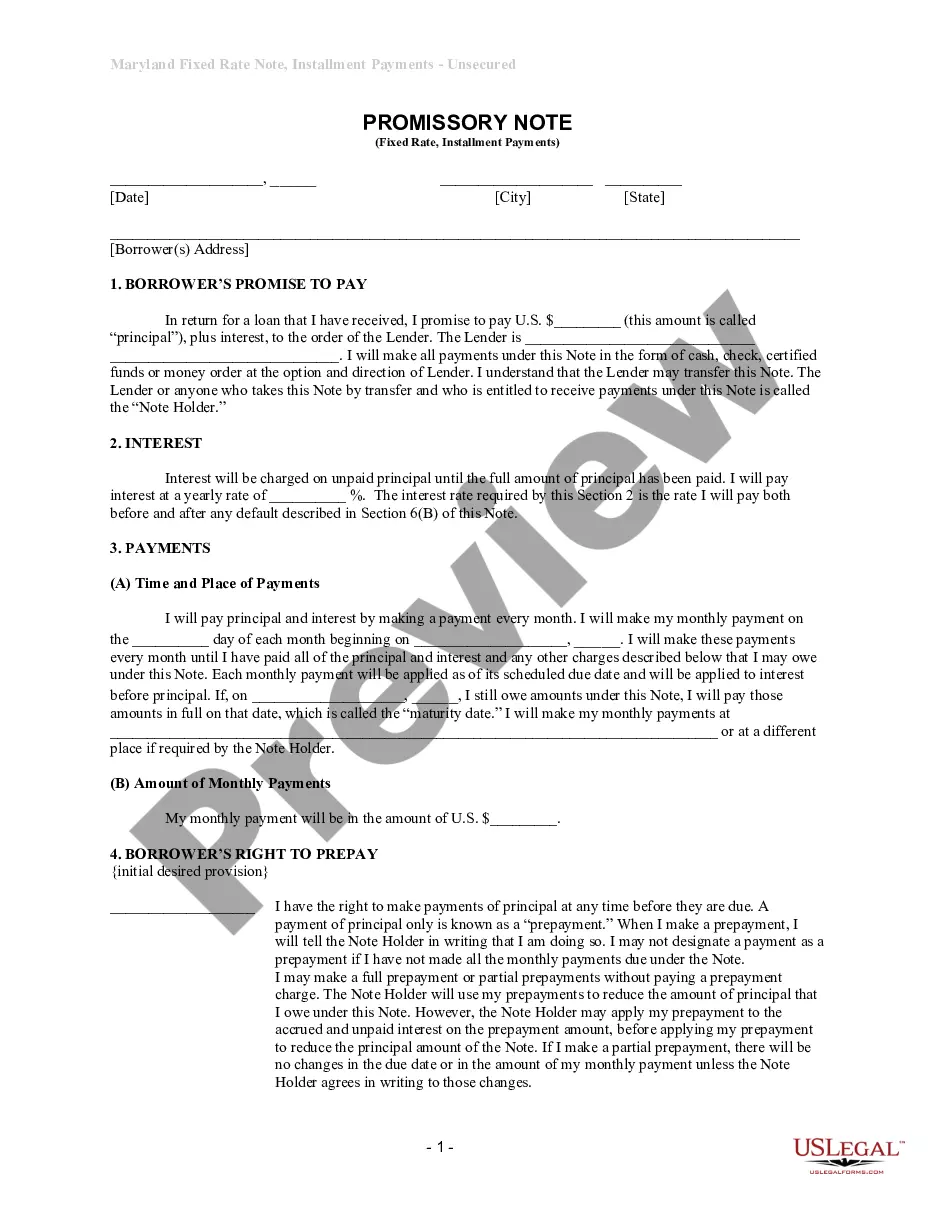

Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Maryland Unsecured Installment Payment Promissory Note For Fixed Rate?

We consistently aim to reduce or evade legal repercussions when managing intricate legal or financial matters.

To achieve this, we engage in attorney services that are generally quite costly.

Nevertheless, not all legal challenges are equally complicated.

The majority can be handled independently.

Benefit from US Legal Forms whenever you require swift and secure access to the Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate or any other document. Just Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it in the My documents section.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and power of attorneys to articles of incorporation and requests for dissolution.

- Our platform empowers you to manage your legal matters without the need for professional legal advice.

- We provide access to legal document templates that are not always readily available to the public.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

