Wichita Kansas Articles of Incorporation for Domestic For-Profit Corporation

Description

How to fill out Kansas Articles Of Incorporation For Domestic For-Profit Corporation?

If you have previously employed our service, Log In to your account and download the Wichita Kansas Articles of Incorporation for Domestic For-Profit Corporation onto your device by clicking the Download button. Ensure your subscription is up to date. If it is not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continual access to every document you have acquired: you can find it in your profile within the My documents section whenever you need to use it again. Leverage the US Legal Forms service to effortlessly locate and preserve any template for your personal or professional requirements!

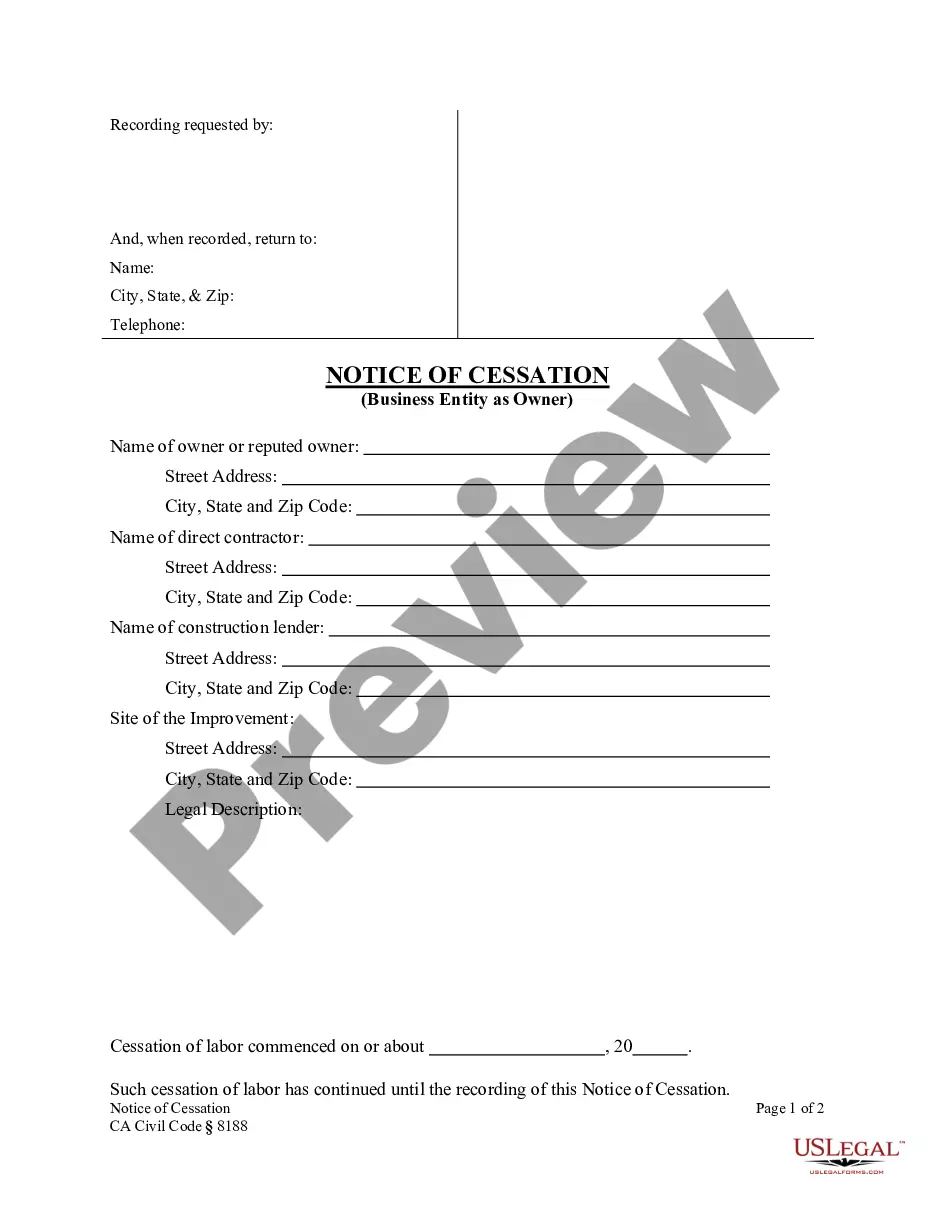

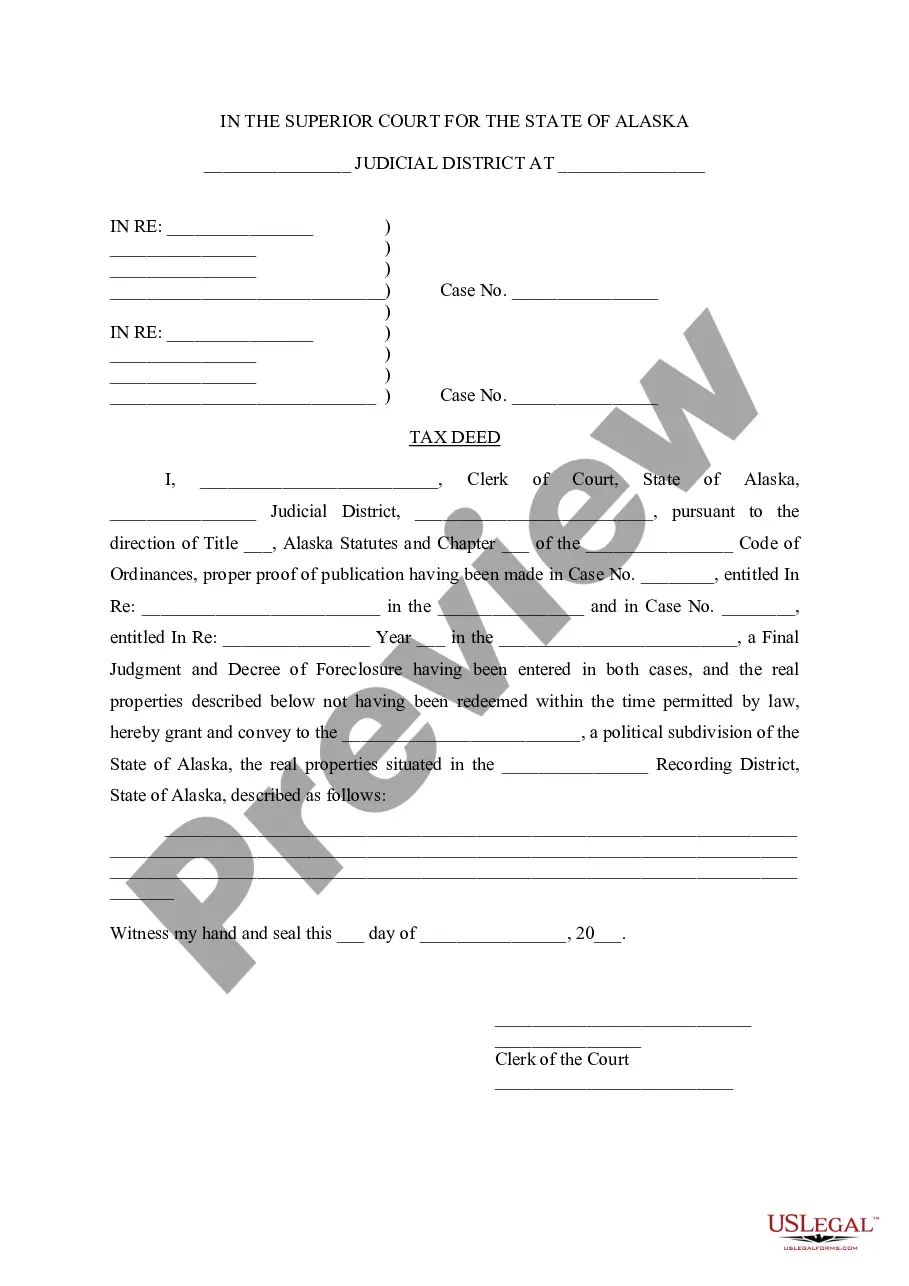

- Confirm you’ve located an appropriate document. Browse the description and utilize the Preview option, if provided, to verify if it suits your requirements. If it does not meet your criteria, use the Search tab above to discover the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process a payment. Use your credit card information or the PayPal alternative to finalize the transaction.

- Receive your Wichita Kansas Articles of Incorporation for Domestic For-Profit Corporation. Select the file format for your document and save it to your device.

