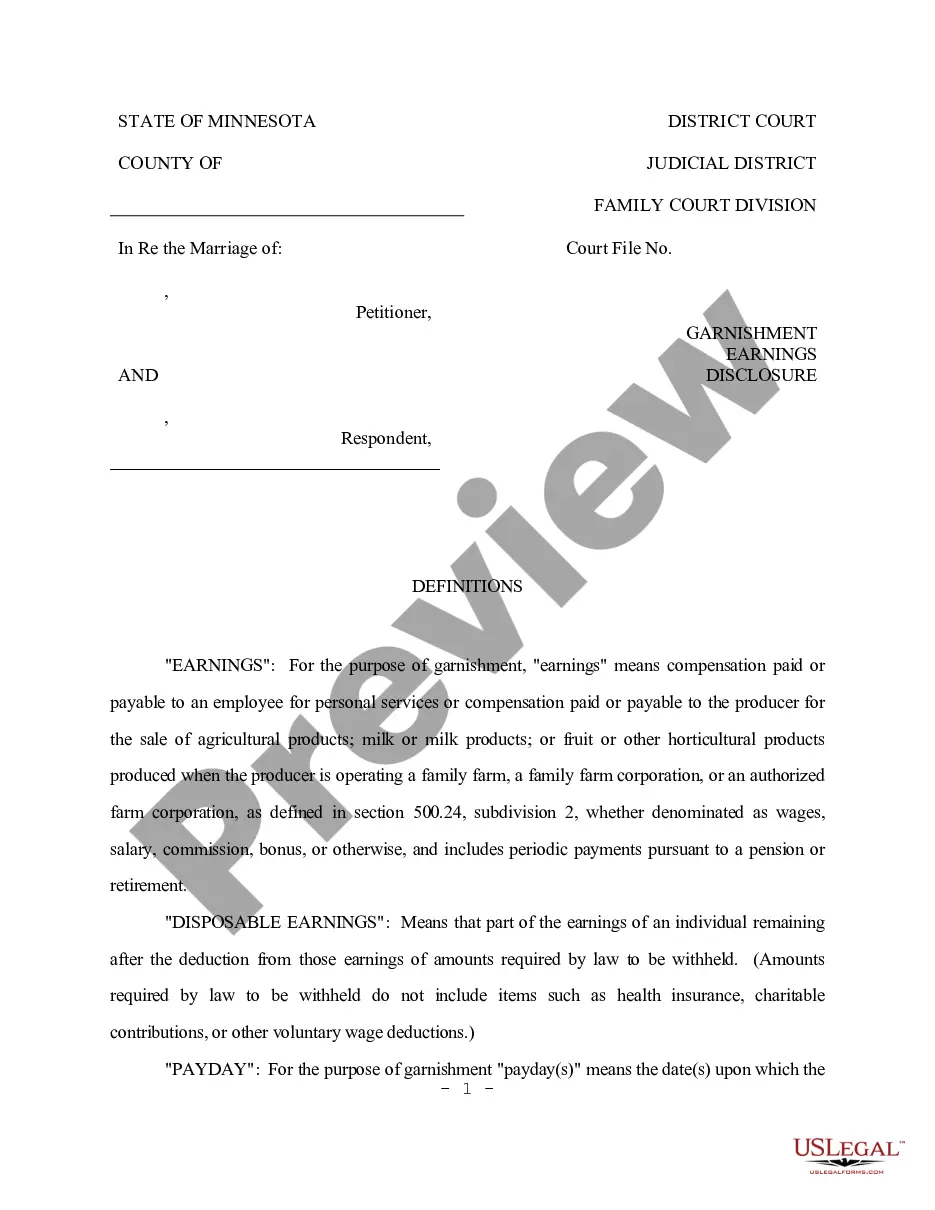

Saint Paul Minnesota Garnishment Earnings Disclosure Instructions

Description

How to fill out Minnesota Garnishment Earnings Disclosure Instructions?

Utilize the US Legal Forms and gain immediate access to any document you need.

Our user-friendly platform with numerous templates simplifies the process of locating and acquiring nearly any document sample you require.

You can download, complete, and sign the Saint Paul Minnesota Garnishment Earnings Disclosure Instructions in just a few minutes instead of spending hours browsing the Internet for the correct template.

Using our collection is an excellent method to enhance the security of your record submissions.

If you do not have an account yet, follow the steps outlined below.

Access the page with the template you need. Confirm that it is the document you were searching for: verify its title and description, and use the Preview option when available. Otherwise, use the Search field to find the suitable one.

