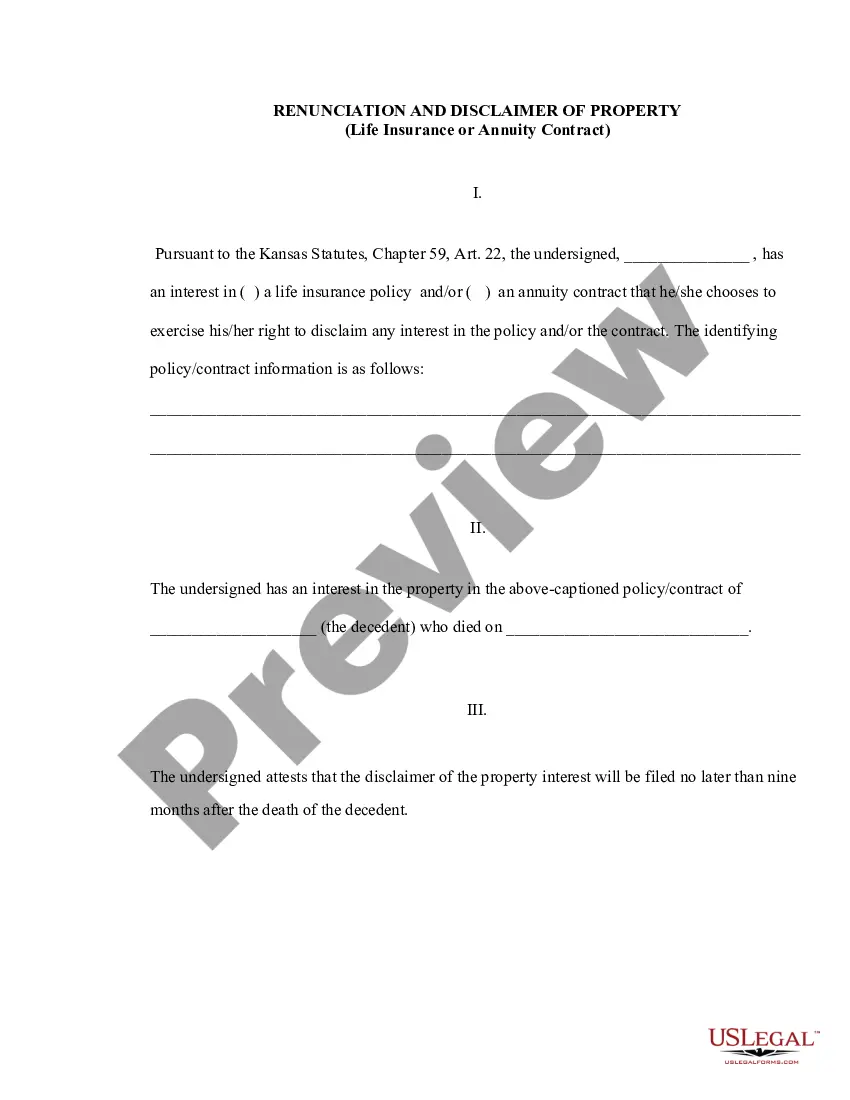

Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Kansas Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

If you are looking for a legitimate form template, it is incredibly challenging to discover a more user-friendly platform than the US Legal Forms website – one of the most extensive collections available online.

Here, you can locate thousands of templates for organizational and personal applications by categories and regions, or keywords.

With our premium search feature, locating the latest Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is as straightforward as 1-2-3.

Finalize the transaction. Use your credit card or PayPal account to complete the registration process.

Acquire the template. Choose the format and save it to your device.

- Moreover, the accuracy of every record is verified by a team of professional attorneys who frequently review the templates on our site and update them in line with the current state and county regulations.

- If you are already familiar with our system and possess an account, all you need to access the Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is to Log In to your profile and click the Download option.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have located the sample you desire. Review its description and use the Preview feature to verify its content. If it does not satisfy your requirements, utilize the Search box at the top of the page to find the suitable document.

- Confirm your choice. Select the Buy now option. After that, choose the preferred payment plan and input your details to create an account.

