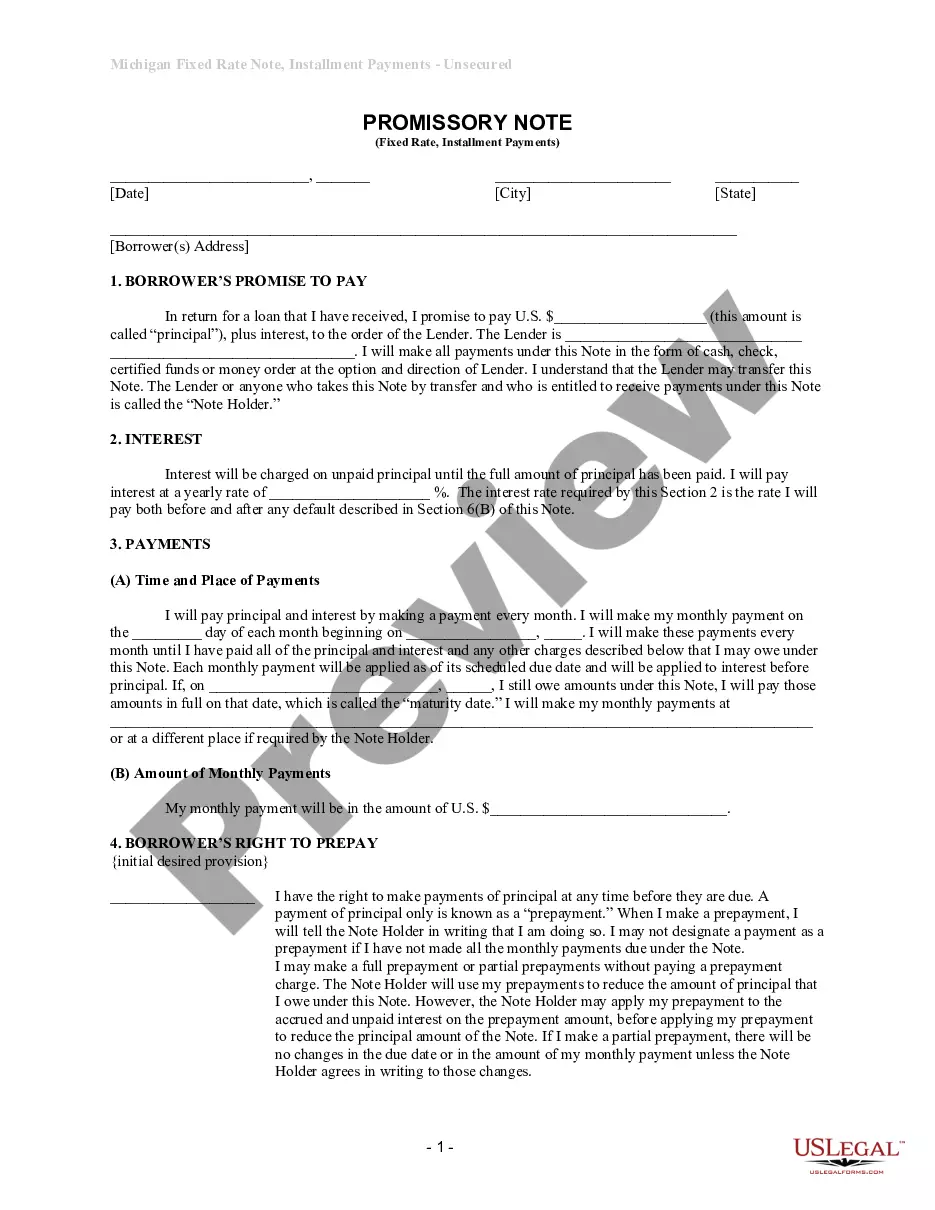

Detroit Michigan Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Michigan Unsecured Installment Payment Promissory Note For Fixed Rate?

If you are looking for a legitimate form template, it's challenging to find a more suitable location than the US Legal Forms website – one of the most exhaustive online repositories.

With this repository, you can access a vast array of form samples for business and personal use categorized by types and states, or keywords.

With our superior search functionality, locating the latest Detroit Michigan Unsecured Installment Payment Promissory Note for Fixed Rate is as straightforward as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Obtain the template. Choose the file format and download it to your device.

