Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Michigan Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Irrespective of one's societal or career standing, finalizing legal documents is an unfortunate requirement in the modern professional landscape.

Often, it's nearly unfeasible for an individual lacking legal expertise to draft these types of documents from the ground up, primarily due to the intricate language and legal nuances they encompass.

This is where US Legal Forms proves to be advantageous.

Ensure that the form you have found is valid for your area, as the laws of one state or county do not apply to another.

Review the document and examine a brief overview (if available) of the circumstances the document can be utilized for.

- Our platform provides an extensive inventory of over 85,000 ready-to-use state-specific forms suitable for almost any legal situation.

- US Legal Forms is also a tremendous resource for paralegals or legal advisors seeking to save time through our DIY documents.

- Whether you need the Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries or any other documentation appropriate in your jurisdiction, with US Legal Forms, everything is readily accessible.

- Here’s how you can swiftly acquire the Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries using our reliable service.

- If you are already a subscriber, proceed to Log In to your account to obtain the necessary form.

- However, if you are not familiar with our database, make sure to follow these steps before downloading the Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

Form popularity

FAQ

Yes, trust income is generally considered taxable in Michigan. The income generated from assets held in trust will be subject to state income tax, which can influence the management of the trust. Executors and trustees managing a Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries should be proactive in understanding the tax implications for beneficiaries.

Capital gains in Michigan are taxed as regular income, subject to the state's income tax rate. This applies to both short-term and long-term gains from the sale of assets like property or stocks. Therefore, when dealing with a Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, it's crucial to consider how capital gains may impact tax filings and obligations.

Michigan does provide tax exemptions for certain types of retirement income, including pensions and social security. However, other retirement accounts such as 401(k)s and IRAs may still be subject to taxation. Executors and trustees involved in managing a Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries should advise beneficiaries on these factors to ensure proper financial planning.

Michigan levies sales tax on various services, such as taxi and transportation services, telecommunications, and certain repairs. Businesses engaged in these services need to be aware of their tax obligations. When handling a Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, it's essential to understand what services might incur taxes.

In Michigan, taxable income includes wages, interest, dividends, and rental income. Additionally, any income generated from trusts may also be subject to taxation. Executors, trustees, and other fiduciaries should be mindful of these income types when managing a Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries.

