Baton Rouge Louisiana Mortgage to Secure Future Advances

Description

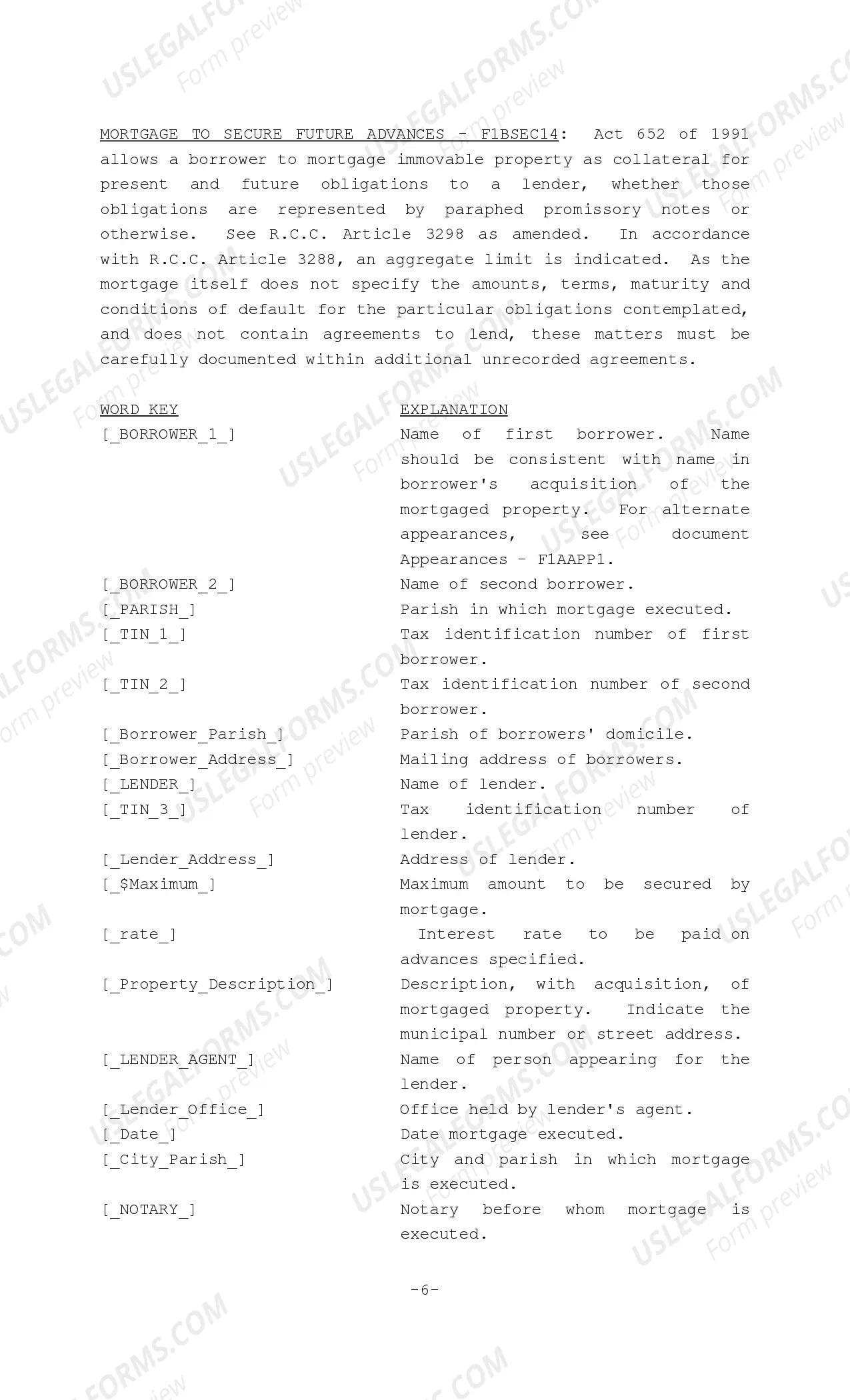

How to fill out Louisiana Mortgage To Secure Future Advances?

