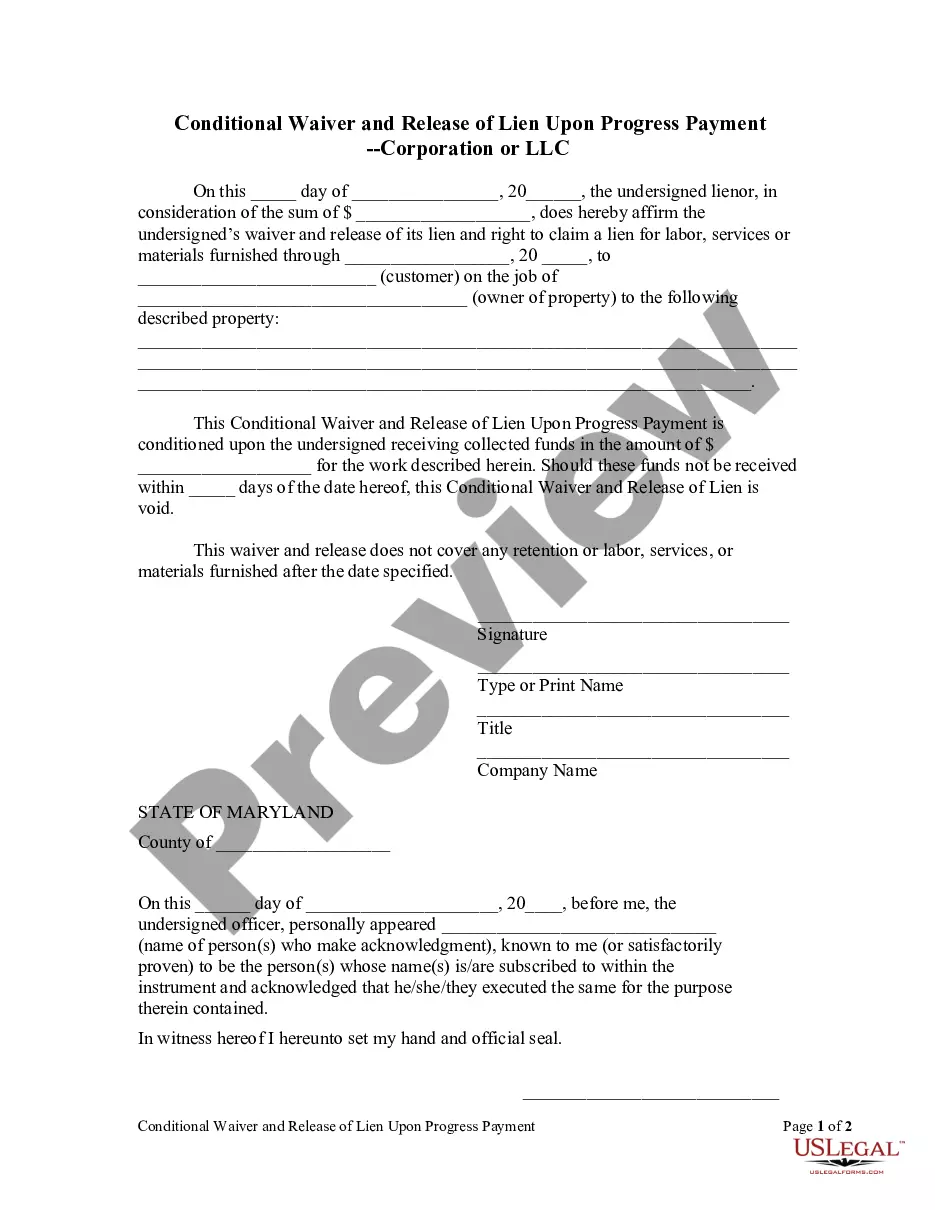

This Conditional Waiver and Release Upon Progress Payment form is for use by a corporate or LLC lienor, in consideration of a certain sum of money to affirm the waiver and release of its lien and right to claim a lien for labor, services or materials furnished on a particular job of the owner of property. This Conditional Waiver and Release of Lien Upon Progress Payment is conditioned upon the lienor receiving collected funds in a certain amount for the work, and will be considered void if the funds are not received within a certain number of days of the date of the waiver.