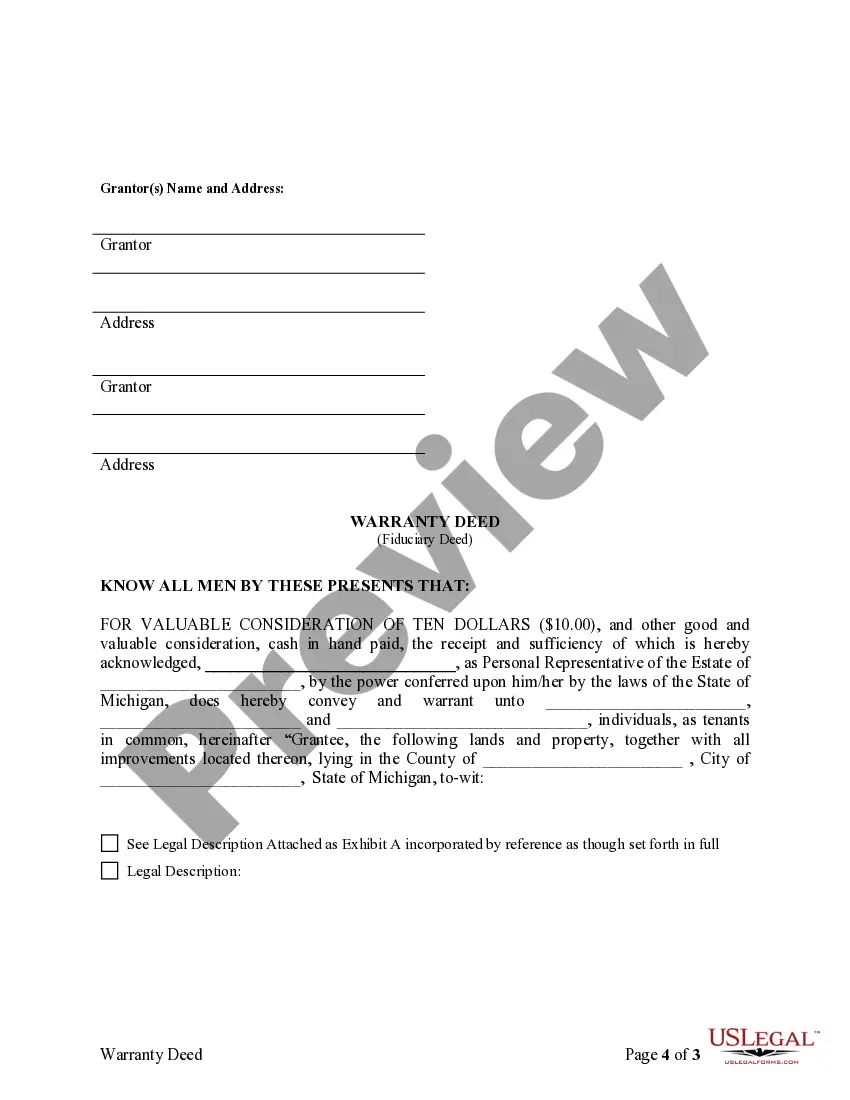

In Michigan, a title refers to the legal ownership of a property, while a deed is the document that formally conveys that ownership. The deed records the specifics of the transfer and identifies the parties involved. Understanding the distinction is vital, especially when dealing with a Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, as this impacts how assets are managed and transferred in fiduciary situations.

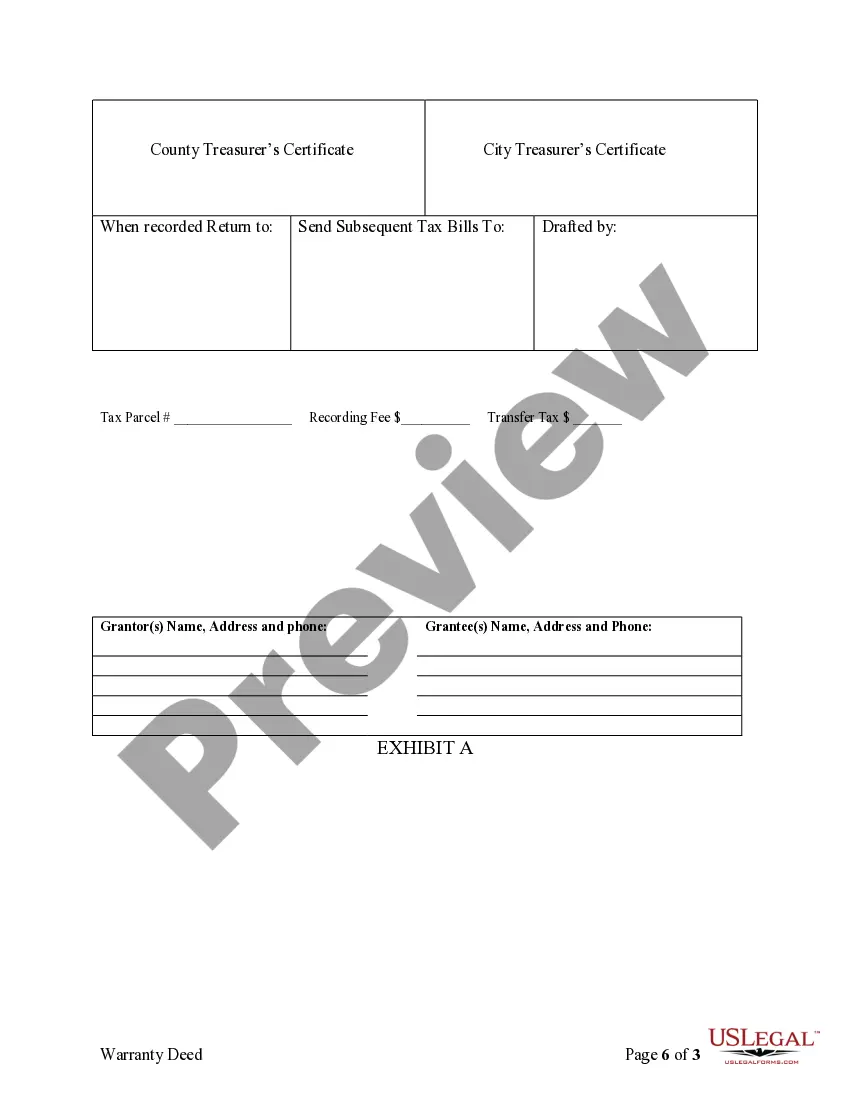

Getting a deed to a house in Michigan typically requires a legal transfer process, often initiated through a sale or inheritance. You should work with a qualified professional to ensure all legal formalities are addressed, especially for a Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries. After the transfer, be sure to file the deed with your county clerk's office to officially record your ownership.