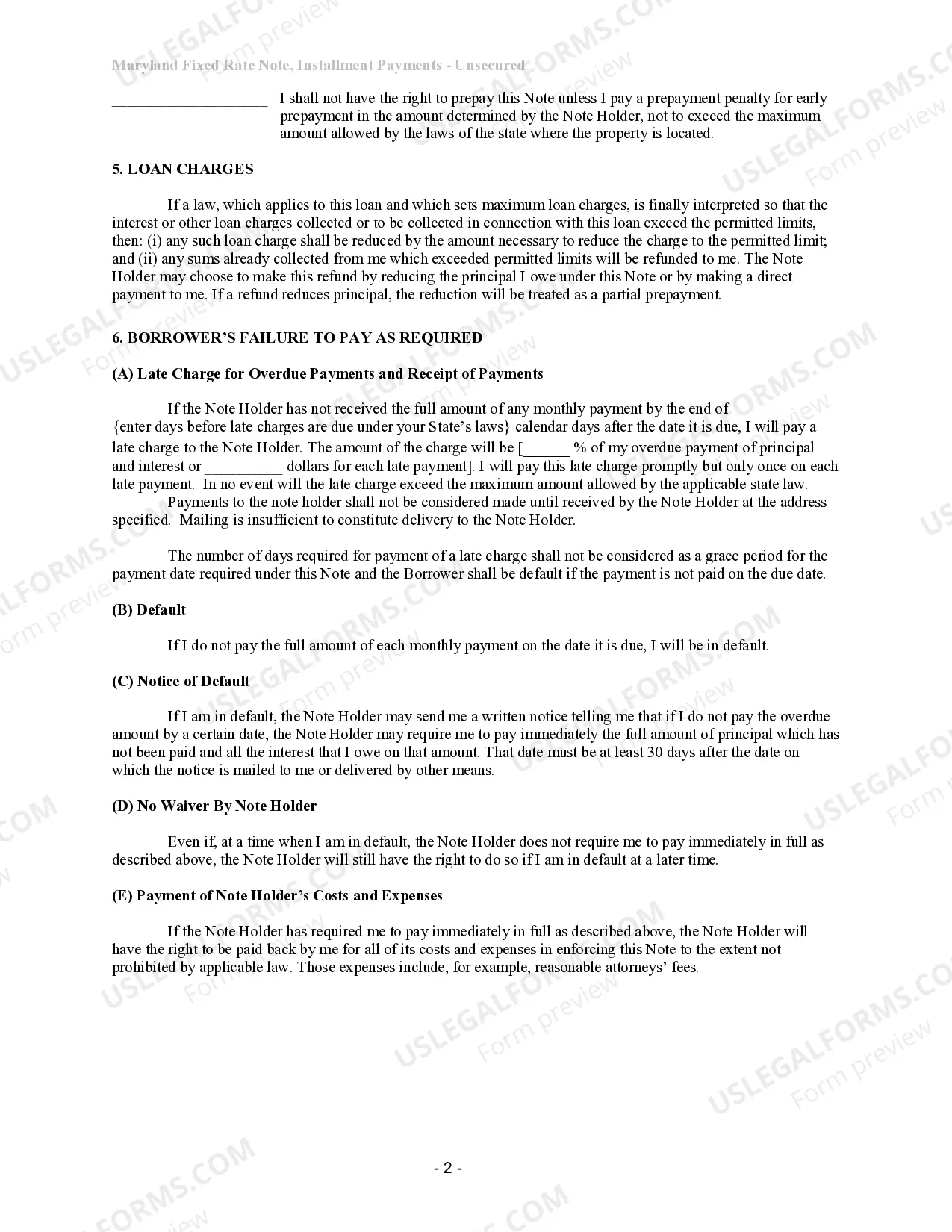

Filling out a promissory demand note involves outlining the names of the borrower and lender at the beginning of the document. Next, state the amount being borrowed and specify that it is a Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate. You should also include any conditions for repayment and the date signed by both parties to validate the agreement. Ensure clarity to avoid misunderstandings in the future.

An example of an on-demand promissory note could be a document stating that the borrower agrees to repay a specific amount to the lender upon request. For instance, if the borrower needs to borrow $5,000 as a Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate, they can include repayment terms that activate when the lender demands payment. This structure allows for flexibility for both parties.

A reasonable interest rate for a Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate typically ranges between 5% and 10%. This rate can vary based on factors such as the borrower's creditworthiness and prevailing market conditions. It's essential to ensure that the rate agreed upon is fair and meets both parties' needs. Opting for a well-structured promissory note can also help clarify terms and prevent potential disputes.

Promissory notes are governed by specific laws that vary by state; in Montgomery Maryland, certain criteria must be adhered to. A valid Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate should be in writing, clearly state the terms, and be signed by the borrower. Familiarizing yourself with these rules can help you craft a solid agreement.

For a Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate to be valid, it typically must include essential elements such as the amount owed, the repayment schedule, and the interest rate. Additionally, both parties must agree to the terms outlined in the note. A well-structured note reduces potential misunderstandings.

To report a Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate on your taxes, include the interest income as mentioned earlier. Use Schedule B to list this income. Ensure that you document all payments and interest accrued, as this information will support your tax return.

A Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate can be legally binding even if it is not notarized, provided it meets certain requirements. However, having it notarized can add a layer of credibility and help prevent disputes. You may want to consider notarization, especially for larger transactions.

While it’s not always mandatory to record a Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate, doing so can provide legal benefits. Recording the note helps establish a public record, which may be necessary if you need to enforce the agreement in court. Consider your specific situation; recording can be helpful for larger sums.

You can file a Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate with your local court or recorder's office if you want to formalize the note. This step ensures that your agreement is recognized legally and can provide protection in case of disputes. It is a good practice to keep a copy for your records.

When you report a Montgomery Maryland Unsecured Installment Payment Promissory Note for Fixed Rate on your tax return, you typically need to include any interest income generated from the note. You will report this income on Schedule B of your Form 1040. Additionally, keep records of the payments received, as this will support your tax filings.