Rockford Illinois Deed In Trust

Description

How to fill out Illinois Deed In Trust?

Locating authenticated templates that adhere to your regional regulations can be difficult unless you utilize the US Legal Forms archive. This is an online assortment of over 85,000 legal documents for both personal and business requirements, covering various real-world situations.

For anyone already acquainted with our service and has utilized it in the past, acquiring the Rockford Illinois Deed In Trust requires just a few clicks. All you need to do is Log In to your account, choose the document, and click Download to save it on your device. This will take just a few more steps for those who are new.

Follow the steps below to begin with the most comprehensive online form collection.

Maintaining organized paperwork that complies with legal mandates is of utmost significance. Utilize the US Legal Forms library to always have vital document templates for any requirements readily available!

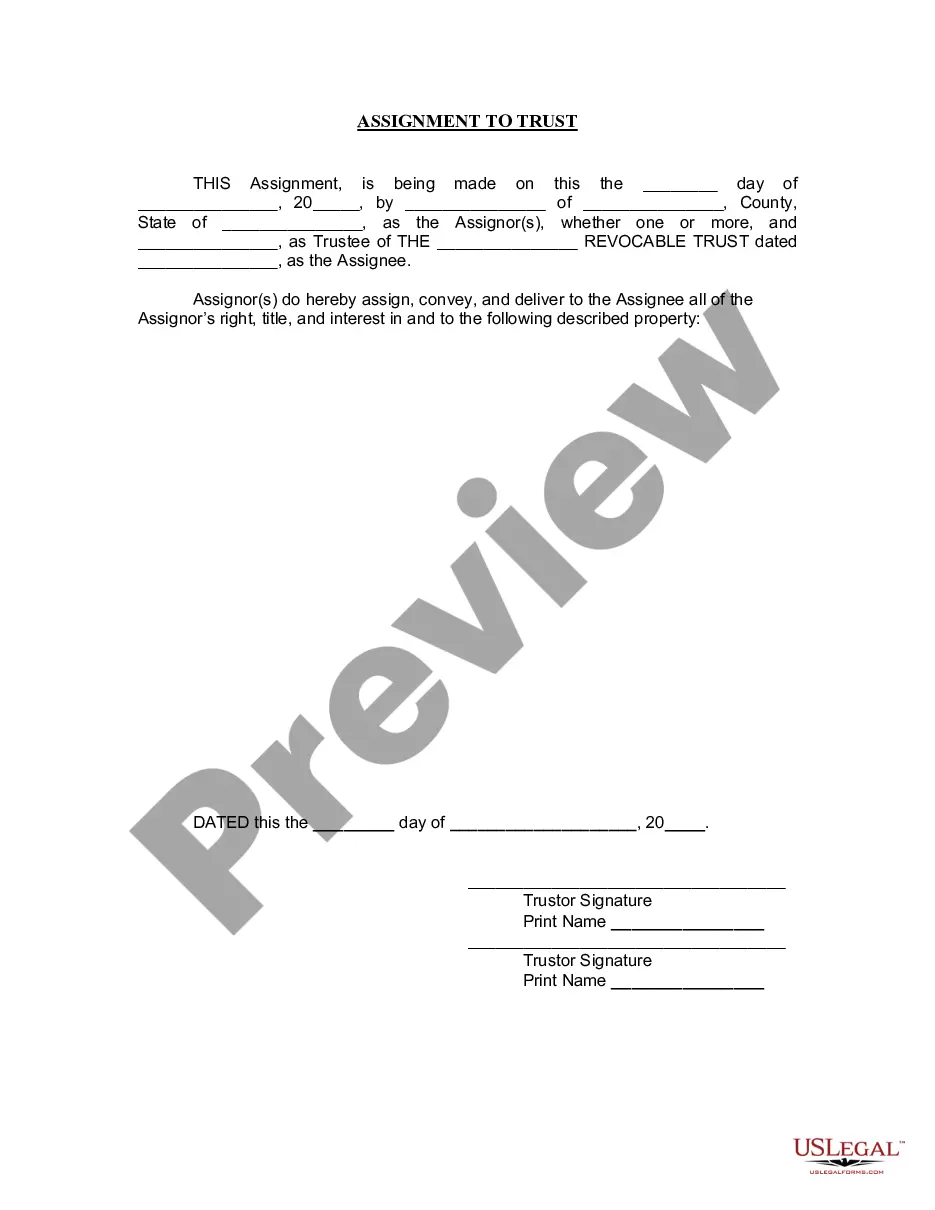

- Check the Preview mode and form description. Ensure you’ve selected the correct one that aligns with your needs and fully complies with your local jurisdiction requirements.

- Look for another template, if required. If you find any discrepancies, utilize the Search tab above to locate the appropriate one. If it fits your needs, proceed to the next step.

- Purchase the document. Click on the Buy Now button and choose your preferred subscription plan. You will need to create an account to access the library’s content.

- Complete the transaction. Enter your credit card information or utilize your PayPal account to pay for the service.

- Download the Rockford Illinois Deed In Trust. Save the template on your device to proceed with its completion and access it anytime from the My documents section of your profile.