In Michigan, various professionals can prepare deeds, including attorneys, real estate professionals, and legal document preparers. It is crucial to ensure that the person preparing the deed has a thorough understanding of the legal requirements. If you need a Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, consider exploring services like USLegalForms to find qualified individuals or templates tailored to your needs.

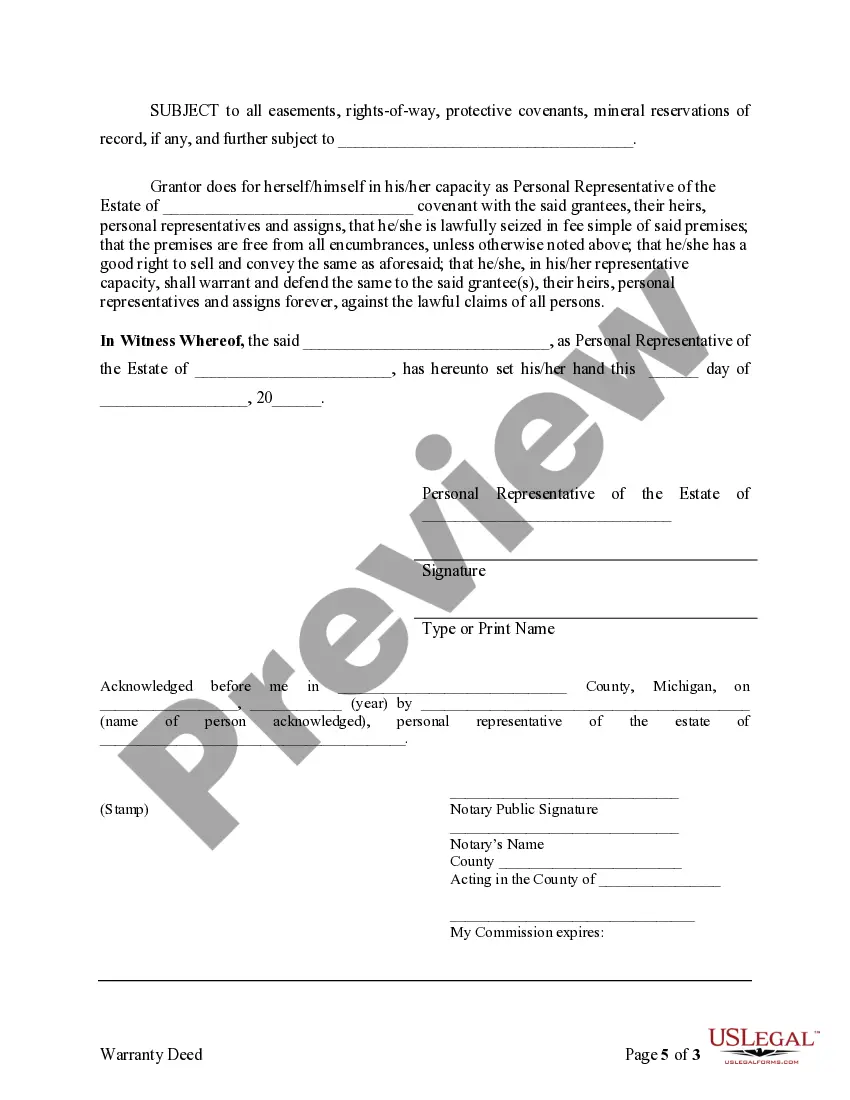

A fiduciary deed in Michigan refers to a specific type of deed executed by a fiduciary, such as an executor or trustee, for the purpose of transferring property on behalf of the estate or trust. This deed underscores the fiduciary's authority to act and simplifies the process of property transfer. When you’re managing estate matters, integrating a Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can greatly benefit your responsibilities.

A trust is a legal entity created to hold assets for the benefit of another party, while a trust deed is the document that establishes the trust and outlines its terms. Essentially, the trust deed serves as the foundational document that creates and governs the trust's operations. Understanding this distinction is crucial if you need to utilize a Grand Rapids Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.