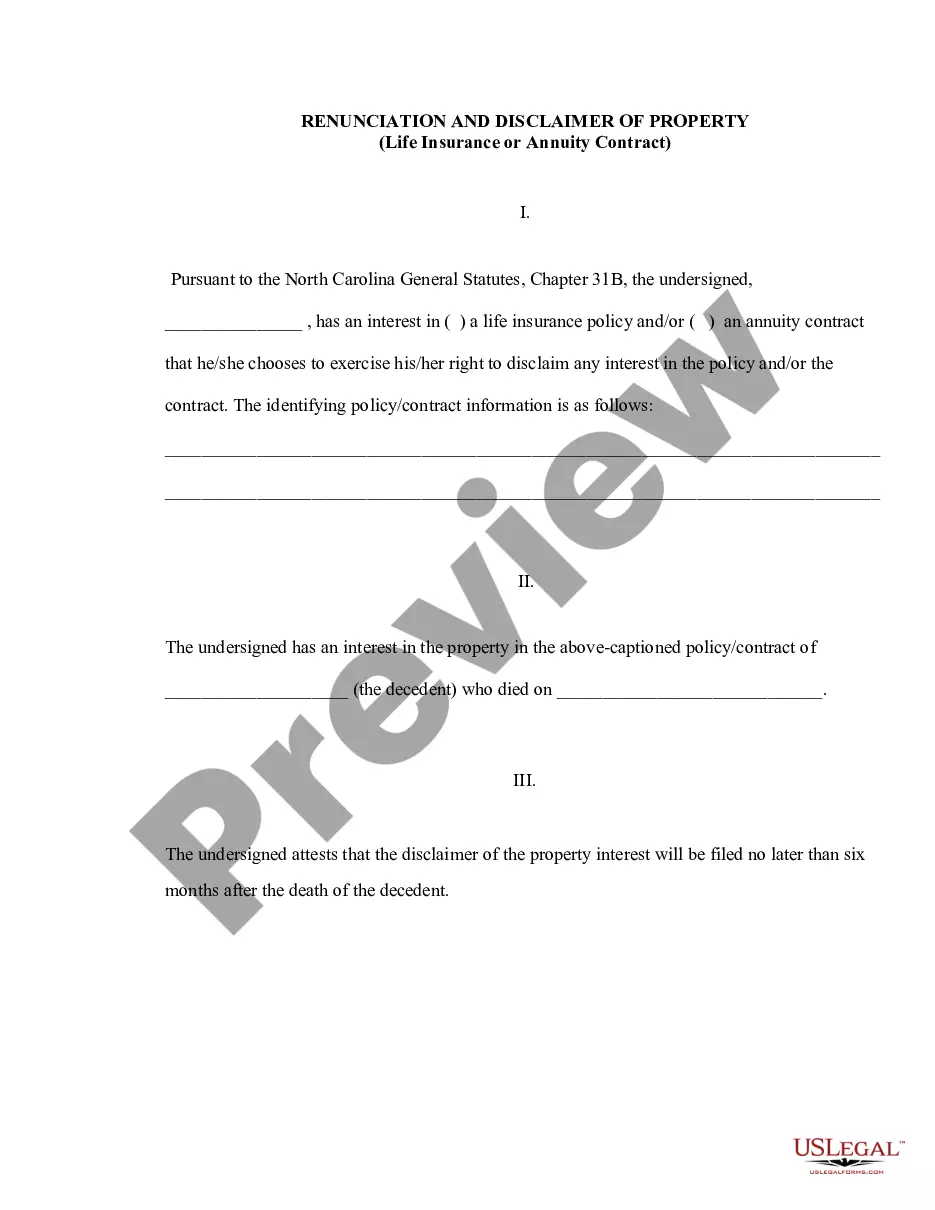

Mecklenburg North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

Description

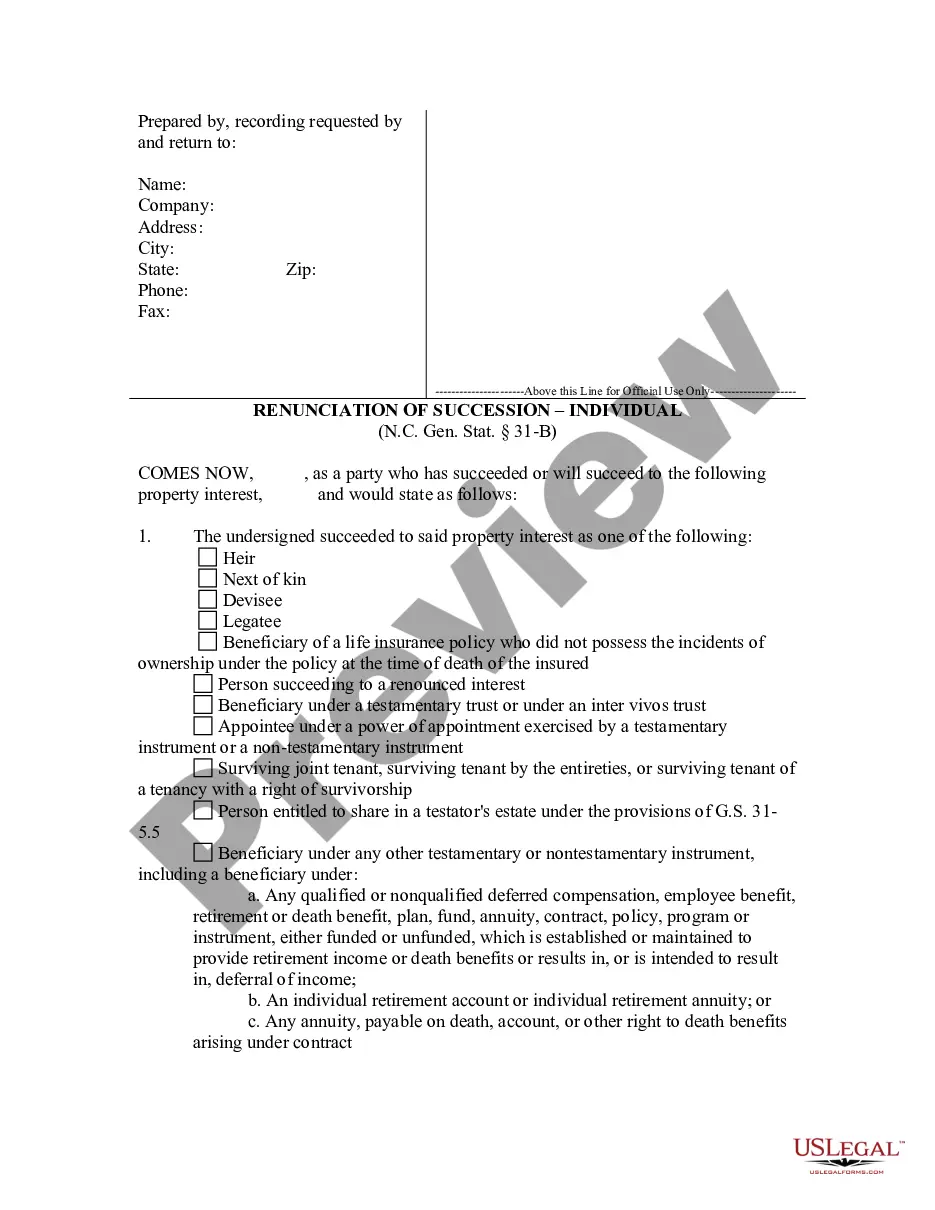

How to fill out North Carolina Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

Regardless of your social or vocational ranking, finishing legal documents is a regrettable requirement in the modern age.

Frequently, it's nearly unfeasible for an individual lacking legal expertise to draft such documentation from the ground up, mainly due to the intricate jargon and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Make sure the template you’ve located is appropriate for your area, bearing in mind that regulations of one state or region may not apply to another state or region.

