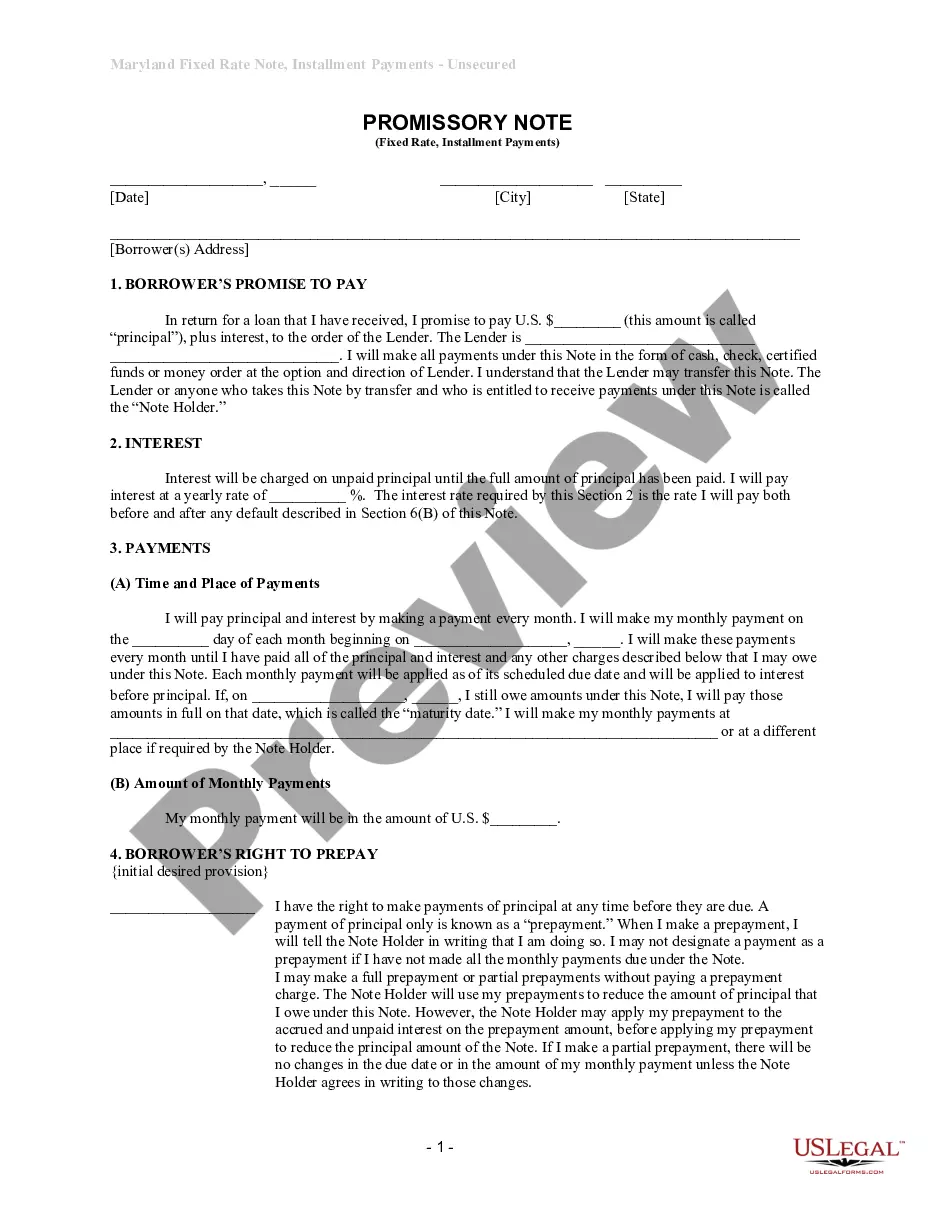

Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Maryland Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

We consistently endeavor to reduce or evade legal harm when managing intricate legal or financial matters.

To achieve this, we seek legal assistance that is generally quite costly.

However, not all legal issues are equally complicated.

Many of them can be handled by ourselves.

Utilize US Legal Forms whenever you need to obtain and download the Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate or any other document effortlessly and securely. Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always download it again from the My documents tab. The process is equally straightforward if you’re new to the website! You can establish your account in just a few minutes. Ensure to verify if the Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate conforms to the laws and regulations of your state and area. Furthermore, it’s essential that you review the form’s structure (if provided), and if you encounter any inconsistencies with your initial request, search for a different form. Once you’ve confirmed that the Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is appropriate for you, you can choose the subscription plan and proceed with the payment. Then, you can download the document in any convenient file format. For over 24 years in the market, we’ve assisted millions of individuals by providing ready-to-customize and up-to-date legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- US Legal Forms is a digital repository of current DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your matters independently without the need for an attorney.

- We offer access to legal document formats that are not always readily available.

- Our templates are specific to states and regions, which significantly eases the search process.

Form popularity

FAQ

When you hold a promissory note, including a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you must report the interest income on your tax return. You should document the interest payments received and include them in your taxable income. If you're unsure how to report them accurately, it may be beneficial to consult a tax professional. Keeping good records will make the process smoother come tax time.

Typically, a promissory note should be filed at the local county clerk or recorder's office where the property is situated. Filing a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate correctly establishes your claim to the property. This filing acts as a public notice, informing others of your rights. It is essential to maintain proper records for legal clarity.

You can generally record a promissory note at the local county recorder's office where the property is located. For a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, this helps secure your lien against the property. Recording adds a layer of legal protection and helps establish priority over other claims. Always ensure you follow local regulations for proper documentation.

Generally, a promissory note, including a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, does not appear on your credit report unless it goes into default. If unpaid debts lead to legal action, the judgment may be recorded, impacting your credit. Staying aware of your obligations can prevent this situation. It’s vital to keep track of your payments to maintain a clean financial record.

One primary disadvantage of a promissory note, particularly a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, is that it may be hard to enforce if the borrower defaults. Legal costs can add up, making collection efforts complex. Moreover, if the borrower faces bankruptcy, the promissory note could be at risk. It is essential to understand these potential issues when considering this financial instrument.

The document that secures a promissory note to real property is known as a mortgage or a deed of trust. In the context of a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, this document establishes the legal relationship between the borrower and lender, outlining the rights and obligations tied to the property. It serves to protect the lender's investment and provides clarity for all parties involved.

To secure a promissory note with real property, the lender and borrower typically execute a security agreement that pledges the property as collateral. In the context of a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, this involves drafting legal documents that clearly outline the terms and conditions. Consulting with professionals, such as those at uslegalforms, can simplify the process and ensure all documents meet legal standards.

Yes, a promissory note can definitely be secured by real property. In fact, a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate specifically relies on real estate as collateral, enhancing security for the lender. This arrangement not only benefits the lender but also provides borrowers access to financing backed by their valuable assets.

A promissory note is secured by the commitment of the borrower to repay the borrowed amount. When specifically dealing with a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the security comes from the real estate valuable asset backing the note. This way, the lender has a tangible asset to enforce in case of non-payment.

Yes, promissory notes can indeed be backed by collateral. In fact, a Montgomery Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate often uses the property as collateral. This arrangement gives lenders greater assurance, as they can claim the collateral to recover their funds in case of a default.