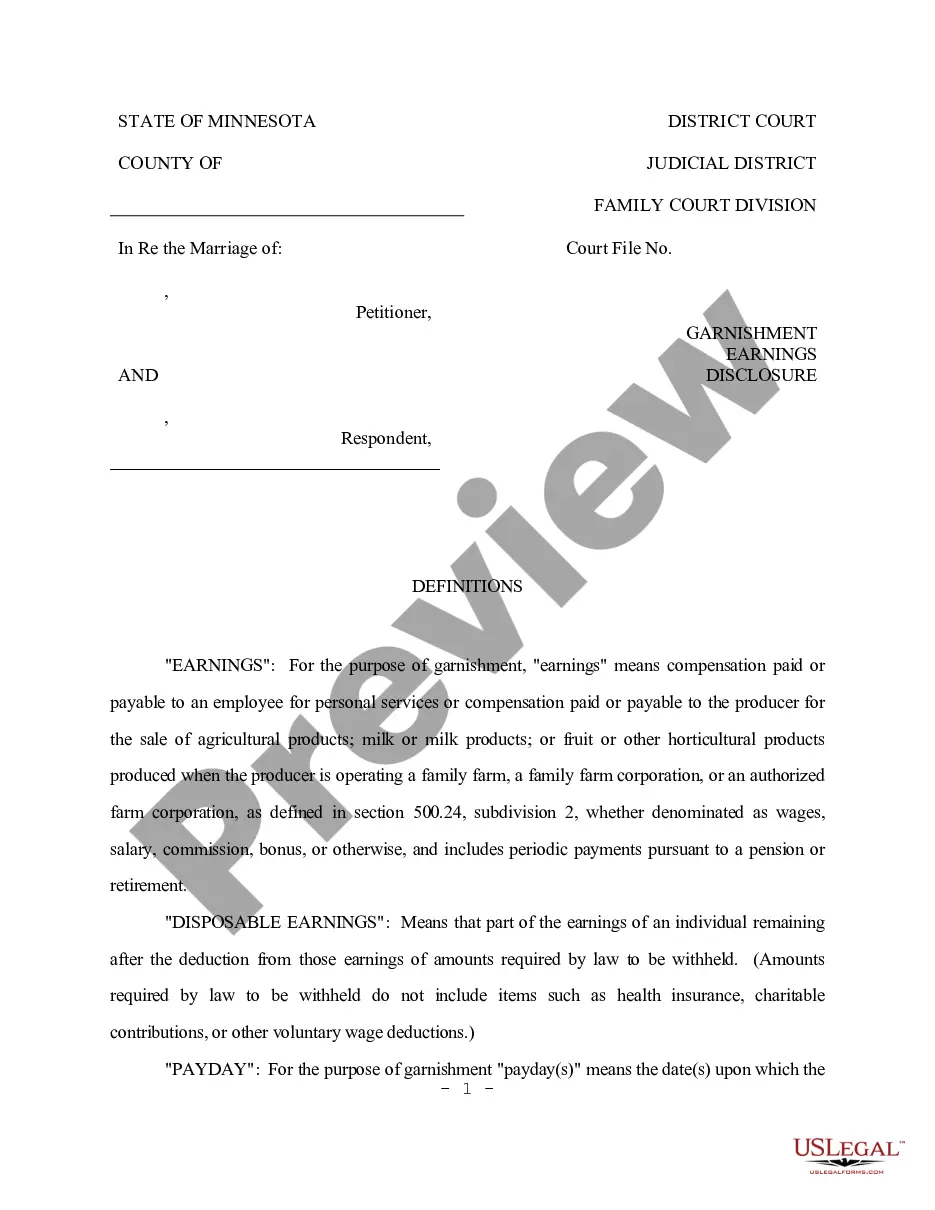

Minneapolis Minnesota Garnishment Disclosure

Description

How to fill out Minnesota Garnishment Disclosure?

If you have previously used our service, Log In to your account and retrieve the Minneapolis Minnesota Garnishment Disclosure on your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial interaction with our service, follow these easy steps to acquire your document.

You have continuous access to all the documents you have purchased: you can locate them in your profile under the My documents section whenever you need to access them again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or business requirements!

- Ensure you’ve found an appropriate document. Review the details and utilize the Preview option, if available, to confirm if it satisfies your needs. If it does not meet your criteria, use the Search tab above to find the correct one.

- Purchase the document. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process the payment. Use your credit card information or the PayPal method to finalize the transaction.

- Obtain your Minneapolis Minnesota Garnishment Disclosure. Choose the file format for your document and save it to your device.