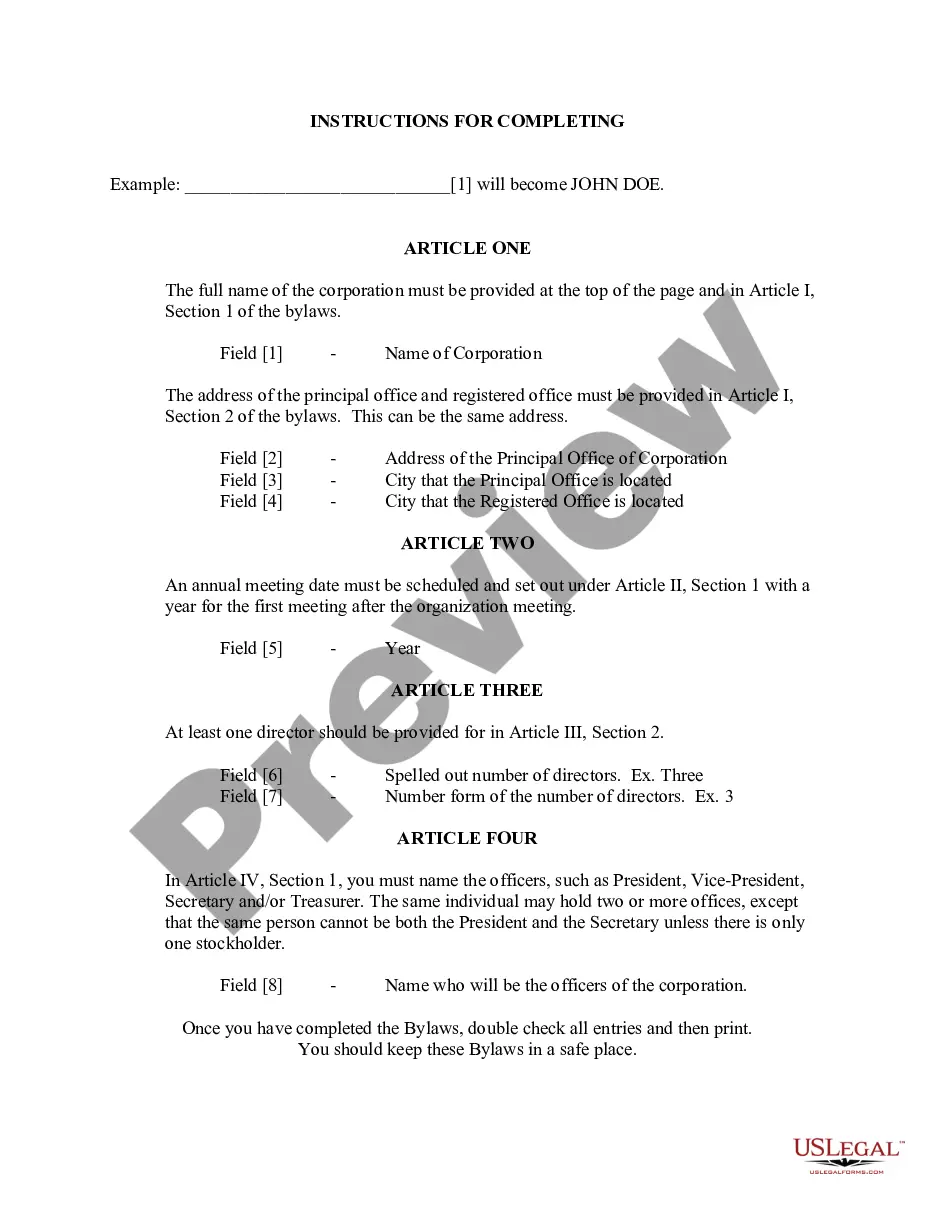

- Complete your template. Print it out or utilize online professional editors to fill it out and sign it electronically.

