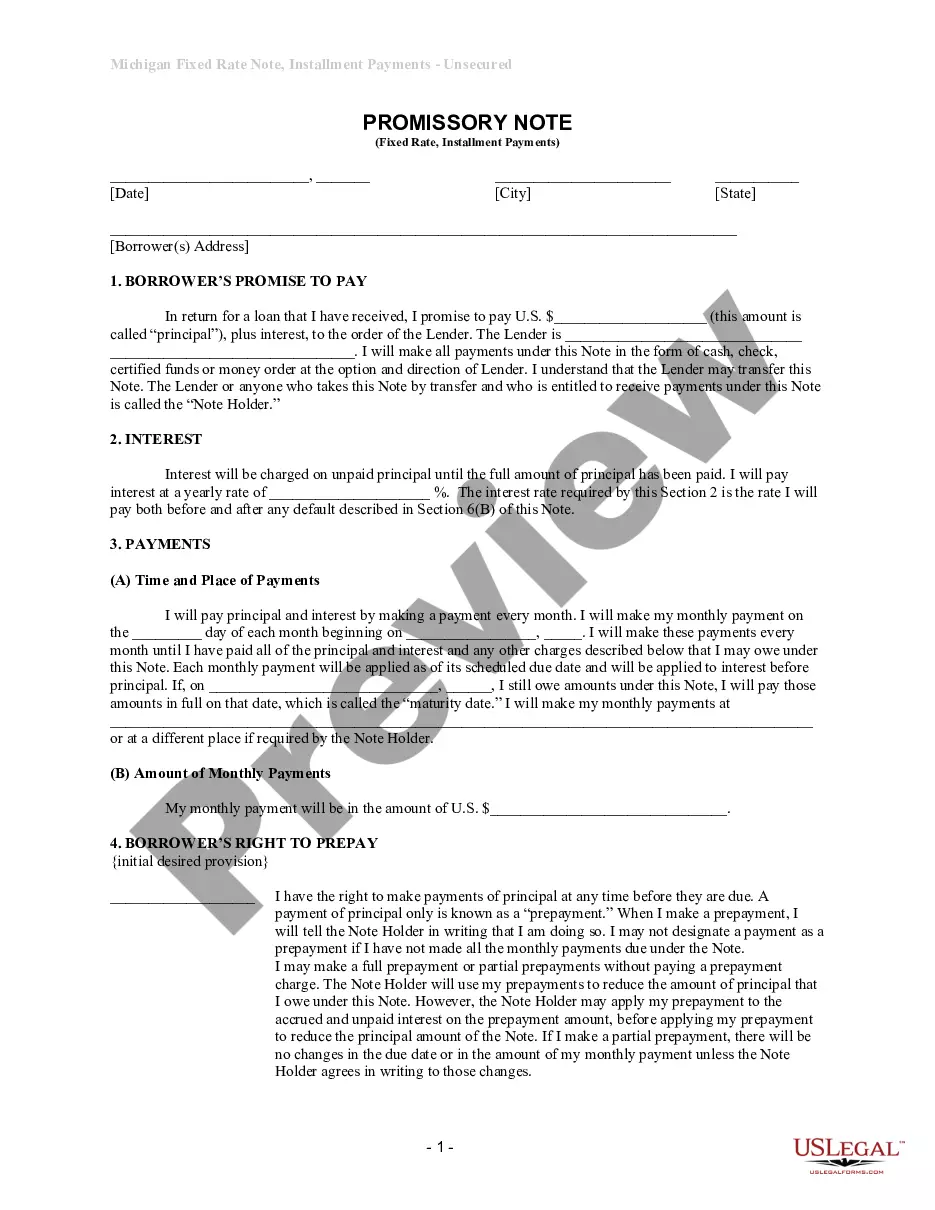

Michigan Unsecured Installment Payment Promissory Note for Fixed Rate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

