Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust

Description

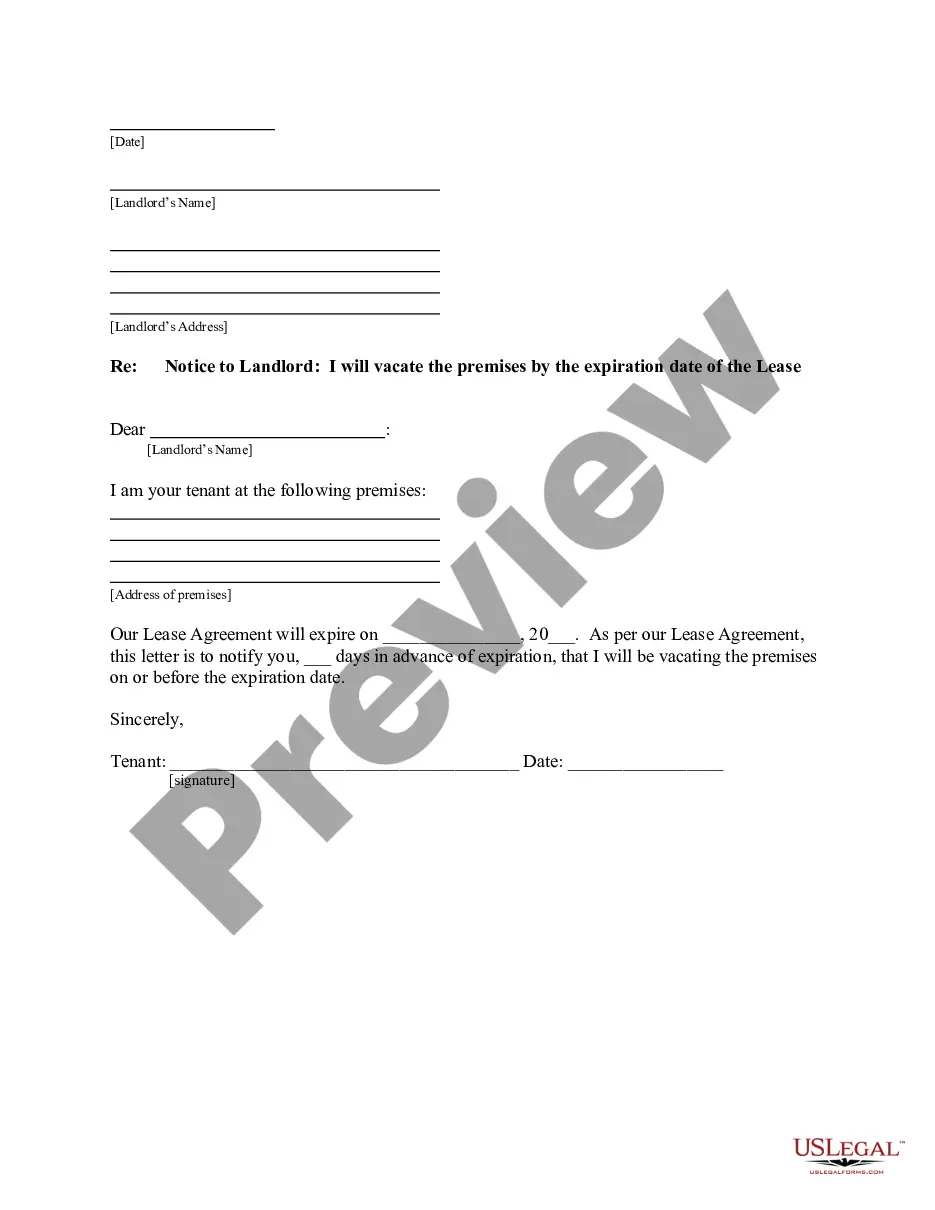

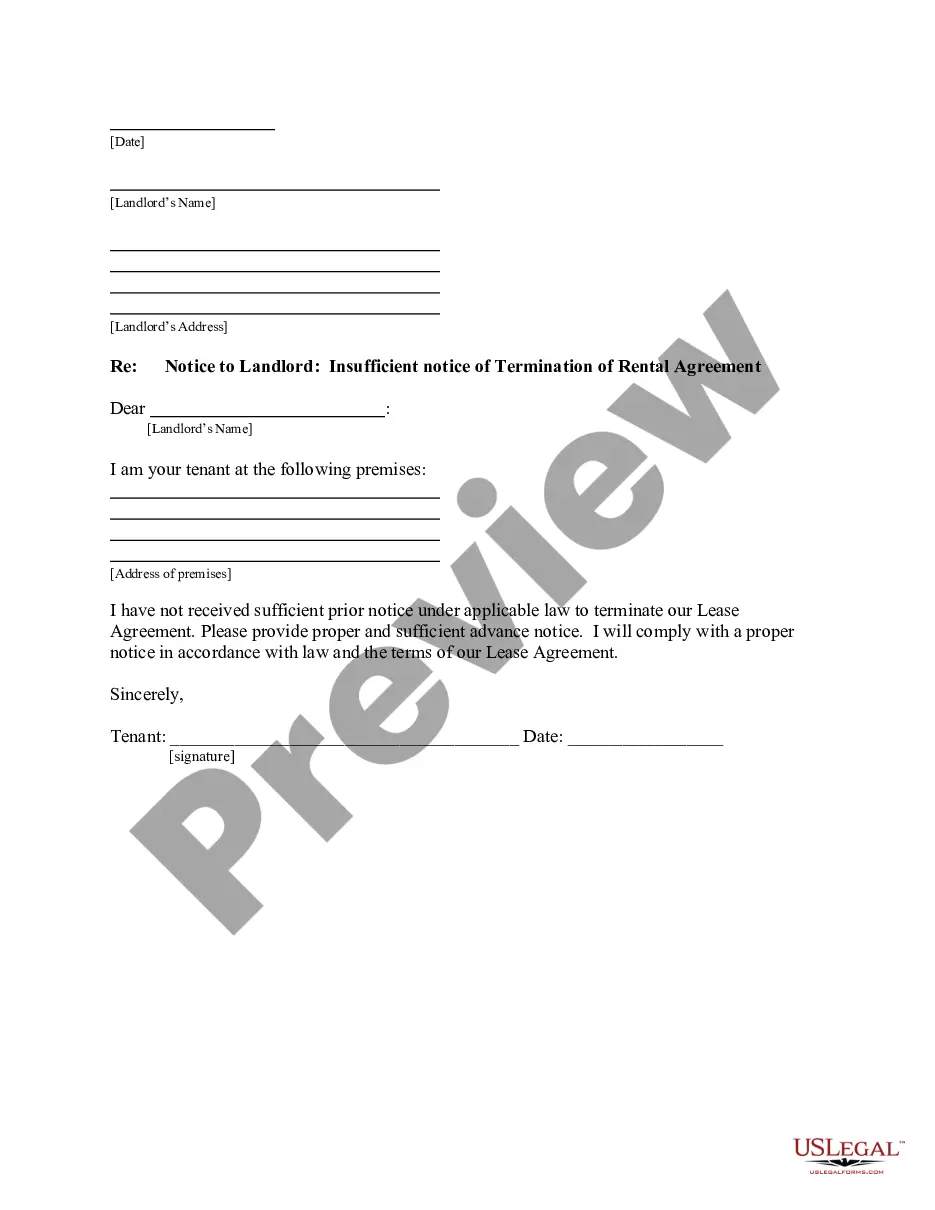

How to fill out Agreement And Plan Of Merger For Conversion Of Corporation Into Maryland Real Estate Investment Trust?

Use the most comprehensive legal library of forms. US Legal Forms is the perfect platform for finding up-to-date Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust templates. Our service offers a huge number of legal documents drafted by certified attorneys and grouped by state.

To download a sample from US Legal Forms, users simply need to sign up for a free account first. If you’re already registered on our service, log in and choose the template you need and buy it. Right after purchasing templates, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines listed below:

- Find out if the Form name you have found is state-specific and suits your needs.

- In case the form features a Preview option, utilize it to check the sample.

- If the sample doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the template meets your expections.

- Select a pricing plan.

- Create your account.

- Pay via PayPal or with yourr debit/credit card.

- Select a document format and download the template.

- Once it is downloaded, print it and fill it out.

Save your time and effort using our platform to find, download, and fill out the Form name. Join thousands of happy clients who’re already using US Legal Forms!

Form popularity

FAQ

If a contract with a dissolved company exists, the contract will stay legally valid.Dissolving a company will not terminate any lease the company has including those for a real estate property, company vehicles, or other creditors.

On average, roughly 30% of employees are deemed redundant after a merger or acquisition in the same industry. In such situations, most people tend to fixate on what they can't control: decisions about who is let go, promoted, reassigned, or relocated.

A merger agreement (or definitive merger agreement) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

Types of Mergers. The three main types of mergers are horizontal, vertical, and conglomerate. In a horizontal merger, companies at the same stage in the same industry merge to reduce costs, expand product offerings, or reduce competition.

Mergers combine two companies into one surviving company. Consolidations combine several companies into a new, larger organization. For instance, if Company ABC and Company XYC were to consolidate, they might create Company MNO.

A merger is an agreement that unites two existing companies into one new company.Mergers and acquisitions are commonly done to expand a company's reach, expand into new segments, or gain market share. All of these are done to increase shareholder value.

In contract law, agreements are merged when one contract is absorbed into another. The merger of contracts is generally based on the language of the agreement and the intent of the parties.

If the company changes owners in whole or in part, it is still the same company and this will not terminate any contracts. If, instead, the company sells its business (which is an asset of the company that it can sell like a car or a building), then the contracts are transferred as part of that sale.