- Moreover, the validity of each document is verified by a team of proficient attorneys who regularly assess the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to obtain the Detroit Michigan Unsecured Installment Payment Promissory Note for Fixed Rate is to sign in to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have accessed the sample you desire. Review its description and utilize the Preview feature (if available) to inspect its content. If it doesn't fulfill your needs, use the Search field at the top of the page to locate the suitable document.

- Confirm your selection. Press the Buy now button. Subsequently, choose the preferred pricing option and provide information to create an account.

Form popularity

FAQ

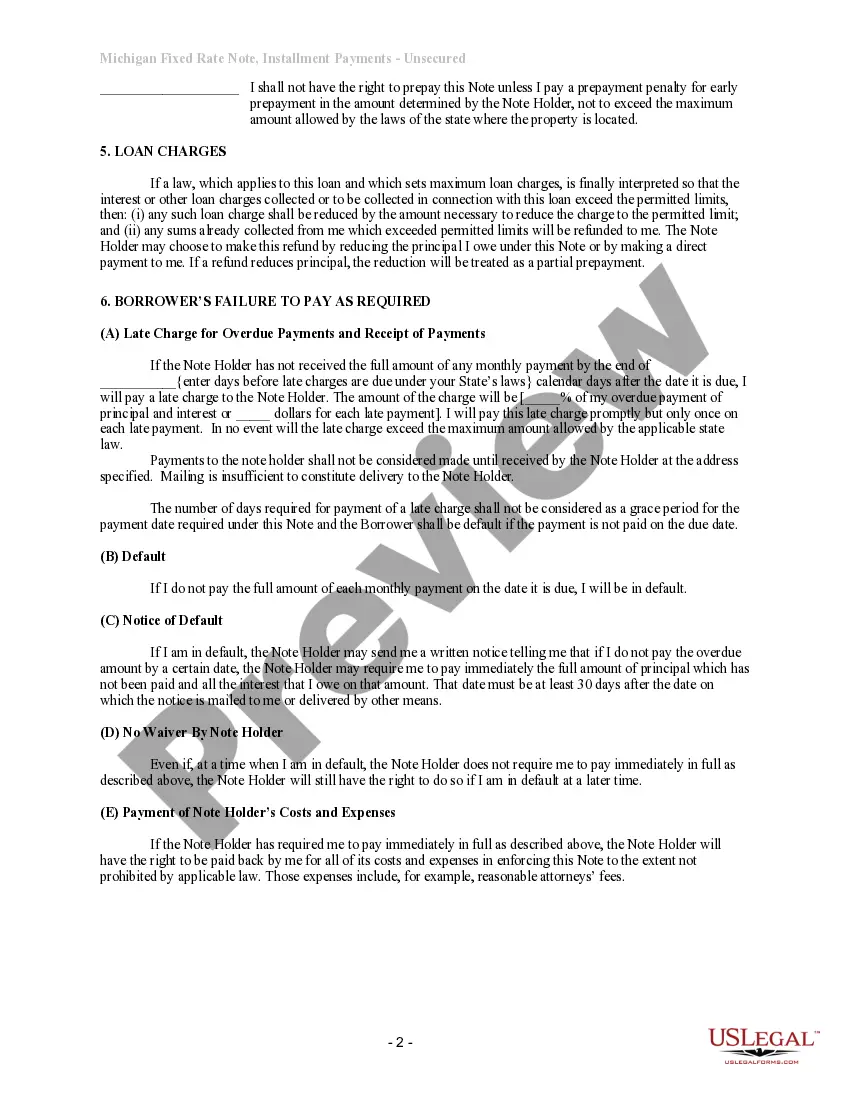

Unsecured Promissory Notes An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

A good personal loan interest rate depends on your credit score: 740 and above: Below 8% (look for loans for excellent credit) 670 to 739: Around 14% (look for loans for good credit) 580 to 669: Around 18% (look for loans for fair credit)

