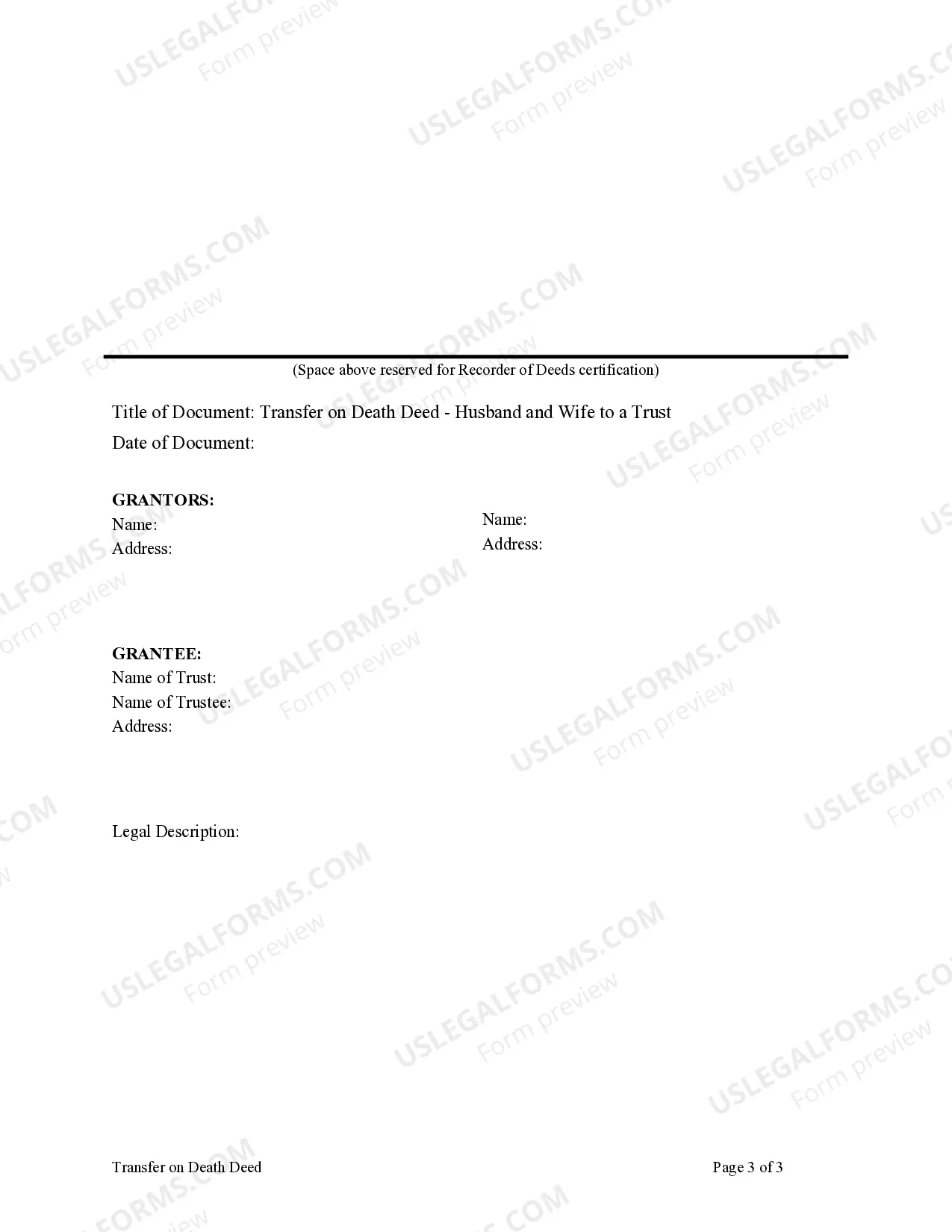

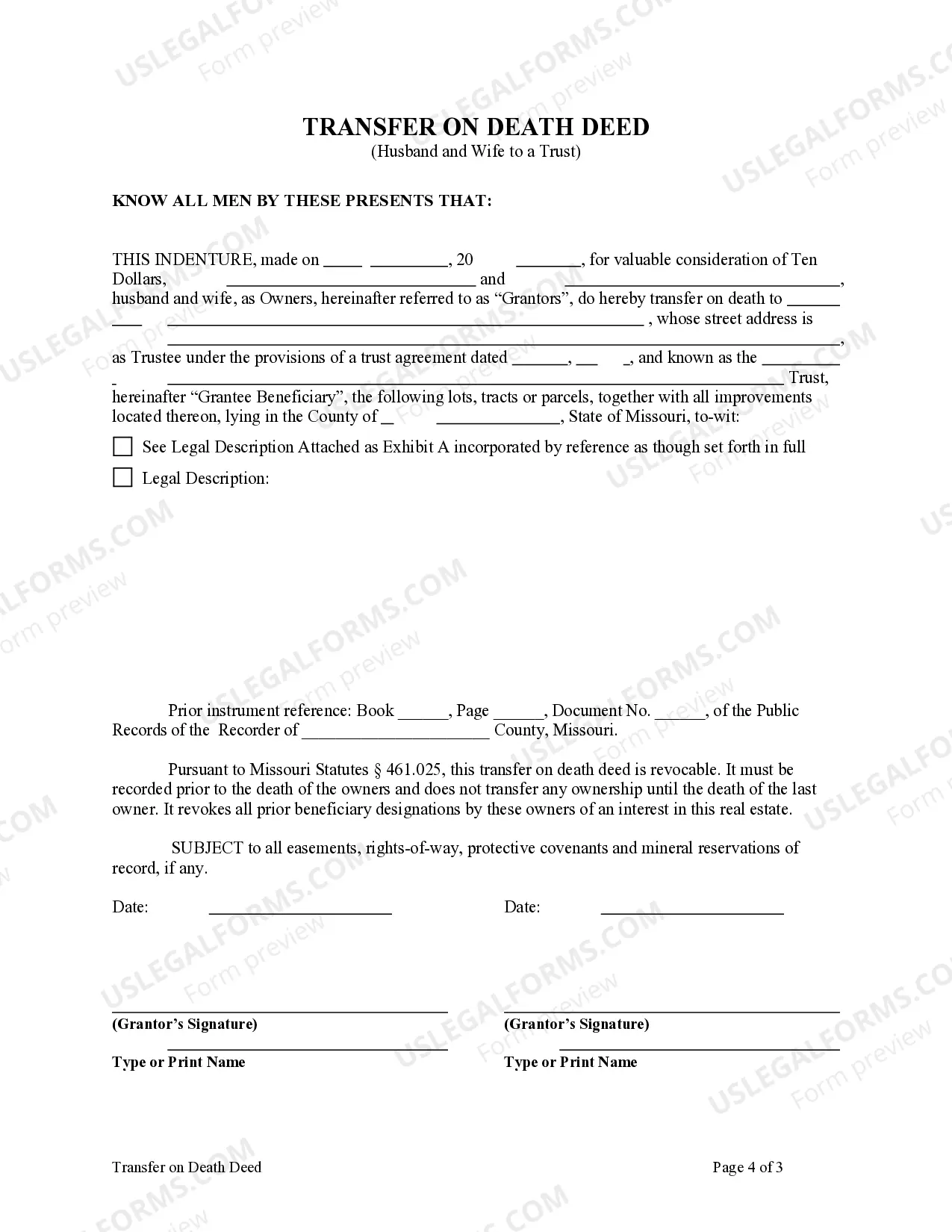

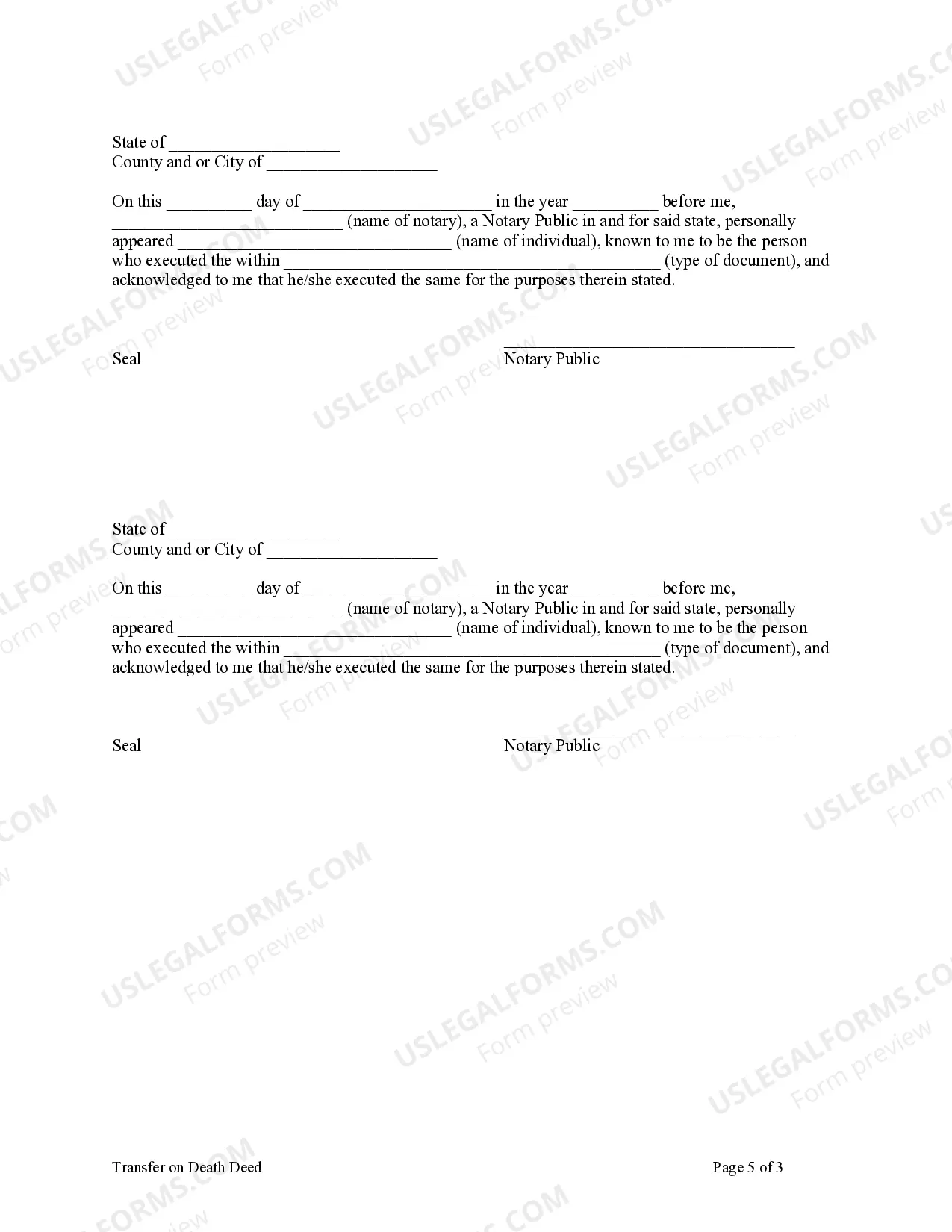

Transfer on Death Deed - Beneficiary Deed Missouri - Husband and Wife to a Trust: This deed is used to transfer the title of a parcel of land, upon the death of the Grantors to the Grantee beneficiary. It is revocable until the death of the last surviving Grantor and it must be recorded prior to the death of the last surviving Grantor.

Kansas City Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to a Trust

Description

How to fill out Missouri Transfer On Death Deed Or TOD - Beneficiary Deed - Husband And Wife To A Trust?

We consistently strive to minimize or evade legal complications when handling intricate law-related or financial issues.

To achieve this, we engage in legal services that are typically highly costly.

Nevertheless, not all legal situations are as complicated.

The majority of them can be managed by us personally.

