This form is a Quitclaim Deed where the grantor is an individual and the grantee is a Trustee acting in their capacity as trustee. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Charlotte North Carolina Quitclaim Deed - Individual to Trust

Description

How to fill out North Carolina Quitclaim Deed - Individual To Trust?

Irrespective of social or occupational standing, finalizing law-related documents is a regrettable obligation in today’s workplace.

Frequently, it’s nearly impossible for an individual without legal training to generate such paperwork from the ground up, primarily due to the intricate terminology and legal subtleties they encompass.

This is where US Legal Forms proves to be useful.

Verify that the form you have located is suitable for your area, as the laws of one state or region do not apply to another.

Examine the document and read a brief overview (if available) of instances the document can be utilized for.

- Our service offers a vast assortment of over 85,000 ready-to-use state-specific documents that are applicable for almost any legal scenario.

- US Legal Forms also functions as an excellent resource for associates or legal advisors looking to save time with our DIY papers.

- Whether you require the Charlotte North Carolina Quitclaim Deed - Individual to Trust or any other document that will be acceptable in your state or region, with US Legal Forms, everything is easily accessible.

- Here’s how you can swiftly obtain the Charlotte North Carolina Quitclaim Deed - Individual to Trust by utilizing our dependable service.

- If you are currently a member, you can proceed to Log In to your account to acquire the necessary form.

- However, if you are not acquainted with our collection, ensure you follow these steps before acquiring the Charlotte North Carolina Quitclaim Deed - Individual to Trust.

