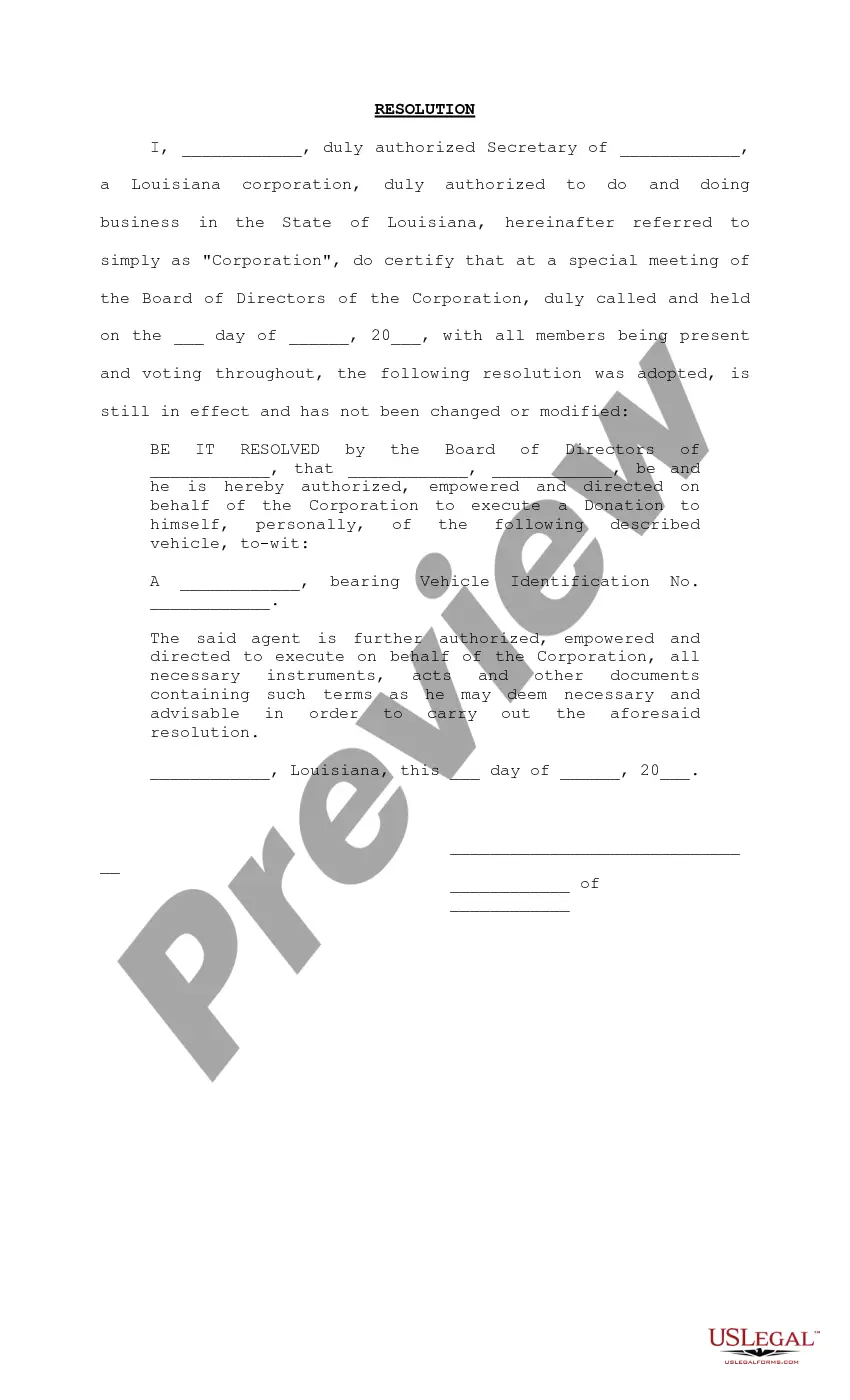

Baton Rouge Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer

Description

How to fill out Louisiana Resolution Authorizing Donation Of Vehicle To Corporate Officer?

If you have previously utilized our service, Log In to your account and download the Baton Rouge Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer onto your device by clicking the Download button. Ensure that your subscription is current. If it is not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have bought: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business needs!

- Confirm you’ve selected an appropriate document. Review the description and utilize the Preview feature, if offered, to determine if it fulfills your needs. If it does not fit your criteria, use the Search option above to find the correct one.

- Buy the template. Click the Buy Now button and choose a monthly or yearly subscription option.

- Create an account and process your payment. Use your credit card information or the PayPal service to finalize the purchase.

- Access your Baton Rouge Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer. Select the file type for your document and save it to your device.

- Complete your sample. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

To gift a vehicle in Louisiana, you will need to prepare a formal act of donation. This act should clearly express your wish to transfer ownership of the vehicle without expecting payment. The Baton Rouge Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer can serve as a vital framework for this transaction. Using UsLegalForms, you can find easy-to-use documentation to ensure all legal requirements are met.

Doing an act of donation for a car in Louisiana involves preparing a donation agreement that specifies the vehicle details and the parties involved. Once the document is complete, it must be signed by both the donor and recipient to be legally binding. Utilizing the Baton Rouge Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer helps streamline this process. With UsLegalForms, you can access templates designed for clarity and compliance.

To file an act of donation in Louisiana, you must create a written document that outlines your intention to donate. This document should include details about both the donor and recipient, as well as a description of the vehicle. The Baton Rouge Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer can guide you in drafting this document properly. You can also consult UsLegalForms to get templates that simplify this process.

Yes, it is important to notify your local motor vehicle division when you donate your vehicle. This step ensures that the vehicle is no longer in your name, protecting you from any future liability. By doing so, you also help facilitate the documentation process of the Baton Rouge Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer. Keeping your records straight is crucial for both the donor and recipient.

The Louisiana tuition donation tax credit allows taxpayers to receive a credit for donations made to certain educational institutions. This program incentivizes contributions to enhance educational opportunities statewide. When considering a Baton Rouge Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer, it is wise to explore how tax credits may apply to your overall financial strategy. Consulting with a tax professional can provide clarity on maximizing such opportunities.

The tax rate on food in Louisiana is currently set at 2%. This is a favorable rate compared to many other states. When dealing with financial choices, knowing the implications of a Baton Rouge Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer can help you better plan your expenses. Always ensure you stay updated on local taxes to make informed decisions.

Yes, you can donate a vehicle to a friend in Louisiana. However, you must properly document the transaction to confirm the transfer of ownership. Utilizing a Baton Rouge Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer can streamline the process and ensure all legal aspects are addressed. This guarantees that both you and your friend are protected during the transfer.

In Louisiana, an act of donation transfers ownership of property, such as a vehicle, from one party to another. To create a valid donation, the donor must express their intent, and the donation must be in writing. Specifically, a Baton Rouge Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer ensures that all legal requirements are met, allowing the donation to proceed smoothly. It's important to consult a legal expert to ensure compliance with local laws.