- Our experienced legal experts frequently evaluate all the documents to ensure that the templates are pertinent for a specific state and adhere to updated laws and regulations.

- How do you acquire the Saint Paul Minnesota Garnishment Earnings Disclosure Instructions.

- If you possess an account, simply Log In to your profile.

- The Download feature will be activated on all the samples you view.

- Additionally, you can locate all previously saved documents in the My documents section.

Form popularity

FAQ

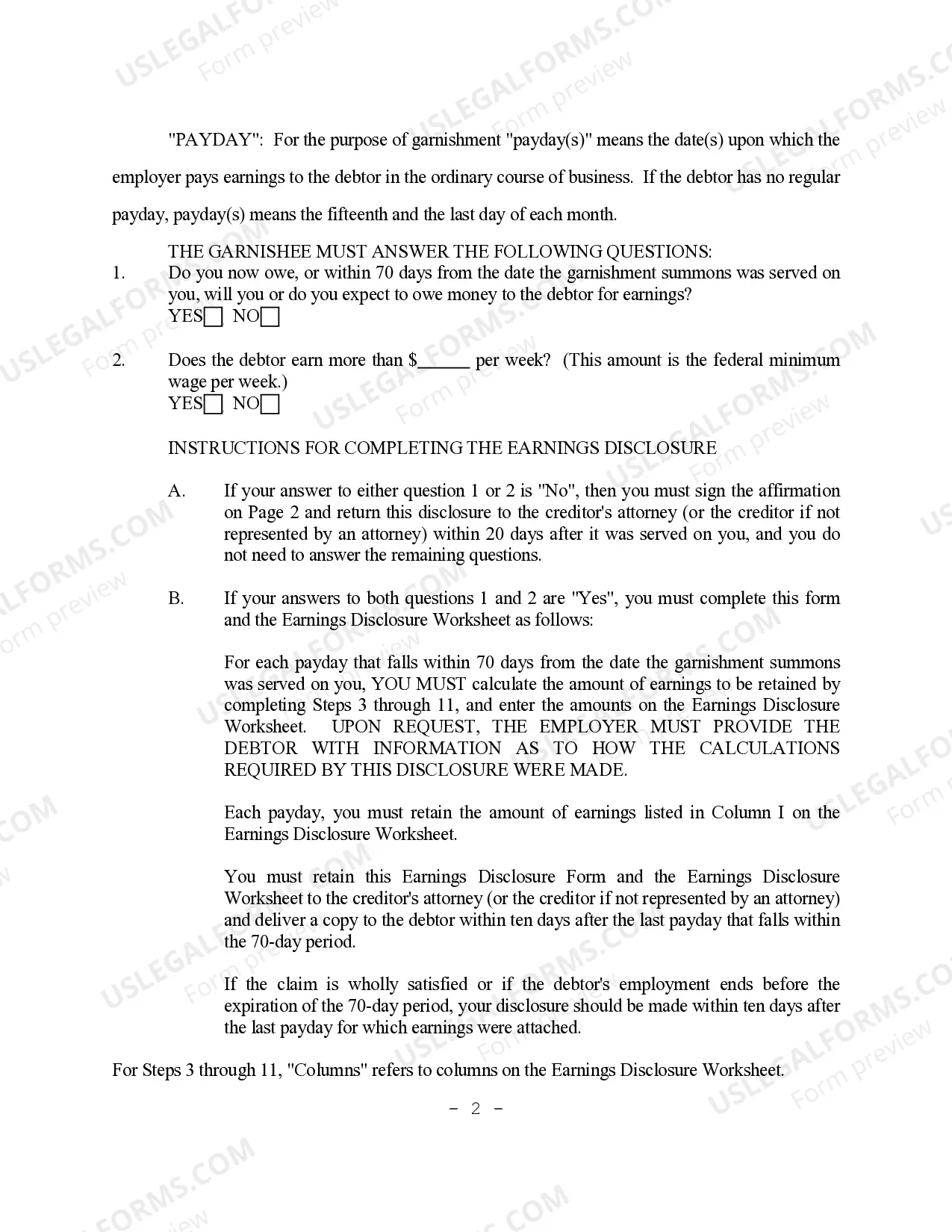

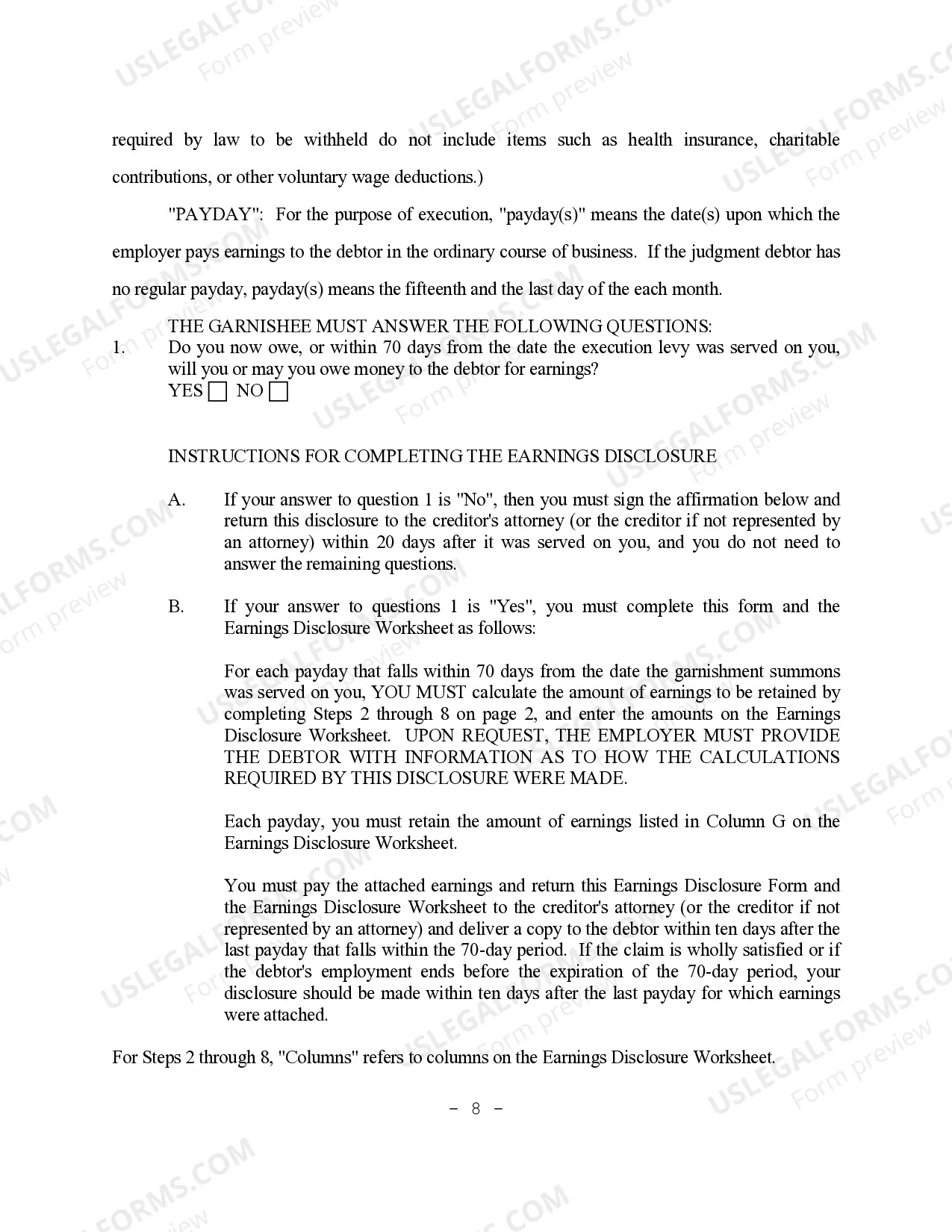

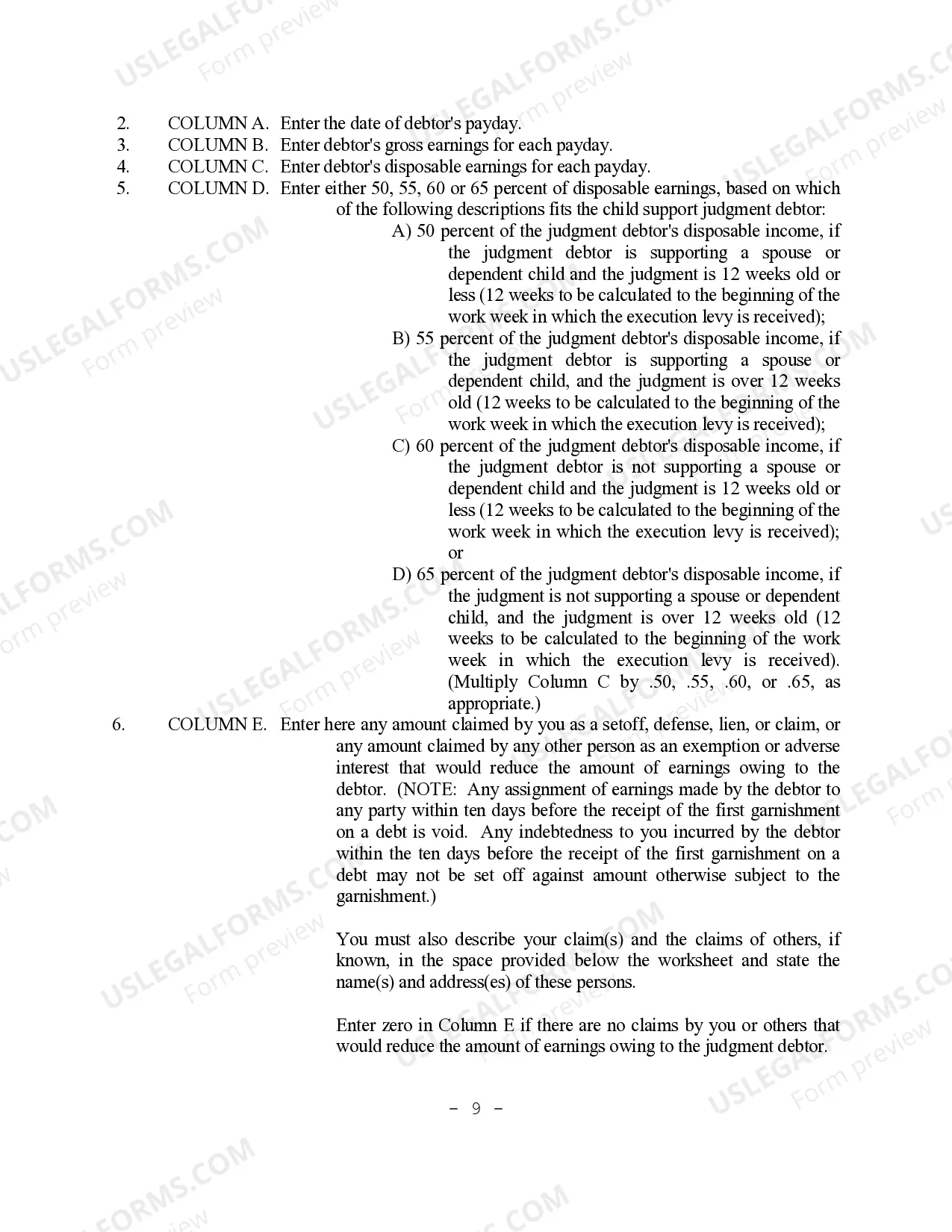

In Minnesota, the law allows garnishments to take a portion of your disposable earnings. Generally, creditors can garnish up to 25% of your disposable income or the amount by which your wages exceed 40 times the federal minimum wage, whichever is less. To effectively manage this, it’s