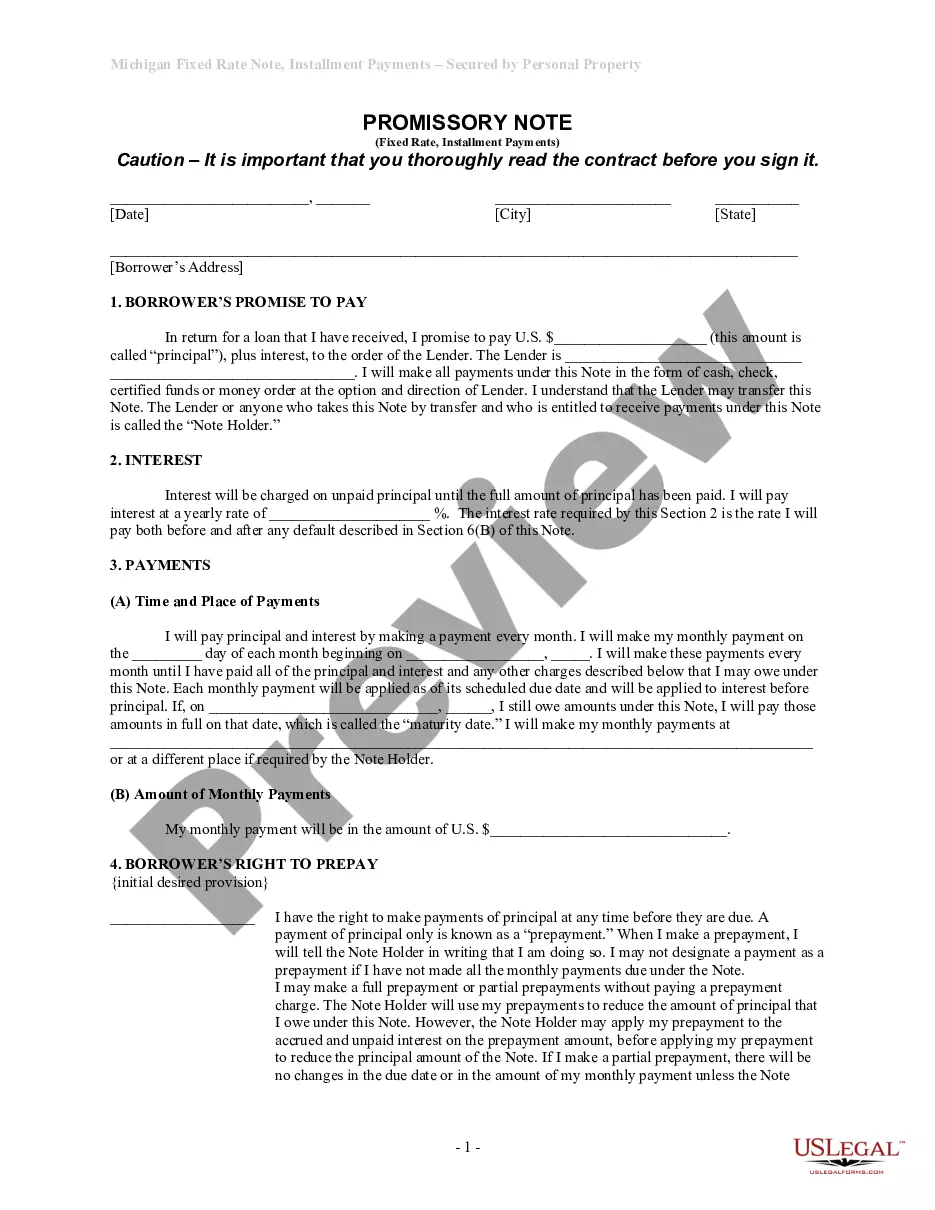

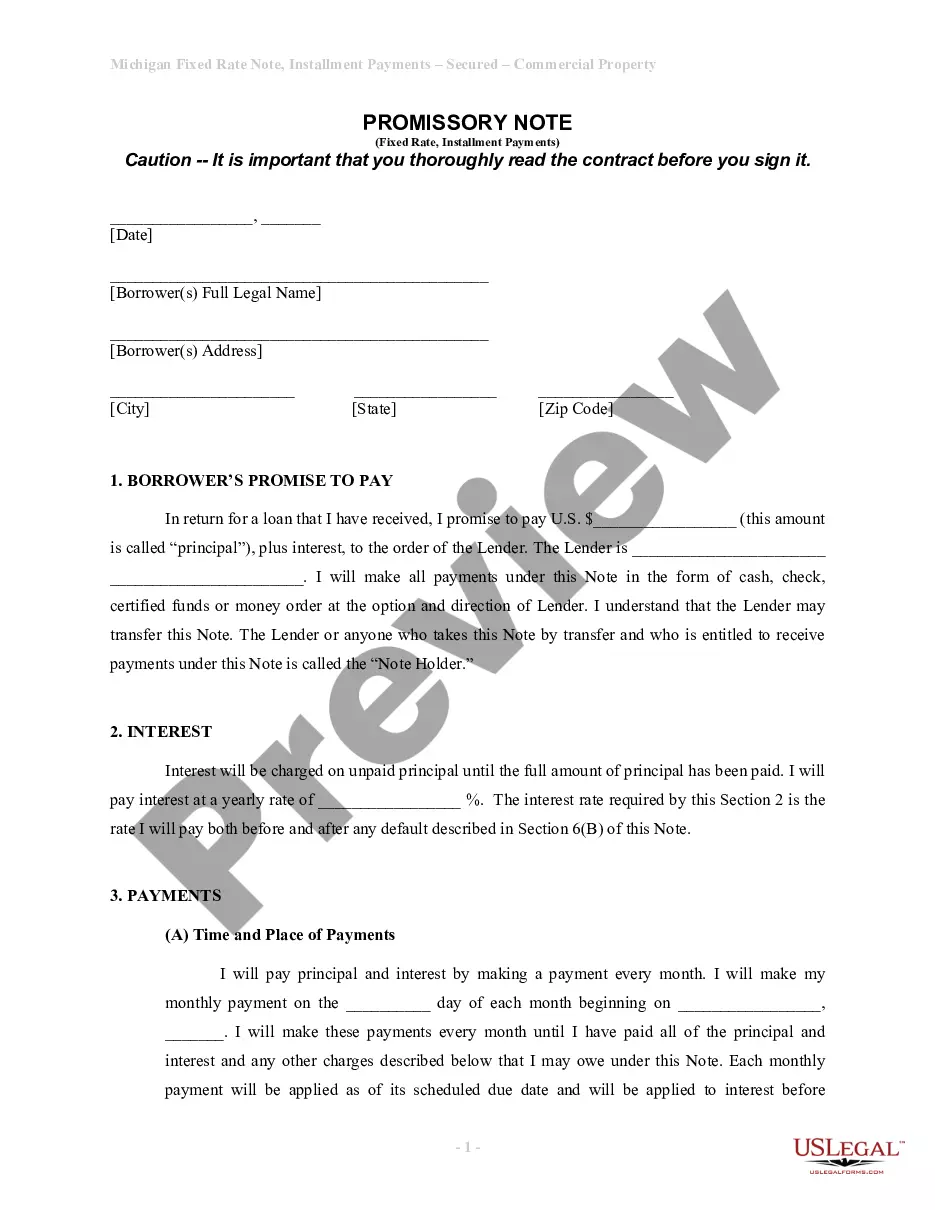

Michigan Unsecured Installment Payment Promissory Note: A legal document in which a borrower promises to repay a loan in periodic installments over a specified period without providing collateral. This type of note is common in personal loans where trust between lender and borrower plays a crucial role.

Step-by-Step Guide

- Determine the Loan Amount: Decide on the total amount to be borrowed and the reason for the loan.

- Agree on Interest Rates: The lender and borrower agree on an interest rate that will be applied to the loan.

- Set a Payment Schedule: Establish a clear schedule for installment payments, typically monthly or quarterly.

- Document the Agreement: Write the terms agreed upon into a promissory note format.

- Sign and Witness: Both parties sign the promissory note and ideally, have it witnessed to strengthen the legality of the document.

- Repayment: The borrower makes payments according to the schedule until the loan is fully repaid.

