Oakland Michigan Unsecured Installment Payment Promissory Note for Fixed Rate

Description

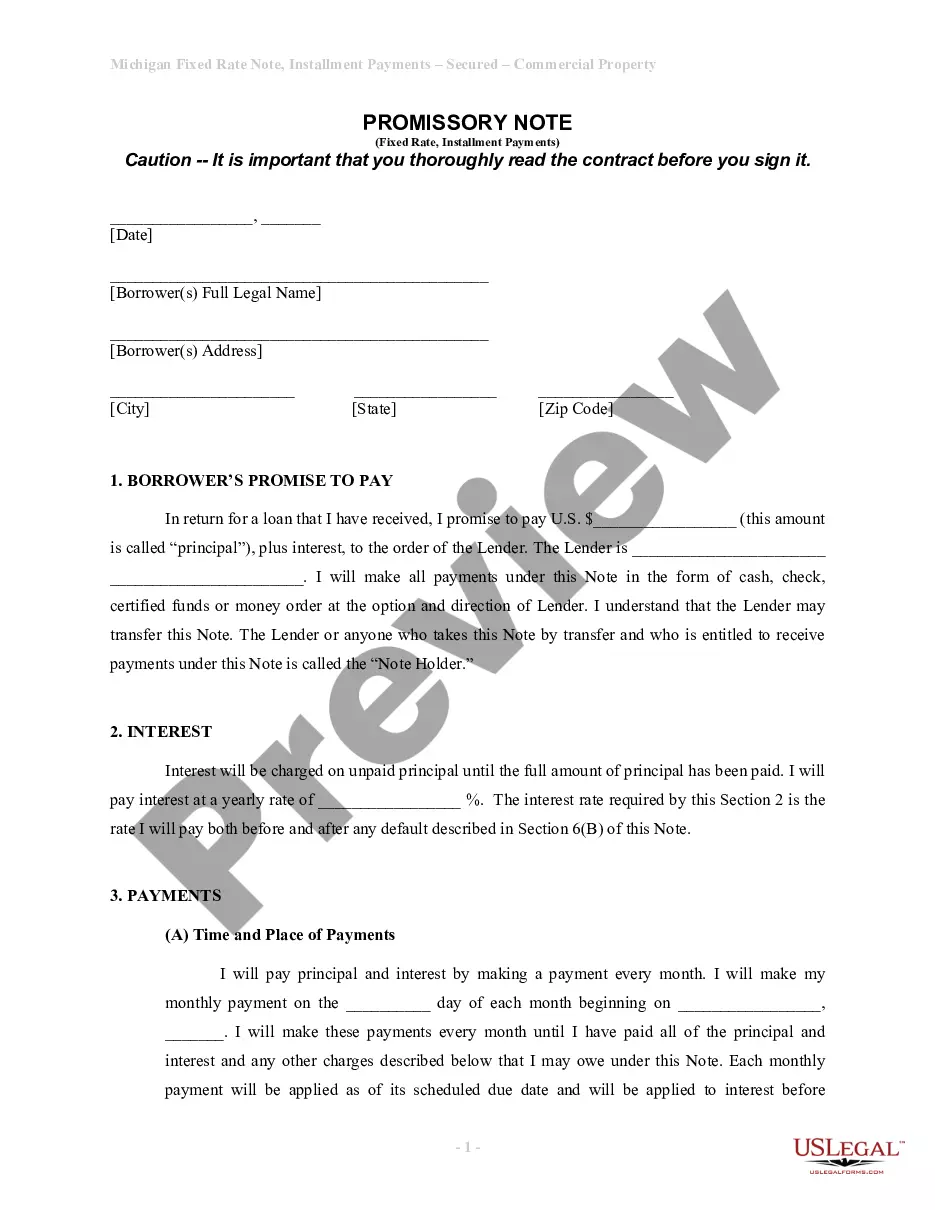

How to fill out Michigan Unsecured Installment Payment Promissory Note For Fixed Rate?

