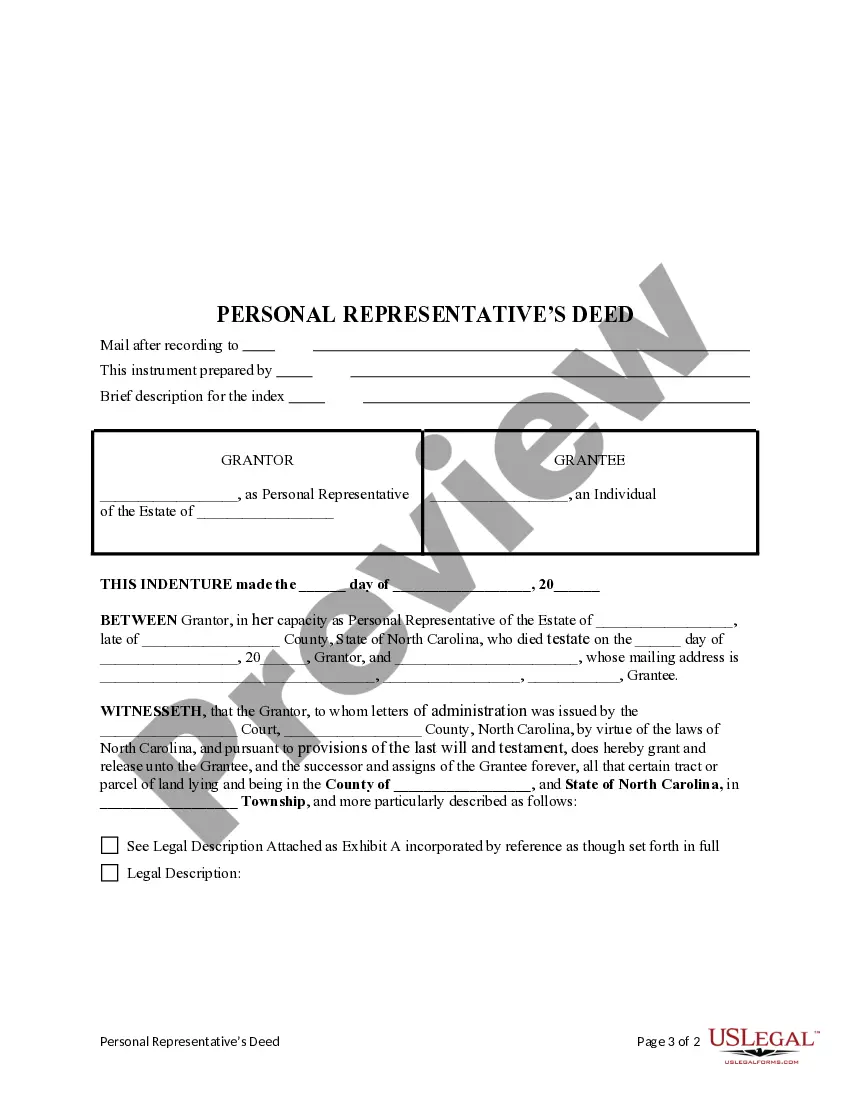

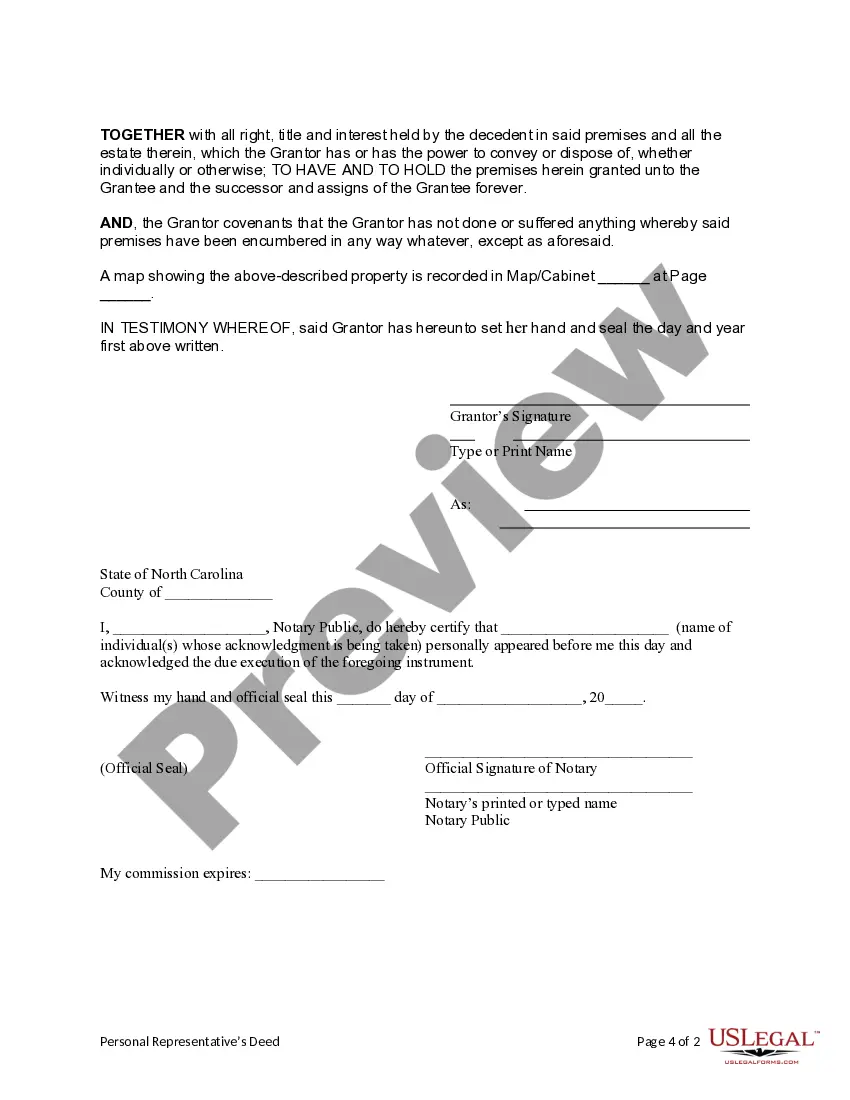

This form is an Personal Representatives's Deed where the grantor is the individual appointed as Personal Representative of an estate and the Grantee is the beneficiary under law. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

Wake North Carolina Personal Representative's Deed to an Individual

Description

How to fill out North Carolina Personal Representative's Deed To An Individual?

We consistently endeavor to reduce or avert legal harm when managing intricate legal or financial matters.

To achieve this, we seek out legal assistance that is typically quite costly.

However, not all legal challenges are equally complicated.

Many of them can be handled on our own.

Benefit from US Legal Forms whenever you need to obtain and download the Wake North Carolina Personal Representative's Deed to an Individual or any other document easily and securely.

- US Legal Forms is an online repository of current DIY legal documents addressing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection aids you in taking control of your affairs without needing to consult an attorney.

- We provide access to legal document templates that aren’t always readily accessible.

- Our templates are specific to states and regions, which significantly streamlines the search process.

Form popularity

FAQ

The answer is yes, it's perfectly normal (and perfectly legal) to name the same person as an executor and a beneficiary in your will.

On the 90-day inventory form, you will need to list the following information: The decedent's county of residence. The decedent's name. Any accounts in the sole name of the decedent and their value. Any joint accounts, the percentage the decedent owned, and their value.

Like the compensation laws in many other states, Alaska's executor compensation laws stipulate that an executor must be paid fairly for services provided. Many people think $25-$35/hour is reasonable, but a personal representative can also suggest different forms of payment in Alaska.

Maryland offers a simplified probate procedure for smaller estates. The simplified procedure is available if the property subject to probate has a value of $50,000 or less. If the surviving spouse is the only beneficiary, the cap goes up to $100,000 or less.

Any individual who is at least 18 years old who is a resident of Florida at the time of the decedent's death, is qualified to act as the personal representative.

Over 18 years of age and ? The surviving spouse of the decedent, ? An adult child of the decedent, ? A parent of the decedent, ? A brother or sister of the decedent, ? A person entitled to property of the decedent, ? A person who was named as personal representative by will, or ? You are a creditor and 45 days have

When someone dies without a will they are said to have died 'intestate' and no one has immediate authority to act as their personal representative. Instead, one of their relatives needs to apply to the Probate Registry for a grant of letters of administration.