We consistently aim to decrease or avert legal complications when addressing intricate legal or financial issues.

To achieve this, we apply for legal support that is typically very expensive.

Nevertheless, not every legal issue is quite as intricate. Many can be handled independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it in the My documents section. The procedure is equally straightforward if you’re new to the platform! You can set up your account in just a few minutes. Ensure to verify if the Baton Rouge Louisiana Mortgage to Secure Future Advances aligns with the laws and regulations of your state and locality. Additionally, it’s crucial to review the form’s description (if available), and should you find any inconsistencies with your initial search, look for another template. Once you confirm that the Baton Rouge Louisiana Mortgage to Secure Future Advances is suitable for your situation, you can select the subscription plan and proceed to payment. Then you’ll be able to download the document in any supported file format. Over our more than 24 years in the market, we’ve assisted millions by offering customizable, up-to-date legal forms. Take advantage of US Legal Forms now to conserve time and resources!

- Our collection allows you to handle your affairs without the need for an attorney.

- We provide access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, which greatly streamlines the search process.

- Utilize US Legal Forms whenever you need to obtain and download the Baton Rouge Louisiana Mortgage to Secure Future Advances or any other document effortlessly and securely.

Form popularity

FAQ

Yes, a mortgage can indeed be structured to secure future debts. This means that the lender agrees to provide funds now or later as needed, especially under a Baton Rouge Louisiana Mortgage to Secure Future Advances. It's a practical option for borrowers who anticipate needing additional capital in the future, as it allows them to plan for potential financial needs without the hassle of seeking new loans.

Yes, it is possible to transfer certain types of debt to your mortgage in many cases. This process can simplify your finances by consolidating your debts, especially if you have a Baton Rouge Louisiana Mortgage to Secure Future Advances. By doing this, you might achieve lower monthly payments and a single monthly bill, making it easier to manage your financial commitments.

Louisiana conventional mortgages are loans that are not insured or guaranteed by the federal government. They typically involve lower interest rates and require good credit for approval. When looking at Baton Rouge Louisiana Mortgages to Secure Future Advances, conventional options may offer a robust choice for many homeowners. Make sure to evaluate your qualifications and financial situation before applying.

A future advance mortgage allows you to borrow additional funds at a later date without needing to go through a new mortgage process. It is particularly beneficial when you have ongoing financing needs. In Baton Rouge Louisiana Mortgages to Secure Future Advances, this feature can provide homeowners with financial flexibility over time. Consider how this option could support your future plans.

The current mortgage rates near Baton Rouge LA can vary widely, depending on the lender and the type of mortgage. It is advisable to consult local banks or online mortgage platforms for the latest rates. Understanding your options for a Baton Rouge Louisiana mortgage to secure future advances can greatly benefit your financial planning.

As of now, the current interest rates on mortgages in Louisiana can fluctuate based on various economic factors, including inflation and the Federal Reserve's policies. It’s essential to monitor these changes to ensure you get the most favorable rate. Rates for a Baton Rouge Louisiana mortgage to secure future advances may also vary based on lender offerings.

A mortgage for future advancements allows homeowners to borrow against their property for future expenses that may arise. This option can reduce financial stress by providing immediate access to funds that can be drawn as needed. In Baton Rouge Louisiana, this type of mortgage is ideal for those anticipating significant future costs.

Currently, a good interest rate for a mortgage generally falls below the average market rate. Factors like credit score and the size of the down payment play significant roles. In Baton Rouge Louisiana, mortgage solutions providing low interest rates can align with your financial goals and help you secure future advances.

Finding the bank with the most competitive mortgage rates can vary based on current market conditions. However, many local lenders in Baton Rouge Louisiana offer attractive rates designed to help you secure a mortgage to secure future advances. It's wise to shop around and compare offers to ensure you get the best deal possible.