Michigan Assignment to Living Trust

What is this form?

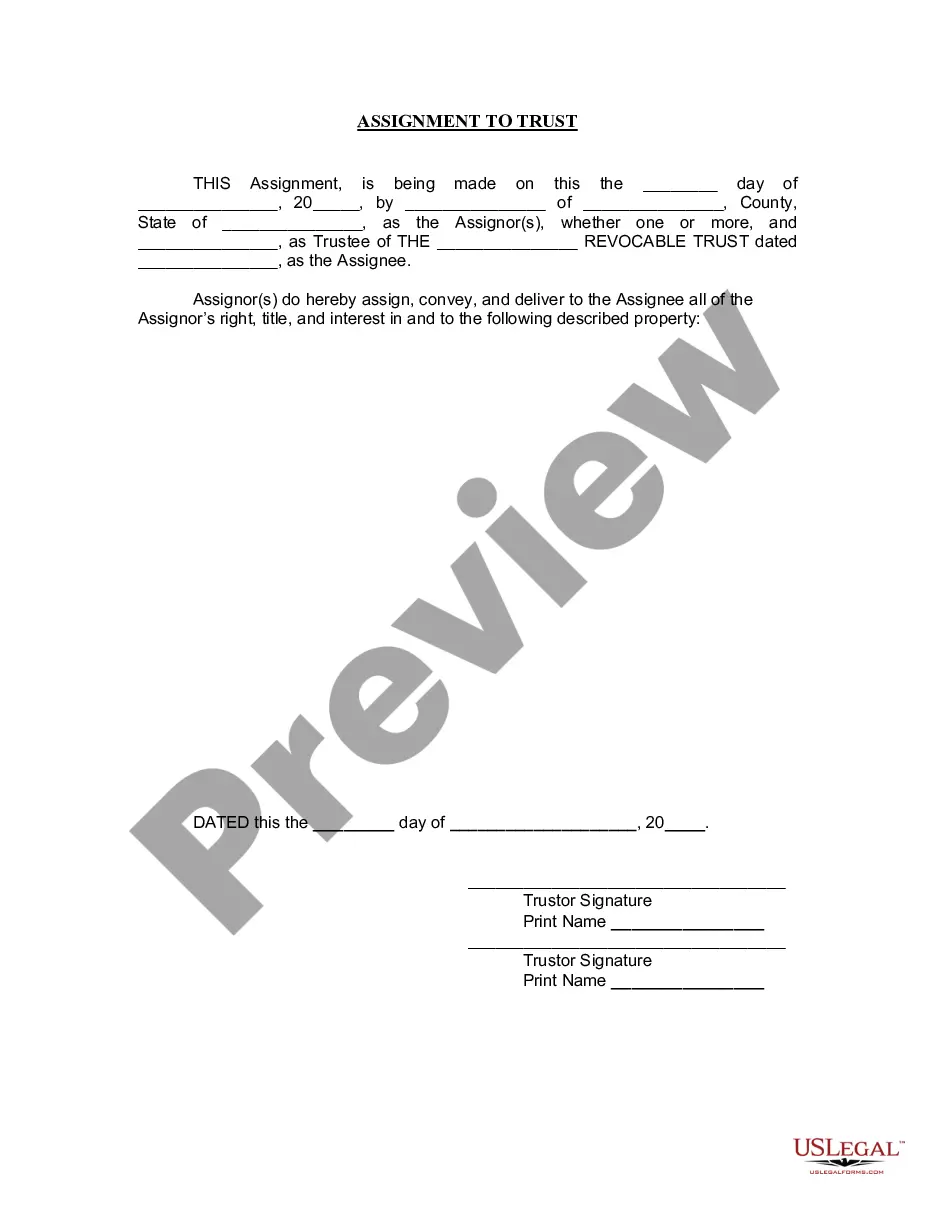

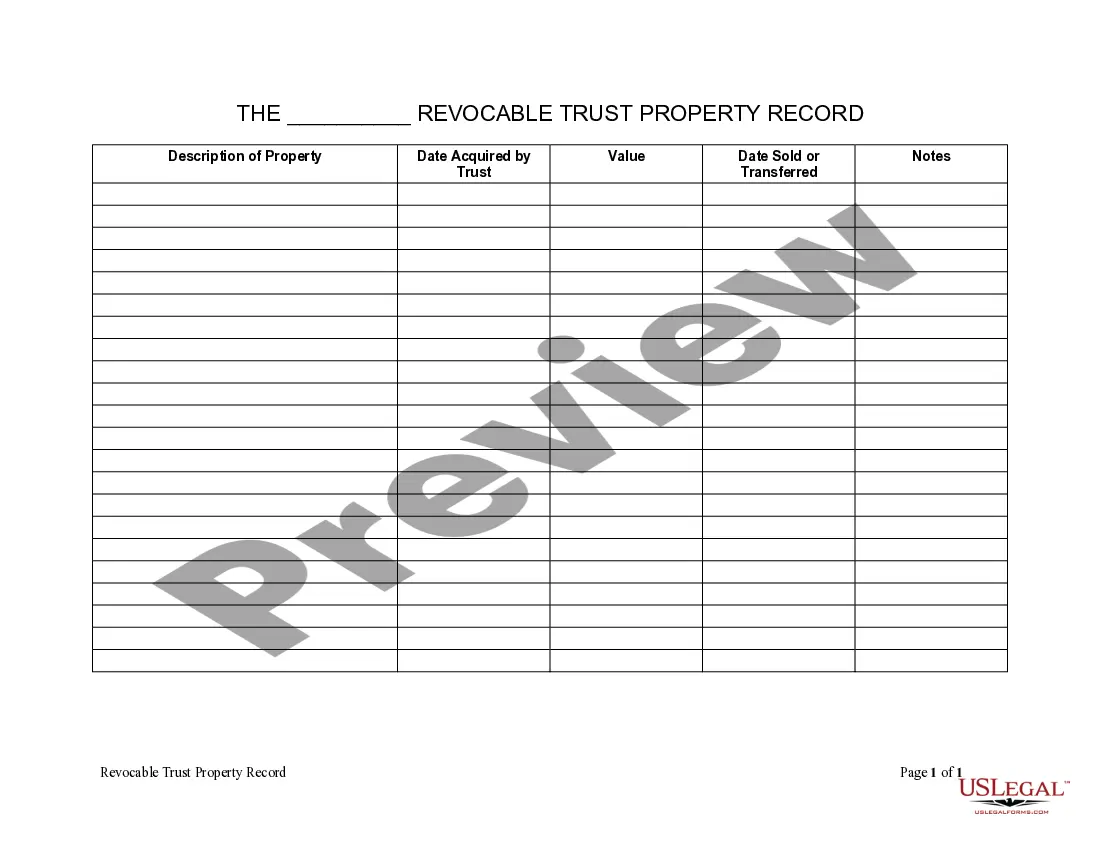

The Assignment to Living Trust form is a legal document used to transfer specific property rights into a living trust. A living trust is created during a person's lifetime to manage and distribute assets for estate planning purposes. This form establishes a clear assignment of property, distinguishing it from other estate planning documents, such as wills or powers of attorney. The transfer of property via this form helps ensure that assets are managed according to the grantor's wishes during their lifetime and after their passing.

Main sections of this form

- Identifies the Assignor(s) transferring property

- Names the Trustee and the associated Living Trust

- Details the specific property being assigned

- Includes date of the assignment

- Requires notarization of signatures for legal validity

Common use cases

This form should be used when an individual wishes to transfer ownership of property into a living trust during their lifetime. It is commonly utilized for estate planning purposes, such as when someone wants to manage their assets more effectively, avoid probate, or provide clear instructions for the distribution of property after their death. This form is especially important if the property assigned is a significant asset like real estate, investments, or personal belongings.

Intended users of this form

This form is suitable for:

- Individuals establishing or modifying a living trust

- Trustors who want to clarify property assignments in their estate plan

- Estate planners, lawyers, or individuals assisting with asset management

How to complete this form

- Identify the Assignor(s) by providing their names and address.

