Grand Rapids Michigan Assignment to Living Trust

Description

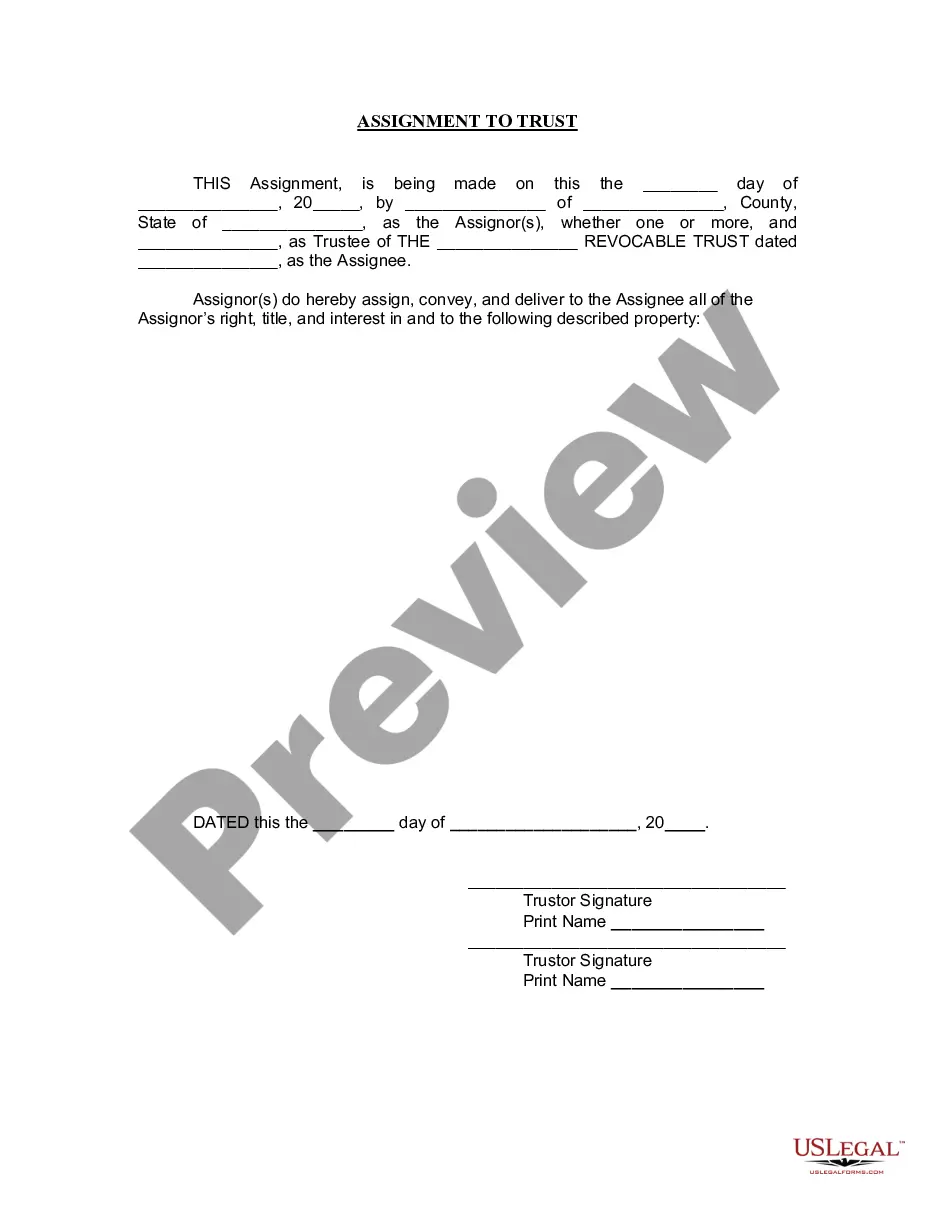

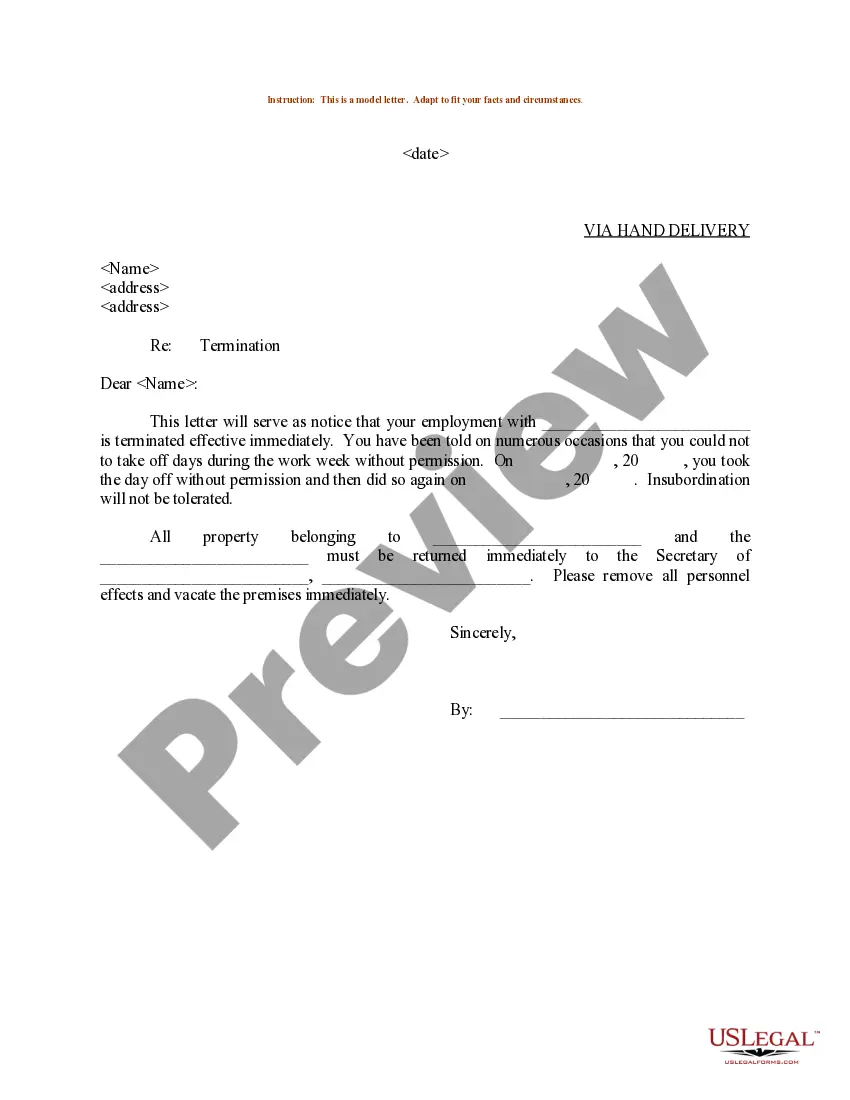

How to fill out Michigan Assignment To Living Trust?

If you are in search of a suitable form template, it is incredibly challenging to discover a superior service compared to the US Legal Forms site – likely the most comprehensive online collections.

With this collection, you can obtain thousands of document samples for business and personal use by categories and states, or search terms.

With the high-quality search feature, discovering the latest Grand Rapids Michigan Assignment to Living Trust is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finish the registration process.

Obtain the template. Select the file format and download it to your device. Edit the document. Complete, modify, print, and sign the acquired Grand Rapids Michigan Assignment to Living Trust. Every template you add to your account does not expire and belongs to you indefinitely. You can access them via the My documents option, so if you need to obtain an additional copy for editing or printing, you can return and download it again at any time. Make the most of the extensive catalog of US Legal Forms to access the Grand Rapids Michigan Assignment to Living Trust you were looking for, along with thousands of other professional and state-specific templates all in one place!

- Moreover, the accuracy of each record is validated by a team of experienced lawyers who routinely review the templates on our site and update them according to the latest state and county laws.

- If you are already familiar with our system and possess a registered account, all you have to do to obtain the Grand Rapids Michigan Assignment to Living Trust is to Log In to your account and hit the Download button.

- If this is your first time using US Legal Forms, just adhere to the instructions below.

- Ensure you have selected the form you require. Review its description and utilize the Preview feature to assess its content. If it does not satisfy your requirements, use the Search bar at the top of the page to locate the appropriate document.

- Confirm your choice. Click on the Buy now button. Then, select your desired pricing option and enter your details to register for an account.

Form popularity

FAQ

To set up a living trust in Michigan, you need to begin by deciding which assets you want to include in your trust. You can then create the trust document, which outlines how the assets should be managed and distributed. It's important to fund the trust properly, which means transferring ownership of the chosen assets to the trust to ensure they are protected under the Grand Rapids Michigan Assignment to Living Trust. For assistance, consider using the US Legal Forms platform to access templates and guidance tailored to your needs.

