High Point North Carolina Business Credit Application

Description

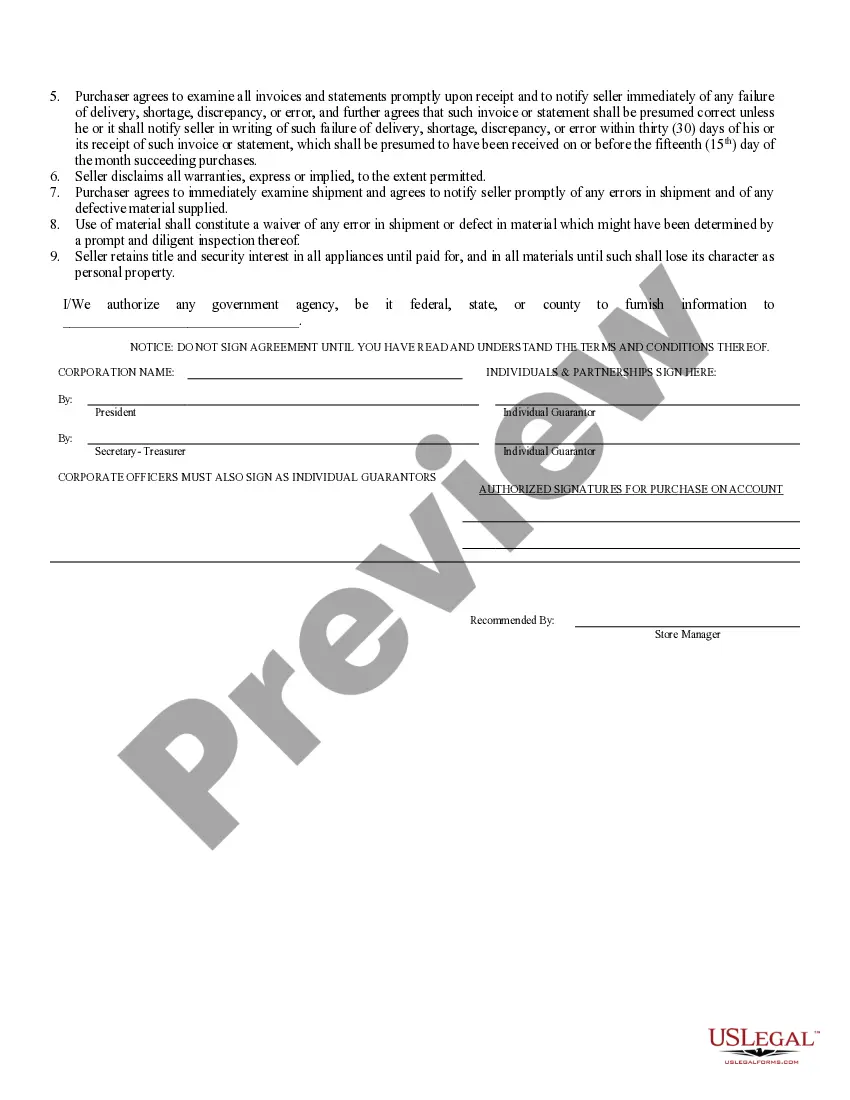

How to fill out North Carolina Business Credit Application?

Take advantage of the US Legal Forms and gain immediate entry to any template you require.

Our user-friendly platform, featuring a vast array of document templates, streamlines the process of locating and obtaining nearly any document sample you may need.

You can download, fill out, and sign the High Point North Carolina Business Credit Application in just a few minutes rather than spending hours online searching for a suitable template.

Utilizing our library is a superb method to enhance the security of your document filing.

US Legal Forms is among the most extensive and trustworthy template libraries available online.

Our organization is consistently prepared to assist you with any legal procedure, even if it’s merely downloading the High Point North Carolina Business Credit Application.

- Our skilled attorneys routinely review all the documents to confirm that the templates are suitable for a specific region and adhere to the latest laws and regulations.