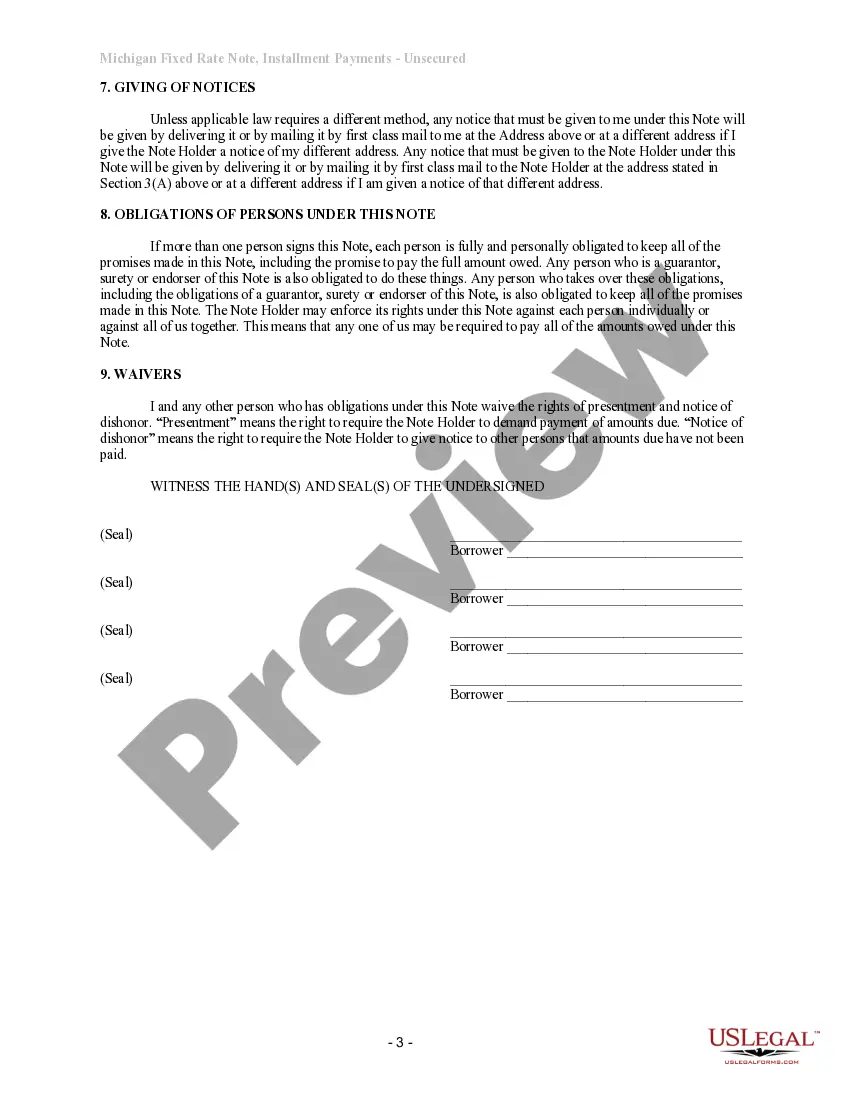

Anyone lending money can issue a promissory note (like home sellers, credit unions, FinTech solutions, and nonmortgage-related banks, for instance) but specific to real estate and the mortgage process, promissory notes serve as an agreement that the borrower will repay their mortgage loan by the maturity date.

Based on discussions with professionals who buy and sell notes, the market rate of return for a privately held note typically ranges from 12% for a well collateralized note with a strong payment history to 25% for an uncollateralized note.

Collecting on an unsecured promissory note through the courts is a two-step process. First, you need to go through the court process to obtain a judgment against the borrower. Then you need to try to attach the borrower's wages, bank accounts, or other assets in order actually get paid.

According to Bankrate, people with a good credit score of 720?850 get an average loan interest rate of 10.3?12.5% from banks or online lenders. Meanwhile, people with credit scores of 630?689 pay an average of 17.8?19.9%.

interest loan is one with an annual percentage rate above 36%, the highest APR that most consumer advocates consider affordable. Highinterest loans are offered by online and storefront lenders that promise fast funding and easy applications, sometimes without checking your credit.

A promissory note is a written promise to pay a specified amount of money with, or without, interest at a stated time or on demand. The main purpose of a promissory note is to serve as written evidence of the amount loaned, the interest rate, if any, and the terms under which the loan is to be repaid.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

If you are borrowing money from a lending institution, they will have someone on staff who creates a promissory note. However, if you need a promissory note for a personal loan or a loan between friends and family, you can contact a lawyer or financial professional to help you create a promissory note.