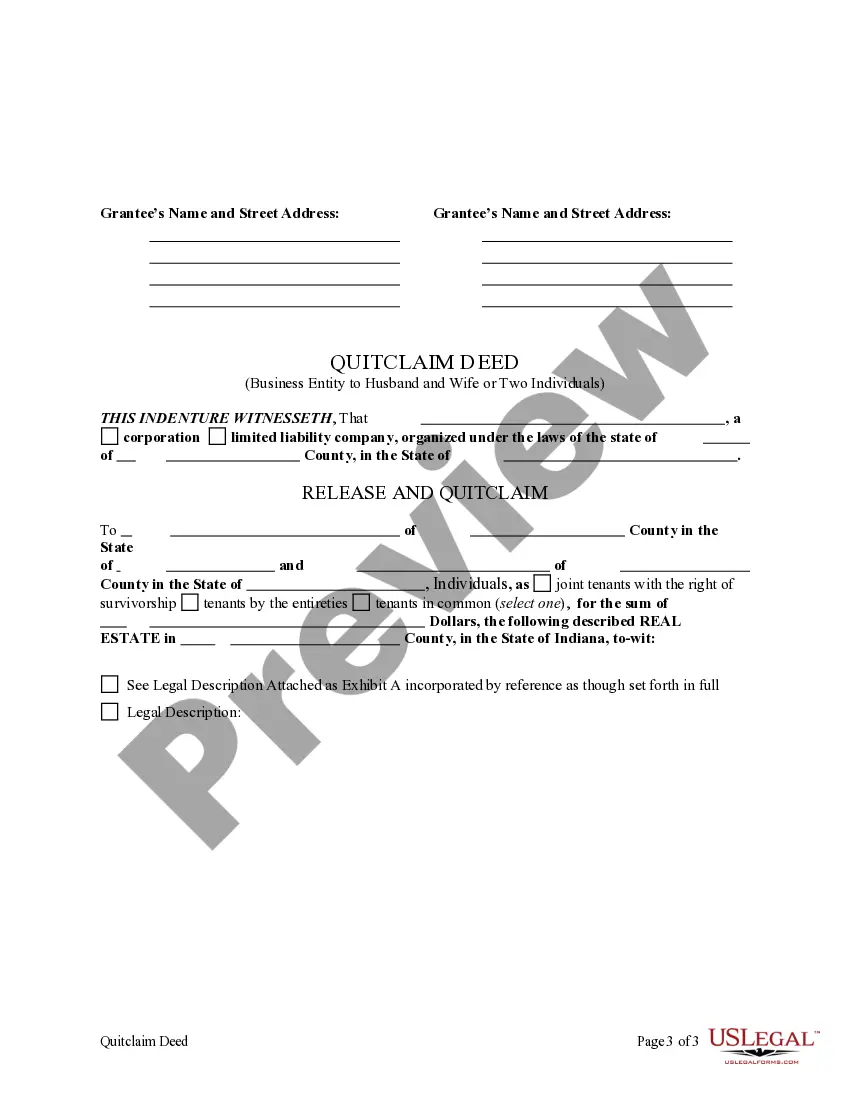

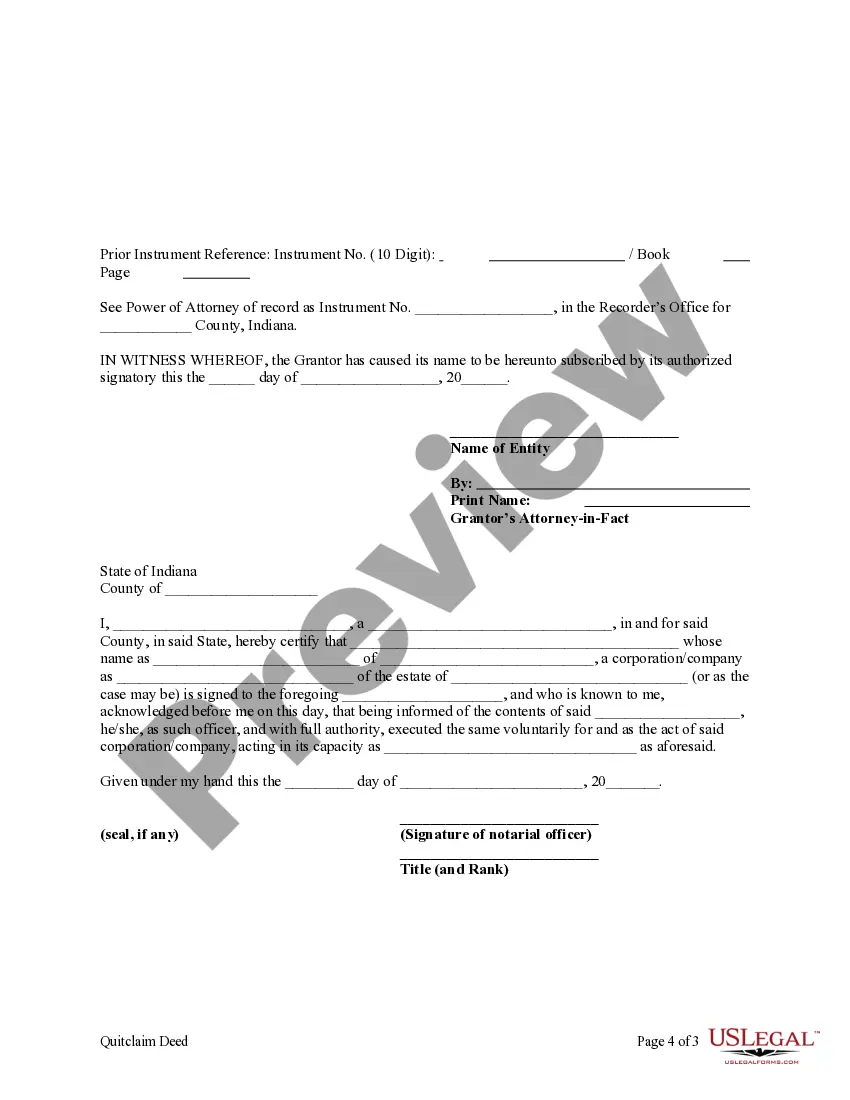

This form is a Quitclaim Deed where the Grantor is a business entity such as a corporation or limited liability company, acting through an attorney, and the Grantees are two individuals or husband and wife. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

Fort Wayne Indiana Quitclaim Deed from Business Entity, through attorney-in-fact, to Two Individuals or Husband and Wife

Description

How to fill out Indiana Quitclaim Deed From Business Entity, Through Attorney-in-fact, To Two Individuals Or Husband And Wife?

We consistently endeavor to reduce or avert legal harm when engaging with intricate legal or financial matters.

To achieve this, we seek legal services that are generally quite costly.

Nevertheless, not every legal issue is as intricate; many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button next to it.

- Our platform empowers you to manage your affairs without the need for an attorney's services.

- We provide access to legal form templates that aren’t always readily accessible to the public.

- Our templates are specific to your state and locality, which significantly streamlines the searching process.

- Leverage US Legal Forms whenever you need to obtain and download the Fort Wayne Indiana Quitclaim Deed from Business Entity, via attorney-in-fact, to Two Individuals or Husband and Wife, or any other form swiftly and securely.

Form popularity

FAQ

Yes, a lawyer can certainly draft and execute a quitclaim deed. Engaging a legal professional ensures the deed, like a Fort Wayne Indiana Quitclaim Deed from Business Entity, through attorney-in-fact, to Two Individuals or Husband and Wife, meets all legal standards. A lawyer can provide the necessary expertise and peace of mind, which is valuable when handling property transactions.

In California, a quitclaim deed can be prepared by anyone, but it is advisable to have it done by an attorney for accuracy. This is especially important for a Fort Wayne Indiana Quitclaim Deed from Business Entity, through attorney-in-fact, to Two Individuals or Husband and Wife, as legal advice can protect against mistakes. Utilizing services like uslegalforms can also aid in providing templates and guidance to ensure you're following the law correctly.

To create a valid quitclaim deed in Indiana, you need to include essential information such as the names of the grantor and grantee and a legal description of the property. Furthermore, a Fort Wayne Indiana Quitclaim Deed from Business Entity, through attorney-in-fact, to Two Individuals or Husband and Wife must be signed and notarized. Ensuring compliance with all local laws is crucial, so using a reliable platform like uslegalforms can simplify the process.