Form popularity

FAQ

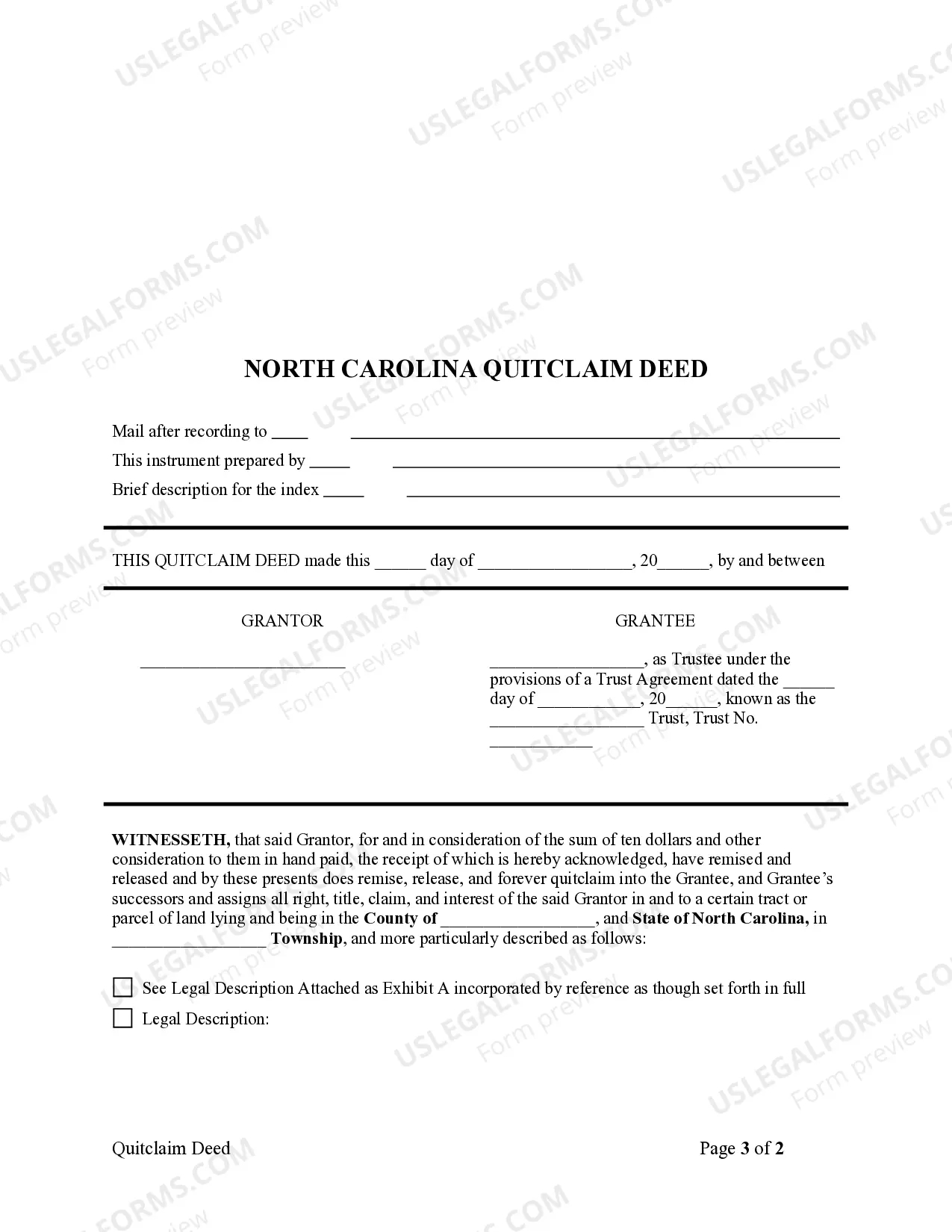

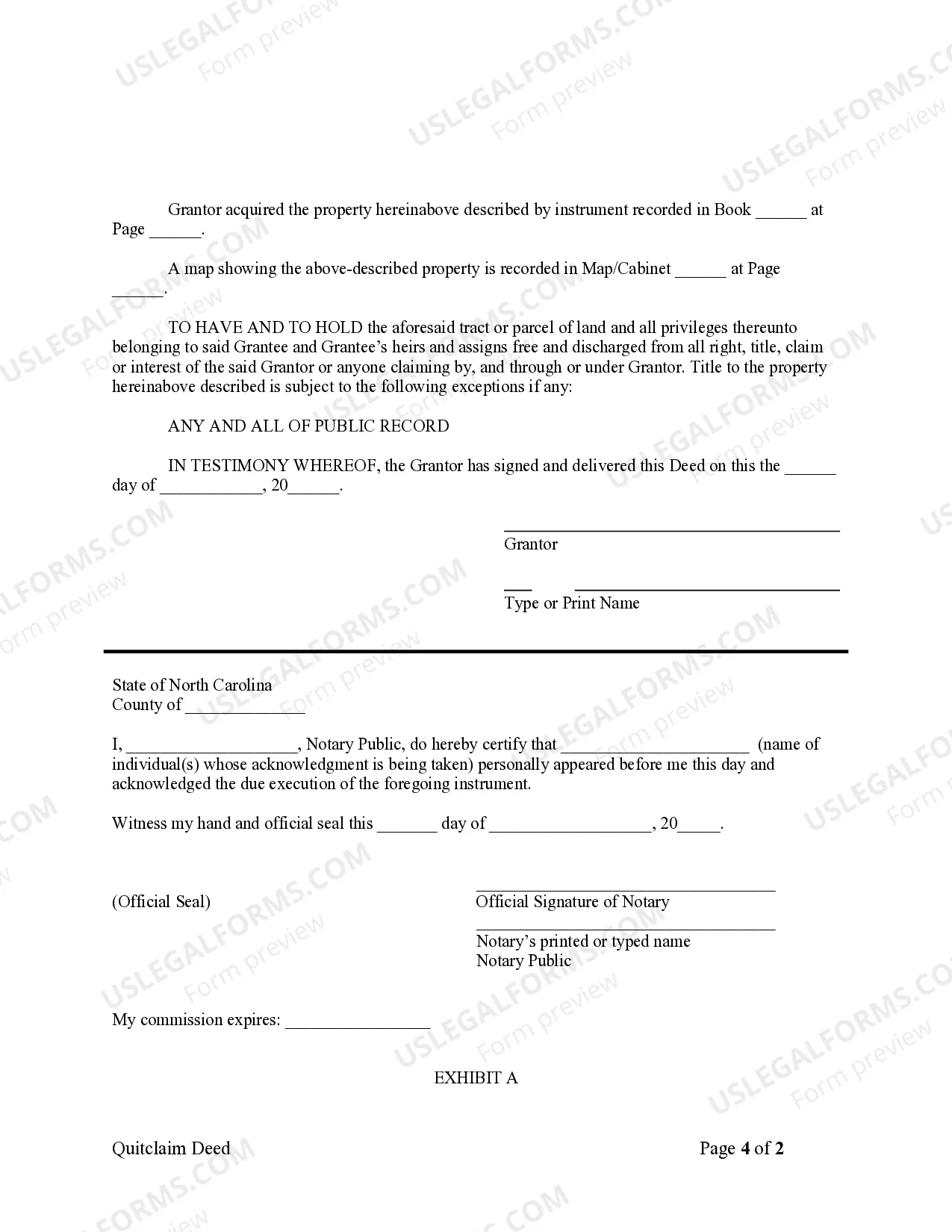

Signing (N.C.G.S.A. § 47-38) ? All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

A North Carolina quit claim deed is a legal form used to convey real estate in North Carolina from one person to another. A quitclaim, unlike a warranty deed, does not come with a guarantee from the seller, or grantor, as to whether the grantor has clear title to the property or has the authority to sell the property.

Almost all instruments presented for recordation first must be acknowledged (notarized) before the Register of Deeds can record the instrument. Notary Publics are authorized by North Carolina law to perform this duty.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

North Carolina's transfer tax rates are straightforward ? expect to pay $1 for every $500 of the sale price. For the state's average home value of $320,291, the transfer tax would amount to $640.58.

A deed is a legal instrument that evidences legal ownership of a parcel of real property, which includes land and any buildings on the land. To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.