Fayetteville North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out North Carolina Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Acquiring validated templates tailored to your local statutes can be difficult unless you access the US Legal Forms collection.

This is an online repository of over 85,000 legal documents for both individual and business purposes and various real-world situations.

All the paperwork is organized meticulously by category of use and jurisdictional areas, making the search for the Fayetteville North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors as straightforward as 123.

Maintaining documentation orderly and in accordance with legal standards is crucial. Leverage the US Legal Forms library to have vital template documents for any requirements conveniently at your disposal!

- Familiarize yourself with our library if you have previously utilized it, obtaining the Fayetteville North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors is just a few clicks away.

- Simply sign in to your account, select the document, and press Download to store it on your device.

- This procedure requires just a couple more steps for new users.

- Adhere to the directions outlined below to begin with the largest online document collection.

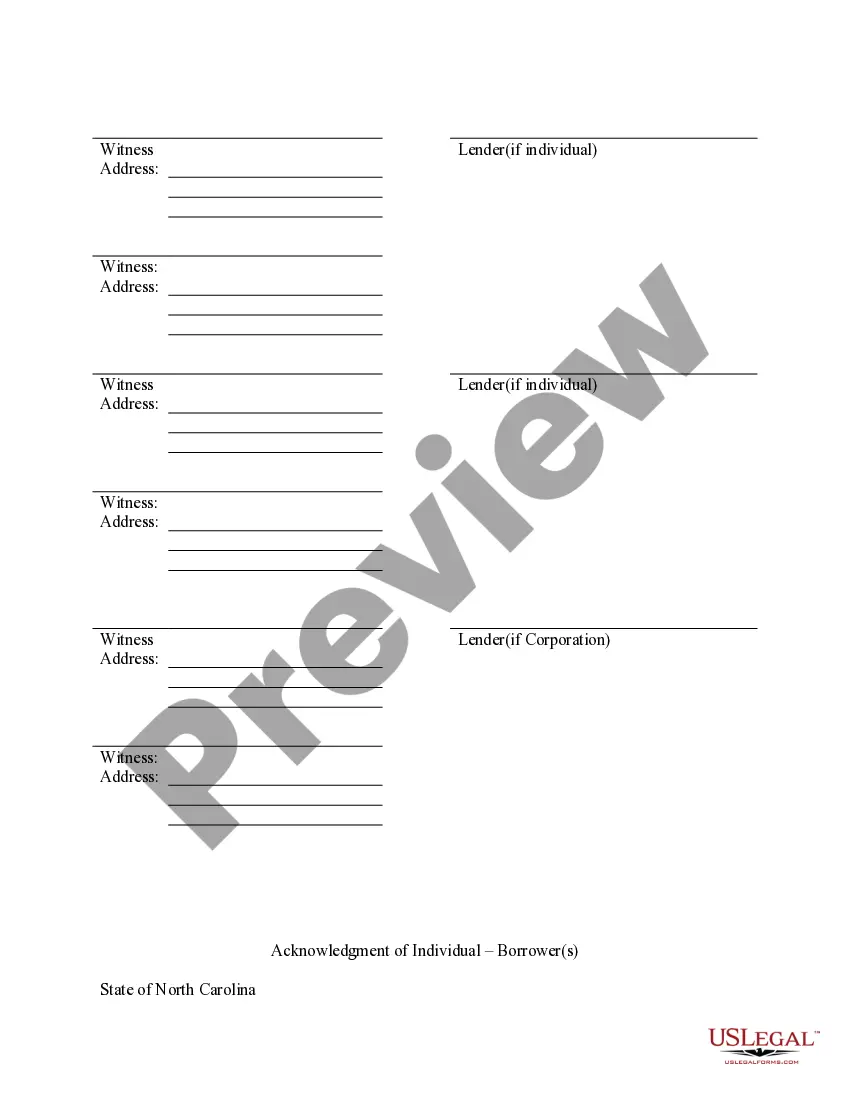

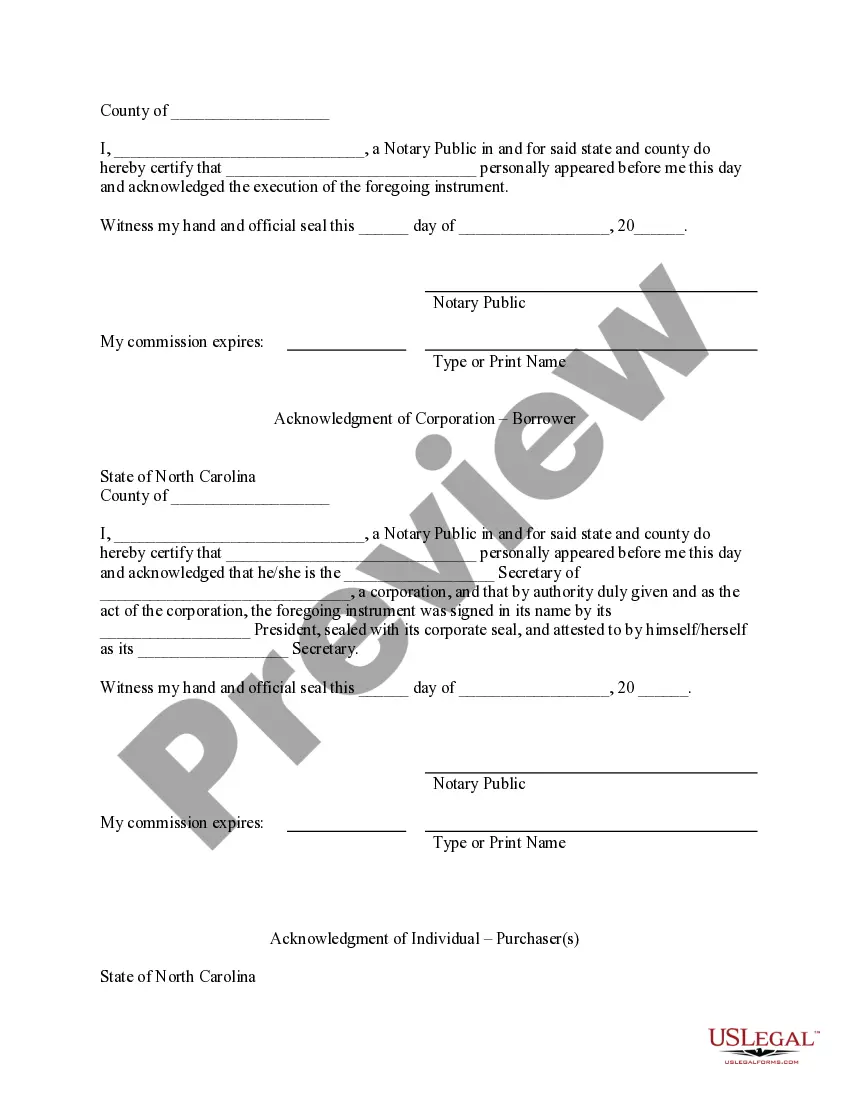

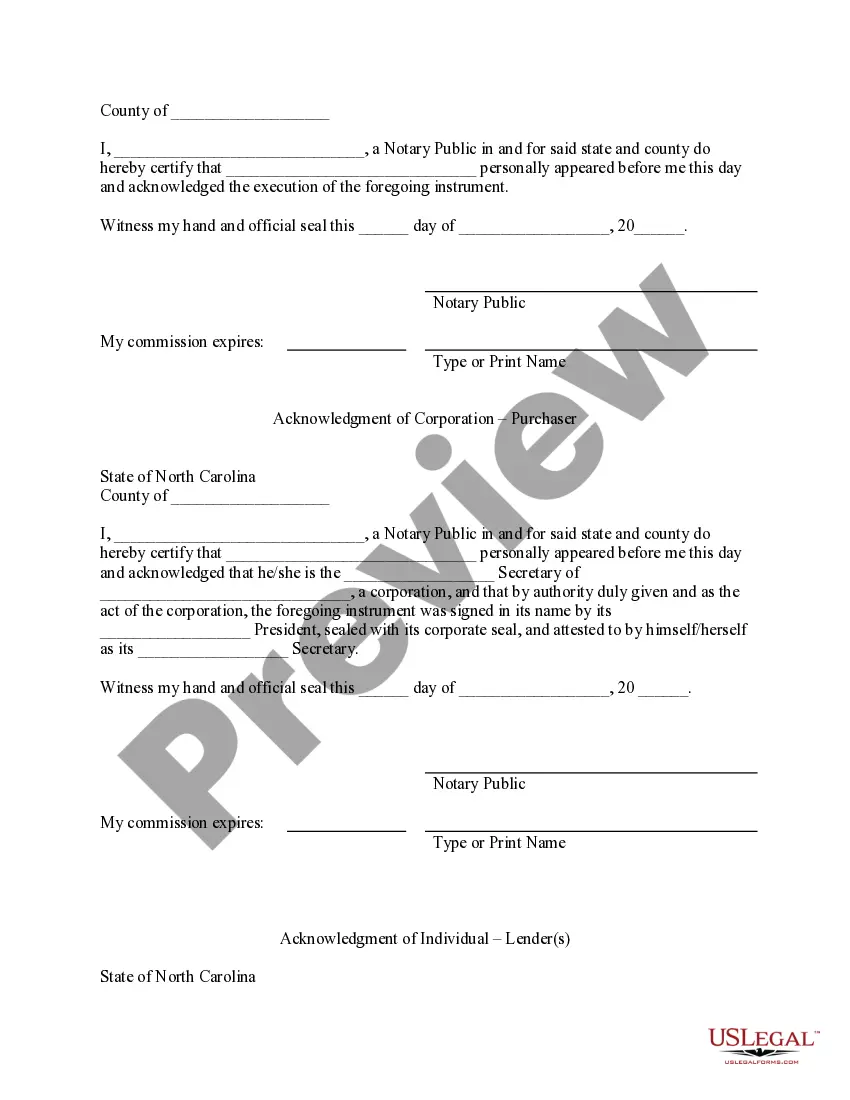

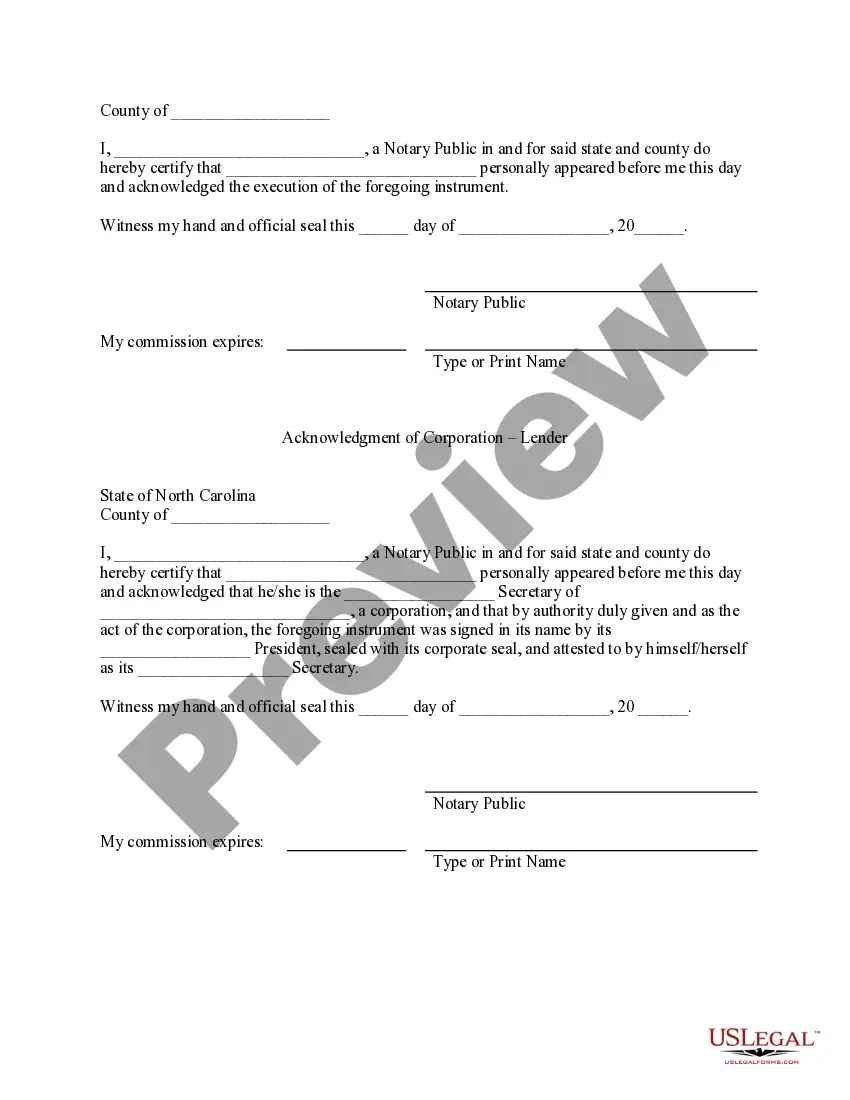

- Review the Preview mode and form details. Ensure you’ve selected the correct one that aligns with your needs and fully complies with your local jurisdiction regulations.