Risk Analysis

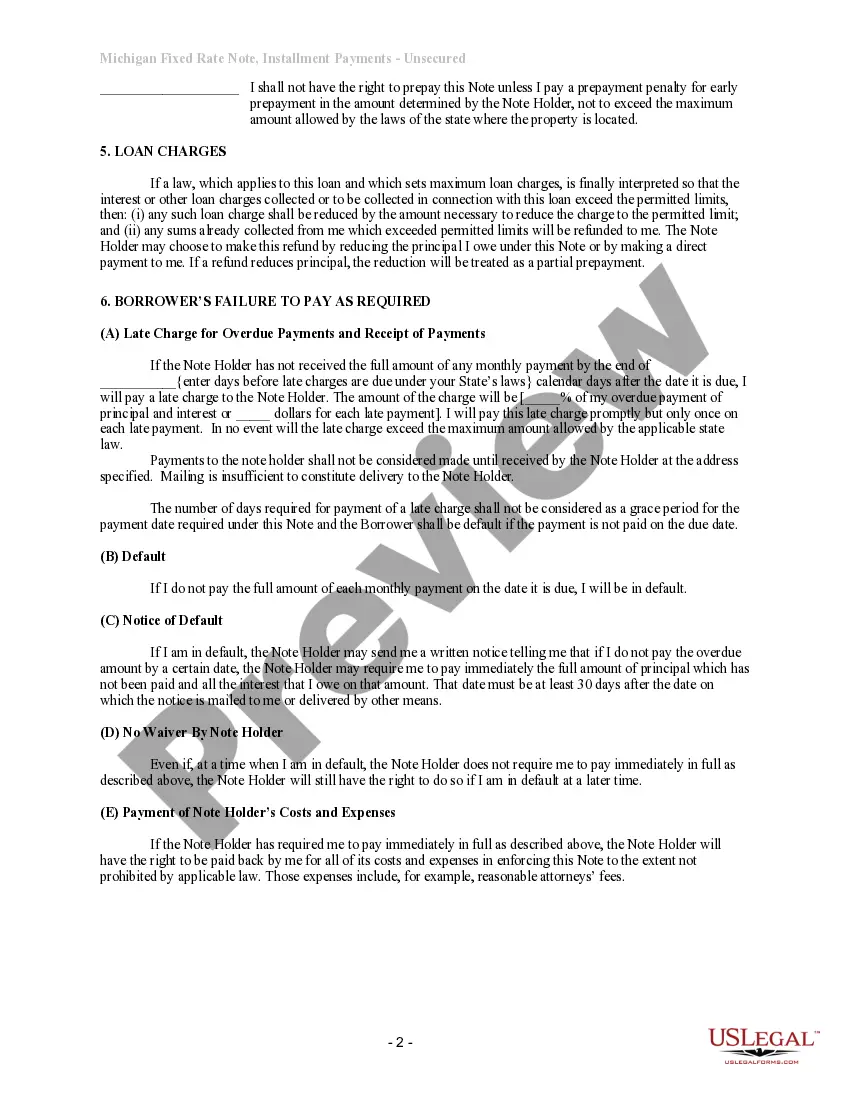

- Credit Risk: Lenders face a high risk due to lack of collateral, meaning if the borrower defaults, the lender has limited options for recourse.

- Legal Risks: If the promissory note is not clearly written, there may be legal ambiguities during disputes.

- Financial Instability: Borrowers may overcommit themselves without securing assets, leading to financial distress and potential default.

Key Takeaways

- Unsecured promissory notes involve higher risk and typically higher interest rates compared to secured loans.

- Ensure that all legal requirements are met in the drafting to avoid future complications.

- Both parties should perform thorough due diligence to ensure trustworthiness and repayment ability.

Common Mistakes & How to Avoid Them

- Vague Terms: Always specify the loan amount, interest rate, repayment schedule, and late payment penalties clearly in the document.

- Skipping Legal Review: Have a lawyer review the promissory note before signing to ensure that all state legal standards are met.

- Lack of Documentation: Maintain detailed records of all payments made under the promissory agreement to prevent disputes.

