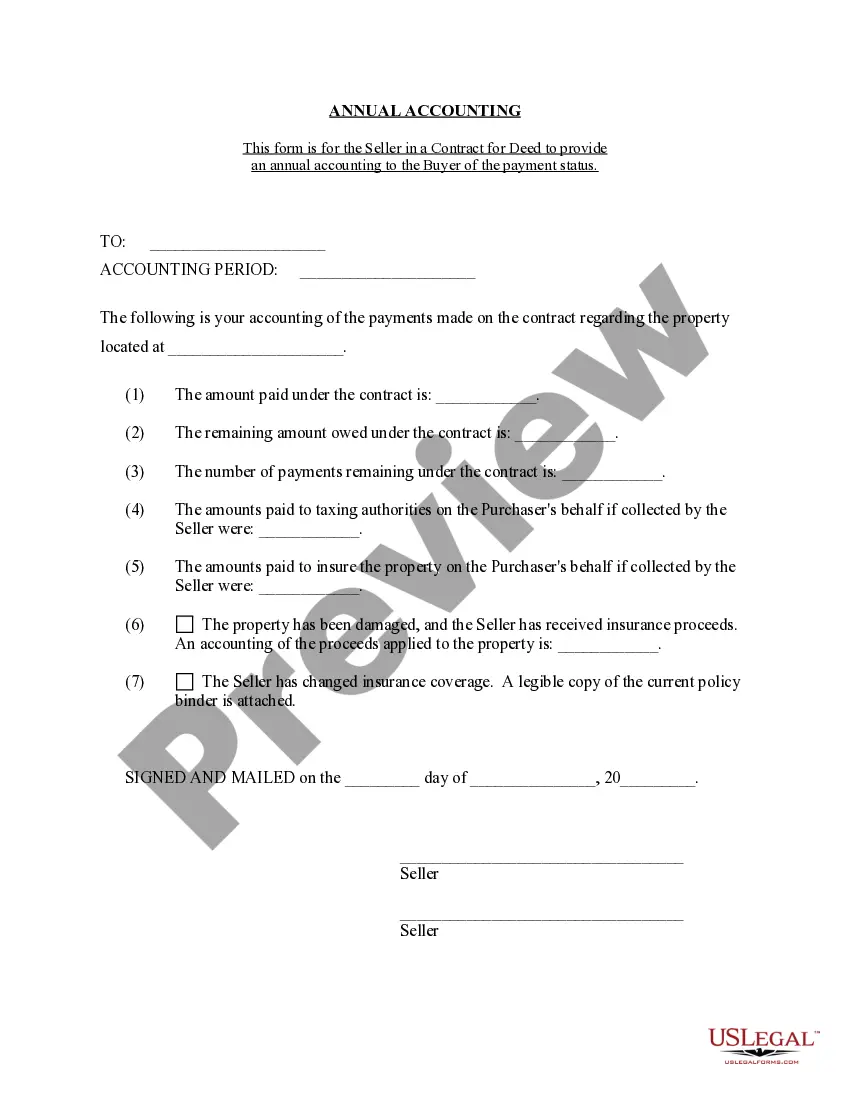

Mecklenburg North Carolina Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out North Carolina Contract For Deed Seller's Annual Accounting Statement?

Utilize the US Legal Forms and gain instant access to any form template you require.

Our useful platform with an extensive collection of templates enables you to locate and obtain nearly any document sample you necessitate.

You can export, complete, and authenticate the Mecklenburg North Carolina Contract for Deed Seller's Annual Accounting Statement in just a few moments instead of spending hours online searching for the appropriate template.

Leveraging our repository is an excellent method to enhance the security of your document submissions.

If you do not have an account yet, follow the instructions below.

Locate the form you need. Ensure it is the template you were looking for: verify its title and details, and use the Preview option if it is provided. Otherwise, use the Search bar to find the required one.

- Our knowledgeable attorneys regularly review all the paperwork to confirm that the forms are applicable to a specific state and adhere to the latest regulations and policies.

- How can you acquire the Mecklenburg North Carolina Contract for Deed Seller's Annual Accounting Statement.

- If you already possess a subscription, simply Log In to your account.

- The Download button will be activated for all documents you view.

- Moreover, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.

To be validly registered pursuant to G.S. 47-20, a deed of trust or mortgage of real property must be registered in the county where the land lies, or if the land is located in more than one county, then the deed of trust or mortgage must be registered in each county where any portion of the land lies in order to be

An installment land contract (also known as a land contract, land sales contract, or contract for deed) is a written agreement whereby real property is sold on the installment payment method with the seller retaining legal title to the property until all of the purchase price is paid or until some other agreed point in

A: Anywhere between 14 to 90 days after closing. A properly recorded deed can take anywhere from 14 days to 90 days. That may seem like a long time, but your local government office goes over every little detail on the deed to make sure the property is correct and there are no errors.

Recording and Document Fees Document TypeFee DetailsDeeds of Trust and Mortgages$64 first 35 pages $4 each additional pageAmendment to Deed of Trust$26 first 15 pages $4 each additional pageAll other Documents / Instruments / Assumed Name (DBA)$26 first 15 pages $4 each additional page3 more rows

How long does title deed registration take? The Deeds Office usually takes 2 ? 3 weeks to process the documents. However, this can fluctuate depending on the process. If things go smoothly it may be done in 7 ? 8 working days, but if there is a bottleneck it can take as long as two months.

A: Anywhere between 14 to 90 days after closing. A properly recorded deed can take anywhere from 14 days to 90 days. That may seem like a long time, but your local government office goes over every little detail on the deed to make sure the property is correct and there are no errors.

Go to your county's website and search for tax maps or real property records. Go to: . Click on ?Access to Local Geospatial Data in NC?.

Recording (N.C.G.S.A. § 47H-2(d)) ? All deeds must be filed in the Register of Deeds in the County where the real estate is located. Signing (N.C.G.S.A. § 47-38) ? All deeds must be signed with the Grantor(s) signing in front of a Notary Public.