Form popularity

FAQ

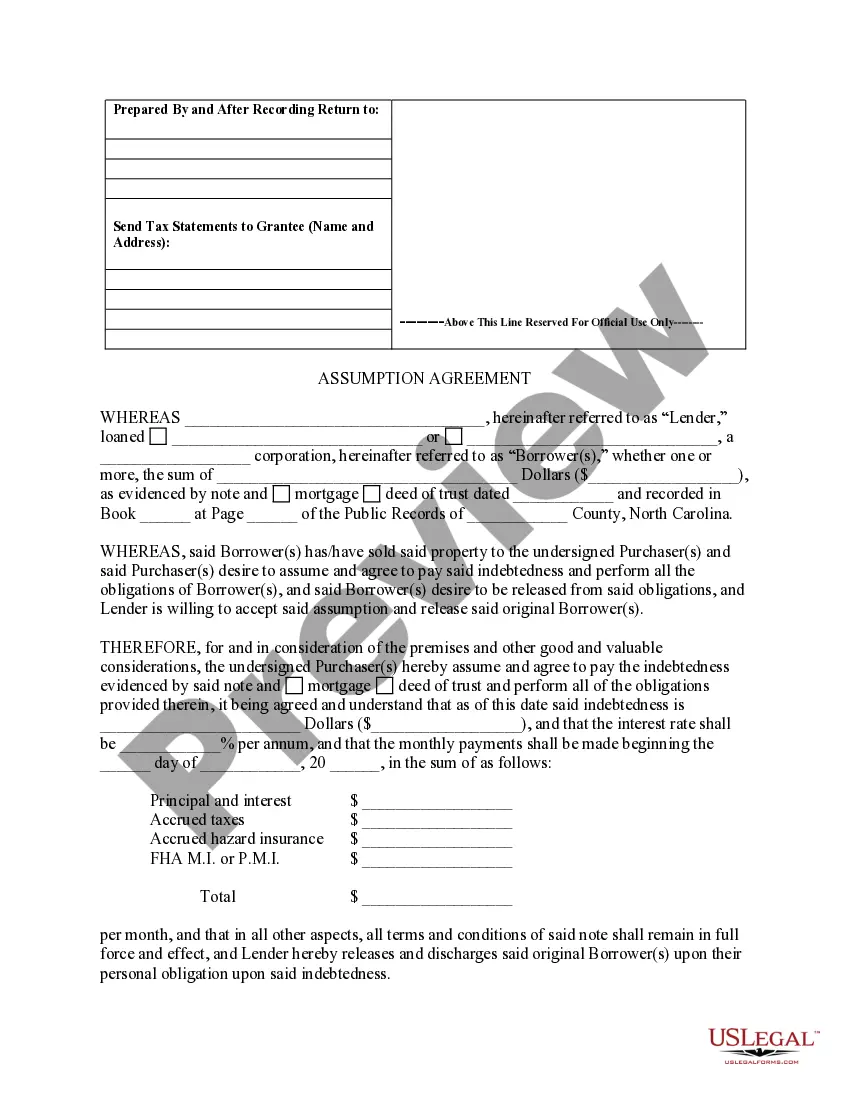

An assignment transfers rights and interests from one party to another, while an assumption agreement specifically involves a buyer agreeing to take over a seller's mortgage obligations. In other words, an assignment may involve a variety of ownership rights, but an assumption focuses solely on mortgage responsibilities. Understanding this distinction can greatly aid in navigating the Fayetteville North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

An assumption agreement is essentially a contract that allows a buyer to take over an existing mortgage, relieving the seller of their payment responsibilities. It details the rights and duties of the buyer, the seller, and the lender. If you are considering an assumption agreement in the scope of the Fayetteville North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, it’s important to ensure all provisions are clearly defined.

An assumption agreement is a legal document that outlines the terms under which one party assumes the responsibilities and obligations of another party’s mortgage. This agreement is crucial in ensuring that all parties involved understand their rights and obligations. In the context of Fayetteville, North Carolina, this document is essential for navigating the Assumption Agreement of Deed of Trust and Release of Original Mortgagors efficiently.

To terminate a trust in North Carolina, you need to follow the trust's specific terms and conditions outlined during its creation. Generally, this involves obtaining agreement from all beneficiaries and ensuring all debts and expenses are settled. It's advisable to consult uslegalforms for assistance with the termination process, especially if it involves your Fayetteville North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

To cancel a deed of trust in North Carolina, you should consult with your lender to obtain the necessary documentation that confirms the debt has been satisfied. Once you receive this, file a release with the county's register of deeds. You can visit uslegalforms for guidance on preparing the correct forms related to your Fayetteville North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

