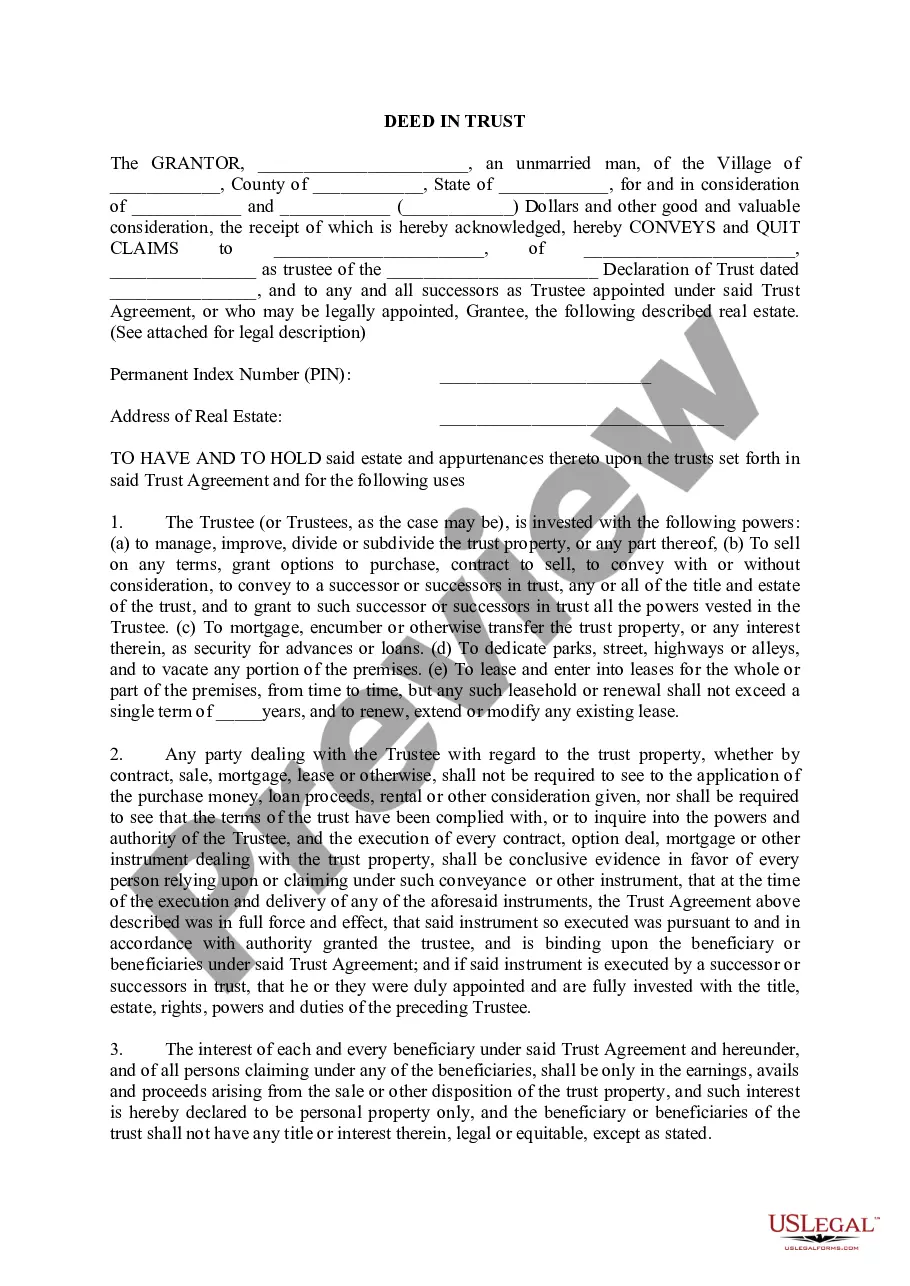

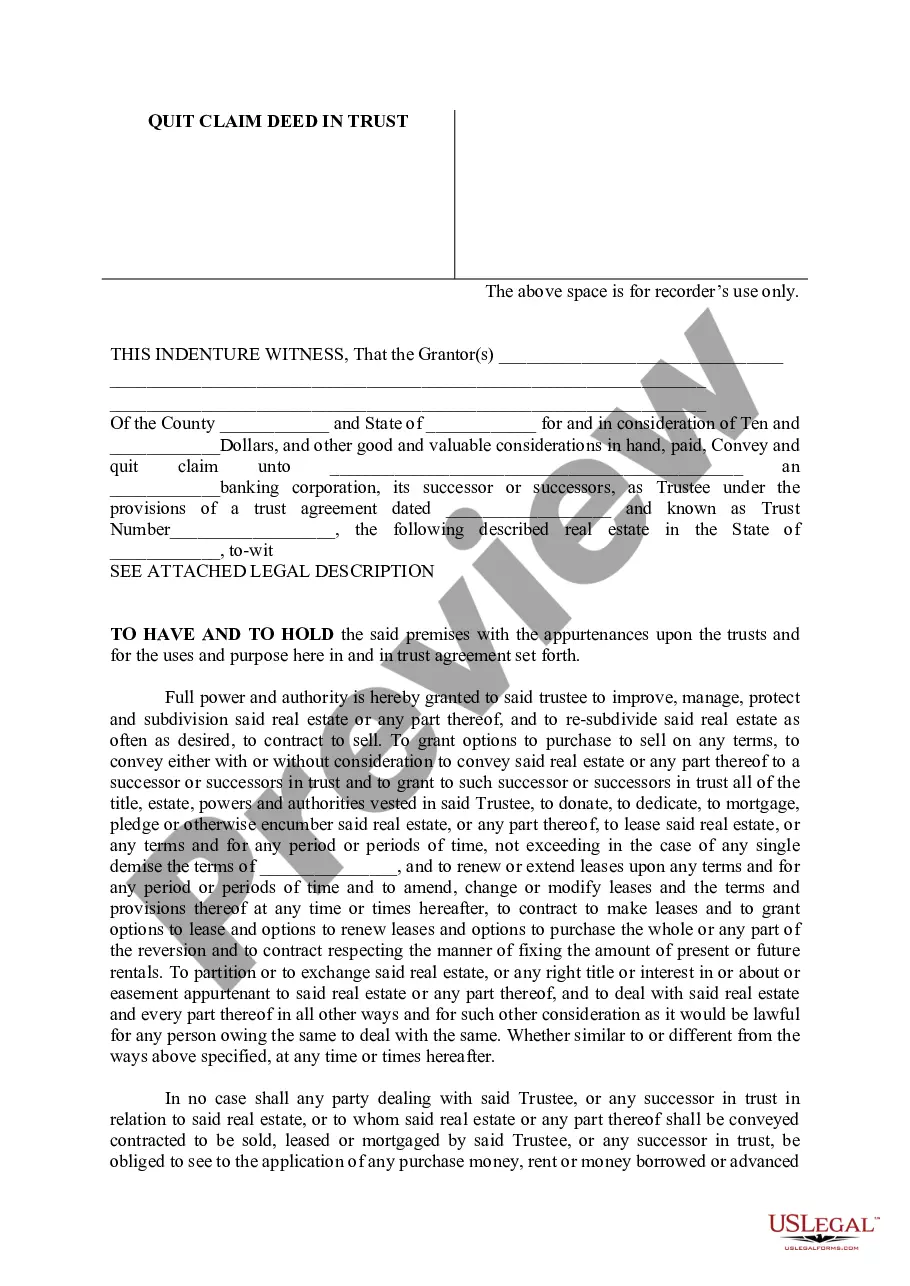

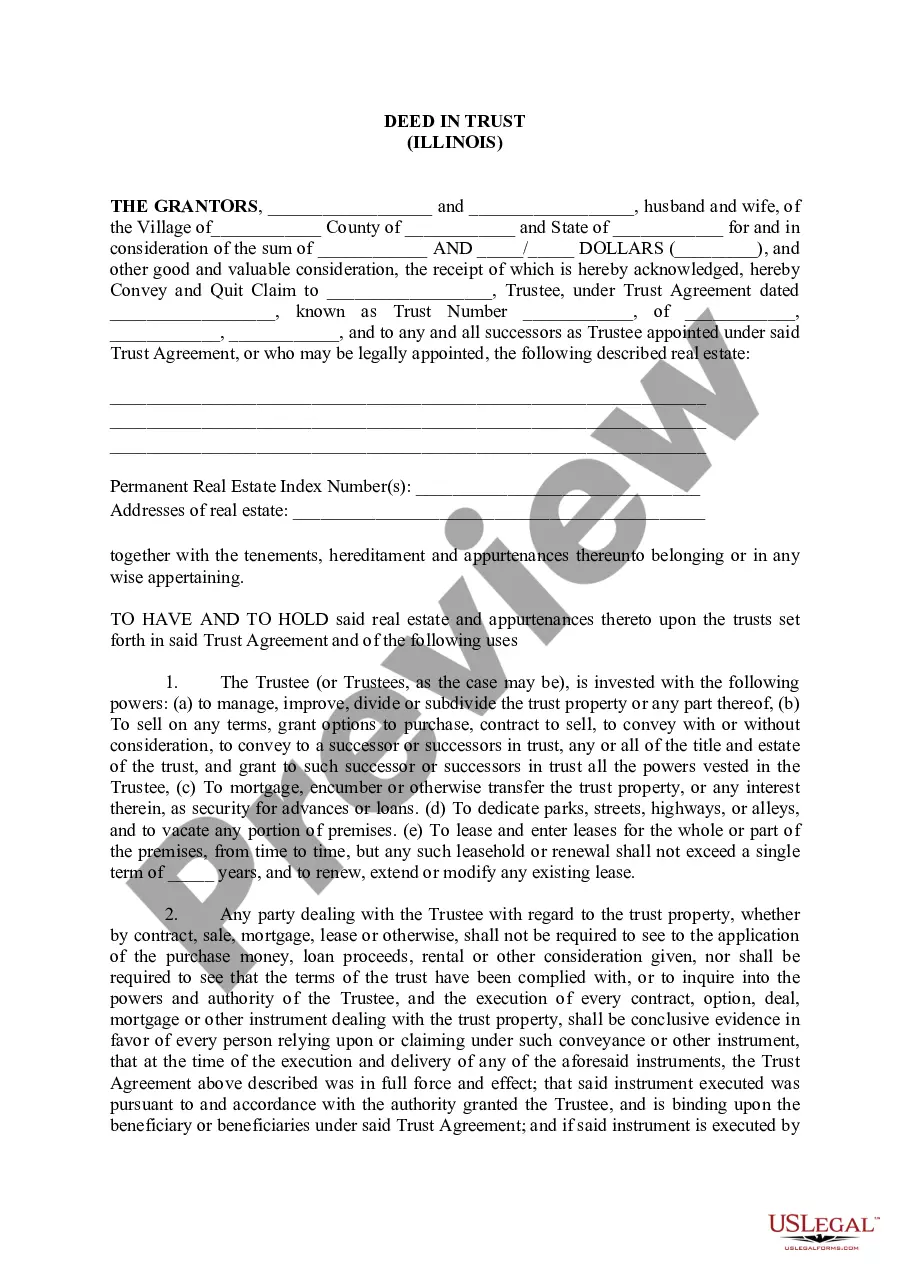

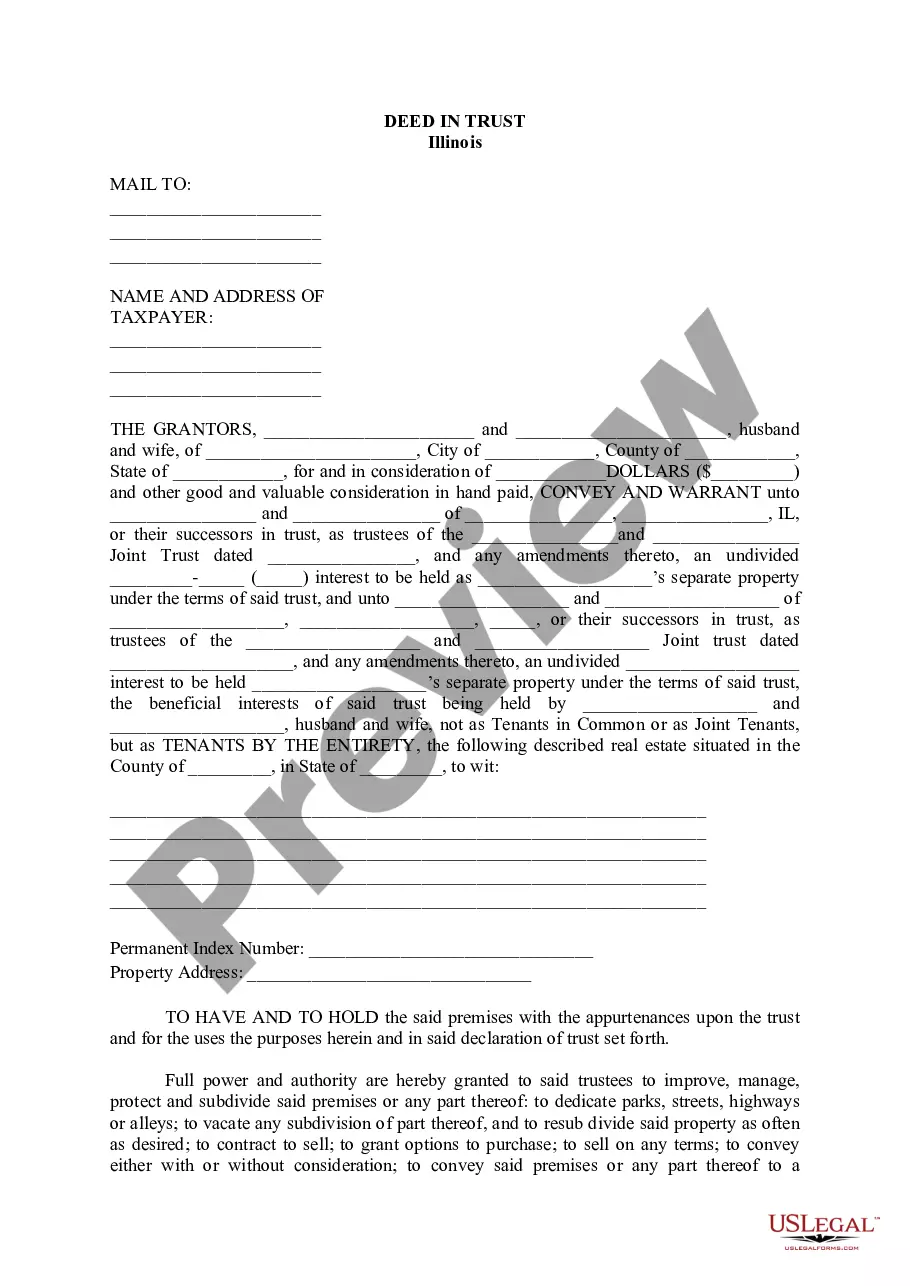

Cook Illinois Deed In Trust

Description

How to fill out Illinois Deed In Trust?

If you have previously used our service, sign in to your account and download the Cook Illinois Deed In Trust to your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your first encounter with our service, follow these straightforward steps to acquire your document.

You have lifetime access to all documents you have purchased: you can find them in your profile under the My documents section whenever you need to reuse them. Make use of the US Legal Forms service to efficiently find and save any template for your personal or professional purposes!

- Confirm you’ve found a suitable document. Review the details and utilize the Preview feature, if available, to verify if it meets your requirements. If it’s not appropriate, use the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal choice to finalize the purchase.

- Receive your Cook Illinois Deed In Trust. Select the file format for your document and download it to your device.

- Fill out your sample. Print it or utilize professional online editors to complete and electronically sign it.