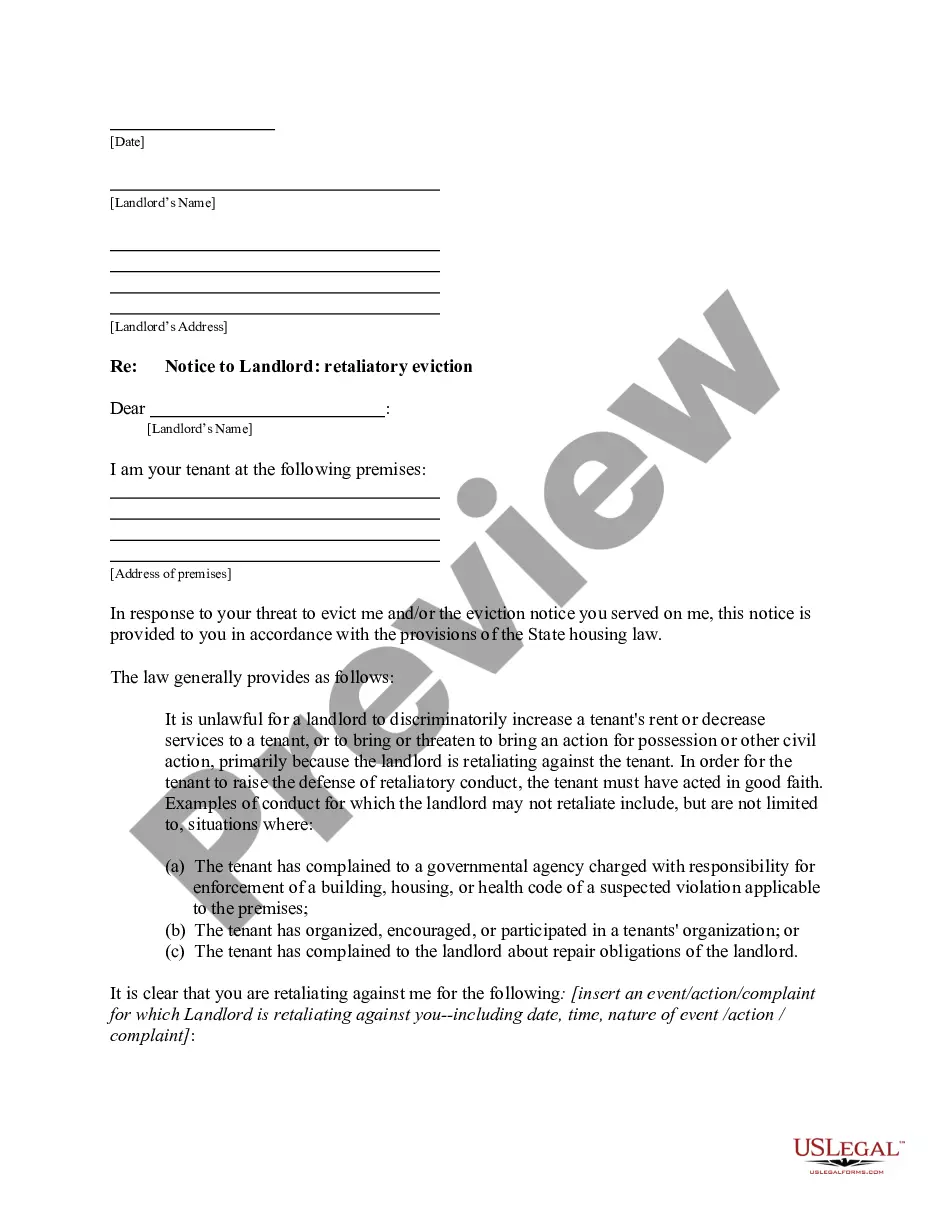

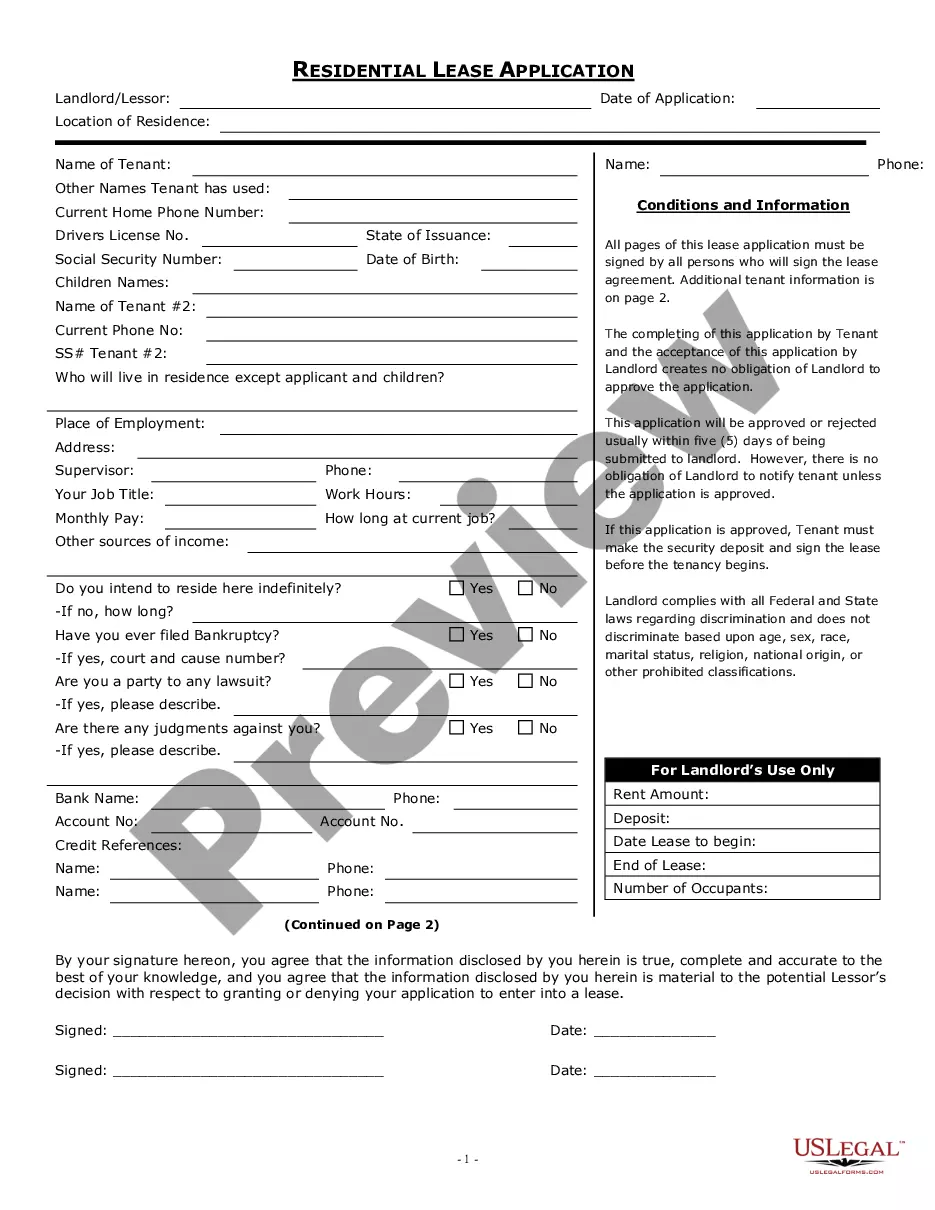

How to fill out Michigan Unsecured Installment Payment Promissory Note For Fixed Rate?

Obtain any version from 85,000 legal documents including the Michigan Unsecured Installment Payment Promissory Note for Fixed Rate online with US Legal Forms. Each template is crafted and refreshed by state-authorized legal specialists.

If you already possess a subscription, sign in. Once you reach the form’s page, click the Download button and navigate to My documents to retrieve it.

If you have yet to subscribe, adhere to the guidelines below.

With US Legal Forms, you will consistently have immediate access to the appropriate downloadable template. The service provides access to forms and organizes them into categories to facilitate your search. Use US Legal Forms to swiftly and easily obtain your Michigan Unsecured Installment Payment Promissory Note for Fixed Rate.

- Review the state-specific criteria for the Michigan Unsecured Installment Payment Promissory Note for Fixed Rate that you wish to utilize.