A deed can be rendered void in North Carolina due to several factors, including lack of proper execution or if the grantor did not have the legal capacity to convey the property. Additionally, if the deed violates public policy or contains fraudulent information, it may also be considered void. It is crucial to ensure all elements of your Fayetteville North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors are accurate and lawful.

In North Carolina, a trustee on a deed of trust can be an individual or a corporation that is authorized to conduct business in the state. The trustee holds the legal title to the property, allowing them to act on behalf of the lender. It is essential that the selected trustee understands the responsibilities involved in managing the Fayetteville North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

To obtain the deed to your house in North Carolina, you will need to contact your local county register of deeds. You can request a copy of the deed by providing necessary information, such as your property address and details about the original mortgagors. It's important to understand that if you are working through a Fayetteville North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, you may need to include specific documentation with your request to ensure a smooth process. Consider using U.S. Legal Forms for guidance and resources that can help streamline your deed acquisition.

Tennessee is primarily a mortgage state, contrasting with North Carolina's usage of deeds of trust. This distinction is significant for anyone considering cross-state property transactions. Knowledge of these differences assists those involved in the Fayetteville North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, especially if transactions extend into Tennessee.

In North Carolina, a deed is often referred to as a 'deed of trust.' This term signifies the legal instrument used to secure financing for real estate transactions. When dealing with the Fayetteville North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, employing the correct terminology helps prevent misunderstandings during the transaction.