Lansing Michigan Living Trust for Husband and Wife with Minor and or Adult Children

Description

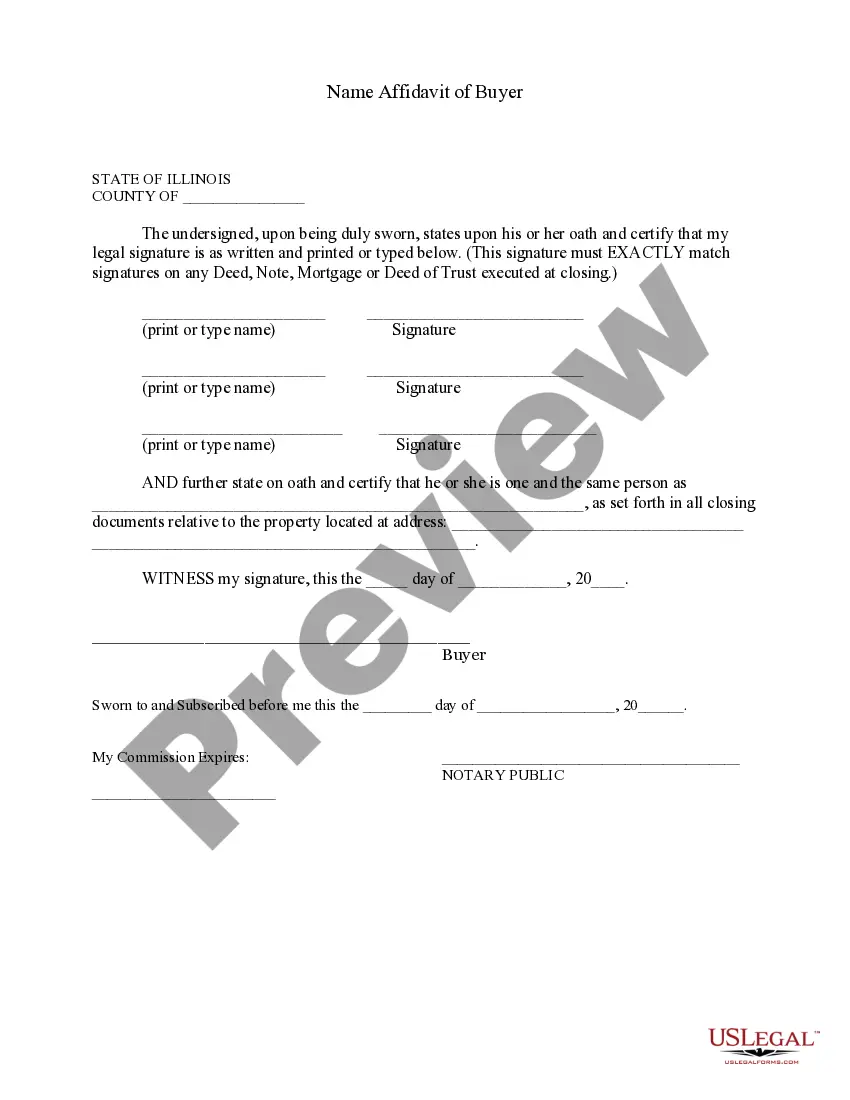

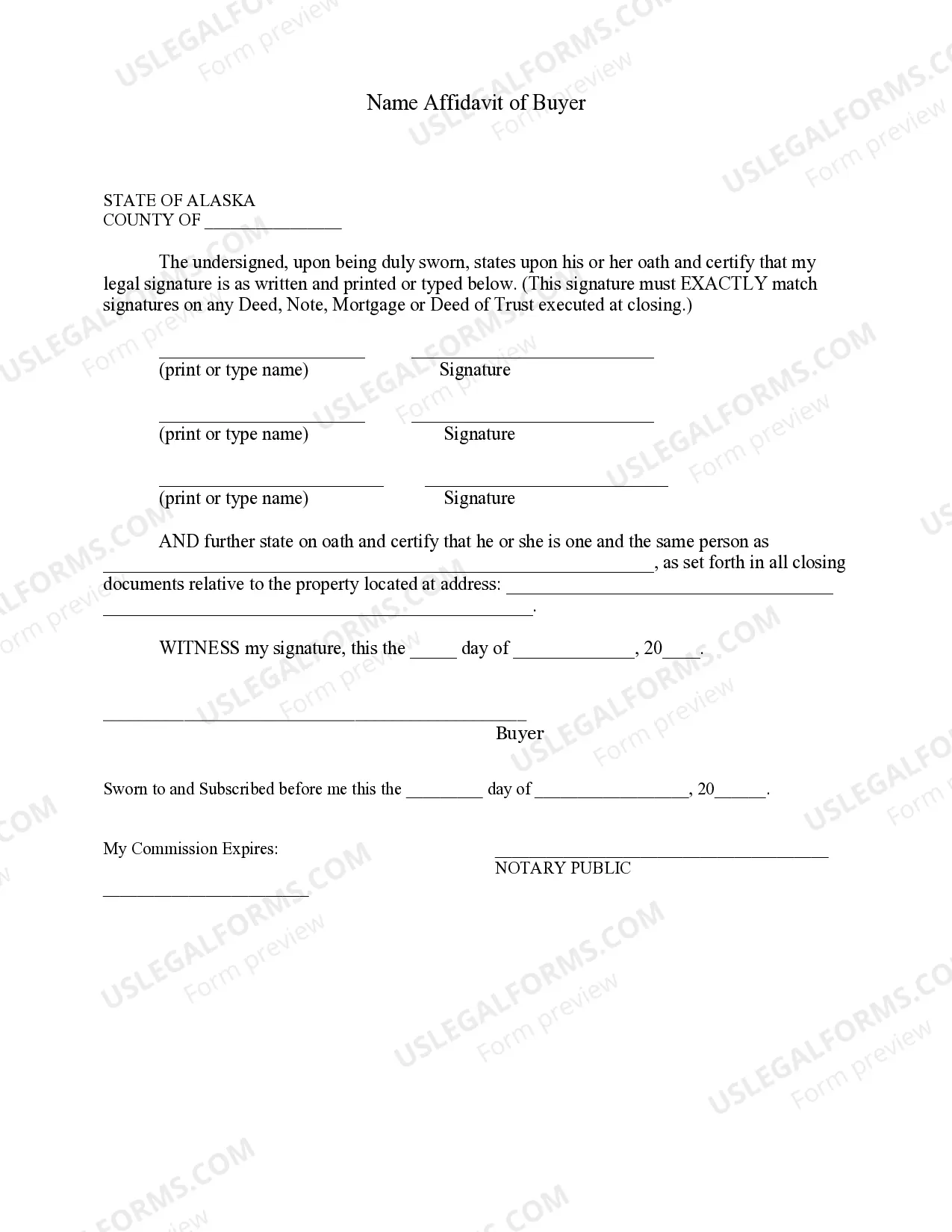

How to fill out Michigan Living Trust For Husband And Wife With Minor And Or Adult Children?

If you have previously accessed our service, Log In to your account and download the Lansing Michigan Living Trust for Husband and Wife with Minor and or Adult Children to your device by clicking the Download button. Ensure that your subscription is up to date. If it isn’t, renew it according to your payment plan.

If this is your first interaction with our service, follow these straightforward steps to obtain your document.

You have ongoing access to every document you’ve bought: you can locate it in your profile within the My documents menu whenever you need to retrieve it again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

