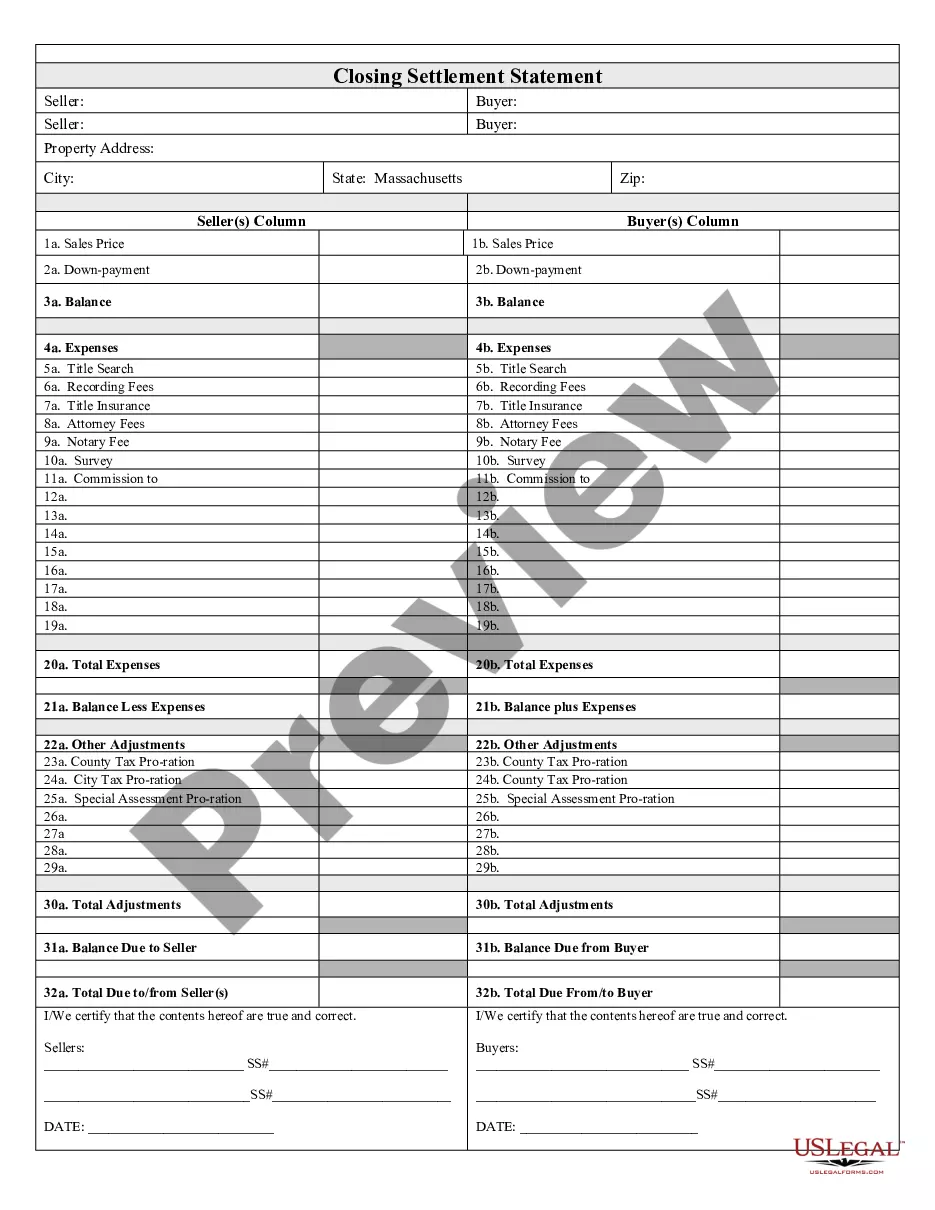

Boston Massachusetts Closing Statement

Description

How to fill out Massachusetts Closing Statement?

Finding authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal forms catering to both personal and professional requirements and various real-world scenarios.

All documents are appropriately sorted by usage area and jurisdiction, making it simple and quick to find the Boston Massachusetts Closing Statement.

Maintain organized and legally compliant paperwork is crucial. Leverage the US Legal Forms library to always have vital document templates readily available for any needs!

- Review the Preview mode and form description.

- Ensure you’ve selected the right one that fulfills your needs and aligns with your local jurisdiction standards.

- Search for another template, if necessary.

