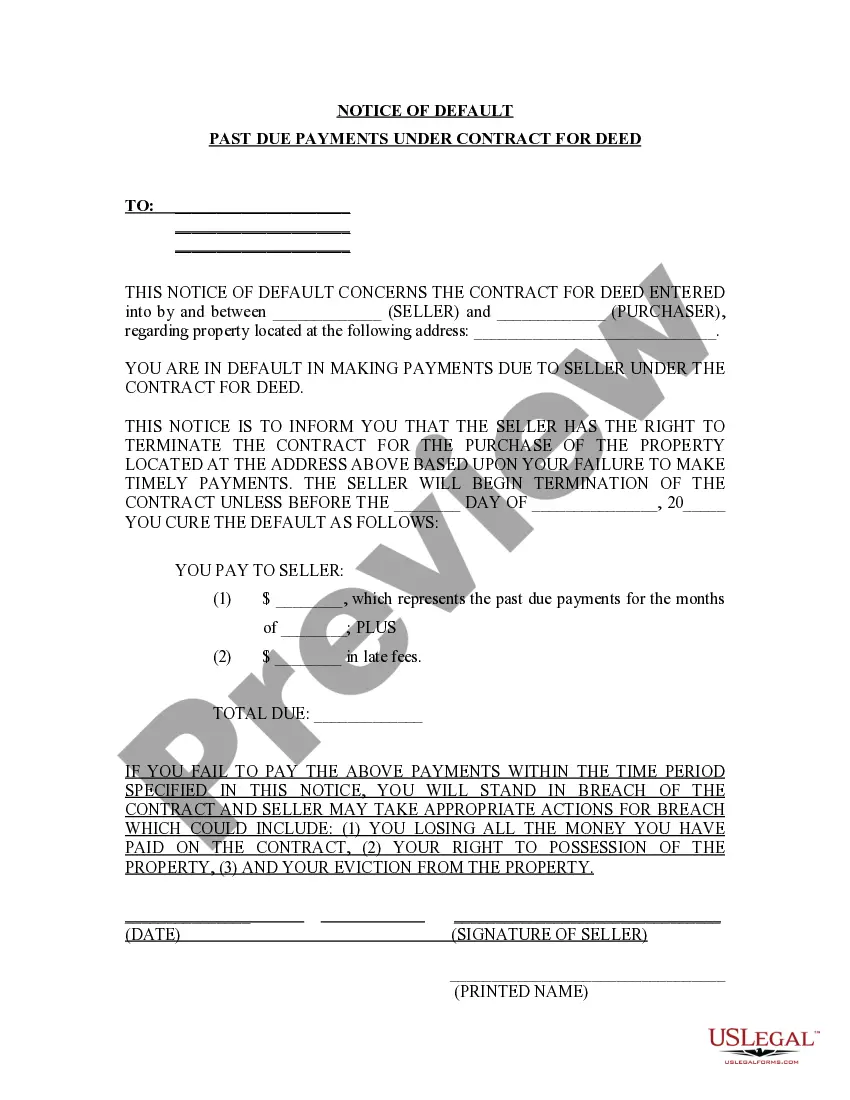

Wake North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out North Carolina Notice Of Default For Past Due Payments In Connection With Contract For Deed?

We consistently endeavor to reduce or evade legal repercussions when navigating intricate legal or financial issues.

To achieve this, we engage attorney services that are, as a general rule, quite costly.

Nonetheless, not all legal challenges are uniformly intricate. Most can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and power of attorney to articles of incorporation and dissolution petitions.

If you happen to misplace the form, you can always download it again from the My documents tab.

- Our platform enables you to manage your affairs autonomously without resorting to a lawyer.

- We offer access to legal form templates that aren’t always readily accessible.

- Our templates are tailored to specific states and regions, which greatly streamlines the search process.

- Take advantage of US Legal Forms anytime you need to locate and obtain the Wake North Carolina Notice of Default for Past Due Payments related to Contract for Deed or any other form securely and effortlessly.

Form popularity

FAQ

To negotiate a deed in lieu of foreclosure, start by communicating openly with your lender about your situation. Present your financial circumstances and propose the deed in lieu as a viable solution. Knowing the specifics of Wake North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed can strengthen your case. Utilizing a platform like USLegalForms can help you prepare the necessary documents and guide you through the negotiation process.

Rescission of a notice of default means that the lender withdraws their initial declaration of default. This action can occur when the borrower resolves their debt or comes to another agreement with the lender. It is especially relevant in cases involving the Wake North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, where timely actions can prevent foreclosure and restore the borrower’s standing.

One major disadvantage for lenders accepting a deed in lieu of foreclosure is the potential for limited recovery on the remaining mortgage balance. This method involves accepting the property back, which may have decreased in value. Furthermore, lenders may face complications when dealing with the Wake North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, as it may not resolve all outstanding obligations.

If someone defaults on a land contract, the seller typically issues a Wake North Carolina Notice of Default for Past Due Payments. This document officially alerts the buyer about the overdue payments and outlines possible consequences, such as foreclosure. Addressing the default promptly can often lead to alternative solutions, preventing further financial issues.

A land contract may be voided if the terms are not met or if there are significant legal violations. For example, failure to make timely payments can lead to a Wake North Carolina Notice of Default for Past Due Payments, serving as a foundation for the seller to terminate the agreement. Ensuring compliance with the contract terms can help avoid these issues.

When someone defaults on a land contract, the seller may issue a Wake North Carolina Notice of Default for Past Due Payments to formally inform the buyer about the missed obligations. This notice typically outlines the amount owed and the timeframe for payment. If the default is not resolved, the seller could potentially take steps to reclaim the property.

Investing in a land contract carries several risks, particularly if you fall behind on payments. The Wake North Carolina Notice of Default for Past Due Payments can trigger serious repercussions, including potential loss of the property. Understanding these risks ensures you can make informed decisions regarding your investment.

A request for notice of default is a formal document that notifies borrowers about their missed payments on a land contract. In Wake, North Carolina, it serves as a crucial step if you are facing default for past due payments in connection with a Contract for Deed. This notice aims to inform you of the situation while providing an opportunity to correct it before further actions are taken.

Negotiating a deed in lieu of foreclosure involves approaching your lender proactively to discuss your financial situation. In the context of a Wake North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, you should prepare to present your case clearly. Demonstrating your willingness to return the property can often lead to favorable terms, such as avoiding foreclosure and settling any debts. Utilizing platforms like UsLegalForms can guide you through the necessary paperwork and negotiations.

The timeline for foreclosure in North Carolina can vary significantly, but typically, the process takes around three to six months. After a Wake North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed is issued, the homeowner has 30 days to respond. If not resolved, the lender can move forward with the foreclosure auction. It's crucial to understand this timeline to explore your options and act promptly.