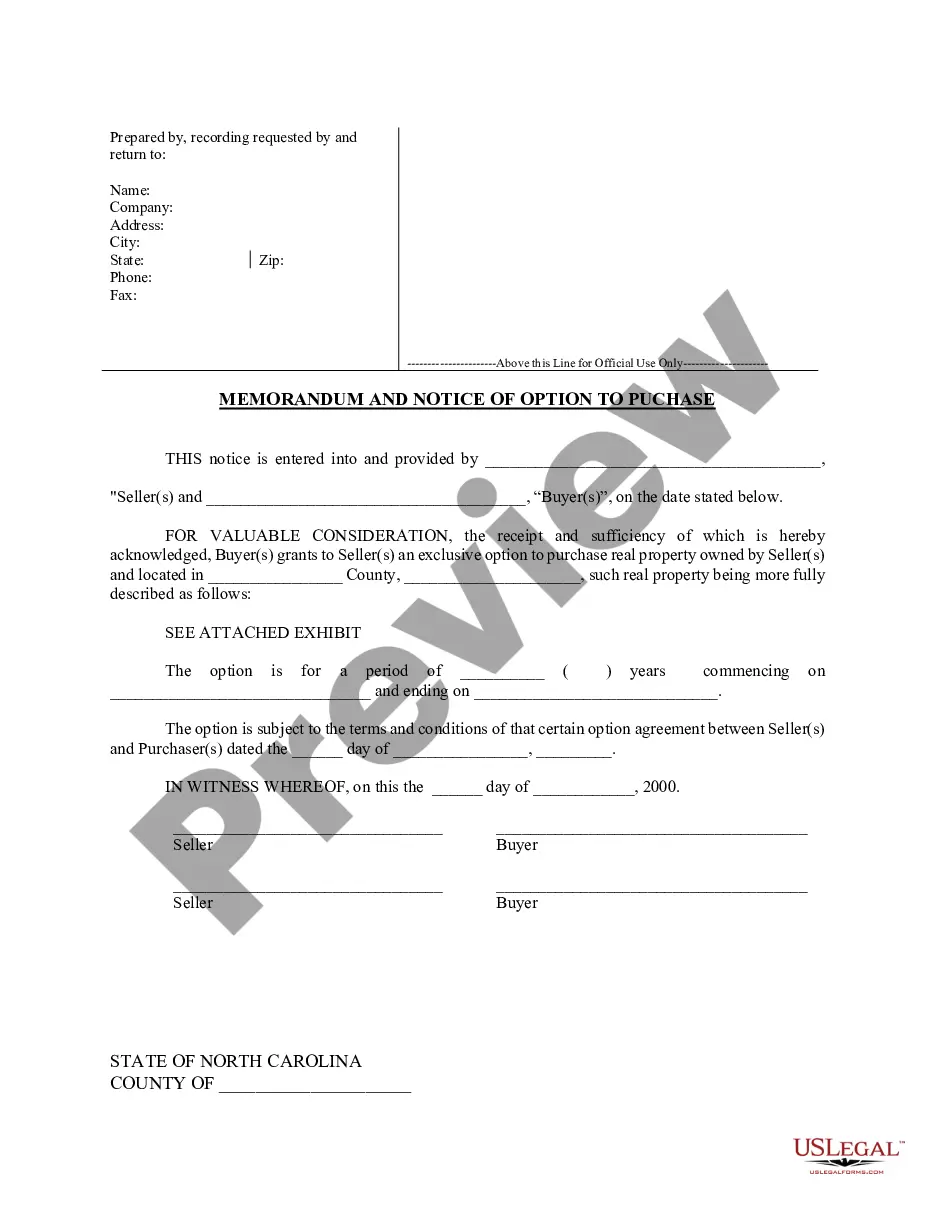

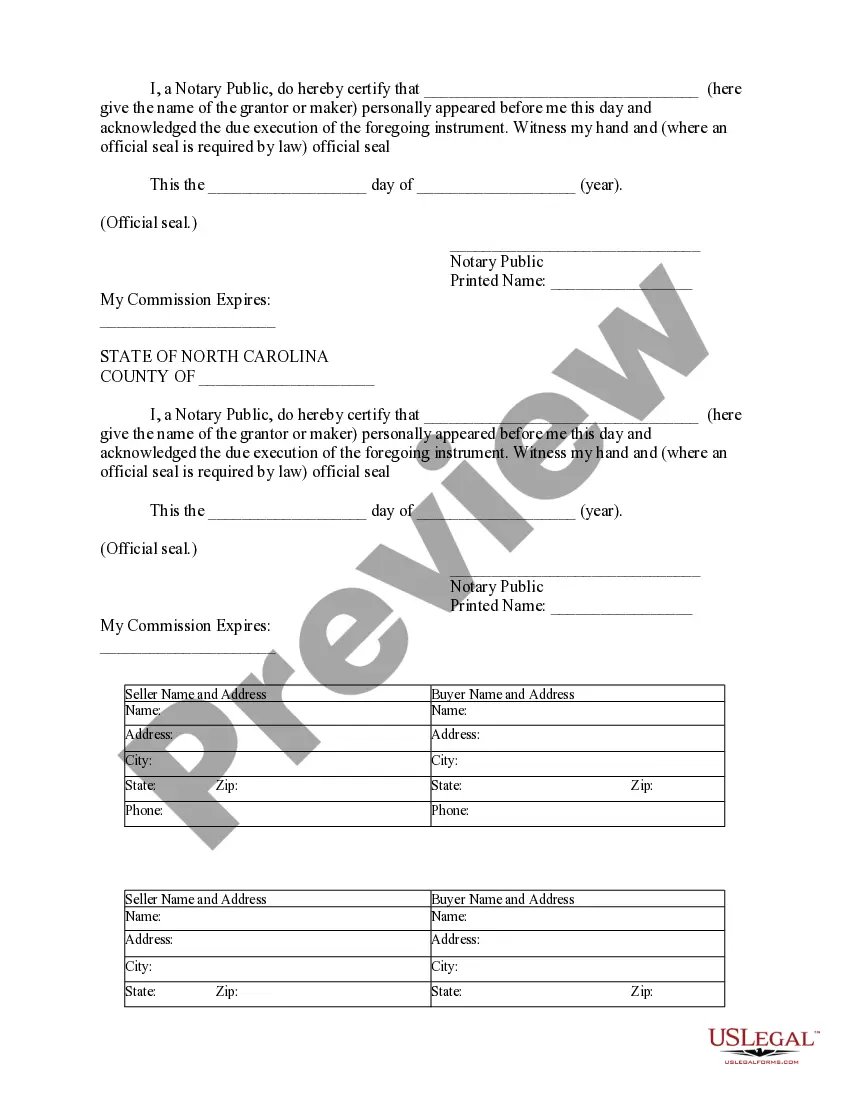

Raleigh North Carolina Notice of Option for Recording

Description

How to fill out North Carolina Notice Of Option For Recording?

Finding authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements and various real-world situations.

All the forms are systematically organized by purpose and jurisdiction, making it as straightforward as ABC to locate the Raleigh North Carolina Notice of Option for Recording.

Giving your payment information or using your PayPal account to settle for the service is essential.

- Ensure the Preview mode and form description are reviewed.

- Confirm you’ve chosen the correct document that satisfies your requirements and aligns perfectly with your local jurisdiction regulations.

- Look for an additional template if necessary.

- If any discrepancies arise, employ the Search tab above to find the accurate one. If it fits your criteria, proceed to the subsequent step.

- Purchase the document.

Form popularity

FAQ

One-sided only....Recording and Document Fees. Document TypeFee DetailsDeeds of Trust and Mortgages$64 first 35 pages $4 each additional pageAmendment to Deed of Trust$26 first 15 pages $4 each additional pageAll other Documents / Instruments / Assumed Name (DBA)$26 first 15 pages $4 each additional page3 more rows

A: Anywhere between 14 to 90 days after closing. A properly recorded deed can take anywhere from 14 days to 90 days. That may seem like a long time, but your local government office goes over every little detail on the deed to make sure the property is correct and there are no errors.

Recording and Document Fees Document TypeFee DetailsDeeds of Trust and Mortgages$64 first 35 pages $4 each additional pageAmendment to Deed of Trust$26 first 15 pages $4 each additional pageAll other Documents / Instruments / Assumed Name (DBA)$26 first 15 pages $4 each additional page3 more rows

??Register of Deeds The Register of Deeds is elected by the people and serves a four-year term. This office records, indexes, and stores all real estate and business related documents that are presented for registration.

?You may file your power of attorney document with the Register of Deeds office.

Requests to expedite ? upto10 working days; Assent of registered land ? around 7 weeks (this would usually be completed in 1-2 weeks);

North Carolina's transfer tax rates are straightforward ? expect to pay $1 for every $500 of the sale price. For the state's average home value of $320,291, the transfer tax would amount to $640.58.

There is no mortgage tax in North Carolina. ?An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. The tax rate is one dollar ($1.00) on each five hundred dollars ($500.00) or fractional part thereof of the consideration or value of the interest conveyed.

To be validly registered pursuant to G.S. 47-20, a deed of trust or mortgage of real property must be registered in the county where the land lies, or if the land is located in more than one county, then the deed of trust or mortgage must be registered in each county where any portion of the land lies in order to be