- Complete your template. Print it or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.

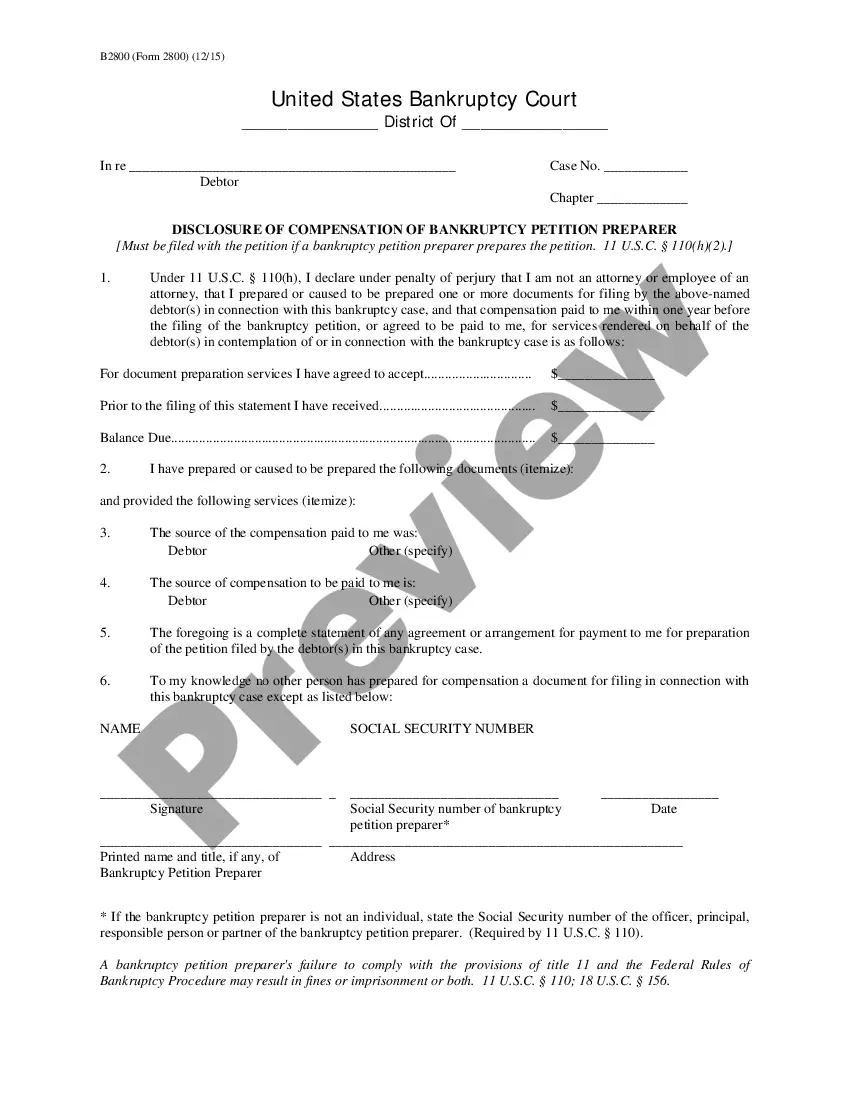

Ways to Stop A Garnishment Paying off the debt in full. Filing an objection to the garnishment with the court if you have legal basis, such debt was a result of fraud or identity theft. Filing for court protection and debt resolution through Chapter 13 or Chapter 7 bankruptcy.

Minnesota Wage Garnishment Process The creditor files a lawsuit.You must respond within 21 days.There's a court hearing.You can raise objections or defenses.The judge makes a decision.After this court order and judgment are made, the creditor can request a garnishment order.

If you receive a notice of a wage garnishment order, you might be able to protect or exempt some or all of your wages by filing an exemption claim with the court. You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep.

Limits on Wage Garnishment in Minnesota In Minnesota, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed the greater of 40 times the federal or state hourly minimum wage.

Limits on Wage Garnishment in Minnesota In Minnesota, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed the greater of 40 times the federal or state hourly minimum wage. (Minn.

This happens when a debt collector secures a court order requiring your employer to subtract wages from your paycheck to cover an unpaid debt. Four states?North Carolina, Pennsylvania, South Carolina and Texas?don't allow wage garnishment for consumer debt.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

A garnishment is the legal action which your employee's creditor may use to claim funds that you, the employer, owe to the employee (salary or hourly wages, for example). The summons is a warning not to transfer those funds to the employee.

There are four ways to stop a garnishment in Minnesota: (1) claim an exemption; (2) negotiate a settlement; (3) vacate the judgment; and (4) file bankruptcy.