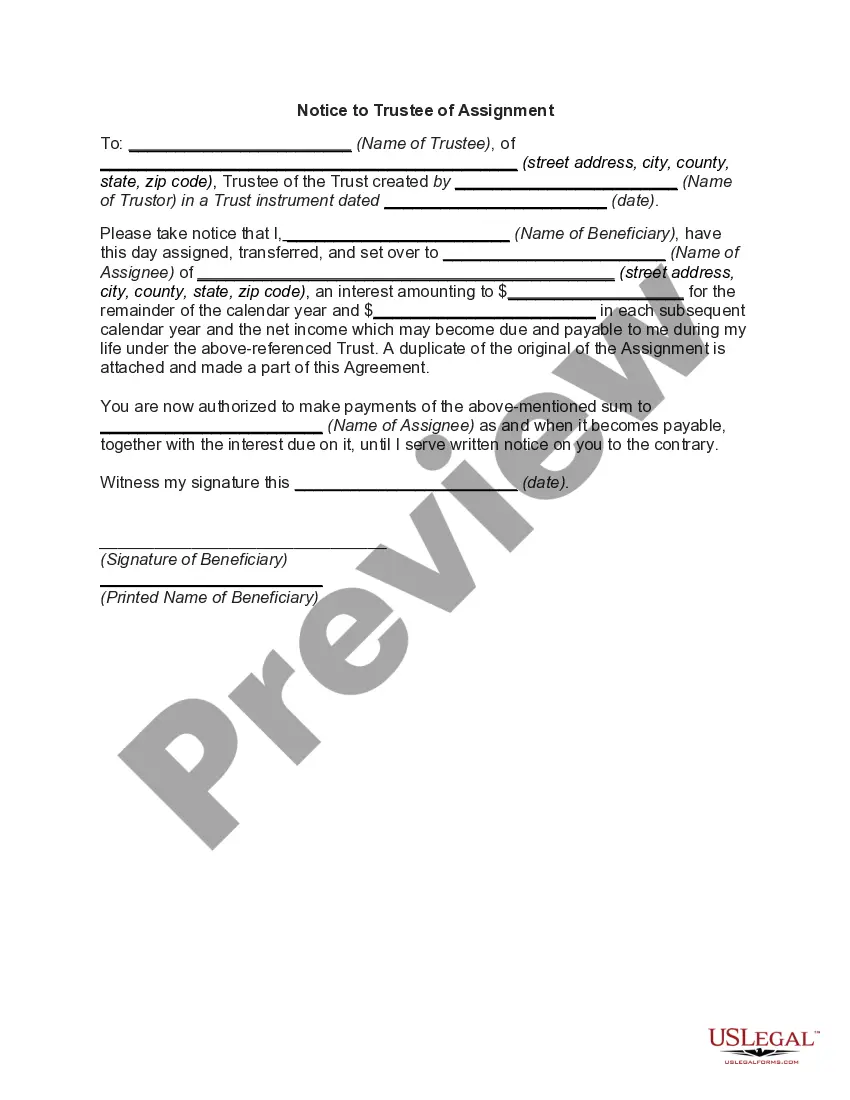

- Examine the description and view the sample.

- When you are assured that the sample meets your needs, click Buy Now.

- Choose a subscription plan that fits your financial plan.

- Establish a personal account.

- Complete the payment using one of the two suitable methods: by credit card or through PayPal.

- Select a format for downloading the document; two choices are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable template is downloaded, print it or save it to your device.

Form popularity

FAQ

Filling out a promissory note format requires careful attention to detail. Start by clearly stating the date, names of the parties involved, and the amount to be borrowed. For a Michigan Unsecured Installment Payment Promissory Note for Fixed Rate, include the specific interest rate, repayment schedule, and any late fees. Utilizing platforms like USLegalForms can simplify this process, offering templates that guide you through each necessary step.

In Michigan, a promissory note does not need to be notarized to be legally binding. However, notarization can provide added validation and security to the document. A Michigan Unsecured Installment Payment Promissory Note for Fixed Rate can benefit from notarization by ensuring all parties involved recognize the authenticity of signatures. It is always a good practice to consult legal advice when finalizing such documents.

A promissory note does not necessarily need to have an interest rate. While adding an interest rate can create a return for the lender, a Michigan Unsecured Installment Payment Promissory Note for Fixed Rate can also be issued without one. The primary requirement is that the terms are clear and agreed upon by both parties. Having written terms benefits both the borrower and lender by providing transparency.

When it comes to collecting on a Michigan Unsecured Installment Payment Promissory Note for Fixed Rate, communication is key. Begin by reaching out to the borrower to discuss payment options. If direct communication doesn’t resolve the issue, you might consider sending a formal demand letter. In some cases, legal action could be a last resort, but using a well-drafted promissory note can simplify the collection process.

To obtain a legal Michigan Unsecured Installment Payment Promissory Note for Fixed Rate, you can start by visiting uslegalforms. This platform provides templates designed to meet state-specific requirements, ensuring your document is legal and enforceable. You can customize these templates to suit your transaction and print or download your promissory note quickly. This approach saves you time and gives you peace of mind.

Setting up a payment plan with the state of Michigan involves contacting the appropriate state agency to discuss your financial situation. You can often negotiate a schedule that aligns with your budget while ensuring timely payments on your Michigan Unsecured Installment Payment Promissory Note for Fixed Rate. Be prepared to provide necessary documentation to support your request. Utilizing platforms like USLegalForms can streamline this process.

The installment payment process involves repaying the principal amount in regular portions, according to an agreed-upon schedule. This can be beneficial for those using a Michigan Unsecured Installment Payment Promissory Note for Fixed Rate, as it allows manageable payments over time. Clarity on the payment timeline and amount is crucial to avoid misunderstandings. You should review the terms carefully before proceeding.

In Michigan, the statute of limitations for an unsecured promissory note is generally six years. This timeframe begins from the date of the last unpaid installment. It’s essential to recognize this limit when dealing with a Michigan Unsecured Installment Payment Promissory Note for Fixed Rate. Knowing your rights within this period helps in maintaining your financial health.