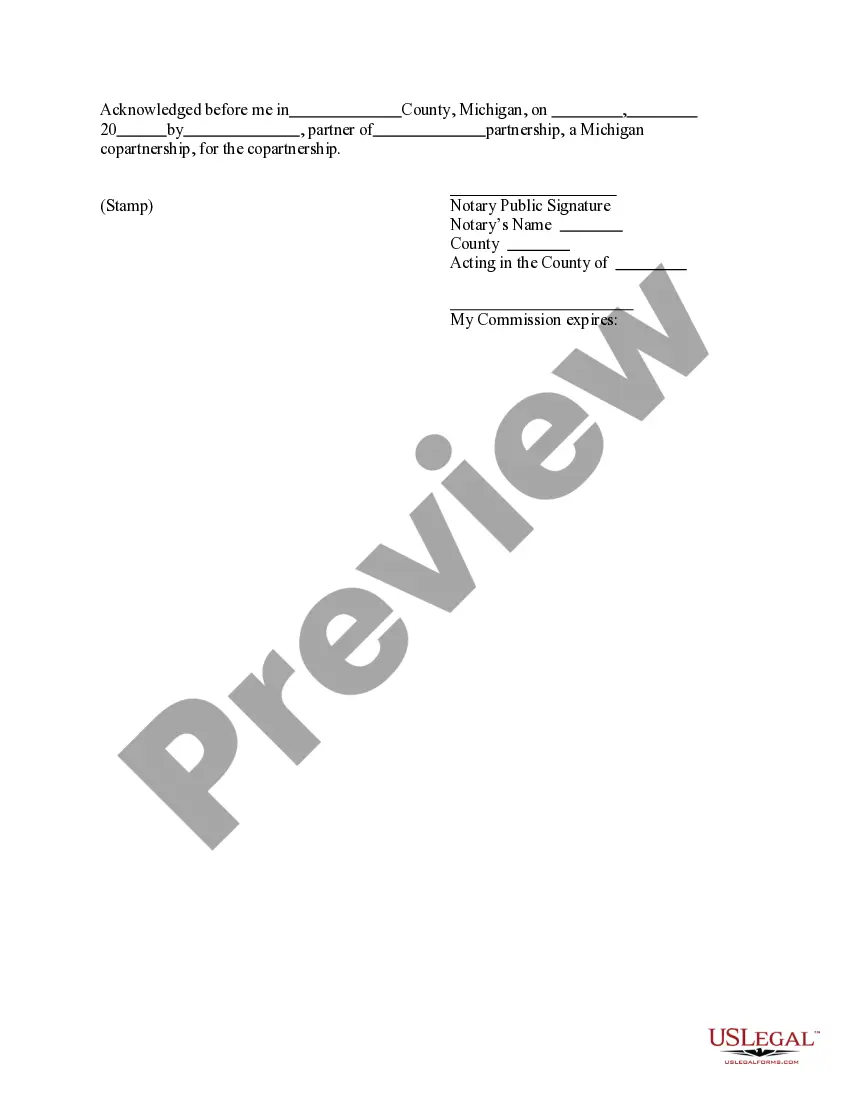

Detroit Michigan Acknowledgment for a Limit Partnership

Description

How to fill out Michigan Acknowledgment For A Limit Partnership?

We consistently endeavor to minimize or avert legal complications when handling intricate legal or financial matters.

To achieve this, we enlist attorney services that are typically very expensive.

Nevertheless, not all legal situations are equally complicated.

A majority of them can be managed by ourselves.

Take advantage of US Legal Forms whenever you require to obtain and download the Detroit Michigan Acknowledgment for a Limit Partnership or any other document swiftly and securely. Simply Log In to your account and select the Get button adjacent to it. If you misplace the document, you can always retrieve it again in the My documents section.

- US Legal Forms is an online collection of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our repository enables you to take control of your affairs without needing to consult a lawyer.

- We provide access to legal form templates that aren’t always readily available.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

About 40 states allow the formation of an LLP, and the laws vary by state. Some states limit what professions can form an LLP, so check your state statutes.

A Limited Partnership Agreement is essential for a Limited Partnership. Limited Partnership's typically do not have bylaws like a corporation and Limited Partnerships laws have fewer guidelines than are provided for corporations.

A limited partnership agreement helps protect your business into the future by outlining each partner's roles and responsibilities, as well as how they share in the business profits. You should use a limited partnership agreement if you want to form a limited partnership or formalize an existing limited partnership.

A limited partnership is formed by two or more entities and must have at least one limited partner and one general partner. Limited partners are only liable for the partnership's debts equal to their investment in the partnership.

Certificate of co-partnership. To create an LLP in Michigan, it must first be formed as a co-partnership....This application requires: the name of the LLP; the address of the principal office; the general nature of the business; and. the information about the registered agent, if required;

Partnerships must file Form SS-4 with the Internal Revenue Service. Form SS-4 is used to get an employer identification number, also known as a federal tax ID number, from the IRS. The IRS allows a partnership to file Form SS-4 online using the IRS website, by telephone, by fax or by mail.

To change information of record for your LP, fill out this form, and submit for filing along with: ? A $30 filing fee. ? A separate, non-refundable $15 service fee also must be included, if you drop off the completed form. pages if you need more space or need to include any other matters.

Key Takeaways. A limited partnership (LP) exists when two or more partners go into business together, but the limited partners are only liable up to the amount of their investment. An LP is defined as having limited partners and a general partner, which has unlimited liability.

Required Documents: Limited Partnership Name and address of business. Business tax ID number: Business Employer Identification Number (EIN) provided by the IRS in the following 9-digit format XX-XXXXXXX. Date business was established (month/year) Country and state of legal formation (must be formed in the US)

Michigan does not require an LLP to have a registered agent unless it is registering as a foreign entity; Certificate of co-partnership. To create an LLP in Michigan, it must first be formed as a co-partnership. This requires filing a Certificate of Co-partnership with the local county clerk.