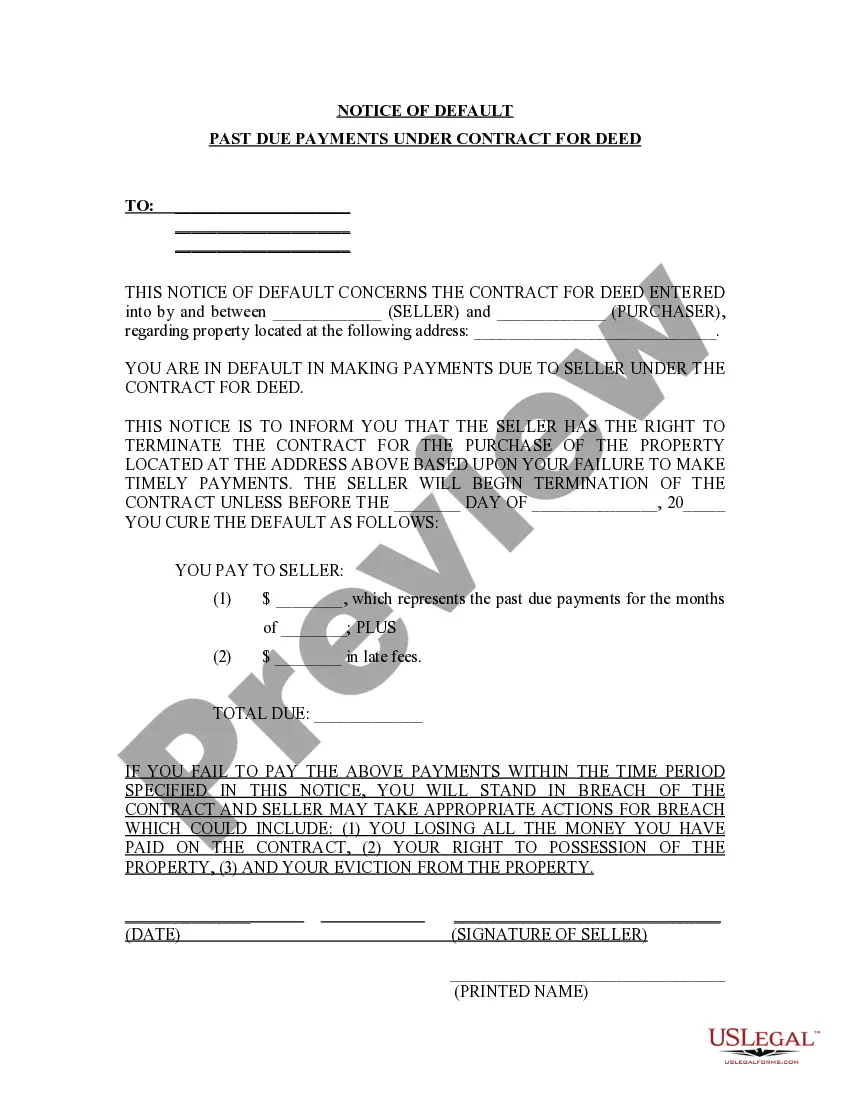

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

In Springfield, Missouri, a Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document that addresses delinquent payments and potential consequences for the defaulting party. It serves as a formal notice to the party in breach of their contractual obligations, informing them of their default status and the steps they need to take to rectify the situation. Below, we will explore different types of Springfield Missouri Notice of Default for Past Due Payments in connection with Contract for Deed, along with relevant keywords to provide a comprehensive understanding of this topic. 1. Standard Notice of Default: A standard Notice of Default is the most common type related to Contract for Deed agreements in Springfield, Missouri. This notice is typically sent by the party holding the deed (the seller or lender) to the defaulting party (buyer or borrower) when they fail to make required payments on time. Keywords: Springfield Missouri, Notice of Default, Contract for Deed, delinquent payments, breach of contract, default status, rectify, consequences, contractual obligations, notice, party holding the deed, defaulting party, required payments. 2. Cure or Quit Notice: Sometimes, a Cure or Quit Notice may be issued alongside or following the standard Notice of Default. This notice informs the defaulting party that they have a specific period (typically 30 days) to cure the default by making the overdue payments and bringing the account back to good standing, or face potential legal consequences, such as eviction or foreclosure. Keywords: Cure or Quit Notice, overdue payments, specific period, cure the default, bring account back to good standing, legal consequences, eviction, foreclosure. 3. Intent to Accelerate Notice: An Intent to Accelerate Notice is sent when the seller or lender intends to accelerate the entire balance due under the Contract for Deed if the defaulting party fails to cure the default within a specified timeframe. This notice essentially demands immediate payment of the entire outstanding amount rather than just the past due payments. Keywords: Intent to Accelerate Notice, accelerate the entire balance, cure the default, specified timeframe, immediate payment, outstanding amount, past due payments. 4. Demand Letter: In certain cases, a Demand Letter is prepared and sent by the party holding the deed as a precursor to a formal Notice of Default. This letter may kindly request the delinquent party to fulfill their payment obligations before the situation escalates into a formal notice, providing them with a last opportunity to rectify the default without invoking legal measures. Keywords: Demand Letter, precursor, formal Notice of Default, payment obligations, situation escalates, last opportunity, rectify, invoke legal measures. In conclusion, Springfield Missouri Notice of Default for Past Due Payments in connection with a Contract for Deed represents a serious legal document designed to address delinquent payments and contractual breaches. Understanding the different types of default notices, such as Standard Notice of Default, Cure or Quit Notice, Intent to Accelerate Notice, and Demand Letter, is crucial for both parties involved in a Contract for Deed agreement in Springfield, Missouri.