Utilize US Legal Forms whenever you need to locate and download the Kansas City Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to a Trust or any other form swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform enables you to take charge of your matters without needing legal representation.

- We provide access to legal form templates that are not always readily available to the public.

- Our templates are specific to the state and region, which greatly simplifies the process of searching.

Form popularity

FAQ

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

If you have made a will or previous beneficiary deed that leaves the property to someone, your new beneficiary deed will override it. Your rights. You keep complete ownership of, and control over, the real estate while you're alive.

A transfer on death deed can be a very helpful planning tool when designing an estate plan. Indiana is one of many states that allows the transfer of real property by a transfer on death deed.

A transfer on death deed, or a TOD Deed, allows for individuals to pass real property to a beneficiary upon their death.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.

A Missouri beneficiary deed form?also known as a Missouri transfer-on-death deed form or simply Missouri TOD deed form?is a written document that transfers real estate at an owner's death. It works in much the same way as a POD or TOD designation on a bank account.

Transfer-on-Death Deeds for Real Estate North Carolina does not allow real estate to be transferred with transfer-on-death deeds.

A transfer on death direction may only be placed on an account record, security certificate or instrument evidencing ownership of property by the transferring entity or a person authorized by the transferring entity.

A deed that conveys an interest in real property to a grantee designated by the owner, that expressly states that the deed is not to take effect until the death of the owner, transfers the interest provided to the designated grantee beneficiary, effective on death of the owner, if the deed is executed and filed of