Form popularity

FAQ

Putting your house in a trust in Illinois involves several steps. First, you would need to draft a trust document, ideally with the assistance of a legal expert. This includes specifying the terms and appointing a trustee who will manage the Rockford Illinois Deed In Trust. Once established, you'll transfer the property title to the trust, completing the process and securing your asset for future management.

Yes, Illinois does have deeds of trust. These legal instruments serve as security for loans, but they are less common than traditional mortgages. In Rockford, Illinois, a Deed In Trust can provide a streamlined way to manage property financing while protecting the interests of involved parties. It's essential to be informed about the specific terms of any deed utilized.

Putting property in a trust can have some drawbacks. Firstly, you might face initial costs such as legal fees for setting up the trust, which can be significant. Moreover, after creating a Rockford Illinois Deed In Trust, you may have limited control over the assets, as the trustee must follow the terms of the trust. Lastly, the process can be complex and might require ongoing maintenance and oversight.

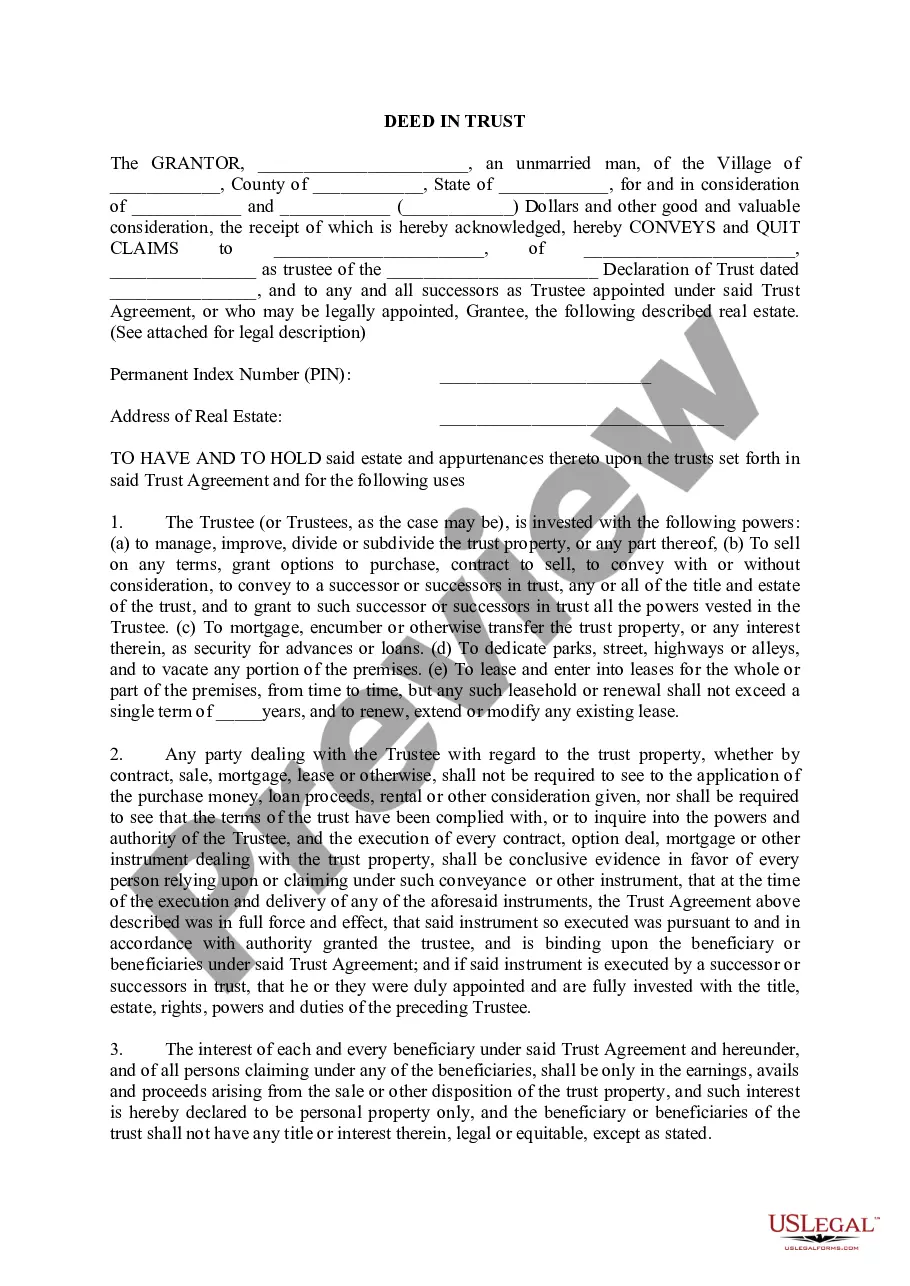

A deed in trust transfers property ownership to a trustee who holds it for the benefit of a third party, usually the borrower. The trustee manages the assets according to the terms set out in the deed. In Rockford, Illinois, a deed in trust can be advantageous for securing loans while protecting the rights of the borrower. This arrangement fosters trust between all parties involved in a property transaction.

