Wake North Carolina Contract for Deed Seller's Annual Accounting Statement

Description

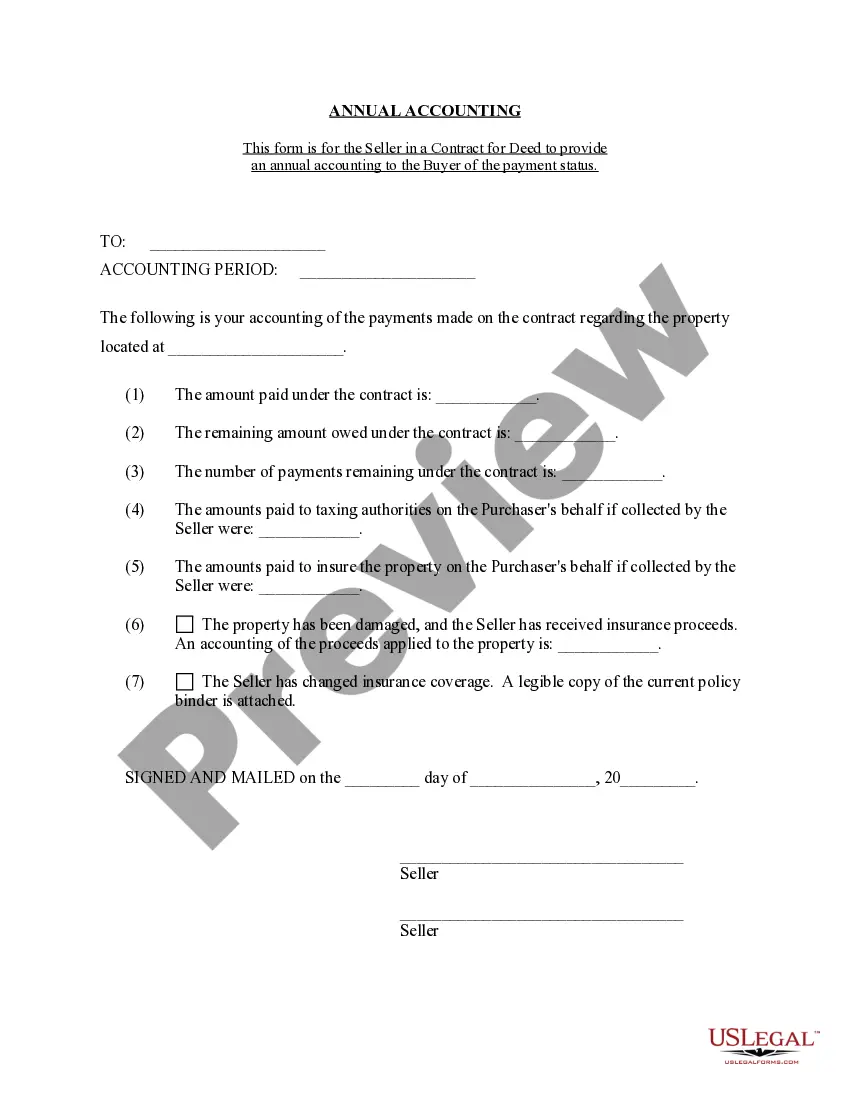

How to fill out North Carolina Contract For Deed Seller's Annual Accounting Statement?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our beneficial website with numerous templates streamlines the process of locating and obtaining nearly any document sample you may require.

You can download, fill out, and verify the Wake North Carolina Contract for Deed Seller's Annual Accounting Statement in just a few minutes instead of spending hours online searching for the right template.

Using our collection is a smart approach to enhance the security of your document submission.

Open the page with the form you need. Ensure that it is the template you are searching for: check its title and description, and use the Preview option if available. If not, utilize the Search box to find the necessary one.

Initiate the saving process. Click Buy Now and select your preferred pricing plan. Then, register for an account and complete your purchase using a credit card or PayPal. Download the document. Choose the format to obtain the Wake North Carolina Contract for Deed Seller's Annual Accounting Statement and modify and finalize, or sign it per your needs.

- Our qualified legal experts routinely examine all the files to ensure that the templates are suitable for specific areas and adhere to updated regulations and guidelines.

- How can you access the Wake North Carolina Contract for Deed Seller's Annual Accounting Statement.

- If you have an account, simply Log In to your profile. The Download option will be available on all the documents you view.

- Additionally, you can retrieve all previously saved documents in the My documents section.

- If you haven't created an account yet, follow the steps below.

Form popularity

FAQ

Recording (N.C.G.S.A. § 47H-2(d)) ? All deeds must be filed in the Register of Deeds in the County where the real estate is located. Signing (N.C.G.S.A. § 47-38) ? All deeds must be signed with the Grantor(s) signing in front of a Notary Public.

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.

NCGS Chapter 47H: Contracts for Deed Installment land sales contracts or contracts for deed are now governed by State law as of October 1, 2010 if the subject property will be used as the principal dwelling of the purchaser.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

An installment land contract (also known as a land contract, land sales contract, or contract for deed) is a written agreement whereby real property is sold on the installment payment method with the seller retaining legal title to the property until all of the purchase price is paid or until some other agreed point in

To be validly registered pursuant to G.S. 47-20, a deed of trust or mortgage of real property must be registered in the county where the land lies, or if the land is located in more than one county, then the deed of trust or mortgage must be registered in each county where any portion of the land lies in order to be

Recording and Document Fees Document TypeFee DetailsDeeds of Trust and Mortgages$64 first 35 pages $4 each additional pageAmendment to Deed of Trust$26 first 15 pages $4 each additional pageAll other Documents / Instruments / Assumed Name (DBA)$26 first 15 pages $4 each additional page3 more rows

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.