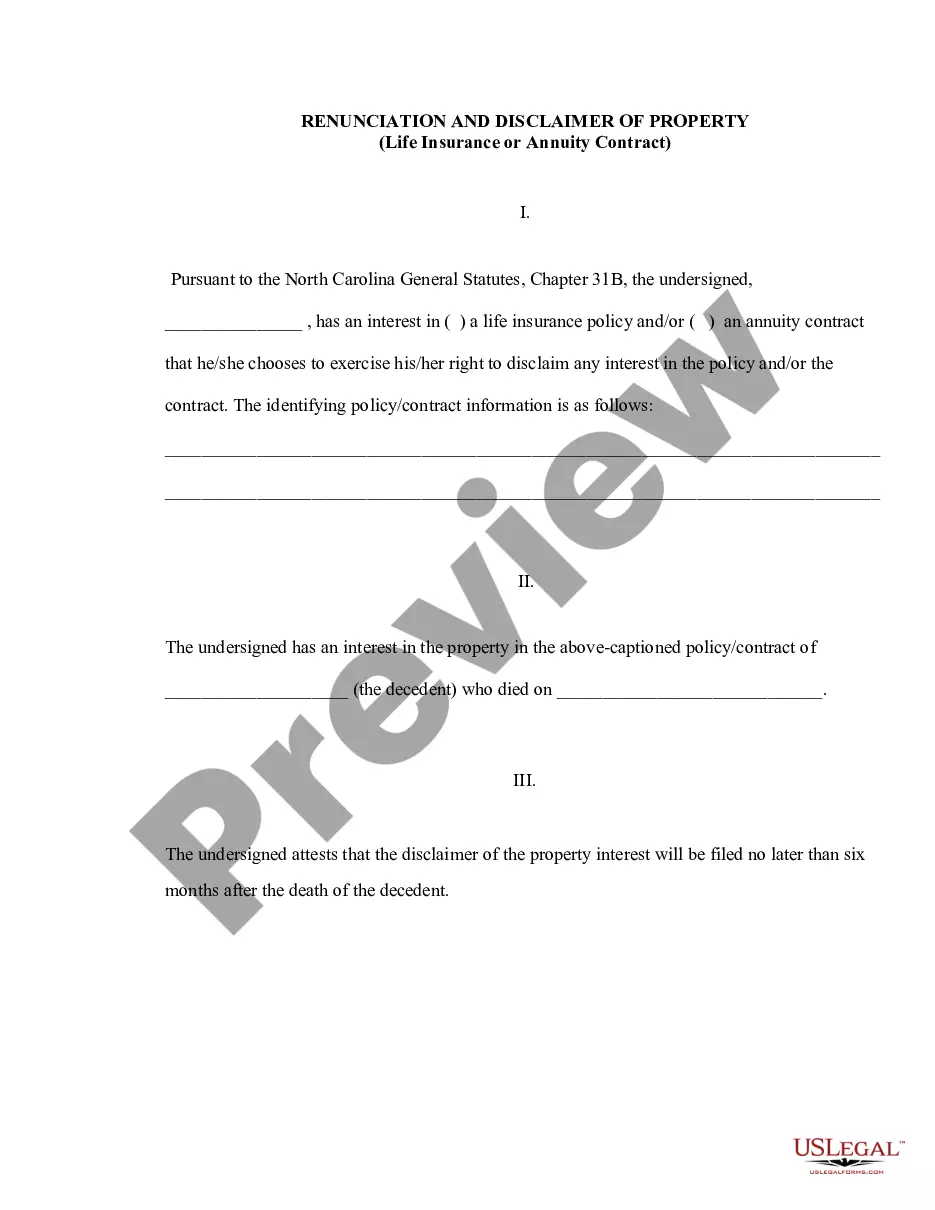

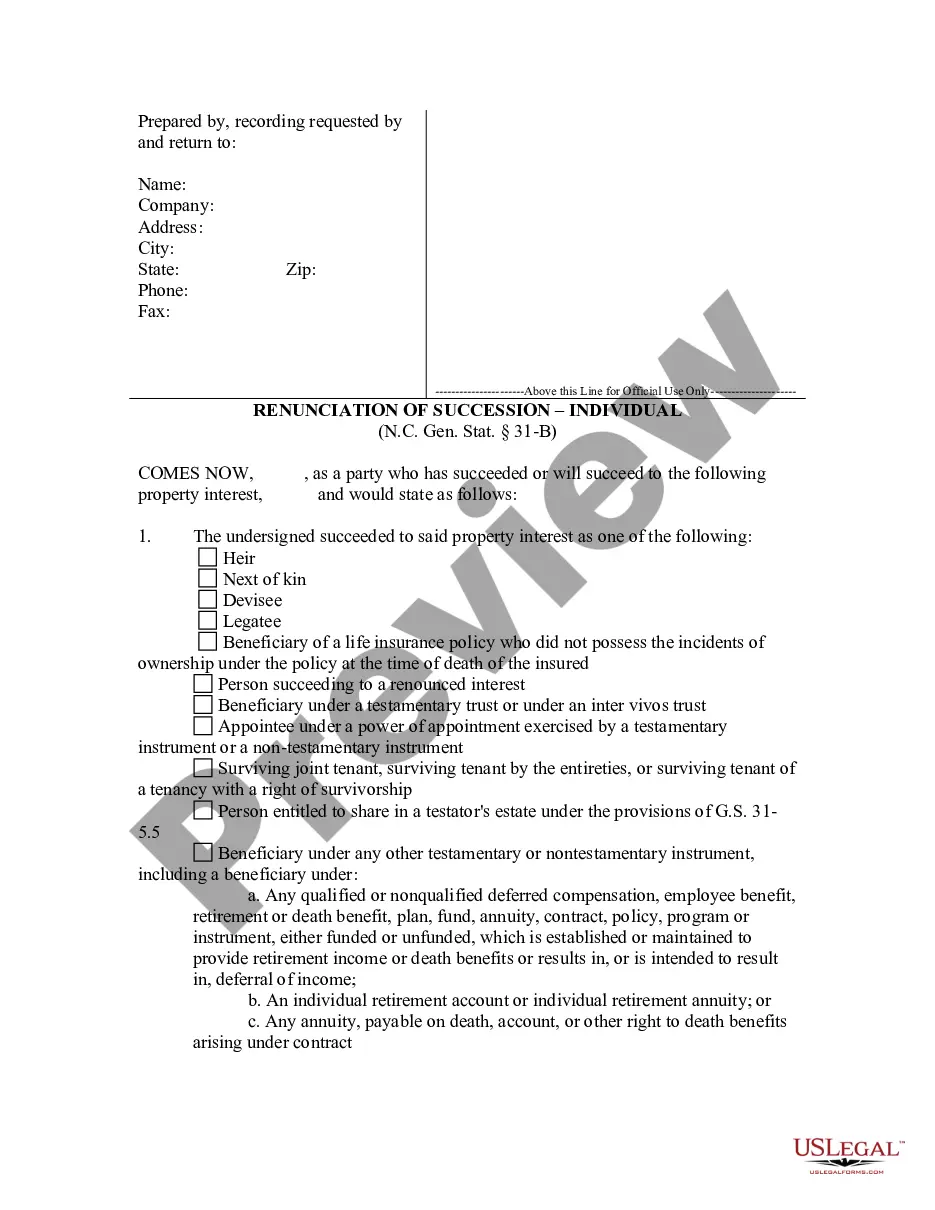

Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out North Carolina Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

We consistently endeavor to reduce or sidestep legal repercussions when managing intricate legal or financial matters.

To achieve this, we seek legal assistance that, typically, comes at a high cost. However, not every legal matter is equally complicated. The majority can be handled by us independently.

US Legal Forms is a digital repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and dissolution petitions. Our collection empowers you to manage your affairs autonomously without relying on an attorney.

We offer access to legal form templates that are not always readily available. Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Be sure to verify that the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract complies with the laws and regulations of your state and area. Additionally, it’s essential to review the form’s outline (if provided), and if you observe any inconsistencies with what you were originally seeking, look for an alternative form. Once you confirm that the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is suitable for your situation, you can select a subscription plan and proceed with payment. Then, you can download the document in any preferred format. For more than 24 years, we’ve assisted millions by providing ready-to-customize and current legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- Leverage US Legal Forms whenever you need to locate and download the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract or any other document effortlessly and securely.

- Just Log In to your account and click the Get button beside it.

- If you happen to misplace the document, you can always retrieve it again from the My documents section.

- The procedure is just as straightforward if you are a newcomer to the platform! You can establish your account in just a few minutes.

Form popularity

FAQ

To disclaim an inheritance in North Carolina, you need to create a formal disclaimer document that states your intention to refuse the inheritance. This action falls under the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract guidelines. Using resources from uslegalforms can guide you through the necessary steps to ensure that your disclaimer adheres to state requirements, thus protecting your estate planning needs.

In North Carolina, property can be transferred without a will through intestate succession laws, where the state determines how assets are distributed among surviving relatives. This process can be complex; therefore, utilizing the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract can ensure that your preferences are honored. Engaging a reliable platform like uslegalforms can streamline this process and help you manage your estate effectively.

The point of renunciation is to give individuals the choice to manage their inheritance in a way that aligns with their financial and personal goals. By engaging in the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, you simplify estate matters and ensure your chosen beneficiaries receive the intended asset distributions. This helps prevent family disputes and upholds your decisions on asset management.

The legal effect of renunciation means that any rights or claims to property or benefits derived from life insurance or annuity contracts will be nullified. This act creates clarity in the estate distribution process as prescribed in the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. Understanding this effect is vital since it can prevent unintended heirs from receiving assets you intended for others.

