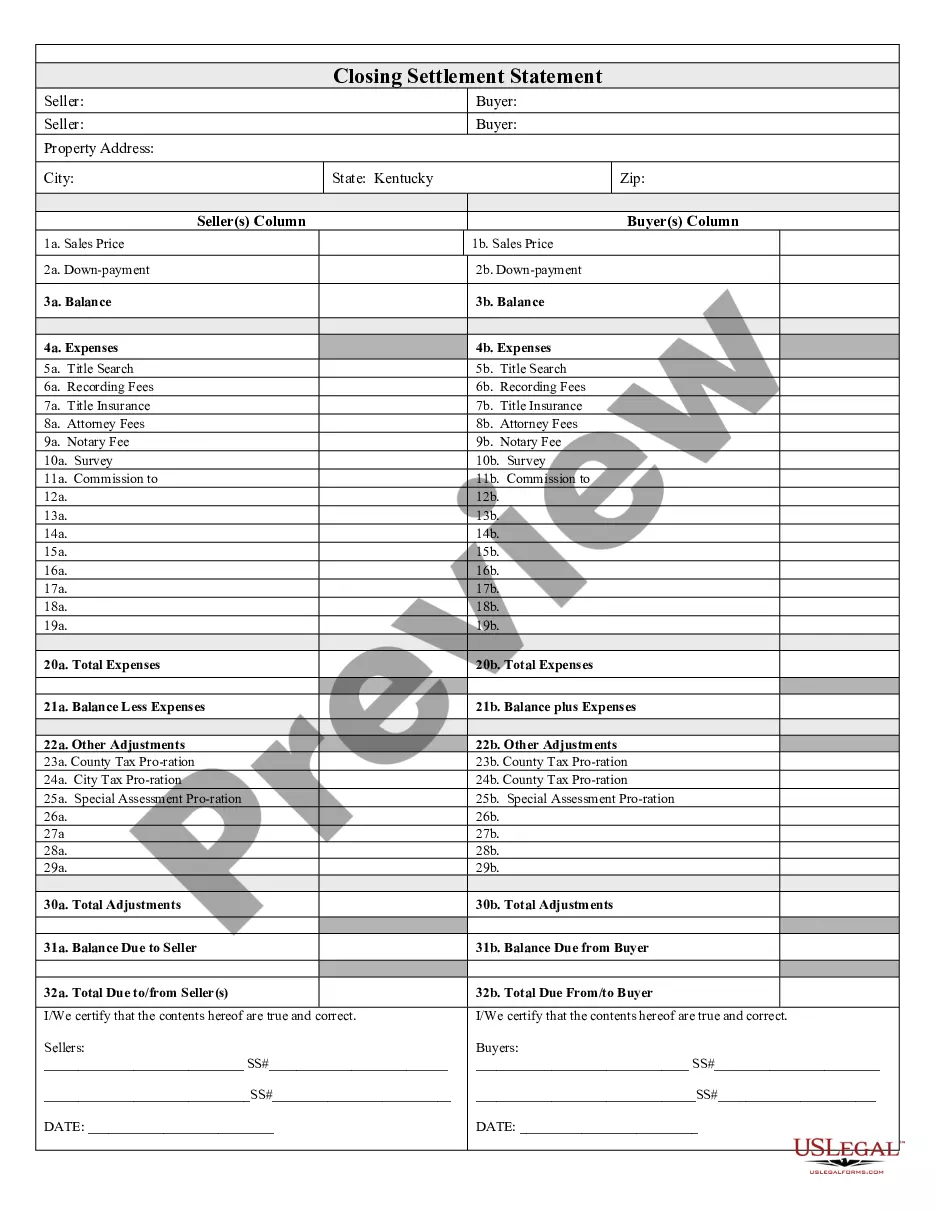

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Louisville Kentucky Closing Statement

Description

How to fill out Kentucky Closing Statement?

If you are looking for a pertinent document, it’s incredibly challenging to find a superior service than the US Legal Forms site – likely the most extensive collections on the internet.

Here you can discover numerous document samples for business and personal needs categorized by types and states, or keywords.

With the sophisticated search feature, locating the most recent Louisville Kentucky Closing Statement is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Choose the file format and download it to your device.

- Moreover, the relevance of each document is validated by a group of expert attorneys who consistently review the templates on our platform and update them according to the latest state and county requirements.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Louisville Kentucky Closing Statement is to Log In to your profile and select the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions below.

- Ensure you have located the document you need. Examine its details and use the Preview option (if available) to review its content. If it doesn’t satisfy your needs, utilize the Search field located at the top of the screen to find the appropriate file.

- Verify your selection. Click the Buy now button. Then, select your desired pricing plan and provide your details to create an account.

Form popularity

FAQ

Yes, you must file a Kentucky part-year resident return known as a 740-NP and report all income earned while in Kentucky, as well as any other income from Kentucky sources.

A single member LLC is required by law to file a Kentucky Single Member LLC Individually Owned Income and LLET Return (Form 725) or; if eligible, a Kentucky Single Member LLC Individually Owned LLET Return (Form 725-EZ). Forms and instructions are available at all Kentucky Taxpayer Service Centers (see page 17).

1. The form 1, Return of Income Tax ithheld on ages, was the original form used to report Federal income tax withholding.

Pay by Mail?Make your checks payable to the Kentucky State Treasurer. Please specify the taxpayer's full name, Social Security number(s), and the tax period you are paying. Mail the payments to the Division of Collections, P.O. Box 491, Frankfort, KY 40602-0491.

Kentucky Department of Revenue P. O. Box 856905 Louisville, KY 40285-6905 Kentucky Department of Revenue Frankfort, KYReturn (Form 725).

If you live in Kentucky... and you are filing a Form...and you are not enclosing a payment, then use this address...and you are enclosing a payment, then use this address...4868Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0045Internal Revenue Service P.O. Box 931300 Louisville, KY 40293-13005 more rows ?

Kentucky Form 725 is designed to tax the single member, individually owned Limited Liability Corporation (LLC) where the income from a business owned by an individual is taxed as a corporation, if business done by the LLC was done in Kentucky.

Employers with 100 or more W-2s are required to file electronically, and employers with 250 or more 1099 or W-2G forms are required to submit those forms in electronic format to: Kentucky Department of Revenue, CD Processing, 501 High Street, Station 57, Frankfort, KY 40601.

Public Service Branch Phone(502) 564-8175. Fax(502) 564-8192. Address. Kentucky Department of Revenue. Public Service Branch ? 501 High Street, Station 32. Frankfort, KY 40601. EmailSend us a message.