Form popularity

FAQ

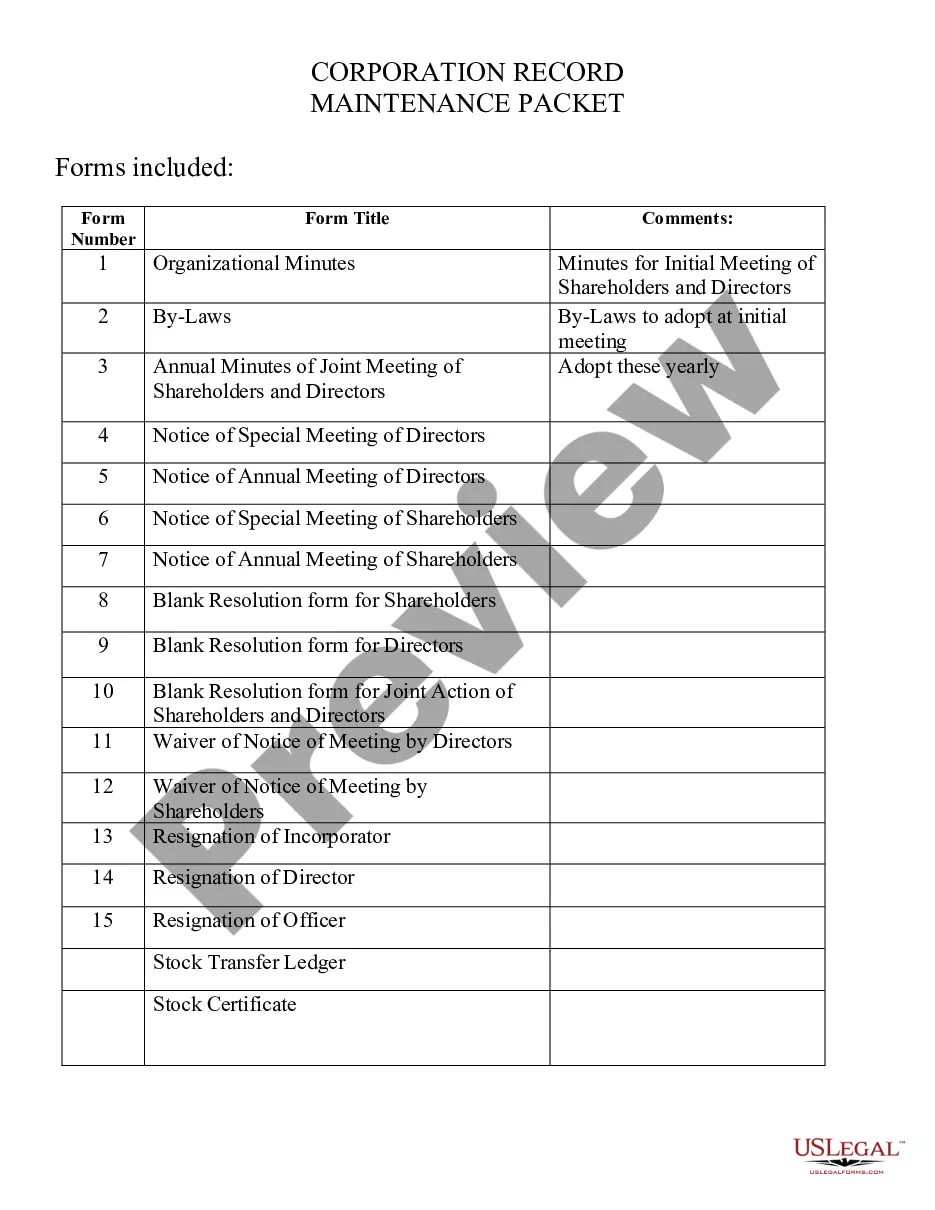

Follow the steps in our How to Start a Corporation in Kansas guide below to get started: Step 1: Name Your Kansas Corporation. Step 2: Choose a Registered Agent. Step 3: Hold an Organizational Meeting. Step 4: File the Articles of Incorporation. Step 5: Get an EIN.

Save time and money by filing your articles of incorporation online at . There, you can also stay up-to-date on your organization's status, annual report due date, and contact addresses.

How to Form a Corporation in 11 Steps Choose a Business Name. Register a DBA. Appoint Directors. File Your Articles of Incorporation. Write Your Corporate Bylaws. Draft a Shareholder Agreement. Hold Initial Board of Directors Meeting. Issue Stock.

The cost to start an LLC in Kansas is $160. It's $160 to file online or $165 for paper filing.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).

To start a corporation in Kansas, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Kansas Secretary of State. You can file this document online or by mail.

But incorporating a business comes with registration costs, legal fees and a greater administrative burden than operating a sole proprietorship. You needa separate bank account for the corporation. ?I usually tell clients that it's not worth incorporating unless the business is bringing in at least $100,000.?

How much does it cost to start a corporation in Kansas? In Kansas, it costs $85 to start a corporation or $90 when filing by mail.

The cost to form a Kansas corporation is $85 online or $90 by paper. A Kansas LLC costs $165 by paper or $160 online. Kansas corporations and LLCs must file the Kansas Annual Report every year after incorporation. The report is due the 15th day of the fourth month following your tax closing month.