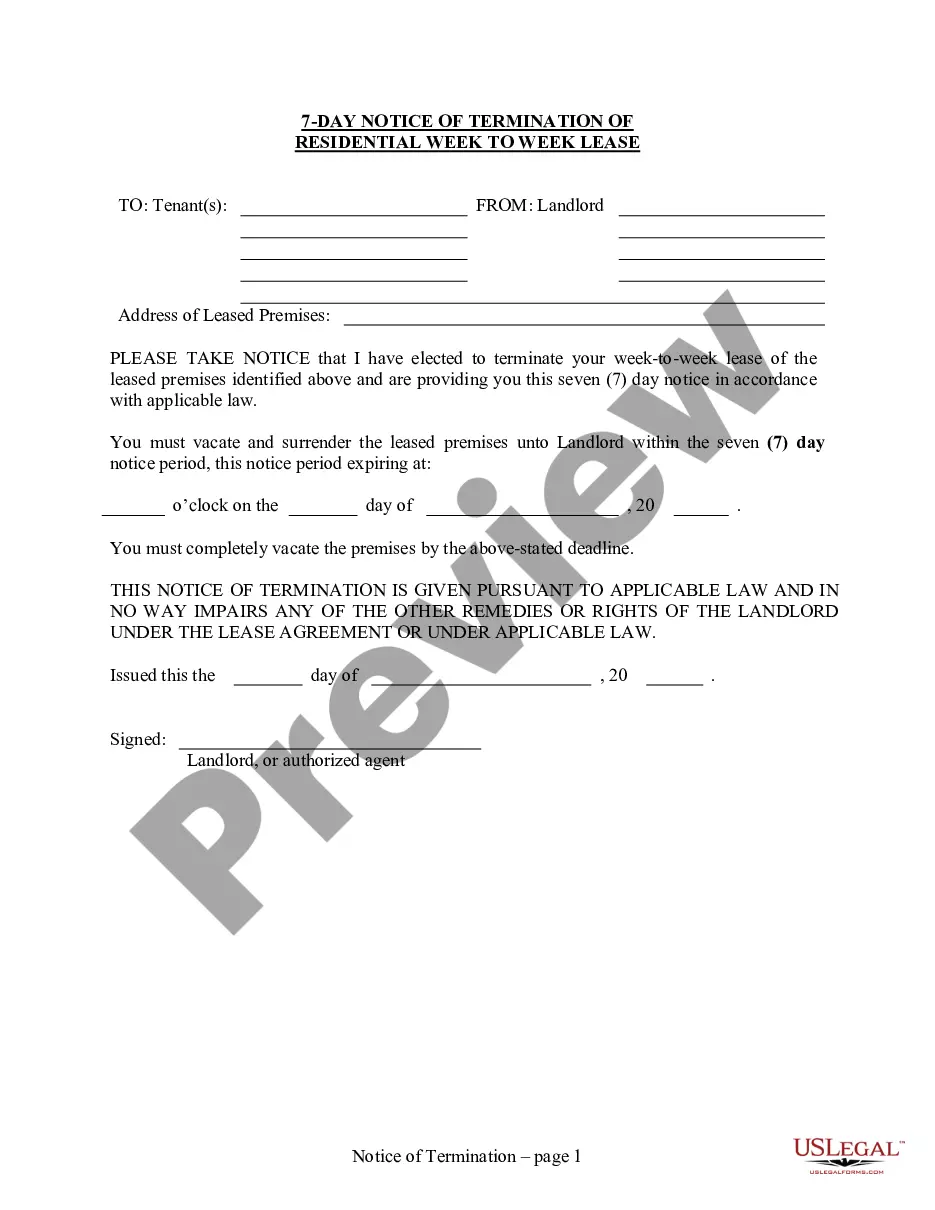

- Ensure you’ve located the correct document. Review the description and utilize the Preview option, if available, to verify if it fulfills your needs. If it doesn’t satisfy you, utilize the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process payment. Enter your credit card information or select the PayPal option to finalize the purchase.

- Obtain your Lansing Michigan Living Trust for Husband and Wife with Minor and or Adult Children. Choose the file format for your document and store it on your device.

- Complete your document. Print it or use professional online editors to fill it out and electronically sign it.

Form popularity

FAQ

A husband and wife might consider separate living trusts depending on their specific circumstances. In Lansing, Michigan, a joint living trust often simplifies the management of assets, especially when children are involved. However, separate trusts can offer unique advantages, such as individualized control over assets and tailored provisions for minor and adult children. Evaluating your family's needs with a professional can help determine the best approach for your Lansing Michigan Living Trust for Husband and Wife with Minor and or Adult Children.

No, Michigan trusts do not have to be filed with the court, allowing for great discretion in managing your assets. The Lansing Michigan Living Trust for Husband and Wife with Minor and or Adult Children can remain private, which helps in minimizing family disputes and maintaining control over your estate. It's vital, however, to ensure that the trust is properly created and funded, so consult resources like UsLegalForms for guidance with this process.

One significant mistake parents often make is not clearly defining their wishes within the trust. When establishing a Lansing Michigan Living Trust for Husband and Wife with Minor and or Adult Children, parents should communicate their intentions with precision. Failure to do this might lead to confusion or disputes among heirs. Using platforms like UsLegalForms can help ensure that all aspects of the trust are clearly outlined and understood.

In Michigan, a trust does not need to be filed with the court. This rule applies to the Lansing Michigan Living Trust for Husband and Wife with Minor and or Adult Children. This means you can maintain privacy regarding your assets and instructions. However, it is essential to properly fund your trust to ensure it operates as intended.

While a Lansing Michigan Living Trust for Husband and Wife with Minor and or Adult Children offers many benefits, it also has some downsides. Setting up a living trust may involve higher initial costs compared to a simple will since you may need legal assistance to draft it properly. Additionally, you must actively manage your assets to ensure they are included in the trust, which can be time-consuming. However, platforms like USLegalForms can help streamline the management process and provide the necessary support.

To create a valid Lansing Michigan Living Trust for Husband and Wife with Minor and or Adult Children, you must be at least 18 years old and legally competent. The trust must be in writing, and you should specify the trust property and beneficiaries clearly. It's essential to sign the trust document in front of a notary to ensure its legality. Using a reliable platform like USLegalForms can simplify this process by providing templates and guidance tailored for Michigan.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

A Living Trust can help you avoid Probate in Michigan, but a Will cannot. A Living Trust is a private document which does not require any court intervention. Most Living Trust transfers take place in the privacy of your attorney's office shortly after a death.

You could end up paying from $2,000 to $8,000 to create a trust. If you do use an attorney, make sure you fully understand his or her fee schedule beforehand. It's also wise to find an attorney who specializes specifically in trusts.