Typically, a quitclaim deed can include multiple parties. In your case, a Fort Wayne Indiana Quitclaim Deed from Business Entity, through attorney-in-fact, to Two Individuals or Husband and Wife allows for both individuals' names to be listed. Including more parties is possible, but clarity in ownership should always be maintained to prevent future complications.

Anyone can prepare a quitclaim deed as long as they understand the necessary legal requirements. However, for a Fort Wayne Indiana Quitclaim Deed from Business Entity, through attorney-in-fact, to Two Individuals or Husband and Wife, it’s wise to consult with a legal professional. Attorneys have the expertise to ensure all aspects are covered correctly, which helps in avoiding potential disputes later on.

Filling out a quitclaim deed form typically involves entering the names of the grantor and grantee, their addresses, and the property description. For a Fort Wayne Indiana Quitclaim Deed from Business Entity, through attorney-in-fact, to Two Individuals or Husband and Wife, ensure you describe the property precisely and indicate the nature of the transfer clearly. You may find it helpful to use resources from US Legal Forms that provide step-by-step instructions and templates to streamline the process.

While quitclaim deeds are useful for transferring ownership, they come with potential issues. They do not provide any protection regarding the ownership’s past claims, meaning buyers may face undisclosed liens or encumbrances later. When utilizing a Fort Wayne Indiana Quitclaim Deed from Business Entity, through attorney-in-fact, to Two Individuals or Husband and Wife, it’s crucial to understand this limitation and possibly seek legal advice to address any concerns.

To fill out a quit claim deed to add a spouse, start by identifying the current owner and the spouse on the form. Provide necessary details like the legal description of the property and the intention to transfer rights through a Fort Wayne Indiana Quitclaim Deed from Business Entity, through attorney-in-fact, to Two Individuals or Husband and Wife. Ensure both parties sign and date the document for validity, and consider using a platform like US Legal Forms for guidance and templates.

People commonly use quitclaim deeds to simplify the transfer of property ownership when relationships change, such as marriage or divorce. In the case of a Fort Wayne Indiana Quitclaim Deed from Business Entity, through attorney-in-fact, to Two Individuals or Husband and Wife, this deed allows for a smooth transition without extensive legal hurdles. It is often the preferred method for quick transfers or when the grantor does not wish to retain any future claims.

A quitclaim deed is a legal document that transfers ownership rights in a property. For instance, if a business entity wishes to transfer real estate to two individuals or a married couple, it might use a Fort Wayne Indiana Quitclaim Deed from Business Entity, through attorney-in-fact, to Two Individuals or Husband and Wife. This type of deed does not guarantee the property's title; it simply releases the entity's interest.