- How can you access the High Point North Carolina Business Credit Application? If you possess a subscription, simply Log In to your account. The Download button will be activated for all the samples you view.

- Additionally, you can find all your previously saved files in the My documents section.

- If you do not have an account yet, follow the steps below.

- Locate the form you need. Verify that it is the correct form: check its title and description, and utilize the Preview function if available. If not, use the Search field to find the required one.

- Initiate the saving process. Click Buy Now and choose the pricing plan that suits you. Then, register for an account and complete your order using a credit card or PayPal.

- Download the file. Choose the format to obtain the High Point North Carolina Business Credit Application and customize, fill out, or sign it according to your requirements.

Form popularity

FAQ

To make a credit application form, start by including essential details such as your business name, contact information, financial history, and the amount of credit you wish to request. Ensure that the form is clear and concise, allowing lenders to evaluate your request easily. Using a High Point North Carolina Business Credit Application template from US Legal Forms can streamline your efforts, enhancing your likelihood of approval by ensuring all necessary information is covered.

Yes, your Employer Identification Number (EIN) is an essential tool for establishing business credit. It acts as a Social Security number for your business, enabling lenders and credit bureaus to track your financial activity. When you apply for credit, ensure that your High Point North Carolina Business Credit Application reflects your EIN to help build a credible business credit file. US Legal Forms offers tools that can assist you in the application process, making the task more manageable.

Creating a business credit file involves establishing your business as a separate legal entity and registering with credit bureaus. Start by applying for an Employer Identification Number (EIN) and opening business credit accounts, such as a business credit card or a vendor account. As you make timely payments and maintain good credit behavior, your High Point North Carolina Business Credit Application becomes a crucial part of your business credit profile. Consider using resources available through US Legal Forms to guide you in building your credit file effectively.

A business credit application form is a document that companies use to request credit from lenders or suppliers. It typically requires information about your business, including its legal structure, financial details, and the purpose of the credit. A properly completed High Point North Carolina Business Credit Application can help you secure the funds you need to grow your business. Utilizing US Legal Forms can simplify this process, providing templates that are easy to fill out and submit.

The minimum credit score for a business account varies by lender, but generally, a score of at least 680 is desirable. However, some lenders may consider businesses with lower scores depending on other financial factors. When applying for credit, ensure your High Point North Carolina Business Credit Application accurately reflects your credit history and financial situation. This transparency can influence lenders' decisions positively.

A credit application for a business account is a document used to request credit from banks or financial institutions specifically for business operations. This application assesses your business's financial health, allowing the bank to determine credit limits and terms. In High Point North Carolina, utilizing a High Point North Carolina Business Credit Application helps you clearly present your financial status and intentions to potential creditors.

To create a business credit application form, start by outlining essential information like the business name, address, and contact details. Include sections for financial data, ownership structure, and credit references. For optimal results, utilize tools or templates available on platforms like uslegalforms, which provide a tailored High Point North Carolina Business Credit Application. This ensures your form meets all necessary standards and requirements.

A credit application for a business is a formal request submitted to lenders or vendors to obtain credit. This document usually includes information about your business, such as financial statements and ownership details. In High Point North Carolina, using a reliable High Point North Carolina Business Credit Application streamlines the process and enhances your chances of obtaining credit. The application helps creditors assess your creditworthiness based on the information provided.

To establish credit, a new LLC in High Point North Carolina should first obtain an Employer Identification Number (EIN) and open a business bank account. Then, apply for a High Point North Carolina Business Credit Application with lenders or vendors that report to credit bureaus. Building relationships with suppliers and maintaining timely payments will improve your credit profile. Over time, consistent positive credit behavior leads to better financing options.

The approval time for an LLC in North Carolina typically ranges from 7 to 10 business days if you file online, and up to 6 weeks for paper applications. Ensuring all your documents are complete and correctly filled out can expedite the process. Once your LLC is approved, applying for a High Point North Carolina Business Credit Application will open doors for business financing that can further strengthen your new venture.