- If you find any discrepancies, use the Search tab above to locate the correct one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

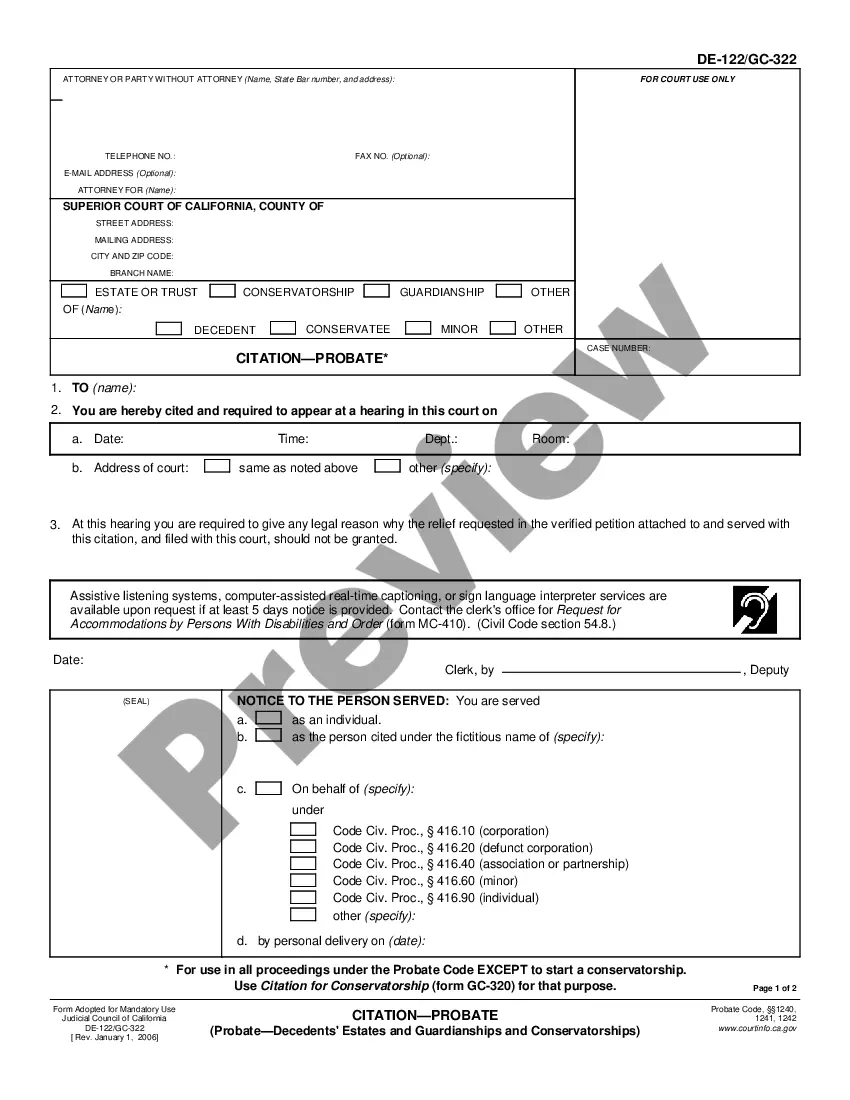

The decedent must have left an estate that consists entirely of personal property valued at $25,000 or less (excluding the value of a car). 30 days or more have passed since the decedent's death. The petitioner must be an interested person, but doesn't need to be a resident of Massachusetts.

Overview of the eFiling Process eFileMA allows attorneys, self-represented litigants, state agencies and others to easily file court documents through the internet. eFiling is currently available in all Probate and Family Court divisions, 24 hours a day, seven days a week, 365 days a year.

A Massachusetts small estate affidavit is a legal document used to present a claim on the estate or part of the estate of a deceased loved one.... Step 1 ? Wait Thirty (30) Days. Wait a minimum of thirty (30) days before filing the affidavit. Step 2 ? Complete Documents.Step 3 ? File With Probate Court.

Is there a deadline to probate an estate? The general rule is that an estate has to be probated within 3 years of when the decedent died.

By Massachusetts statute, a probate case must be kept open for twelve months to allow creditors to file any claims against the estate and before final distributions should be made to the heirs. The good news is that not all estates must go through probate. Certain factors determine whether probate is necessary.

You can submit the forms and fees in person at the correct Probate & Family Court. If the decedent lived in Massachusetts ? File in the county where they lived when they died. If the decedent didn't live in Massachusetts ? File in any county where the decedent had property when they died.

The cost of probate in MA Probate can be very costly. It is not uncommon for total costs for a probate to easily reach upwards of 5% to 10% of the estate's total value.

The personal representative can close the estate by filing a sworn statement, which says that debts, taxes, and other expenses have been paid and that the estate assets have been transferred to the people entitled to inherit them.

Letters and probate fees Type of pleadingFiling feeSurcharge (if applicable)Small Estate Closing Statement$75Supervised Administration, Petition$375$15Termination of Trust, Petition$240$15Vacate a Formal Order, Petition$15027 more rows