Form popularity

FAQ

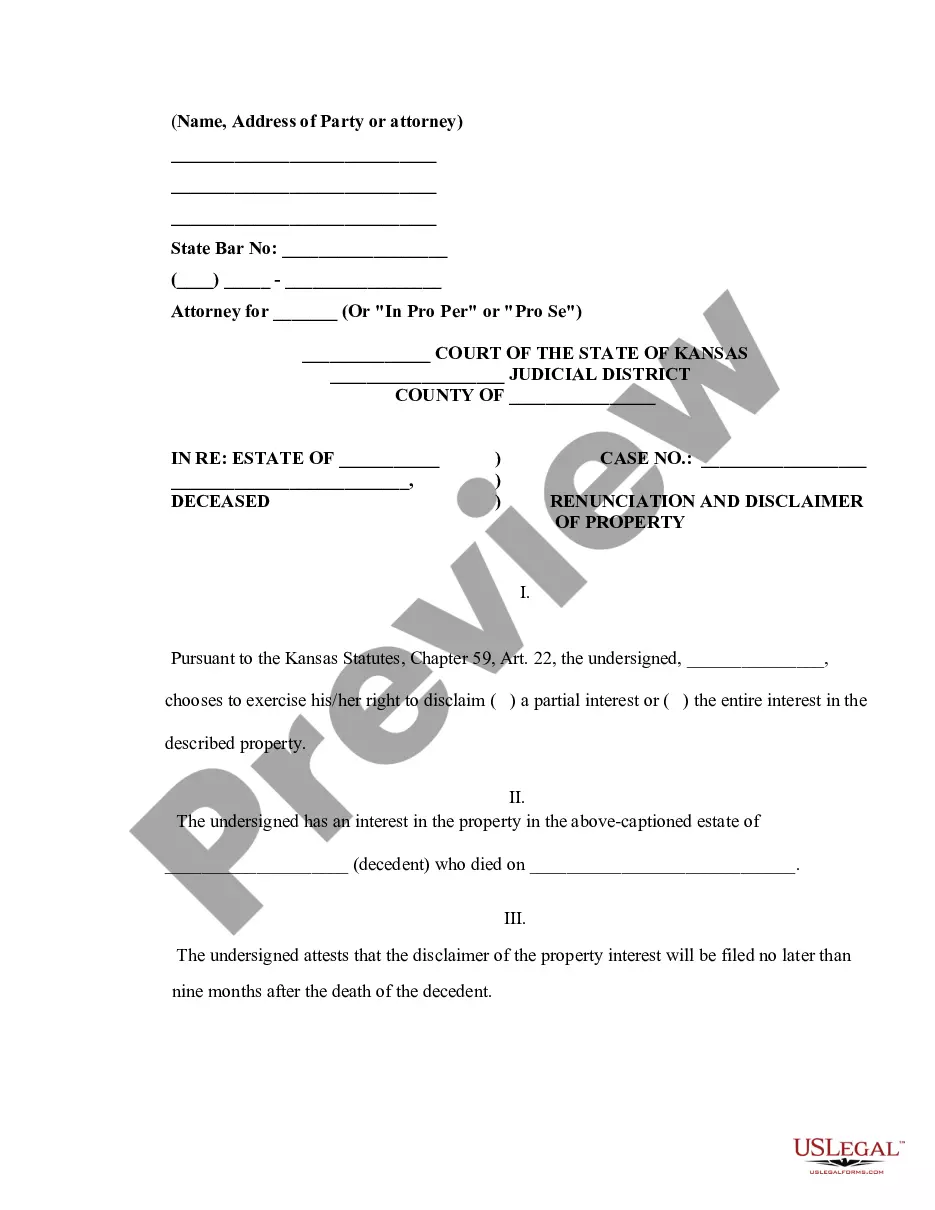

Statute 59 3501 in Kansas pertains to the administration of estates and outlines procedures for disclaiming interests in property. This law protects individuals who choose to renounce ownership of assets in life insurance or annuity contexts. Awareness of this statute is key when dealing with the Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. Utilize platforms like uslegalforms to access templates and guidance, helping you navigate your legal options successfully.

Statute 47 645 in Kansas relates to the regulation of estates, specifically regarding the inheritance of property without the acceptance of ownership. This statute is instrumental for individuals wishing to navigate the renunciation process effectively. Understanding this law is essential for those involved in the Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. It ensures a clear pathway for appropriately handling unwanted interests in property.