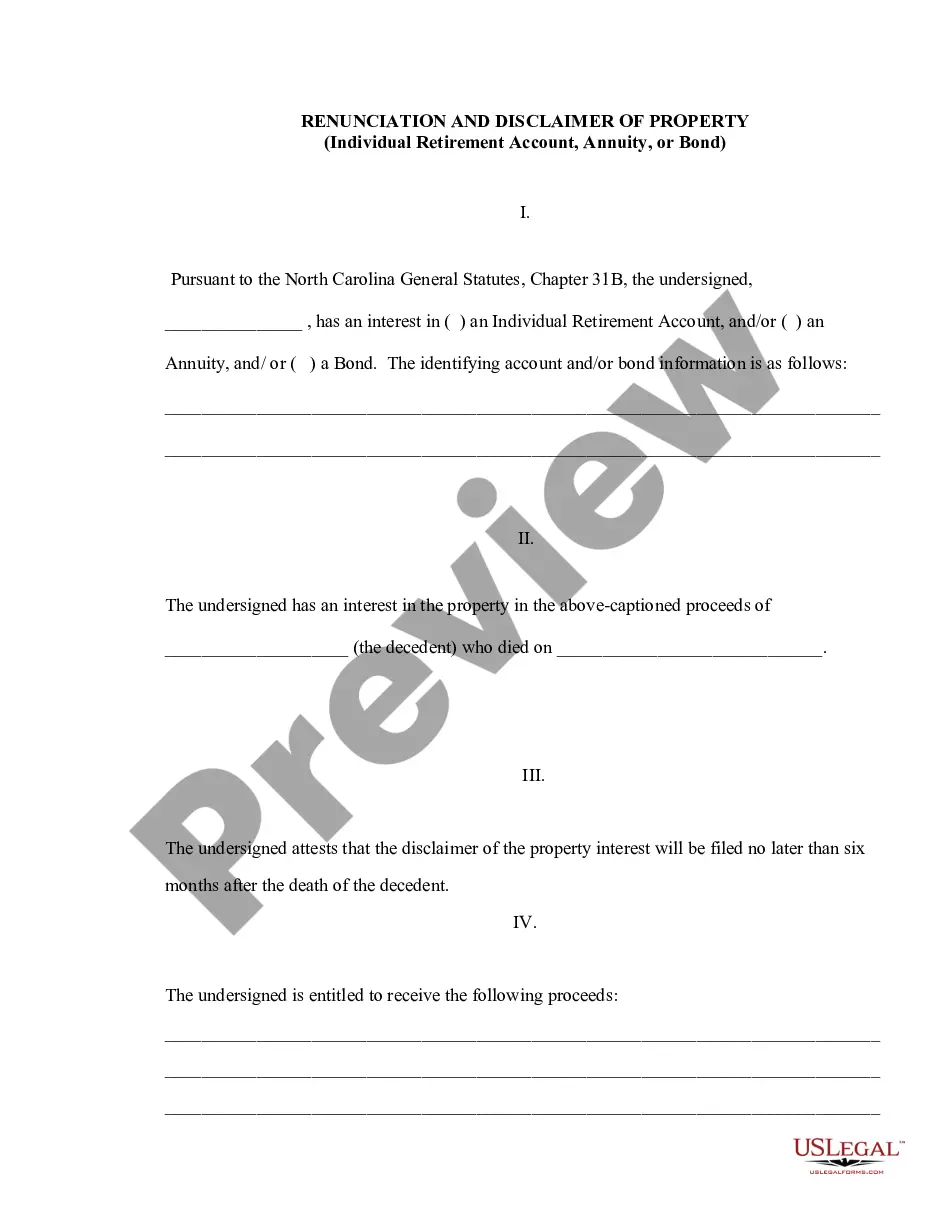

Renunciation of property involves the legal act of refusing to accept ownership or benefits of an asset, such as property derived from a life insurance policy or annuity. In the context of the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, this means that you willingly choose to relinquish any claim to the property. This crucial decision can significantly impact how estates are settled and ensures that assets go to the intended beneficiaries.

A letter of renunciation serves as a formal declaration of intent to refuse inheritance rights or benefits related to life insurance or an annuity contract. This document is critical in the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract process, as it provides clear evidence of your decision that can be referenced in future legal matters. Creating this letter helps avoid disputes and ensures that assets are distributed according to your family's needs.

Renunciation allows individuals to voluntarily forfeit their rights to property or benefits from life insurance or annuity contracts, which can be essential in estate planning. By choosing the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, you help clarify the distribution of assets according to your wishes. This process can also protect beneficiaries from potential tax liabilities associated with inherited property.

To disclaim an inheritance in North Carolina, you must follow specific legal steps which involve submitting a written disclaimer. This document should express your intention to refuse the inheritance clearly. It is also beneficial to reference the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract as it provides a structured approach to avoid undesired properties or benefits.

If there is no will in North Carolina, the state follows intestate succession laws to determine inheritance. Generally, spouses and children have priority in inheriting property. If you find yourself in this situation, it's wise to consult professionals who understand the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract to ensure your rights are protected.

Settling an estate in North Carolina without a will involves a process called intestate succession. This means the state determines who inherits the deceased's assets based on familial relationships. You may need to file for letters of administration to manage the estate, and engaging in the Wake North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract can provide clarity on how to handle specific assets.