Form popularity

FAQ

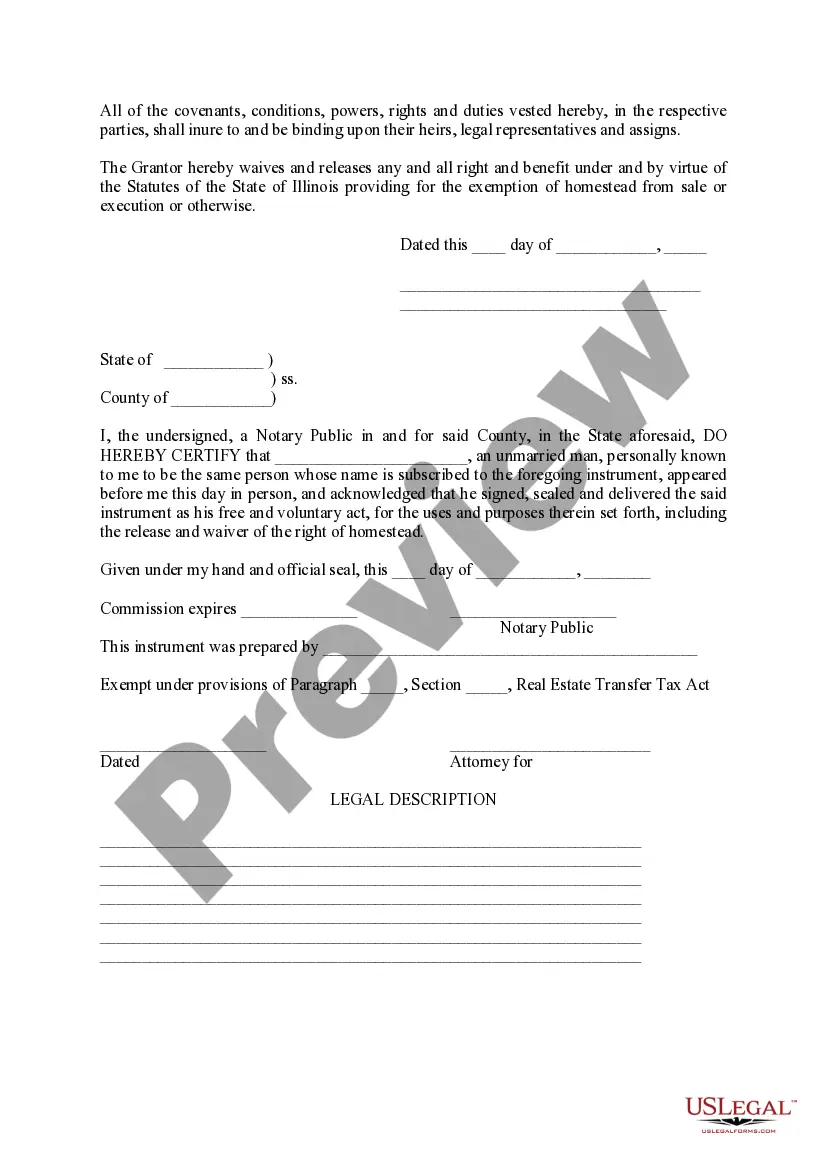

To put your house in a trust in Illinois, you first need to create the trust document, which outlines the terms and conditions. After establishing the Cook Illinois Deed In Trust, you should transfer the property title into the trust's name. It's important to follow the legal requirements for property transfers to avoid complications. If you feel uncertain about the process, consider using a platform like US Legal Forms to assist you with the documentation and ensure everything is in order.

Using a lawyer for a quitclaim deed can provide reassurance and clarity. A legal professional can help you understand the terms of your Cook Illinois Deed In Trust and ensure that everything follows state laws. While some homeowners choose to go without legal help, having an expert can help avoid mistakes that may lead to issues later. It is always better to be safe than sorry when it comes to legal documents.

You do not necessarily need a lawyer to file a quit claim deed in Illinois; however, having legal guidance can be beneficial. A lawyer can help ensure that your Cook Illinois Deed In Trust is accurately prepared and filed. They can also advise you on any potential implications of transferring property. If you are uncertain about the process, consulting with a lawyer is a wise choice.

Writing a trust deed involves drafting a document that explicitly states the trust’s terms and conditions. You must identify the trustee, the beneficiaries, and the property involved, including any relevant Cook Illinois Deed In Trust details. Utilizing resources from US Legal Forms can simplify this process by providing you with templates and instructions tailored to your needs.

Filling out a quitclaim deed requires careful attention to detail. Provide the full names of the individuals transferring and receiving the property, followed by an accurate legal description. If applicable, reference a Cook Illinois Deed In Trust. Don't forget to sign in front of a notary public, as this step is crucial for legal acceptance.

To fill out a quit claim deed in Illinois, first identify the parties involved with complete names and addresses. Next, include the property’s legal description and indicate if it relates to a Cook Illinois Deed In Trust. Finally, authenticate the document with appropriate signatures and notarization to make it legally binding.

Filling out an Illinois quit claim deed involves several steps. Start by providing the names of the grantor and grantee, including their addresses. You’ll then need to include a legal description of the property, and if applicable, mention the Cook Illinois Deed In Trust designation. Ensure you sign the deed in front of a notary public for it to be valid.

To put your property in a trust in Illinois, you must first create a trust document that specifies the terms of the trust. Next, you will transfer the property title to the trust, which may involve drafting a Cook Illinois Deed In Trust. You can simplify this process using US Legal Forms, which offers templates and guidance for creating and transferring property into a trust.

You can file a quitclaim deed in Illinois without a lawyer, but it is often beneficial to consult one. A lawyer can help ensure the deed is properly filled out and meets all legal requirements. If you plan to create a Cook Illinois Deed In Trust, professional guidance can streamline the process and provide peace of mind.

Deciding whether to place your house in a Cook Illinois Deed In Trust largely depends on your goals. If you want to streamline the transfer of your property upon your passing or protect your assets from creditors, a trust can be beneficial. However, it’s wise to evaluate the complexities involved and consider your unique financial situation. Consulting uslegalforms can provide clarity and direction.