Ann Arbor Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Michigan Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

We consistently endeavor to reduce or avert legal complications when managing subtle legal or financial matters.

To achieve this, we seek legal remedies that, generally speaking, are exceedingly expensive.

Nonetheless, not every legal complication is equally intricate. A majority of them can be handled independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Just Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always re-download it from the My documents tab. The procedure is equally simple if you’re new to the platform! You can establish your account in just a few minutes. Ensure to verify if the Ann Arbor Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate complies with the laws and regulations of your state and area. Furthermore, it's essential to review the form’s outline (if available), and if you notice any inconsistencies with what you originally required, search for a different form. Once you confirm that the Ann Arbor Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate is suitable for your situation, you can select the subscription option and proceed to payment. Afterward, you can download the document in any available file format. For over 24 years in the market, we’ve assisted millions of individuals by providing customizable and current legal forms. Take advantage of US Legal Forms now to conserve time and resources!

- Our platform enables you to manage your affairs autonomously without needing to consult an attorney.

- We provide access to legal document templates that are not always available to the public.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Benefit from US Legal Forms whenever you need to obtain and download the Ann Arbor Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other document quickly and securely.

Form popularity

FAQ

Promissory notes can indeed be backed by collateral, which adds security for the lender in case of borrower default. Real property is a common form of collateral, providing a significant assurance for lender interests. For an Ann Arbor Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this approach can ensure that both parties have a clear understanding of their obligations and risks.

Yes, a promissory note can absolutely be secured by real property. This involves placing a lien on the property to protect the lender's rights. When utilizing an Ann Arbor Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you ensure that your investment is safeguarded against defaults, creating a more secure lending environment.

A reasonable interest rate for a promissory note can vary based on several factors, including the creditworthiness of the borrower and the current market rates. Generally, you might see rates ranging from 5% to 10% for a Fixed Rate Promissory Note in Ann Arbor, Michigan. It’s essential to research local rates and consult with professionals to set a fair rate that meets your financial needs.

In Michigan, a promissory note does not require notarization to be legally valid. However, notarization adds an extra layer of authenticity and can help prevent disputes in the future. If you are considering using an Ann Arbor Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, having it notarized can be a prudent choice for safeguarding interests.

To secure a promissory note with real property, you typically need to draft a security agreement detailing the property involved. This agreement creates a lien on the property, which gives the lender rights in the event of default. In Ann Arbor, Michigan, using a Fixed Rate Promissory Note Secured by Residential Real Estate allows you to formalize this arrangement and establish clear terms for repayment.

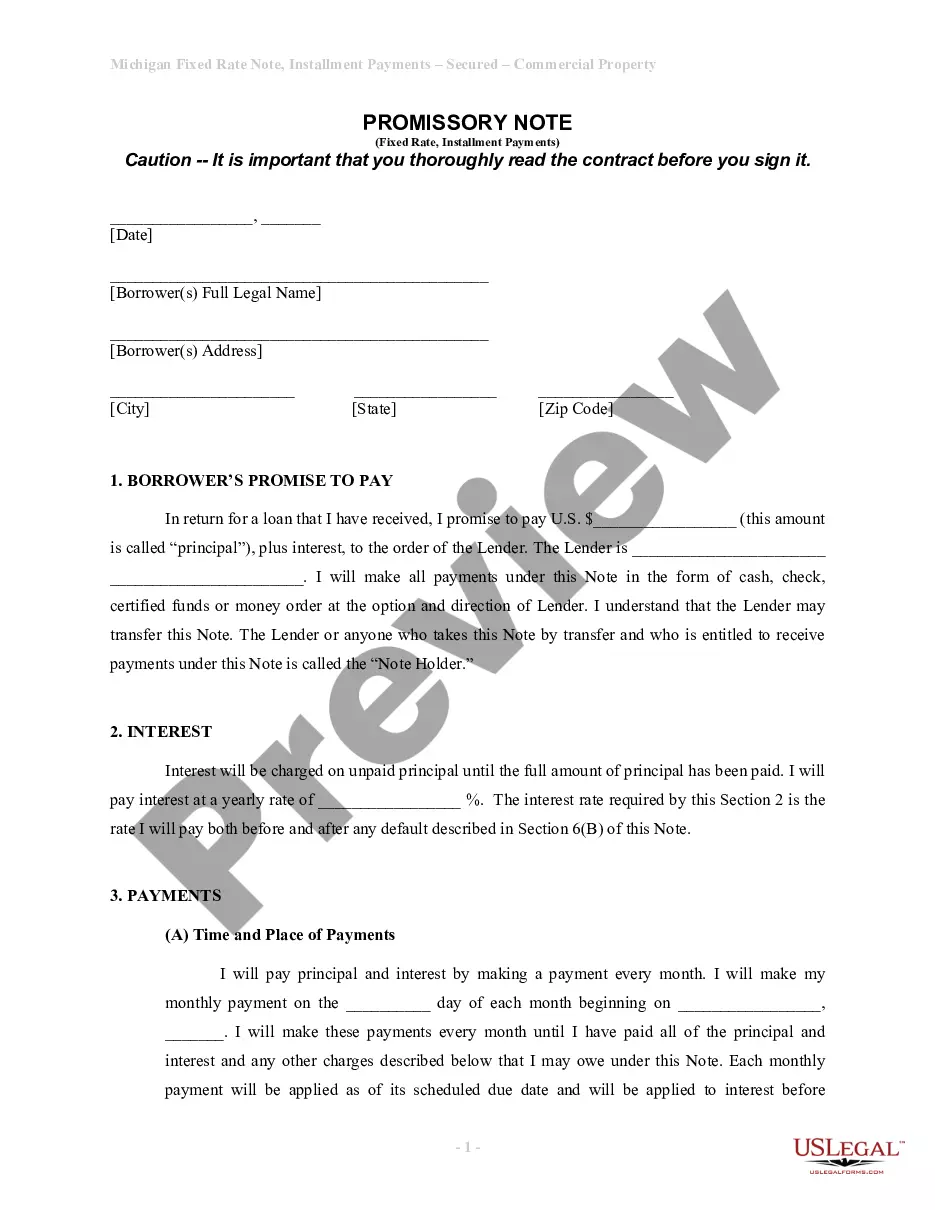

A promissory note typically follows a standard format that includes the date, the amount owed, the interest rate, repayment terms, and signatures of both the borrower and lender. For an Ann Arbor Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is crucial to outline the specific details that pertain to real estate security. This ensures clarity and legal enforceability. Utilizing a professional template can help streamline this process.

Yes, interest earned on an Ann Arbor Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate is generally considered taxable income. This means that you must report it on your tax return. Understanding this obligation is important so that you avoid penalties or issues with the IRS.

Interest earned from an Ann Arbor Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate should be reported on your tax return, specifically on Schedule B of Form 1040. This form helps you calculate your total interest income, including amounts from various sources. Accurately filling out this form ensures you comply with tax laws and regulations.

When dealing with an Ann Arbor Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is important to understand that you generally do not need to report any interest payments received under $10. The IRS requires reporting of interest income only when it meets or exceeds this threshold. However, keeping accurate records is essential for tax purposes, as it may be relevant in future assessments.