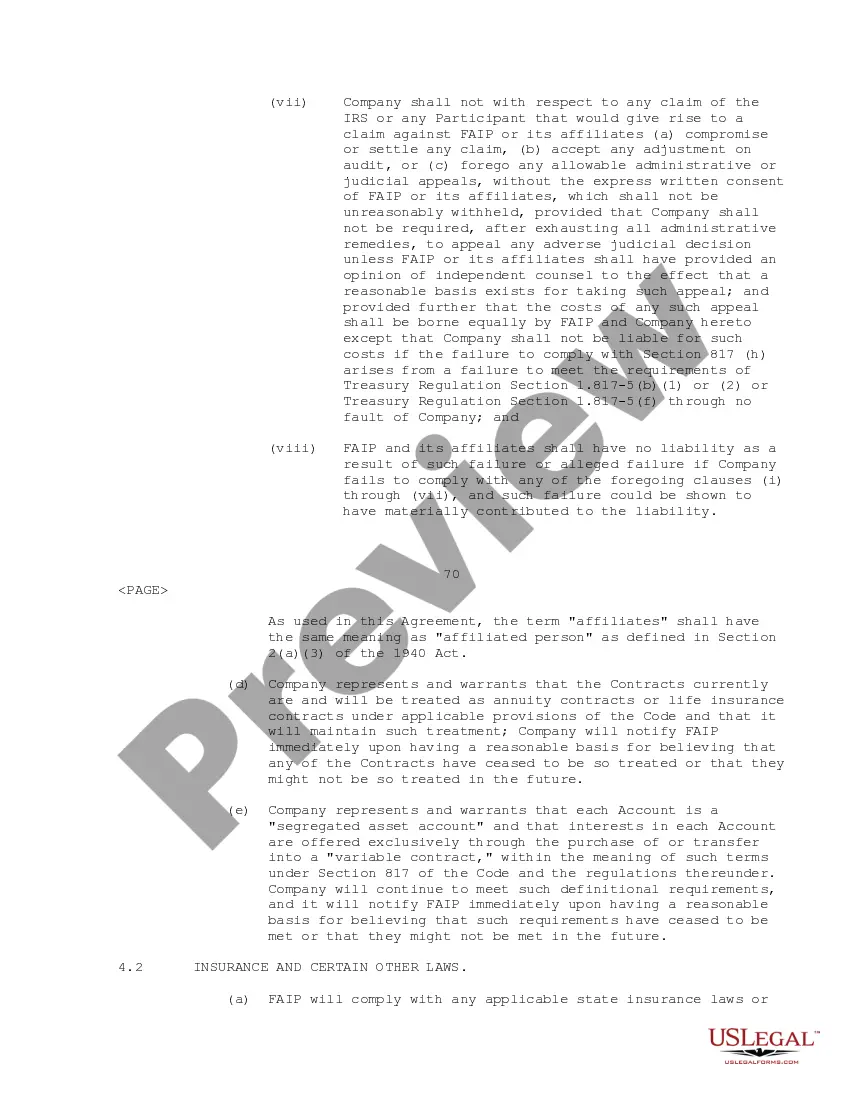

Participation Agreement between First American Ins. Portfolios, Inc., SEI Investments Distribution Co.

Description

How to fill out Participation Agreement Between First American Ins. Portfolios, Inc., SEI Investments Distribution Co.?

When it comes to drafting a legal document, it’s easier to leave it to the specialists. Nevertheless, that doesn't mean you yourself can’t get a sample to use. That doesn't mean you yourself cannot get a template to use, however. Download Participation Agreement between First American Ins. Portfolios, Inc., SEI Investments Distribution Co. from the US Legal Forms web site. It gives you a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. After you are signed up with an account, log in, look for a certain document template, and save it to My Forms or download it to your gadget.

To make things much easier, we have included an 8-step how-to guide for finding and downloading Participation Agreement between First American Ins. Portfolios, Inc., SEI Investments Distribution Co. quickly:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Hit Buy Now.

- Choose the suitable subscription to suit your needs.

- Create your account.

- Pay via PayPal or by debit/bank card.

- Choose a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

As soon as the Participation Agreement between First American Ins. Portfolios, Inc., SEI Investments Distribution Co. is downloaded you are able to complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

The new Industry Master Participation Agreement endorsed by BAFT is designed to simplify the exchange of documentation between banks and reduce legal costs by minimizing redundancies and excessive bi-lateral discussions.It is anticipated to become the standard framework agreement for member banks of the EAC.

Also known as a profit participation agreement or exit fee agreement. In the context of a finance transaction, an agreement between a lender and borrower, where the borrower agrees to pay the lender a fee or profit share on the occurrence of a specified, future contingent event.

Risk participation is an agreement where a bank sells its exposure to a contingent obligation to another financial institution. These agreements are often used in international trade, although they remain risky.

A loan participation is an instrument that allows multiple lenders to participate or share in the funding of a loan. The originating lender underwrites and closes the loan, and subsequentlyor sometimes simultaneouslysells portions of the loan to other participants.