essential to understand the Saint Paul Minnesota Garnishment Earnings Disclosure Instructions, which guide you through the garnishment process and your rights.

To stop a garnishment in Minnesota, start by reviewing the official garnishment notice you received. You may have the option to appeal the garnishment if there are valid reasons to do so. Working with a legal expert can be beneficial, as they understand the laws and procedures involved. Additionally, access resources like Saint Paul Minnesota Garnishment Earnings Disclosure Instructions for clear directions on managing your situation.

In Minnesota, you can stop a garnishment by filing a motion with the court that issued the original order. You can also negotiate directly with your creditor to agree on an alternate payment arrangement. It is important to present evidence that shows your financial hardship to support your request. For detailed guidance, Saint Paul Minnesota Garnishment Earnings Disclosure Instructions can be very helpful.

To effectively stop wage garnishment, consider negotiating a payment plan with your creditor. You can also review the garnishment details to ensure compliance with state laws. Filing for bankruptcy may provide another option to halt garnishment temporarily. Remember, seeking guidance on Saint Paul Minnesota Garnishment Earnings Disclosure Instructions can help you navigate this process.

To find your garnishment information in Saint Paul, Minnesota, you can start by reviewing any legal documents delivered to you regarding the garnishment. Additionally, you can contact your employer’s payroll department, which typically manages wage garnishments. It is also helpful to check with the Clerk of Court in your county for public records related to your case. Utilizing the right resources will ensure you have accurate and comprehensive information.