Preview the document and review a short summary (if accessible) of instances the form can be utilized for.

- Our platform features an extensive collection of over 85,000 ready-to-use, state-specific documents that cater to nearly every legal circumstance.

- US Legal Forms also acts as an excellent aid for partners or legal advisors looking to conserve time by utilizing our DIY templates.

- Whether you require the Mecklenburg North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract or any other valid document for your jurisdiction, with US Legal Forms, everything is readily available.

- Here’s how you can obtain the Mecklenburg North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract in mere minutes using our dependable service.

- If you are already a member, you can simply Log In to your account to access the relevant document.

- However, if you are not acquainted with our platform, be sure to follow these guidelines before downloading the Mecklenburg North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

Form popularity

FAQ

In North Carolina, life insurance beneficiaries have specific rights outlined in state law. Beneficiaries can receive proceeds from life insurance policies, but certain rules apply to disclaimers and renunciations. If a beneficiary wishes to disclaim their inheritance, this can affect how the proceeds are distributed. To navigate these rules effectively, you can leverage our platform to access resources that simplify the process and ensure compliance with the Mecklenburg North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

Yes, you can disclaim an inheritance in North Carolina. The process allows you to refuse an inheritance you do not wish to accept, including property from life insurance or annuity contracts. However, you must adhere to specific state laws to ensure your disclaimer is valid and recognized. Utilizing resources from our platform can provide you with the necessary forms and guidance to effectively complete this process.

The renunciation of inheritance signifies a decision to refuse an inheritance one is entitled to receive. In Mecklenburg North Carolina, this action can have significant implications, especially regarding property from life insurance or annuity contracts. It helps streamline the distribution process and may assist in tax planning. You should ensure proper documentation to support your decision and maintain legal compliance.

To disclaim an inheritance, you must file a written disclaimer with the probate court or the executor of the estate. In Mecklenburg, North Carolina, it is important to ensure that your disclaimer complies with the state's laws regarding the Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. Be mindful of deadlines, as you may have a limited time to act. Consulting our platform can guide you through each step necessary to properly disclaim an inheritance.

Writing a disclaimer of inheritance requires clarity and adherence to legal standards. Start by stating your intention to disclaim the inheritance, referencing the specific property or assets involved. In the Mecklenburg North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract context, make sure to include your personal details and potentially, a legal representative's contact information. Using our platform can help you create a valid disclaimer that meets state requirements, ensuring everything is in order.