An Illinois deed in trust is a legal document that establishes a trust arrangement for real estate transactions. This document places your property into a trust, allowing a trustee to manage it on behalf of the beneficiaries. In Rockford, Illinois, using a deed in trust can simplify estate planning and provide security for loans. Understanding this concept is essential for anyone looking to navigate real estate in the area.

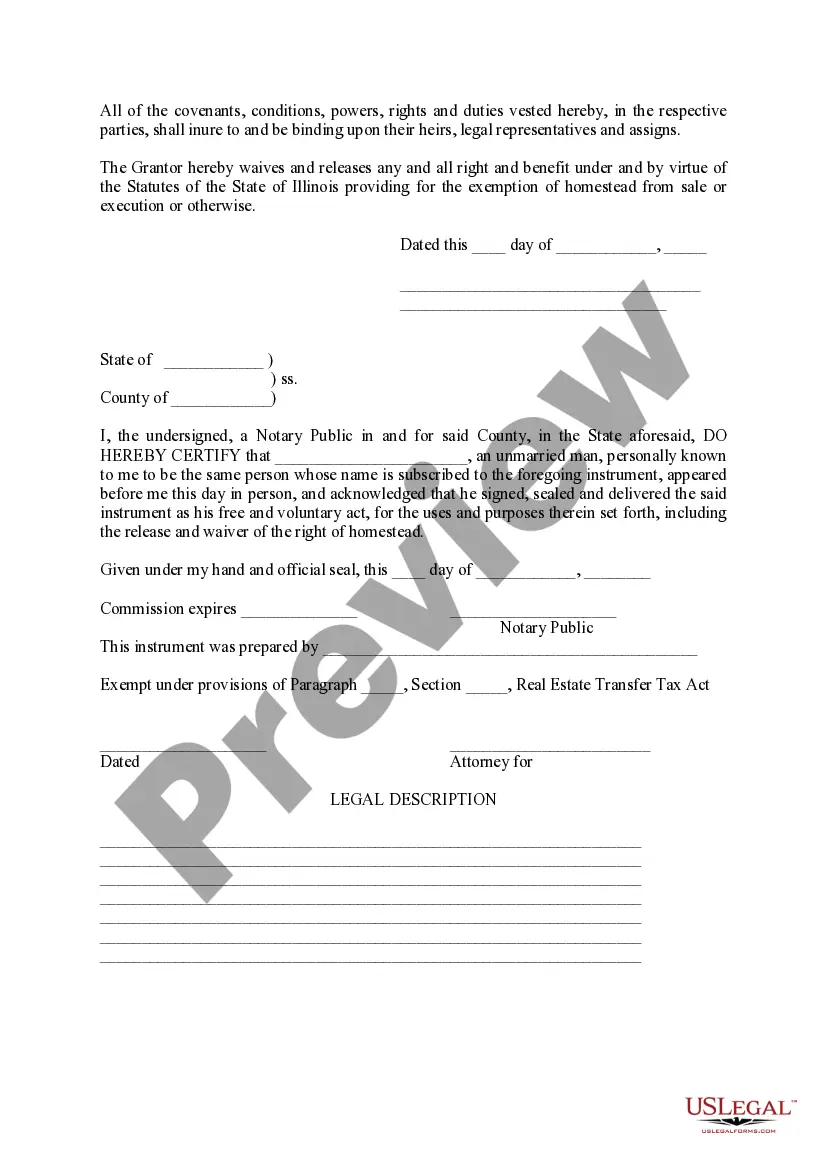

Yes, to protect your legal interests, you should file a deed of trust with the county recorder's office. This formalizes the transfer of property ownership and secures the lender’s interest. In the context of a Rockford Illinois Deed In Trust, filing ensures the trust's legal validity and provides a clear record of ownership.

To place your property in a trust in Illinois, start by selecting a type of trust that aligns with your goals. You will need to create a trust document outlining the terms and conditions. After drafting, transfer the title of your property to the trust, which may involve filling out and filing a Rockford Illinois Deed In Trust, ensuring proper documentation with your county recorder's office.

In Illinois, a trust does not typically need to be filed with the court unless it becomes a part of a probate process. This means that unless the trust is contested or requires judicial oversight, you can manage it privately. However, using a Rockford Illinois Deed In Trust can help clarify property ownership during your lifetime and beyond, making it an essential estate planning tool.

The trust deed is usually created by the grantor, the person who establishes the trust. In some cases, a legal professional may assist in drafting the Rockford Illinois Deed In Trust to ensure all legal requirements are met. It's beneficial to seek expert advice, especially if you're unfamiliar with trust laws. This collaboration can help you create a robust and effective trust that meets your family’s needs.

To draw up a trust deed in Rockford, Illinois, start by gathering all necessary information about the assets and the involved parties. Draft the document carefully, clearly outlining the roles and responsibilities of each party. You may use templates or legal forms available online through platforms like uslegalforms, ensuring compliance with local laws. Lastly, don’t forget to have the deed signed and notarized to validate it.