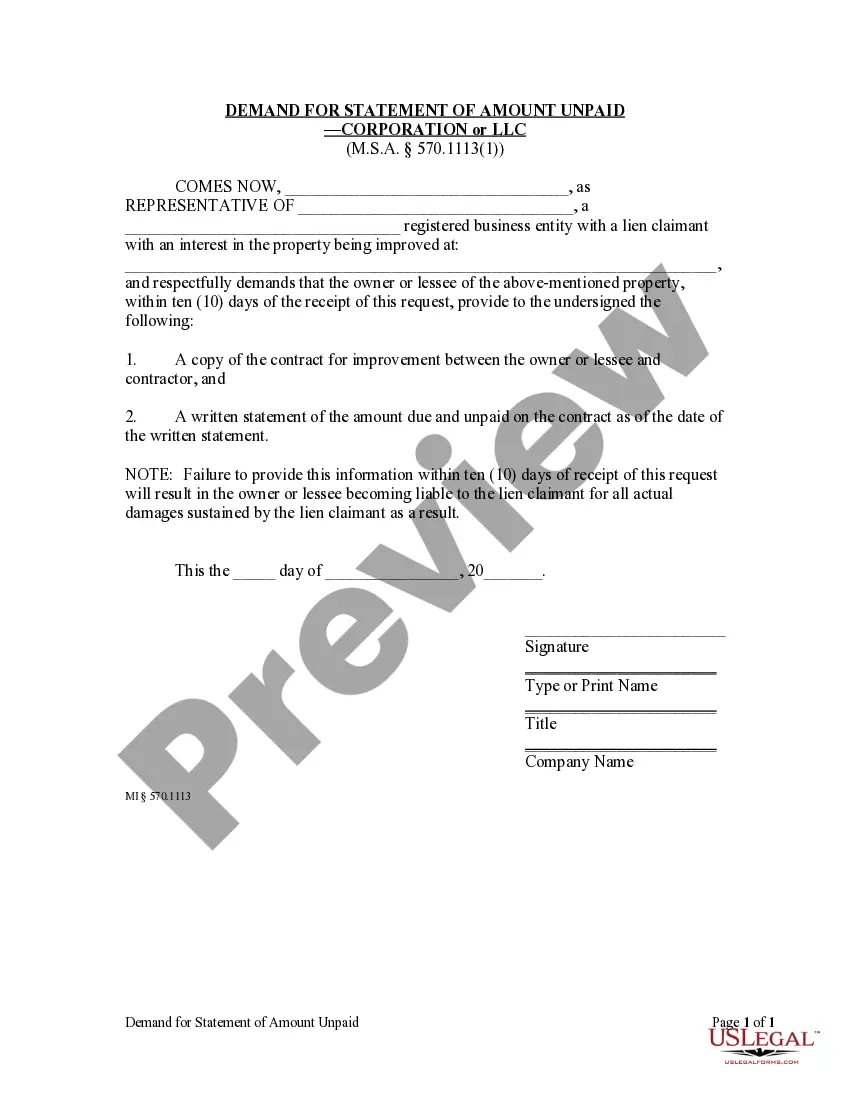

Detroit Michigan Demand for Statement of Amount Unpaid - Corporation or LLC

Description

How to fill out Michigan Demand For Statement Of Amount Unpaid - Corporation Or LLC?

Are you searching for a reliable and affordable provider of legal documents to purchase the Detroit Michigan Demand for Statement of Amount Unpaid - Corporation or LLC? US Legal Forms is your ideal choice.

Whether you need a simple arrangement to establish guidelines for living with your partner or a set of paperwork to facilitate your divorce proceedings in court, we've got you covered. Our platform features over 85,000 current legal document templates for both personal and business purposes.

All the templates we provide are not generic and are designed in accordance with the regulations of various states and local jurisdictions.

To obtain the form, you must Log In to your account, find the desired template, and click the Download button next to it. Please remember that you can download any previously purchased form templates at any time from the My documents section.

Now you can create your account. Then select the subscription plan and proceed with the payment. After the payment is processed, download the Detroit Michigan Demand for Statement of Amount Unpaid - Corporation or LLC in any available format.

You can return to the website anytime to redownload the form without any additional fees. Finding current legal documents has never been simpler. Try US Legal Forms today and eliminate the need to spend hours searching for legal papers online.

- Is it your first visit to our platform? No need to worry.

- You can create an account in just a few minutes, but before you do, ensure you take the following steps.

- Verify that the Detroit Michigan Demand for Statement of Amount Unpaid - Corporation or LLC meets the legal requirements of your state and locality.

- Examine the details of the form (if available) to understand for whom and what the form is intended.

- Restart your search if the template doesn't fit your particular situation.

Form popularity

FAQ

The 6 year period, known as the statute of limitations, may be extended by certain actions such as a court judgment. By law, the Department may use a variety of actions to collect your past-due tax, penalty and interest and may take these actions at any time during the course of collection.

A Michigan limited liability company (LLC) is a relatively new type of corporate entity. It is authorized by the Michigan Limited Liability Company Act (Michigan Compiled Laws Section 450.4101) and combines the limited liability advantages of a Michigan corporation with the tax advantages of a general partnership.

A limited liability company (LLC) is neither a corporation nor is it a sole proprietorship. Instead, an LLC is a hybrid business structure that combines the limited liability of a corporation with the simplicity of a partnership or sole proprietorship.

LLC's and corporations both have owners, but the form of ownership is different. LLC members have an equity (ownership) interest in the assets of the business because they have made an investment to join the business. Corporate owners are shareholders or stockholders who have shares of stock in the business.

Yes. Property owners who had delinquent taxes under the old law could also lose their property, but they had at least four (4) years to pay. Under the new law, if your taxes are delinquent for two (2) years, your property is foreclosed and you lose title to it.

The State of Michigan requires you to file an annual statement for your LLC. You must file the statement each year by February 15. (The one exception is for new LLCs formed after September 30 of the preceding year, which don't need to file a statement on the February 15 immediately succeeding the date of formation.)

For federal income tax purposes, there is no such thing as being taxed as an LLC. Instead, an LLC can be taxed like a sole proprietorship, a partnership, a C corporation or?if it qualifies?an S corporation.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

The state of Michigan requires all business owners of limited liability companies (LLC) and corporations to file an annual report. An annual report is a filing that helps ensure the state's records about a business entity are accurate.

Every limited liability company is required to file an Annual Statement each year. The bureau sends a pre-printed form to the registered office of each company 90 days before the due date.