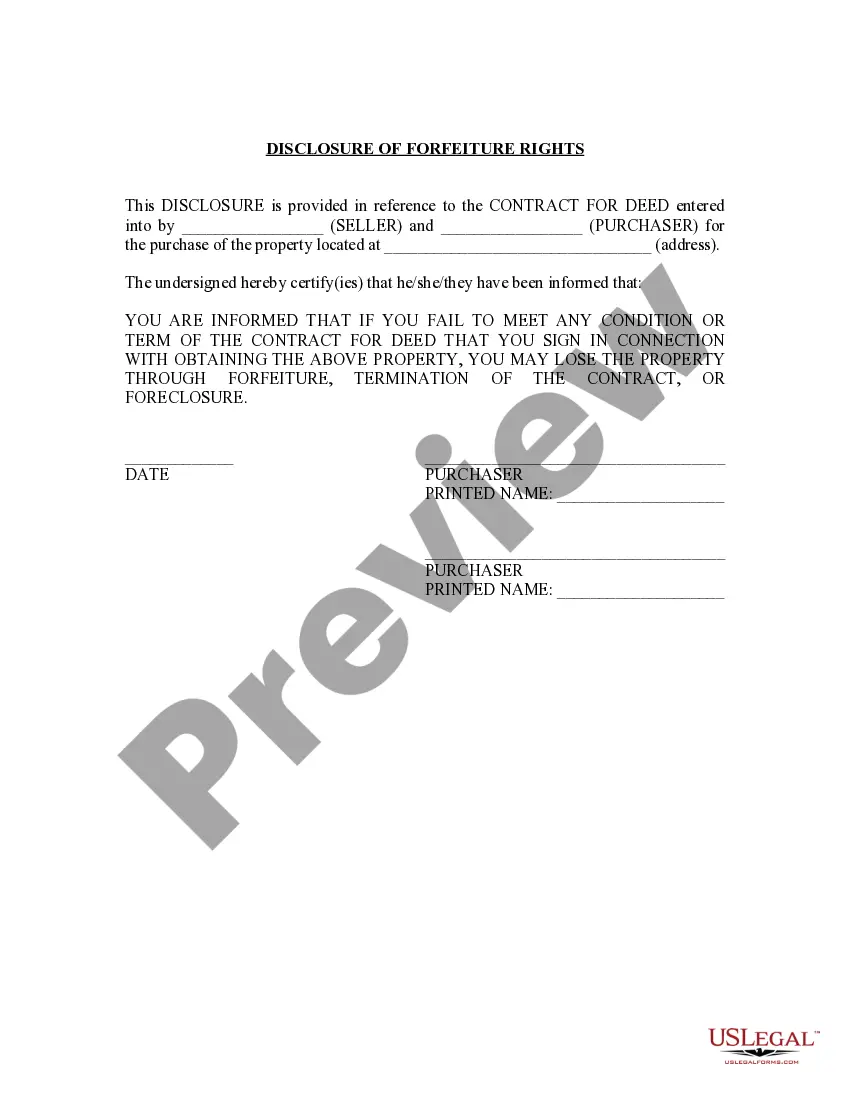

Cary North Carolina Seller's Disclosure of Forfeiture Rights for Contract for Deed

Description

How to fill out North Carolina Seller's Disclosure Of Forfeiture Rights For Contract For Deed?

Do you require a dependable and economical legal forms provider to obtain the Cary North Carolina Seller's Disclosure of Forfeiture Rights for Contract for Deed? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a collection of documents to progress your divorce through the courts, we have you covered. Our website features over 85,000 current legal document templates for both personal and business use. All the templates we provide are not generic and are designed based on the regulations of particular states and counties.

To acquire the form, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please remember that you can access your previously purchased document templates at any time in the My documents section.

Is this your first visit to our platform? No problem. You can create an account with great ease, but beforehand, ensure you do the following.

Now you can register your account. Then, choose the subscription option and proceed to payment. Once the payment is completed, download the Cary North Carolina Seller's Disclosure of Forfeiture Rights for Contract for Deed in any available format. You can revisit the website at any time and redownload the form at no additional charge.

Finding current legal forms has never been more straightforward. Try US Legal Forms today, and say goodbye to spending countless hours searching for legal documents online.

- Verify if the Cary North Carolina Seller's Disclosure of Forfeiture Rights for Contract for Deed complies with the laws of your state and local area.

- Review the form's description (if available) to understand for whom and what the form is intended.

- Restart the search if the template does not meet your particular needs.

Form popularity

FAQ

The Transfer Disclosure Statement (TDS) is required in the state of California unless the seller (or transferor) meets one of the following conditions: Court-ordered sales such as probate sales, foreclosure sales, sale by bankruptcy trustee, eminent domain.

Commonly, there aren't definite disclosure laws and the sale prices will only reflect on public records if the seller submits one. These states are the following: Alabama, Arkansas, Louisiana, Nevada, North Carolina, Oklahoma, Rhode Island, and Tennessee.

North Carolina law mandates that sellers identify any known defects in their property before a purchase contract is signed. The purpose of this is to make sure that buyers are not surprised with a problem when they move into the home: a busted air-conditioner, a termite infestation, a flooded basement, and so forth.

Which of these transactions in California is exempt from agency disclosure requirements? Agency disclosure is not required for transactions involving residential properties with five or more units, as these are exempt from this disclosure requirement.

Real estate agents are now required to provide the Agency Law Disclosure to all participants when listing, selling, buying or leasing for a term greater than one year: property containing one-to-four residential units; mobilehomes; and. commercial property.

Exempt Sellers include: (d) Sales or transfers by a fiduciary in the course of the administration of a trust, guardianship, conservatorship, or decedent's estate.

Which transfers of property are exempt from a disclosure report? The property consists of one to four dwelling units. The property is sold at public auction. The property is a sale, exchange, land sales contract, or lease with option to buy.

Transfers made by court order, default, divorce, and by government entities are exempt from the disclosure requirement. Sellers with exempt property should fill out an exemption certificate provided by the Delaware real estate commission.

The Transfer Disclosure Statement (TDS) is required in the state of California unless the seller (or transferor) meets one of the following conditions: Court-ordered sales such as probate sales, foreclosure sales, sale by bankruptcy trustee, eminent domain.

A seller is required to provide the TDS even when selling property without an agent, such as in a ?for sale by owner? transaction. The TDS also must be provided for sales of a new residential property that is not part of a subdivision, such as a new home or a new four-unit building being built on a lot.