- Specify the property being assigned to the trust.

- Name the Trustee and ensure they are authorized.

- Complete the date of the assignment.

- Sign the form in the presence of a notary public to validate the transfer.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide complete information about the property.

- Not including all required signatures on the form.

- Overlooking the need for notarization.

- Leaving the date of the assignment blank.

- Incorrectly naming the Trustee or Living Trust.

Benefits of using this form online

- Convenience of accessing and completing the form at any time.

- Editability allows you to customize the form to your specific needs.

- Reliability with templates drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

To put your assets in a living trust, start by creating the trust document that outlines the terms and conditions. Next, you will need to retitle your assets, like real estate or bank accounts, in the name of the trust. This process is known as the Michigan Assignment to Living Trust. Lastly, consider consulting a legal expert or using platforms like USLegalForms to guide you through the necessary paperwork.

Putting your house into a trust can have some disadvantages, such as the complexities of managing the trust and possibly incurring fees for its setup and maintenance. Additionally, while a Michigan Assignment to Living Trust can help avoid probate, it does not protect against creditors or lawsuits. Also, you may lose certain tax benefits associated with direct ownership, so it's important to weigh these factors carefully. Consulting with professionals, or utilizing U.S. Legal Forms, can assist in making informed decisions.

Setting up a living trust in Michigan involves drafting a trust document that defines your wishes for property management and distribution. This document should detail who the trustee and beneficiaries are, as well as the terms of trust management. You can establish a Michigan Assignment to Living Trust by also funding it with your assets, thereby ensuring smooth transitions upon your passing. Consider using U.S. Legal Forms for guidance and templates to streamline the setup.

To transfer property to a trust in Michigan, start by creating your living trust document, clearly outlining all beneficiaries and terms. Next, prepare a new deed to transfer ownership from yourself to the trust, which must be signed and notarized. Finally, file the new deed with the local county clerk’s office, ensuring that your Michigan Assignment to Living Trust is legally recognized. Using platforms like U.S. Legal Forms can simplify this entire process.

A trust becomes valid in Michigan when it is created with a clear intent, involves a competent trustor, and contains identifiable trust property. Additionally, a valid trust should have at least one beneficiary and an appointed trustee to manage the trust’s assets. It is essential to ensure compliance with Michigan laws when creating your trust. If you need help, US Legal Forms provides valuable resources for establishing a Michigan Assignment to Living Trust.

In Michigan, a trust does not have to be filed with the court to be valid. Unlike a will, a living trust can operate privately without court involvement. However, assets held within the trust must be managed according to Michigan state laws for the trust to fulfill your wishes effectively. For more detailed information on the Michigan Assignment to Living Trust, consider visiting US Legal Forms.

To write an amendment to a living trust, start by clearly identifying the original trust document you wish to amend. Use straightforward language to specify which sections you are changing and what the new provisions will be. Be sure to sign and date the amendment, as well as have it witnessed or notarized if necessary, depending on Michigan laws. US Legal Forms offers templates and guidance to help you through the Michigan Assignment to Living Trust amendment process.

To file a trust in Michigan, you need to prepare the trust document, ensuring it complies with state laws. After drafting the document, you should review it to confirm that it reflects your intentions. Once reviewed, you can fund the trust by transferring assets into it. If you need assistance, US Legal Forms provides resources to guide you through the Michigan Assignment to Living Trust process.

The 2 year rule for trusts in Michigan refers to the time frame during which certain actions, like transferring assets without tax implications, must occur. This rule essentially helps streamline the management of your trust and avoid complications with asset transfers later on. Understanding this rule is vital, and using platforms like US Legal Forms can assist you in mastering the Michigan Assignment to Living Trust and ensuring compliance.

Transferring property to a trust in Michigan involves creating a new deed that assigns ownership from you to your trust. It's crucial to reference the trust document to ensure clarity. If you're navigating this process for the first time, US Legal Forms offers helpful resources and templates specifically for Michigan Assignment to Living Trust, making your transfer seamless and efficient.