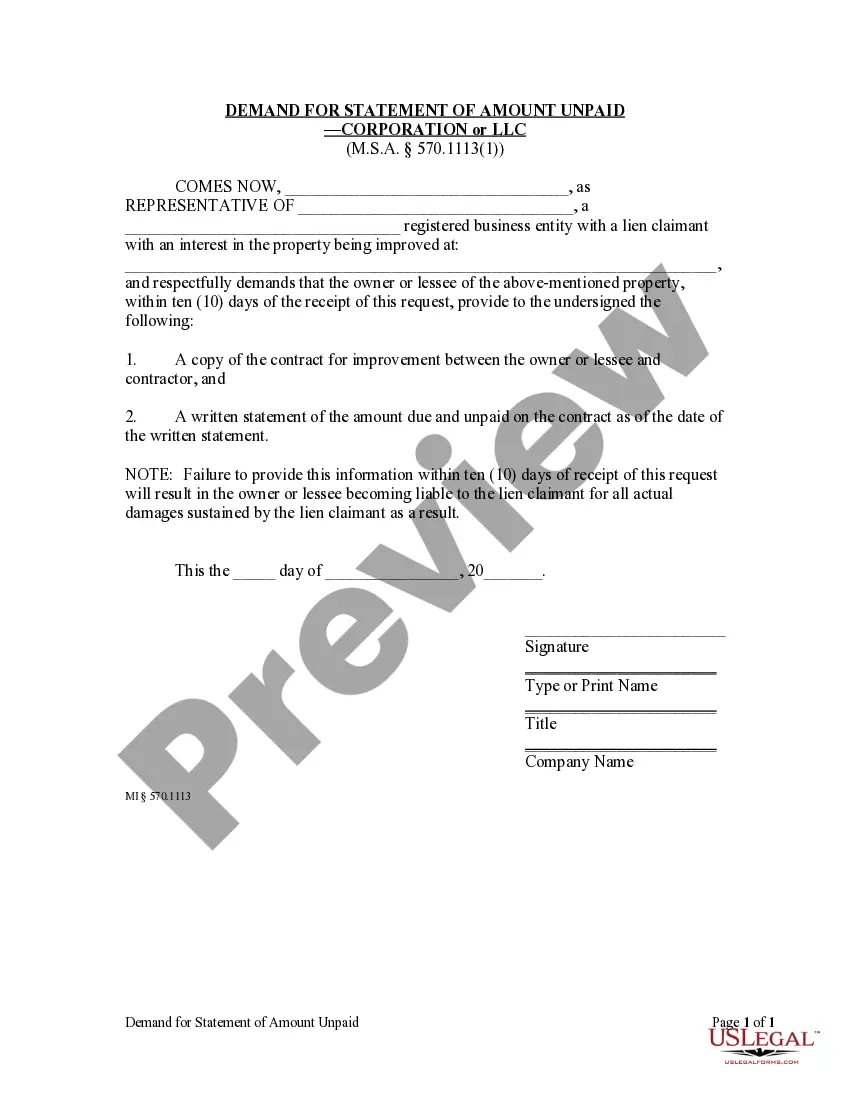

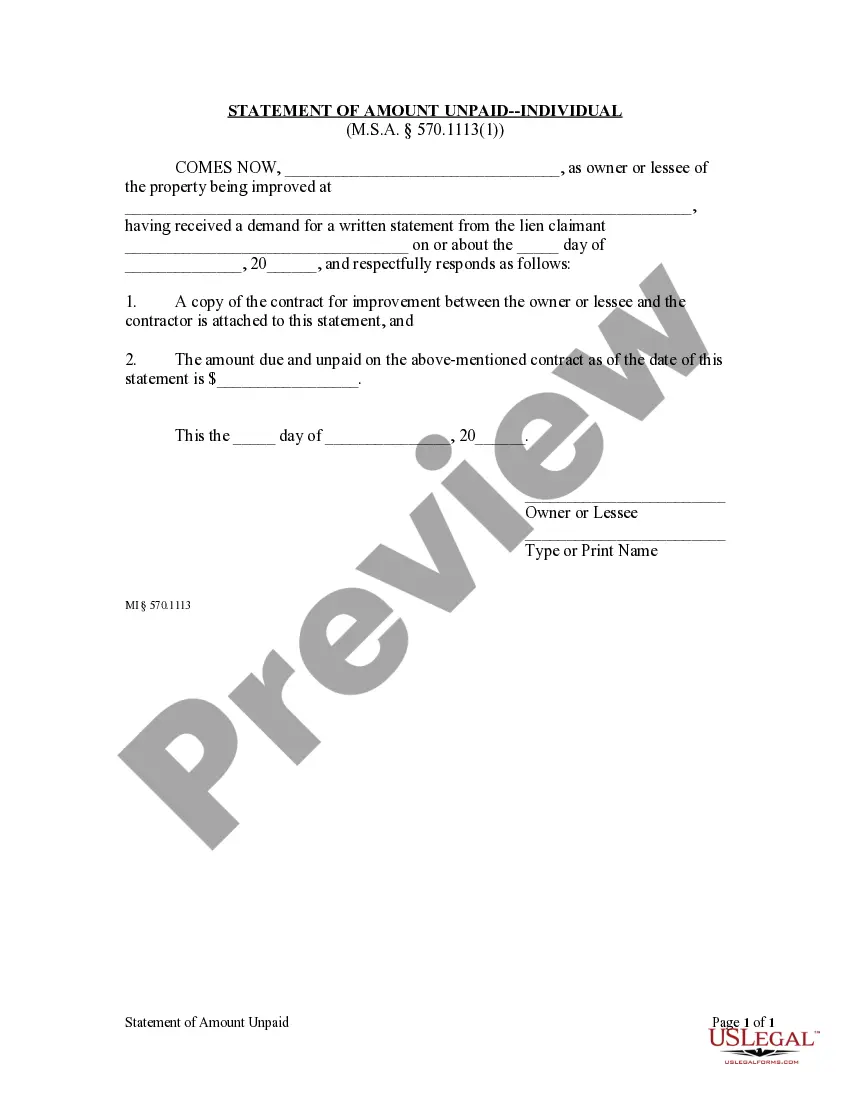

Detroit Michigan Statement of Amount Unpaid - Individual

Description

How to fill out Michigan Statement Of Amount Unpaid - Individual?

If you have previously employed our service, Log In to your account and retrieve the Detroit Michigan Statement of Amount Unpaid - Individual onto your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it according to your payment plan.

If this is your first time using our service, follow these easy steps to obtain your document.

You have lifelong access to all documents you have purchased: you can find them in your profile under the My documents section whenever you need to use them again. Take advantage of the US Legal Forms service to quickly find and download any template for your personal or professional requirements!

- Confirm that you’ve found the correct document. Review the description and utilize the Preview feature, if available, to ascertain whether it fulfills your requirements. If it does not meet your expectations, use the Search tab above to locate the appropriate one.

- Acquire the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Establish an account and process a payment. Enter your credit card information or utilize the PayPal option to finalize the transaction.

- Receive your Detroit Michigan Statement of Amount Unpaid - Individual. Choose the file format for your document and store it on your device.

- Finish your form. Print it or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

Real property tax delinquency entails a three-year forfeiture and foreclosure process in Michigan. Parcels are forfeited to the county treasurers when the real property taxes are in the second year of delinquency.

Reasons the IRS sends a certified letter These are sent to notify individuals or businesses of unpaid or late balances that must be resolved within a given timeframe (usually before penalties or further escalatory actions commence). Consider tax resolution services to resolve delinquent tax debt if you feel lost.

