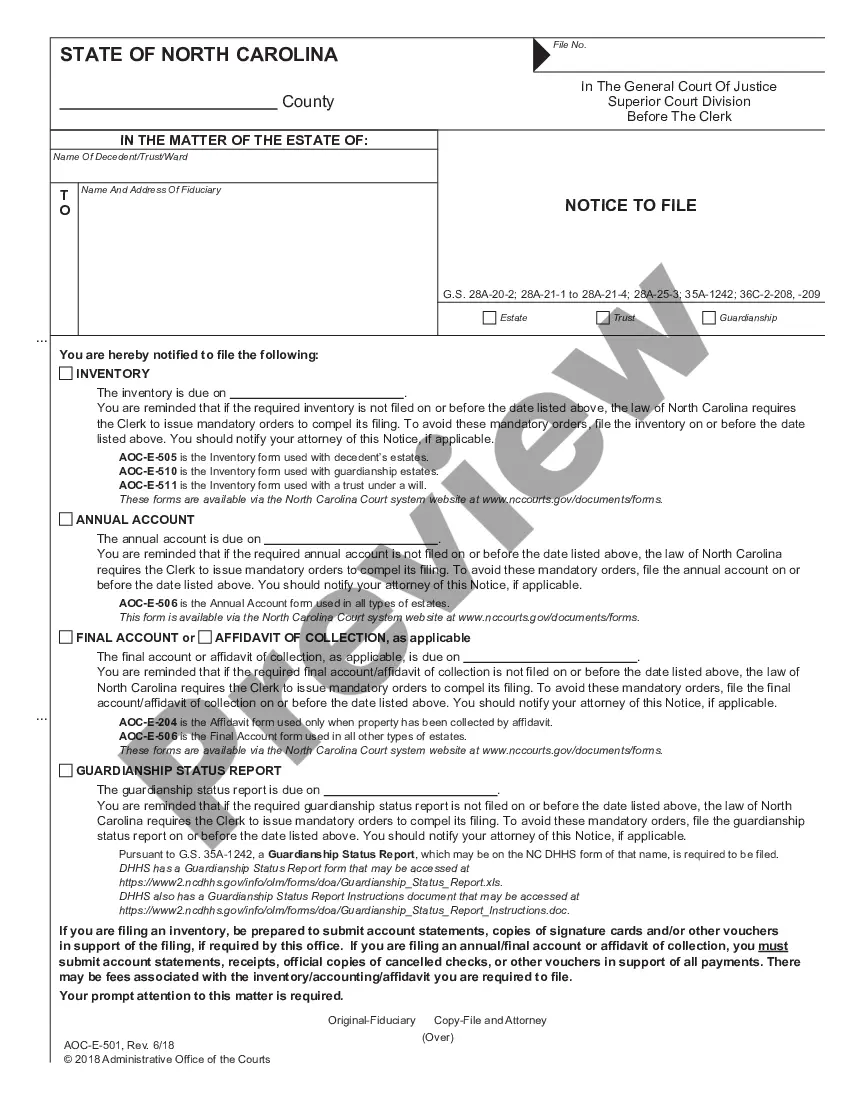

Account, Annual or Final: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Charlotte North Carolina Account Annual Final

Description

How to fill out North Carolina Account Annual Final?

Utilize the US Legal Forms and gain instant access to any form template you desire.

Our user-friendly website featuring a vast array of documents makes it simple to locate and acquire almost any document template you require.

You can save, complete, and certify the Charlotte North Carolina Account Annual Final in just a few minutes instead of spending hours searching the internet for the correct template.

Leveraging our library is an excellent method to enhance the security of your record submissions.

If you have not yet created a profile, follow the instructions outlined below.

Visit the page with the form you require. Confirm that it is indeed the document you intended to locate: verify its title and description, and utilize the Preview feature if accessible. Otherwise, employ the Search box to find the suitable one.

- Our expert attorneys routinely review all documents to ensure that the templates are suitable for a specific state and adhere to recent laws and regulations.

- How can you access the Charlotte North Carolina Account Annual Final.

- If you possess a subscription, simply Log In to your account. The Download option will be visible on all the documents you view.

- Additionally, you can retrieve all previously saved records in the My documents section.

Form popularity

FAQ

Mail to P.O. Box 29525, Raleigh, NC 27626-0525 or bring it into the office. Include the appropriate filing fee for your specific company type.

North Carolina requires LLCs to file Annual Reports to keep the state up to date. You file your Annual Report with the Secretary of State, and you must pay a $200 fee for your filing. After formation, your Annual Report is due by April 15 of each following year.

The annual report fee for a limited liability company is $200.00. If filed electronically, there is a $3.00 transaction fee.

How much does it cost to form an LLC in North Carolina? The North Carolina Secretary of State charges a $125 filing fee for the Articles of Organization. It will cost $30 to file a name reservation application if you wish to reserve your LLC name prior to filing the Articles of Organization.

You may file sales and use tax returns and pay through eServices for Businesses or call the E-Services Help line at 1-877-308-9103 (toll free) Monday through Friday.

Each Business Corporation, Limited Liability Company, Limited Liability Partnership and Limited Liability Limited Partnership is required to file an annual report with the Secretary of State.

Each Business Corporation, Limited Liability Company, Limited Liability Partnership and Limited Liability Limited Partnership is required to file an annual report with the Secretary of State.

Annual Report Due Dates Type of entityFeeBusiness Corporations and BanksOnline $23.00 Paper $25.00Limited Liability Company (LLC or L3C )Online $203.00 Paper $200.00Partnerships (LLP and LLLP)Online $203.00 Paper $200.001 more row

Each Business Corporation, Limited Liability Company, Limited Liability Partnership and Limited Liability Limited Partnership is required to file an annual report with the Secretary of State.

The annual report must be filed each year by April 15 except that new LLCs don't need to file a report until the first year after they're created. The filing fee is $200.