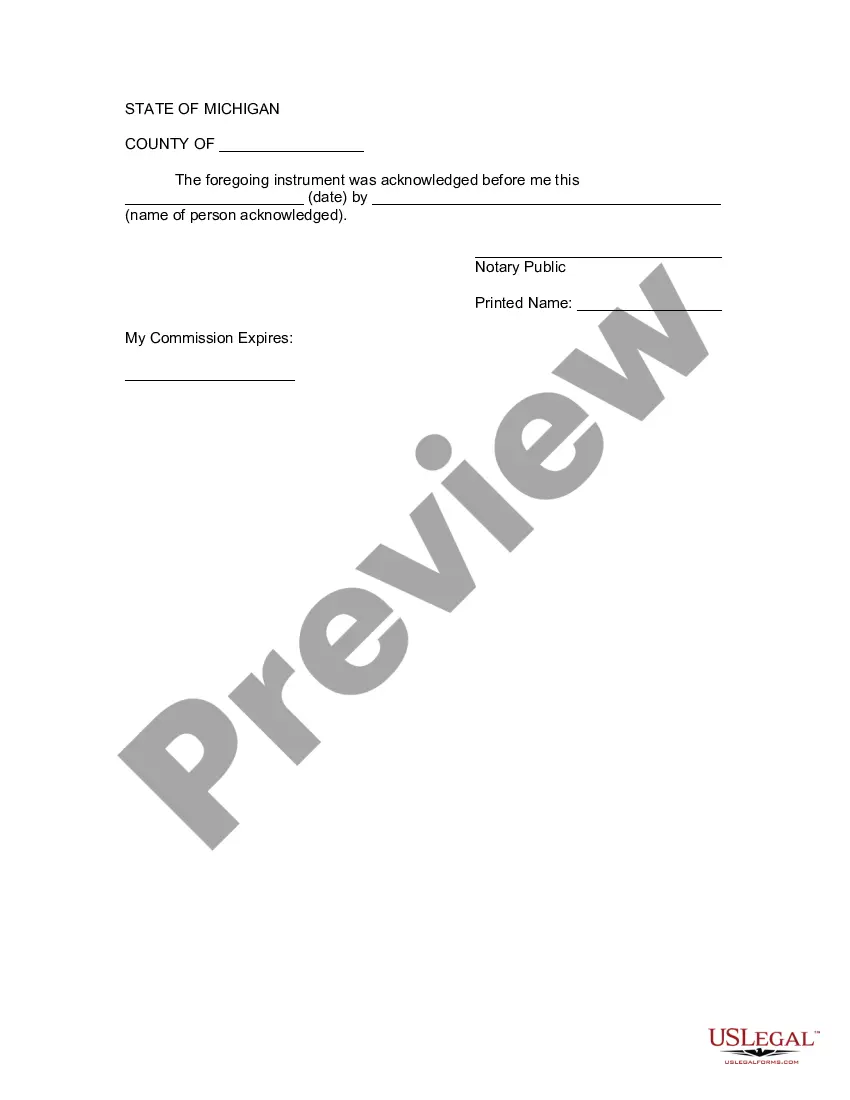

To transfer property to a trust in Michigan, you must execute a deed that conveys the property from your name to the name of the trust. This deed should be recorded at the local county clerk’s office to complete the transfer. Properly documenting this process is essential for establishing a valid Grand Rapids Michigan Assignment to Living Trust. Consider leveraging US Legal Forms for templates and instructions that can simplify these necessary steps.

You do not need to register a living trust in Michigan for it to be valid. However, it is important to properly execute and fund your trust for it to function effectively as part of your estate plan. Ensuring all assets are transferred correctly will aid in your Grand Rapids Michigan Assignment to Living Trust. Using services like US Legal Forms can assist with the necessary documentation and guidance.

In Michigan, if the trust earns income or has certain deductions, it may need to file a Michigan trust return. This typically applies to irrevocable trusts or those that have taxable income. Understanding your obligations is crucial for maintaining compliance with tax laws, especially in the context of a Grand Rapids Michigan Assignment to Living Trust. Platforms like US Legal Forms provide resources to help streamline this process.

In Michigan, a living trust does not need to be recorded with the state. However, certain assets, like real estate, may require recording a transfer deed to reflect the trust as the new owner. It's essential to follow these steps to ensure your Grand Rapids Michigan Assignment to Living Trust is effective. Always consider consulting a legal expert if you have specific concerns.

To file a living trust in Michigan, you first need to create the trust document. This document outlines the terms of the trust and designates the trustee. After creating the document, you should fund the trust by transferring assets into it. Utilizing a platform like US Legal Forms can simplify this process and ensure all required documents are prepared correctly for a Grand Rapids Michigan Assignment to Living Trust.

To petition a Kent County court for a trust, you need to submit the necessary documents with the court clerk's office. Be prepared to provide your Grand Rapids Michigan Assignment to Living Trust and other relevant information to facilitate the process. It may be beneficial to seek assistance from legal resources or platforms like uslegalforms to ensure your petition complies with local rules. Having the right documentation will help streamline your experience.

Yes, you can create your own living trust in Michigan, but it's important to approach this carefully. Developing a Grand Rapids Michigan Assignment to Living Trust requires understanding Michigan laws and ensuring that all documents are executed correctly. Various online resources, including uslegalforms, can help guide you through the process to avoid common pitfalls, making it feasible to manage a trust on your own.

In Michigan, having both a will and a trust can offer a comprehensive estate plan. A Grand Rapids Michigan Assignment to Living Trust can help avoid probate, providing faster access to your assets for beneficiaries. While a will works well for smaller estates, a trust offers more control over asset distribution. Many people find that a combination provides the best protection and flexibility.

One significant mistake parents often make when creating a trust fund is failing to properly fund it. A Grand Rapids Michigan Assignment to Living Trust needs to be funded with assets in order to be effective. If assets remain outside of the trust, they won't benefit from the trust's protection or management. Ensuring all intended assets are enrolled in the trust is essential for achieving your estate planning goals.