Montgomery Maryland Conditional Waiver and Release Upon Progress Payment - Corporation or LLC

Description

How to fill out Maryland Conditional Waiver And Release Upon Progress Payment - Corporation Or LLC?

Locating authenticated templates tailored to your regional regulations can prove difficult unless you access the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents for both personal and business requirements and various real-life situations.

All the forms are appropriately categorized by area of use and jurisdictional regions, making the search for the Montgomery Maryland Conditional Waiver and Release Upon Progress Payment - Corporation or LLC as straightforward as one-two-three.

Safeguarding documentation orderly and adhering to legal obligations is crucial. Utilize the US Legal Forms library to always have vital document templates for any requirement readily accessible!

- Verify the Preview mode and form details.

- Ensure you’ve selected the right one that meets your requirements and aligns with your local jurisdiction standards.

- Look for another template if necessary.

- If you notice any discrepancies, use the Search tab above to find the accurate one. If it meets your needs, proceed to the next step.

- Acquire the document.

Form popularity

FAQ

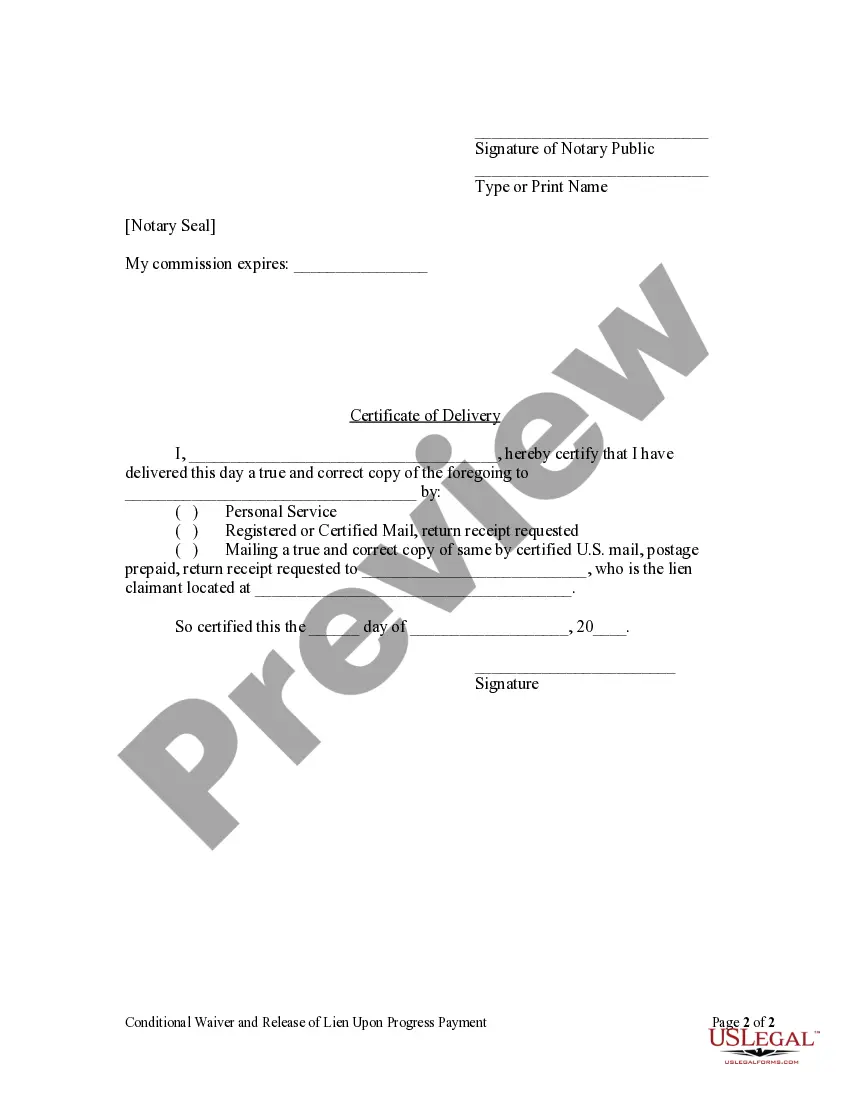

To fill out a final waiver of a lien, start by gathering the necessary information, such as the property details and payment information. Clearly indicate that this is a Montgomery Maryland Conditional Waiver and Release Upon Progress Payment - Corporation or LLC, ensuring that the waiver states it covers the payment received. Sign the document and include the date to validate the waiver. You might consider using the US Legal Forms platform, which provides templates and guidance to help you complete this process accurately.