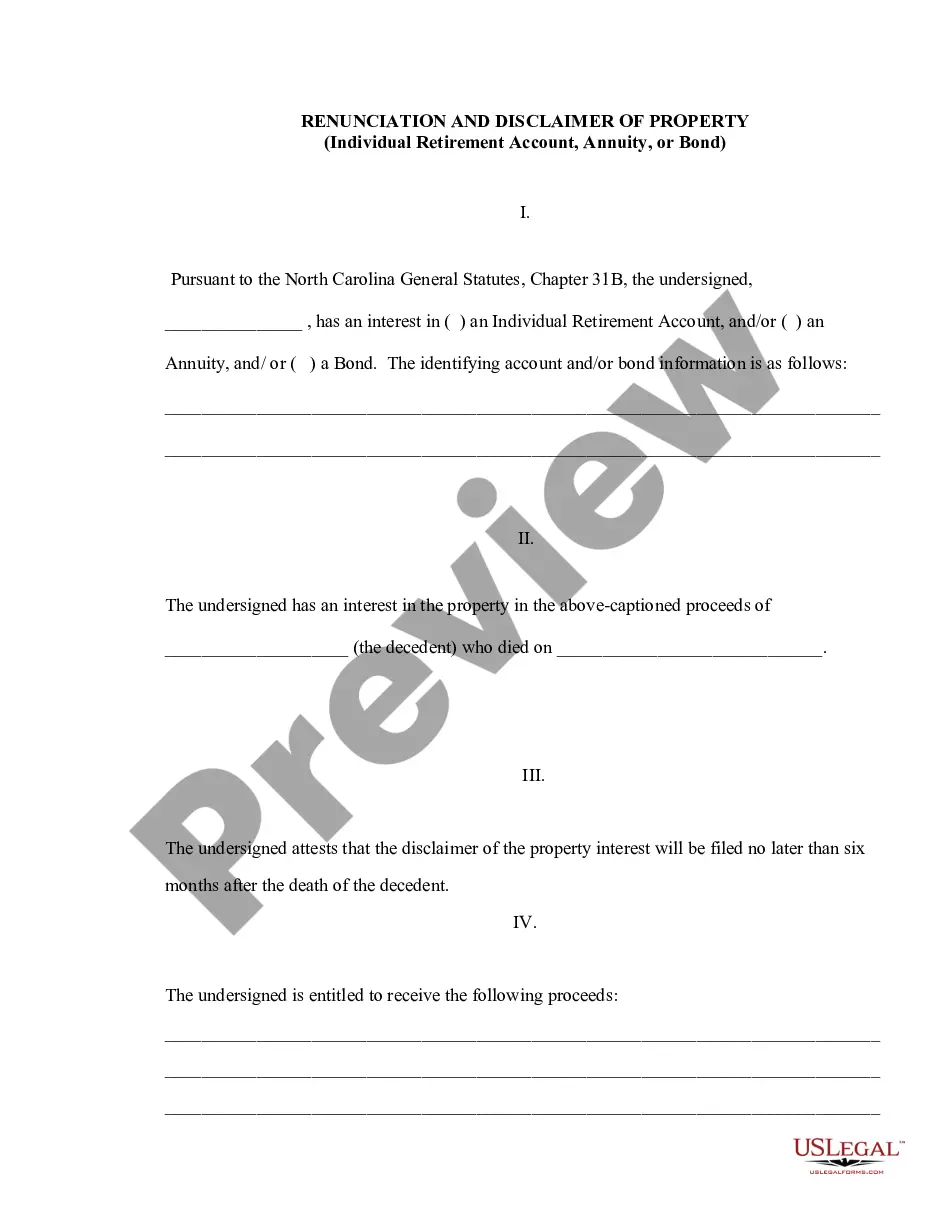

Renunciation in probate refers to a formal refusal to accept an inheritance or a property right. In the context of the Mecklenburg North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, this means that an heir or beneficiary chooses to give up their right to receive certain assets. This can simplify estate management and help avoid tax implications. It is crucial to follow the legal procedures to ensure your renunciation is valid.

To disclaim an inheritance in North Carolina, you must file a disclaimer with the appropriate court or through a written document stating your intent. This process must be completed within a specific time frame set by law. In Mecklenburg, North Carolina, utilizing resources like uslegalforms can simplify this process by providing the necessary templates and guidance for effective renunciation and disclaimer of property from life insurance or annuity contracts.

To renounce an inheritance means to formally decline the right to receive assets from a deceased person's estate. This action impacts your entitlement to property, including life insurance and annuity contracts, in Mecklenburg North Carolina. It's a decision that can influence tax obligations and heirs' rights, so understanding the implications is crucial.

The renunciation of inheritance is a legal action that allows a person to refuse an inheritance. In Mecklenburg North Carolina, this includes any benefits derived from life insurance or annuity contracts. When you renounce an inheritance, you relinquish your rights, which can provide significant financial advantages and aid in estate planning.

Renunciation and disclaimer of interests in an estate refer to the legal process by which an individual declines to accept assets from a deceased person's estate. This process is particularly relevant in Mecklenburg North Carolina, where individuals can renounce their rights to property from life insurance or annuity contracts. By completing this process, you ensure that the assets bypass your estate and may directly pass to alternate beneficiaries.