The Michigan Department of Treasury is responsible for collecting, disbursing, and investing all state monies. The Department advises the Governor on all tax and revenue policy, collects and administers over $20 billion a year in state taxes, and safeguards the credit of the state.

Wage Garnishment and Other Tax Levies As in the case with the IRS, if you fail to pay state taxes owed, many states will levy or garnish your wages. If they levy or garnish your wages, your employer must comply. Some states may also contact your bank to have funds taken from your bank account to pay down a balance.

When the IRS files a federal tax lien, it's making a legal claim against your current and future property. The notice of a federal tax lien is a public notice to let creditors know the IRS has a claim against your assets. Seizure/levy. The IRS can seize your wages, assets, and money in accounts.

Penalty is 25 percent of the tax due (with a minimum of $25 per quarter) for failing to make estimated payments or 10 percent (with a minimum of $10 per quarter) for failing to make sufficient estimated payments or making estimated payments late.

The division is located within the Tax Compliance Bureau and is comprised of various units with a variety of responsibilities. Discovery promotes taxpayer education and tax registration and licensing, while helping to maintain voluntary tax compliance.

The 6 year period, known as the statute of limitations, may be extended by certain actions such as a court judgment. By law, the Department may use a variety of actions to collect your past-due tax, penalty and interest and may take these actions at any time during the course of collection.

We will send a letter/notice if: You have an unpaid balance. You are due a larger or smaller refund. We have a question about your tax return. We need to verify your identity.

The Michigan Department of Treasury contracts with two private collection agencies, GC Services LLP and Harris & Harris LTD, to help us collect the delinquent tax, penalty and interest owed to the State of Michigan.