A conditional release waiver is a legal document that relinquishes certain payment rights under specified conditions. Specifically, the Montgomery Maryland Conditional Waiver and Release Upon Progress Payment - Corporation or LLC protects both parties by ensuring that payments are only made after specific project milestones are met. This waiver is crucial for maintaining transparency and trust in construction and contractual agreements. To obtain a reliable template, you can explore US Legal Forms, which offers a variety of legal documentation options.

Filling out the Montgomery Maryland Conditional Waiver and Release Upon Progress Payment - Corporation or LLC involves several key steps. First, accurately complete the form with your business name, project details, and payment amounts. Next, ensure each party signs the waiver to validate it. If you prefer a guided solution, consider using US Legal Forms to access templates and instructions that simplify the process.

A release and waiver form is a legally binding document that relinquishes the right to make future claims regarding specific transactions or agreements. This form is commonly used in the construction industry to ensure that contractors and suppliers cannot pursue payment claims after receiving agreed-upon compensation. Using a release and waiver form effectively protects both parties involved. In Montgomery, Maryland, you may utilize the Montgomery Maryland Conditional Waiver and Release Upon Progress Payment - Corporation or LLC to simplify this process.

Filling out a conditional waiver and release on progress payment involves several key steps. First, ensure you include the names of the parties involved, project details, and the exact payment amounts. Carefully review the language to confirm that it reflects the conditional nature of the waiver. For easier navigation through this process in Montgomery, Maryland, consider leveraging platforms like uslegalforms for templates and guidance on the Montgomery Maryland Conditional Waiver and Release Upon Progress Payment - Corporation or LLC.

The claimant on a conditional waiver is typically the individual or entity entitled to receive payment for services rendered or materials supplied. In construction contexts, this often includes contractors, subcontractors, or suppliers who seek to confirm their right to payment. Understanding the role of the claimant is critical in navigating the financial framework of a project. In Montgomery, Maryland, using a Montgomery Maryland Conditional Waiver and Release Upon Progress Payment - Corporation or LLC helps establish clear rights and obligations.

A conditional waiver and release on progress payment in Arizona is a legal document that protects contractors and subcontractors during the payment process. When signed, it ensures that a party consents to receive payment while waiving any future claims against the payment received. This tool is essential for managing financial risks, particularly in construction projects. For those involved in projects in Montgomery, Maryland, a Montgomery Maryland Conditional Waiver and Release Upon Progress Payment - Corporation or LLC can provide similar protection.

Typically, most waivers do not need to be notarized, including the Montgomery Maryland Conditional Waiver and Release Upon Progress Payment - Corporation or LLC. However, the requirements may differ based on specific situations or agreements. By clarifying these details upfront, you can simplify the process and prevent potential delays. Always check local guidelines to ensure compliance and a smooth transaction.

A lien waiver and a lien release serve different purposes, even though they sound similar. A lien waiver relinquishes the right to file a lien before the payment is made, while a lien release confirms that a lien is officially removed after payment. Understanding this distinction is essential when working with the Montgomery Maryland Conditional Waiver and Release Upon Progress Payment - Corporation or LLC. This knowledge can help you manage your financial risks effectively.

A conditional lien waiver indicates that a party waives its right to lien until payment is actually received. This form protects both the payer and the payee by ensuring that the waiving of lien rights is valid only upon the appropriate conditions being met. With the Montgomery Maryland Conditional Waiver and Release Upon Progress Payment - Corporation or LLC, utilizing conditional waivers offers security in construction payments. Clarity on this aspect is crucial for maintaining trust in business dealings.