After wage garnishment, your remaining earnings will reflect the deductions made by the creditor. It's essential to keep records of all payments and understand how this affects your finances moving forward. The Saint Paul Minnesota Garnishment Earnings Disclosure Instructions can guide you on what steps to take after the garnishment and how to seek relief if needed.

In Minnesota, creditors are required to notify you before garnishment proceedings begin. This notification allows you to address the debt before any deductions occur. The Saint Paul Minnesota Garnishment Earnings Disclosure Instructions provide helpful insights on how to respond to such notices and assert your rights.

A garnishment may be deemed invalid if proper notification procedures were not followed or if the debt is not legally established. It's important to refer to the Saint Paul Minnesota Garnishment Earnings Disclosure Instructions for locating potential errors in the garnishment process. Documenting any discrepancies can help you challenge the garnishment effectively.

After 70 days of wage garnishment in Minnesota, the creditor may seek a hearing to confirm or extend the garnishment. During this period, you should review your Saint Paul Minnesota Garnishment Earnings Disclosure Instructions to ensure your rights are protected. Seeking legal advice can be beneficial at this stage.

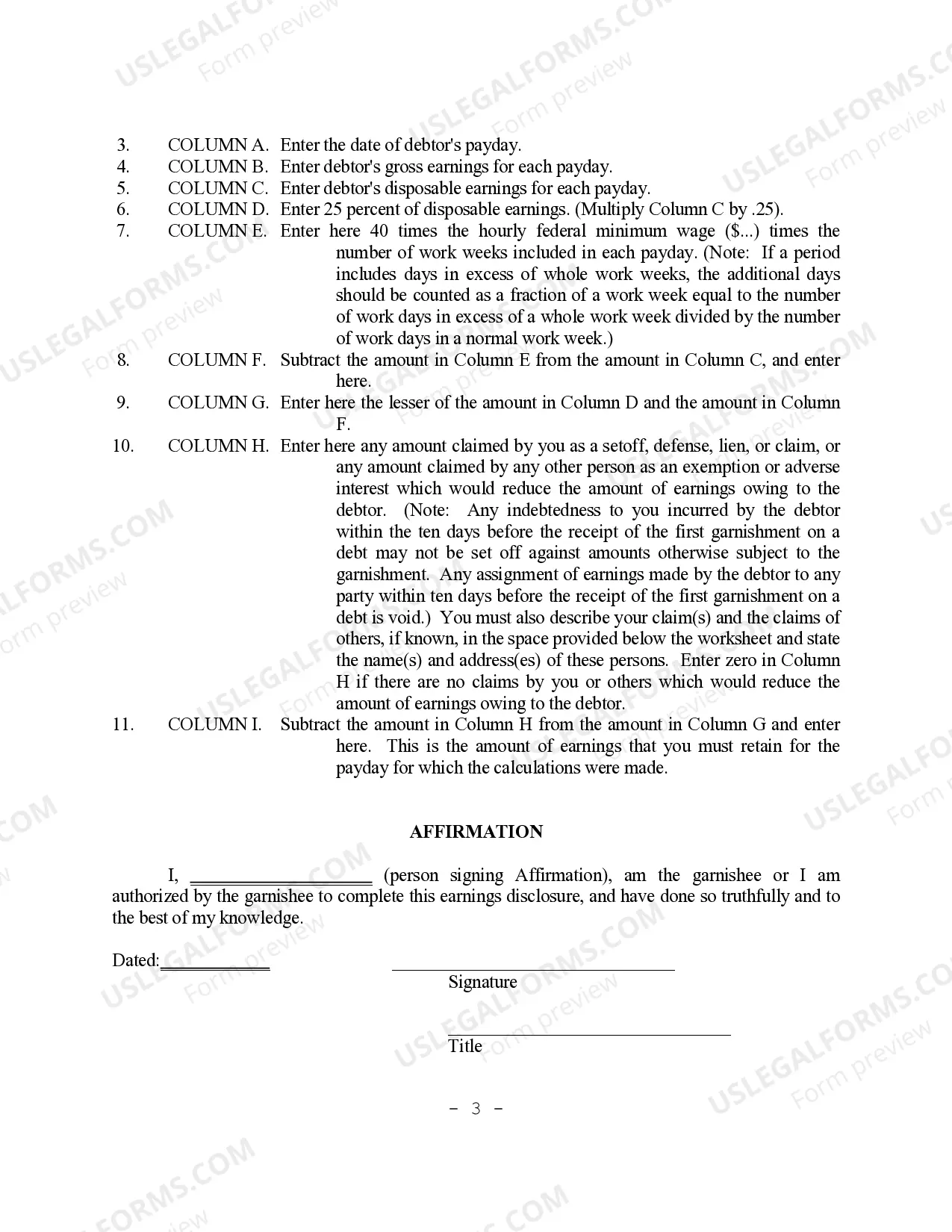

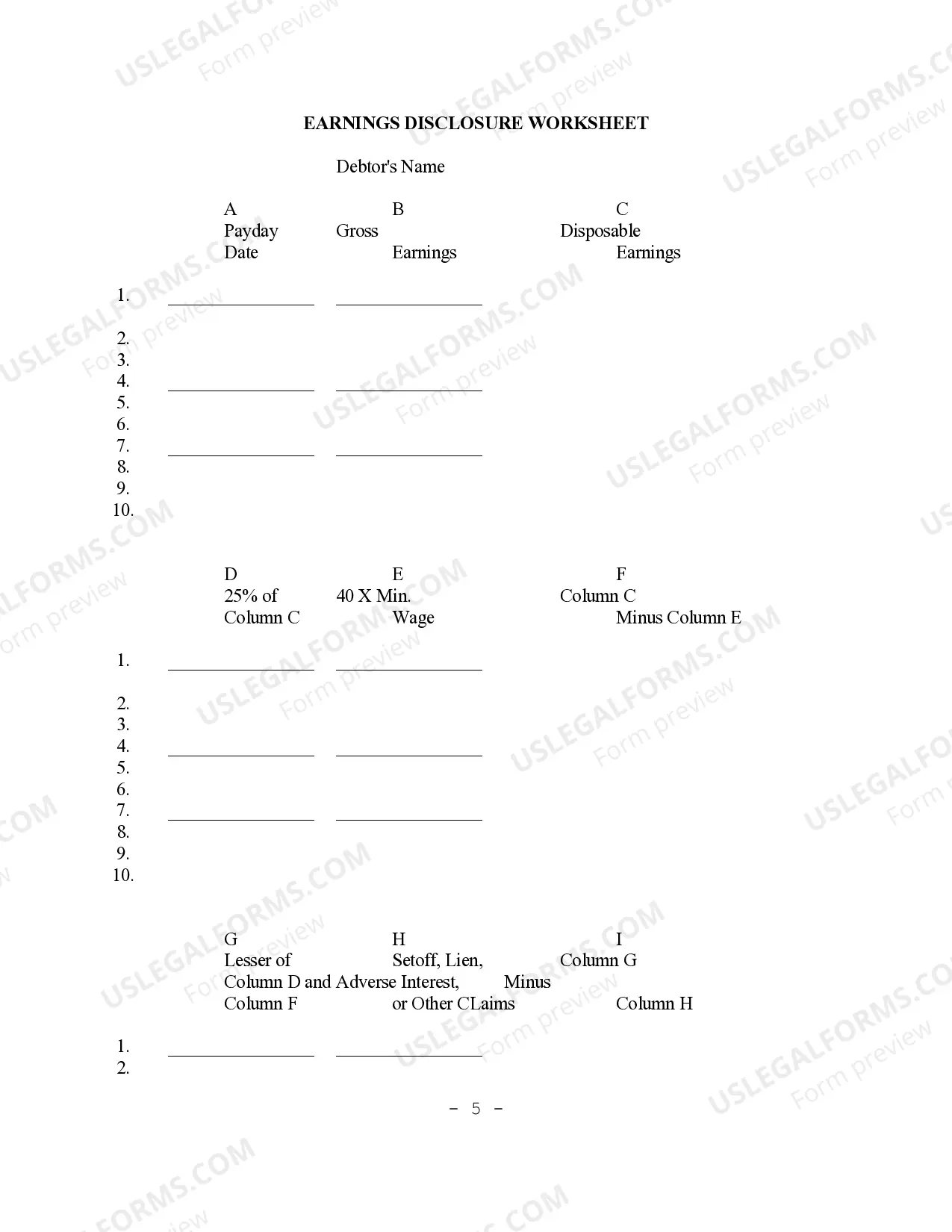

To calculate disposable earnings for garnishment, start with your gross income and deduct mandatory deductions, such as taxes and social security contributions. The remaining amount represents your disposable earnings, which creditors can target for garnishment. Ensure accuracy in your calculations, as this will affect the amount that can be garnished. For specific calculations and examples, consult the Saint Paul Minnesota Garnishment Earnings Disclosure Instructions.