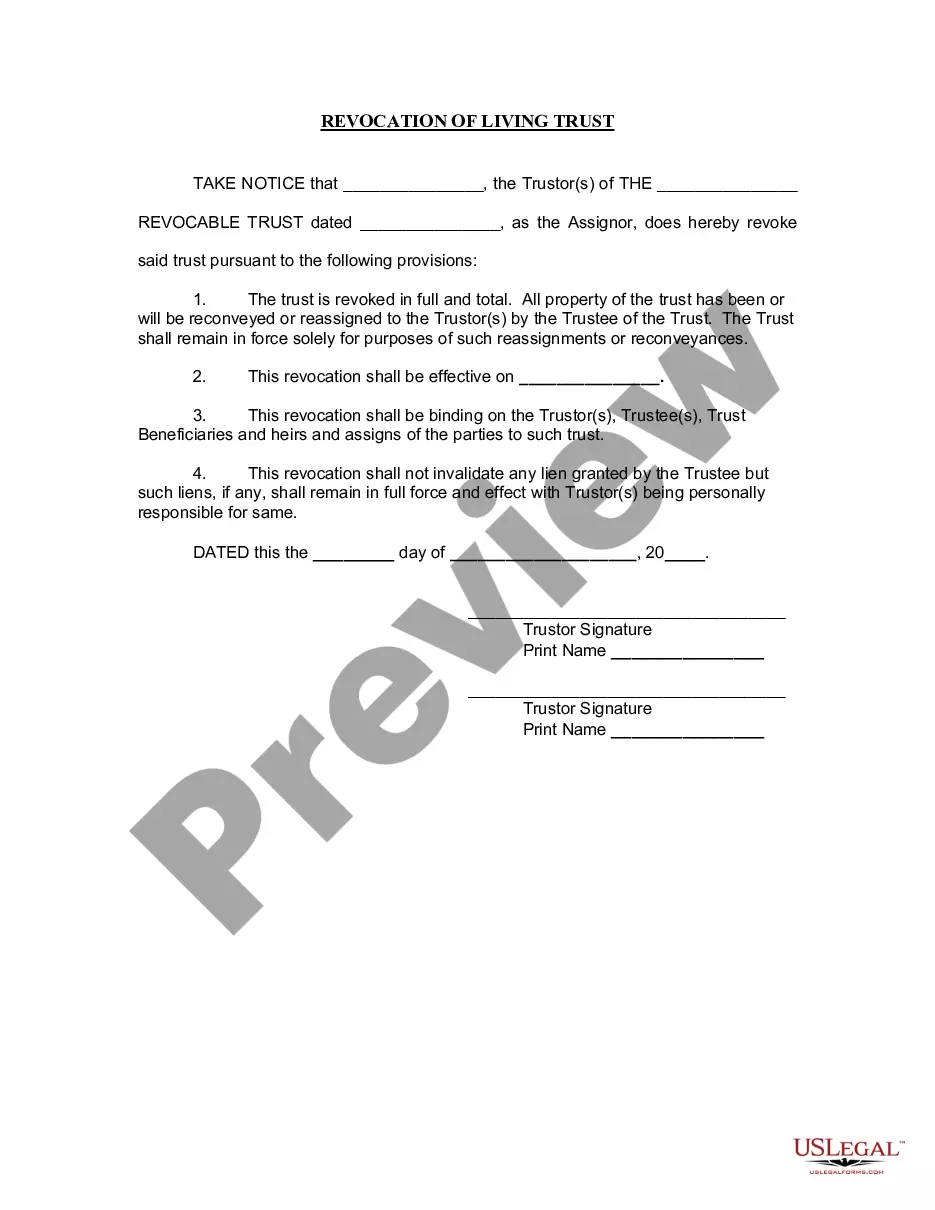

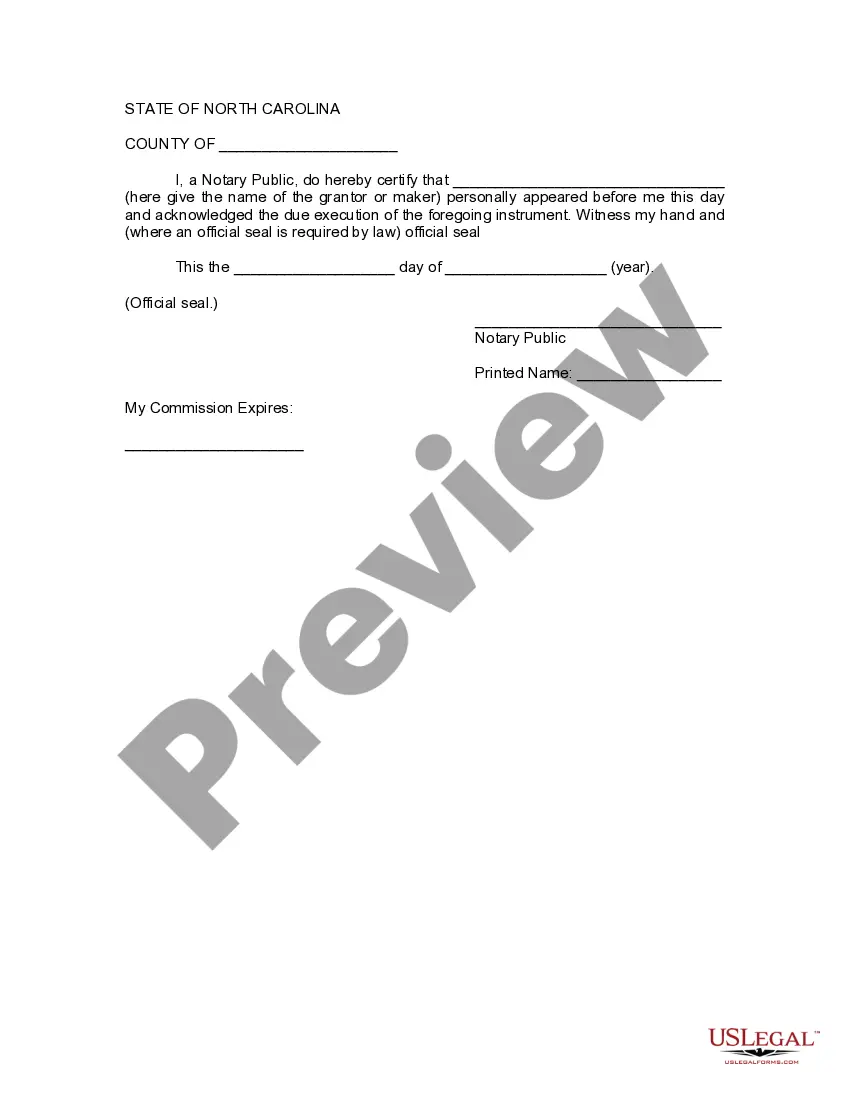

Raleigh North Carolina Revocation of Living Trust

Description

How to fill out North Carolina Revocation Of Living Trust?

If you are looking for a legitimate form template, it’s difficult to find a more suitable location than the US Legal Forms site – one of the most comprehensive online repositories.

With this collection, you can discover thousands of form examples for business and personal use categorized by type and state, or by keywords.

With our enhanced search feature, locating the latest Raleigh North Carolina Revocation of Living Trust is as straightforward as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finish the registration process.

Obtain the form. Choose the file type and download it to your device. Edit as necessary. Fill in, alter, print, and sign the acquired Raleigh North Carolina Revocation of Living Trust.

- Furthermore, the validity of every single document is validated by a team of professional attorneys who regularly assess the templates on our platform and refresh them in accordance with the latest state and county laws.

- If you are already familiar with our service and possess an account, all you need to do to obtain the Raleigh North Carolina Revocation of Living Trust is to sign in to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have accessed the sample you wish to use. Review its description and make use of the Preview feature to examine its contents. If it doesn’t meet your requirements, use the Search bar at the top of the page to find the appropriate document.

- Verify your selection. Click the Buy now button. Then, select the desired subscription plan and enter your details to create an account.

Form popularity

FAQ

Does a Beneficiary Have the Right to See the Trust? The California Probate Law section 16061.7 provides for the beneficiaries right to see the trust. Trustees should furnish beneficiaries and heirs with copies of the trust document.