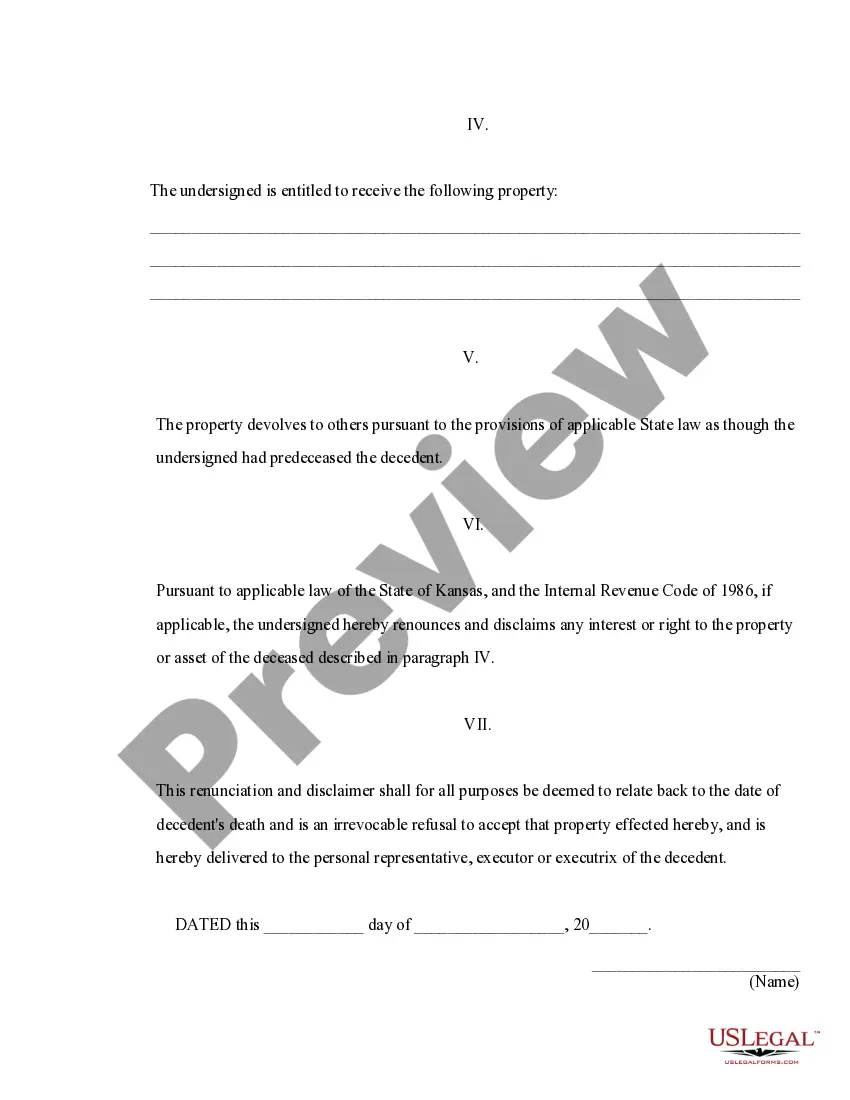

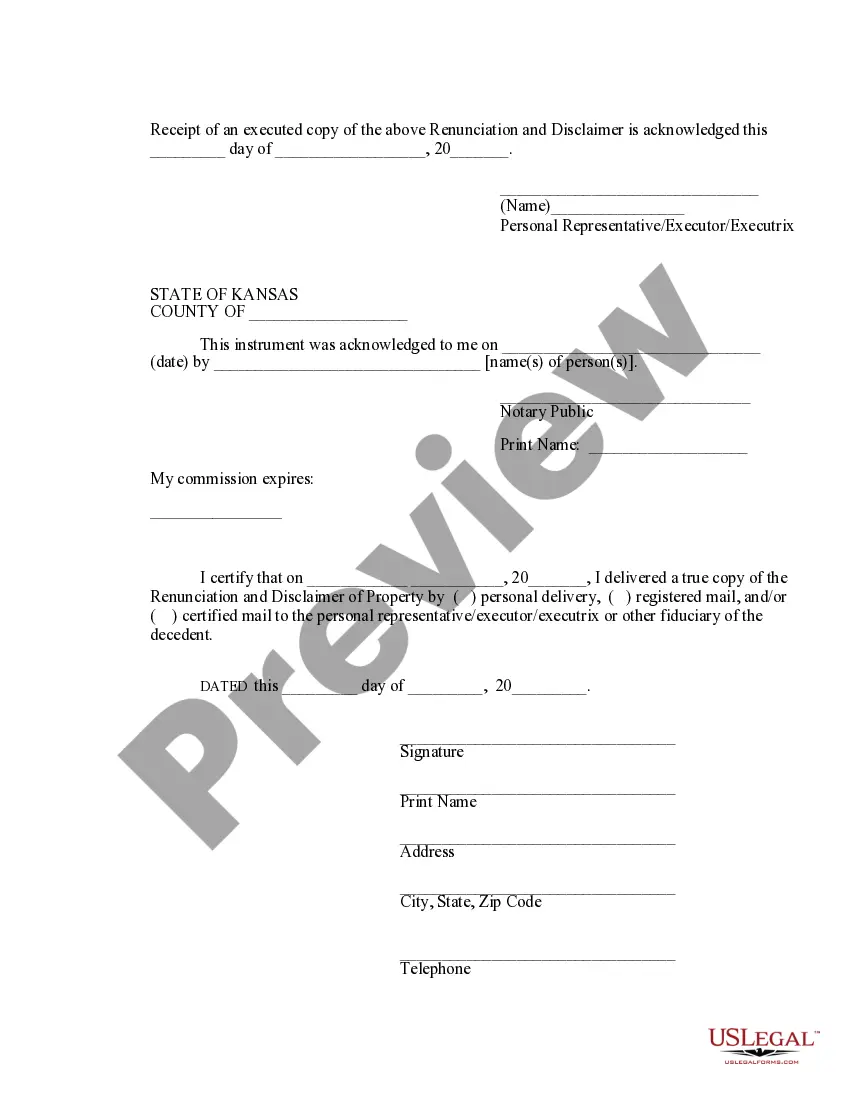

In Kansas, the time limit for filing a disclaimer is typically nine months after you receive notice of the interest you stand to inherit. However, this time frame can vary based on specific circumstances and the type of property involved. It is crucial to act promptly to ensure acceptance of your disclaimer under the Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. Legal advice can help clarify your situation and ensure compliance with these timelines.

Statute 21 5411 in Kansas outlines the legal framework for the renunciation and disclaimer of property, specifically in the context of life insurance policies and annuity contracts. This statute allows individuals to refuse ownership of property they would receive under such contracts. By understanding this statute, you can make informed decisions about your inheritance or benefits. For a comprehensive understanding of the Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, consult with legal resources or professionals who specialize in this area.

Overturning a life estate involves challenging the existing legal rights associated with it. This can typically be done by proving that the life estate should be terminated due to specific legal grounds. To navigate this process effectively, you may want to explore the Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract for guidance. Consulting a lawyer who specializes in real estate law can also help you understand your options and any potential consequences.

Yes, you can disclaim life insurance proceeds if you adhere to the guidelines set forth in the Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. Typically, this involves submitting a formal disclaimer that states your intention to reject the proceeds, and it should be completed within a specified time period. A disclaimer can allow the proceeds to be redirected according to the policy's terms, often to contingent beneficiaries or the estate. Legal assistance can provide clarity on the necessary steps.

Abandoning a life estate can be complex, but it is possible to relinquish your interest in the property. Generally, to abandon a life estate, you can formally declare your intention through a document that expresses your desire to unconditionally relinquish your rights. The Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract can guide you through this process. Seeking legal advice can be beneficial to ensure you are following the right procedures.

To disclaim an inherited property, you need to submit a written disclaimer that meets the requirements outlined in the Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. This document must clearly state your intent to renounce the property and should be filed with the appropriate court or agency. It's crucial to understand that a disclaimer typically must be filed within a specific time frame following the inheritance. Consulting a legal professional can help ensure that you complete this process correctly.

In Kansas, the disclaimer statute outlines the rules for refusing property from an estate, ensuring it adheres to both state and federal requirements. This statute provides a structured way for beneficiaries to disclaim property, protecting their interests. For further information on the Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, consult legal resources to guide you through the process.

There are several reasons why a beneficiary may choose to disclaim property, such as minimizing tax liability, maintaining eligibility for certain government benefits, or simply not wanting the additional responsibility of managing the asset. This process helps ensure the property goes to someone better suited for it. The Olathe Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract can help you understand the ramifications of your decision.