Take advantage of the US Legal Forms and gain immediate access to any document you require.

Our beneficial website with an extensive collection of templates enables you to locate and retrieve nearly any document example you need.

You can download, complete, and validate the Oakland Michigan Unsecured Installment Payment Promissory Note for Fixed Rate in just a few minutes instead of spending hours searching online for an appropriate template.

Utilizing our library is an excellent approach to enhance the security of your document submissions.

Access the page with the document you require. Confirm that it is the form you intended to locate: check its title and description, and take advantage of the Preview option if available. Otherwise, utilize the Search bar to find the suitable one.

Initiate the download process. Click Buy Now and select the payment plan you prefer. Then, register for an account and complete your order with a credit card or PayPal.

- Our experienced attorneys routinely review all documents to ensure that the forms are applicable for a specific state and adhere to current regulations and laws.

- How can you access the Oakland Michigan Unsecured Installment Payment Promissory Note for Fixed Rate.

- If you possess a subscription, simply Log In to your account. The Download option will be visible on all the templates you examine.

- Moreover, you can retrieve all the previously saved documents from the My documents section.

- If you are yet to create an account, follow the guidelines below.

Form popularity

FAQ

A reasonable interest rate for a promissory note often depends on current market conditions and the borrower's credit profile. Generally, rates can range from 5% to 15%, but it's essential to research local regulations. For an Oakland Michigan Unsecured Installment Payment Promissory Note for Fixed Rate, ensure the rate is competitive and reflective of the borrower's reliability.

The primary difference between a secured and unsecured note lies in collateral. A secured note is backed by an asset, providing the lender with a claim if the borrower defaults. In contrast, an Oakland Michigan Unsecured Installment Payment Promissory Note for Fixed Rate does not include collateral, which increases risk for the lender but may simplify the borrowing process.

In Michigan, a promissory note does not necessarily need to be notarized. While notarization can add an extra layer of authenticity, it is not a legal requirement for the note to be enforceable. If you decide to create an Oakland Michigan Unsecured Installment Payment Promissory Note for Fixed Rate, make sure to retain a signed copy for your records, whether notarized or not.

To obtain an Oakland Michigan Unsecured Installment Payment Promissory Note for Fixed Rate, you can start by visiting a reliable legal document service like USLegalForms. This platform offers easy access to customizable and legally compliant promissory note templates that suit your needs. Simply choose the appropriate form, fill it out with your specific terms, and then follow the instructions to ensure its validity. Once completed, you’ll have a solid document ready for your financial agreements.

You can indeed set up a payment plan with DTE by visiting their website or contacting their customer service. They offer flexible arrangements that can include an Oakland Michigan Unsecured Installment Payment Promissory Note for Fixed Rate to help you manage your utility payments effectively. This plan can ease financial pressure and ensure ongoing service. Prepare your account information for a quicker setup.

Yes, you can make payment arrangements with the State of Michigan. They offer various options to accommodate your financial situation. Utilizing an Oakland Michigan Unsecured Installment Payment Promissory Note for Fixed Rate can be a beneficial option, allowing you to structure your payments over time. Engage with their support for guidance on the necessary documentation and steps involved.

Setting up a payment arrangement for taxes in Oakland, Michigan, typically begins with reaching out to the Michigan Department of Treasury. They can assist you with options such as filing an Oakland Michigan Unsecured Installment Payment Promissory Note for Fixed Rate. This arrangement will help you address tax liabilities while providing you with manageable payment terms. Ensure you provide all necessary tax documents to streamline the process.

To set up a payment plan with the State of Michigan, you can start by visiting their official website or contacting their customer service. They provide detailed guidelines on setting up a payment plan that may include an Oakland Michigan Unsecured Installment Payment Promissory Note for Fixed Rate. This option allows you to manage your payments while avoiding potential penalties. Make sure to gather your financial information for a smoother process.