Likewise, North Carolina law provides that all current trust beneficiaries have a right to receive a copy of the trust document, and a right to financial accountings and trust management records at ?reasonable intervals.? It is a good idea for a trustee to be proactive, and responsive, in providing these items to

In most instances, it is the beneficiary who makes the decision to take action against a trust or trustee. Nevertheless, it is also possible for any other party to file a claim, if they believe they have just cause to do so.

A trustee has the responsibility of handling, managing, and distributing assets within the trust even while the grantor is alive. A revocable trust can be changed or canceled only when the grantor is alive but becomes irrevocable after their death.

The deed and certificate are generally recorded together in the county's public land records. A certificate of trust reveals limited information such as the date the trust was created, the name of its creator and trustee, and the powers granted to the trustee.

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

Similar to contesting a will, a plaintiff must first prove that they have proper legal standing to challenge the trust. North Carolina law requires a person to have 'pecuniary interest' in the trust or they must be able to establish that they would be in a position to inherit property, if the trust did not exist.

Interest in possession trust The beneficiary can get income from the trust straight away but cannot control the assets that provide the income. The beneficiary has to pay income tax on the money they receive.

Another reason to use a trust is that it creates a veil of privacy for you and your family. Wills become part of the public record when they go through probate. Your trust will never become public record and no one needs to know what assets are in it, who your beneficiaries are, or how assets are being distributed.