Lansing Michigan Revocation of Living Trust

Description

How to fill out Michigan Revocation Of Living Trust?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents catering to both private and corporate requirements as well as various real-world situations.

All the files are adequately categorized by area of application and jurisdiction, making the search for the Lansing Michigan Revocation of Living Trust as quick and simple as 1-2-3.

Keep your paperwork organized and compliant with legal standards is vital. Leverage the US Legal Forms repository to always have crucial document templates for any requirements right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve picked the correct one that satisfies your requirements and aligns with your local jurisdiction guidelines.

- Seek another template, if necessary.

- Upon noticing any discrepancies, use the Search tab above to find the accurate one.

- If it meets your criteria, proceed to the next step.

Form popularity

FAQ

Revoking a revocable trust is generally straightforward, provided that the correct procedures are followed. In Michigan, as part of the Lansing Michigan Revocation of Living Trust process, you typically need to create a formal document stating your intention to revoke the trust. Although it sounds simple, consulting with a legal expert can ensure that the revocation is executed correctly and that all assets are properly managed thereafter.

Yes, you can contest a living trust in Michigan, much like you would a will. Grounds for contesting include lack of mental capacity or undue influence when establishing the trust. Navigating the complexities of the Lansing Michigan Revocation of Living Trust can be challenging, so seeking professional guidance might be necessary to build a strong case and understand your legal standing.

A trust can typically be terminated in three ways: through the terms outlined in the trust document, mutual agreement among beneficiaries, or by court order. If you consider ending a trust, it may involve the Lansing Michigan Revocation of Living Trust process. Each method has specific requirements and implications, making it beneficial to discuss your circumstances with a qualified attorney.

In Michigan, a will generally cannot override a living trust if the trust is valid and properly funded. The assets in the trust are governed by its terms, which take precedence over a will upon the creator's death. Therefore, ensuring that both documents align is crucial for effective estate planning, particularly regarding the Lansing Michigan Revocation of Living Trust. It's wise to seek expert advice to avoid conflicts between these documents.

Yes, a trust can be contested in Michigan. When a party believes the trust is invalid due to issues like lack of capacity or improper execution, they may challenge it in court. Understanding the Lansing Michigan Revocation of Living Trust process can help clarify your rights and options. Consider consulting legal resources or professionals to guide you through this complex situation.

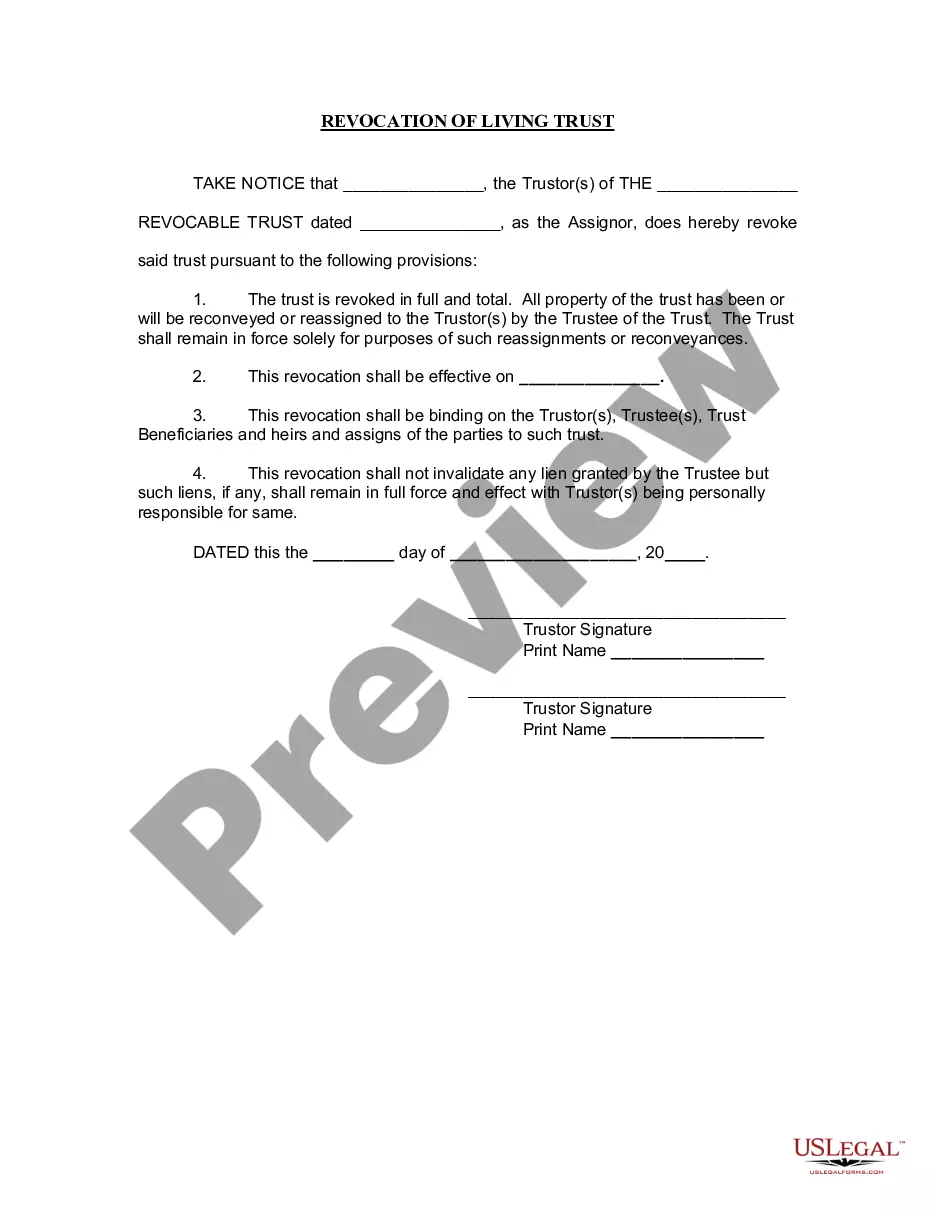

An example of a trust revocation involves the trust creator signing a document that removes all terms of the existing trust. This could state, 'This living trust, established on date, is hereby revoked.' If you are considering a Lansing Michigan Revocation of Living Trust, it’s important to understand that this process should be handled carefully, and tools from platforms like US Legal Forms can guide you through creating the necessary documents.

A trust revocation declaration is a formal statement that officially cancels a trust. In this declaration, the trust creator would typically declare, 'I revoke the trust established on date.' When pursuing a Lansing Michigan Revocation of Living Trust, it's crucial to create a clear and legally sound declaration, which can also be conveniently generated through US Legal Forms.

A revocation clause is a specific provision in a trust document that allows the creator to cancel the trust at any time. For example, a revocation clause might state, 'I hereby revoke any and all existing trusts created by me.' This clause is vital during the Lansing Michigan Revocation of Living Trust process, as it clearly communicates the intent to nullify the trust, ensuring all parties understand the change.

A form to dissolve a revocable trust is a legal document that communicates your decision to terminate the trust. This form typically requires your signature and may need to be notarized, depending on Michigan laws. It is crucial to follow the correct format to ensure validity. For individuals seeking assistance, USLegalForms offers customizable templates for the Lansing Michigan revocation of living trust that can simplify this process.

To revoke a revocable living trust, you need to follow a clear process. Start by creating a written document that states your intent to revoke the trust, and ensure you sign and date it. Next, you should provide copies to all relevant parties and notify any institutions holding assets within the trust. For additional support, USLegalForms can provide specific forms and guidance regarding the Lansing Michigan revocation of living trust.