Cook Illinois Deed In Trust

Description

How to fill out Illinois Deed In Trust?

We consistently aim to minimize or evade legal repercussions when managing intricate regulatory or financial matters. To achieve this, we seek legal remedies that are typically quite costly. Nevertheless, not every legal situation is as intricate. Most issues can be addressed independently.

US Legal Forms is an online repository of current self-service legal documents encompassing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our collection empowers you to manage your affairs without relying on an attorney. We provide access to legal form templates that aren’t always publicly available. Our templates are specific to states and regions, which significantly eases the search process.

Utilize US Legal Forms whenever you require to locate and download the Cook Illinois Deed In Trust or any other form swiftly and securely. Simply Log In to your account and click the Get button adjacent to it. Should you misplace the form, you can always re-download it in the My documents tab.

The process is equally simple if you’re new to the website! You can establish your account within moments.

With over 24 years of experience in the market, we’ve assisted millions of individuals by providing ready-to-customize and current legal documents. Maximize the benefits of US Legal Forms now to conserve time and resources!

- Ensure that the Cook Illinois Deed In Trust adheres to the laws and guidelines of your state and locality.

- It's crucial to review the form's description (if present), and if you notice any inconsistencies with what you initially sought, look for an alternative form.

- Once you have confirmed that the Cook Illinois Deed In Trust is suitable for your needs, you can select a subscription plan and proceed with payment.

- After that, you can download the form in any convenient format.

Form popularity

FAQ

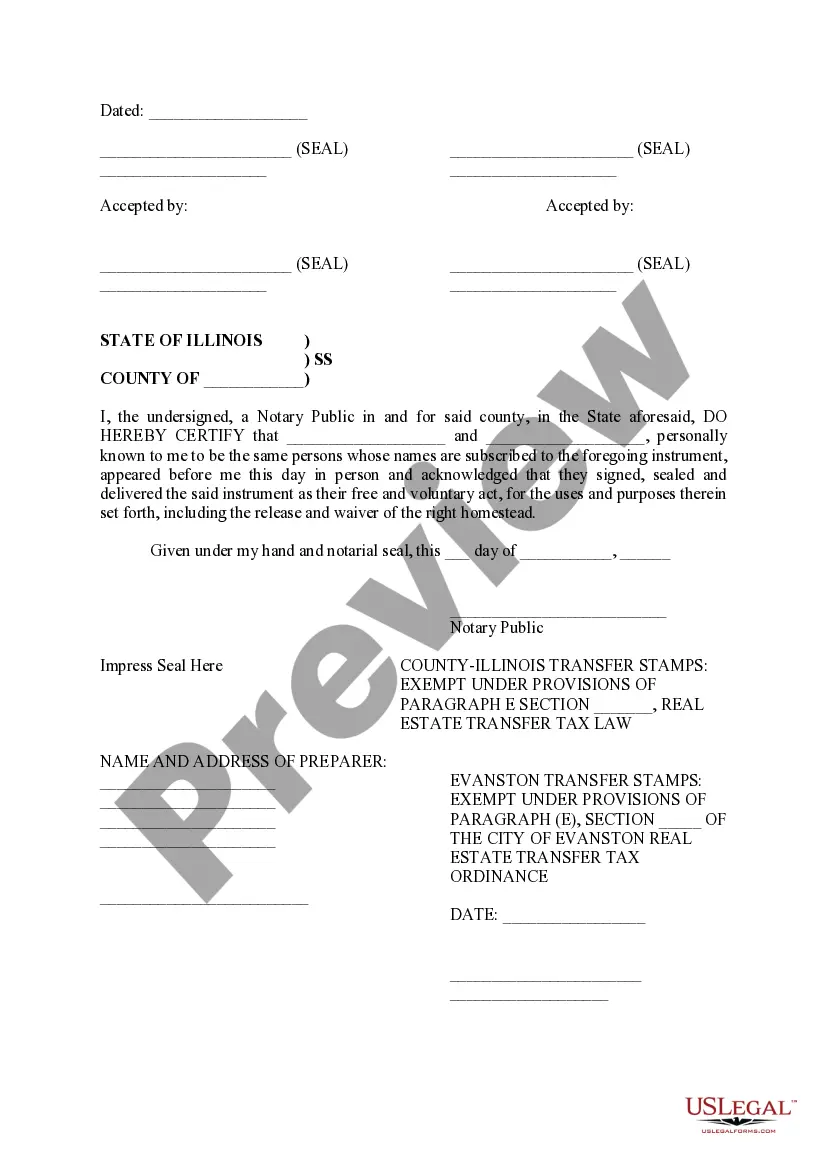

Finding a copy of a deed online is easy, thanks to various online resources. You can use the Cook County Recorder of Deeds website to search for your Cook Illinois Deed In Trust. Simply enter the required information, and you will be able to access your deed without any hassle.

To get a copy of your property deed in Cook County, Illinois, you can use the online search feature provided by the Cook County Recorder of Deeds. You may also visit their office in person or request a copy through mail. This process ensures you have access to your Cook Illinois Deed In Trust when you need it.

Getting a copy of your property deed in Illinois is straightforward. You can contact the recorder's office in the county where your property is located or access their online portal. By entering your property details, you can quickly find and retrieve your Cook Illinois Deed In Trust.

To obtain a copy of your house deed in Cook County, Illinois, you can start by visiting the Cook County Recorder of Deeds website. You can search for your property using your name or property address. If you prefer, you can also visit their office in person to request a copy of your Cook Illinois Deed In Trust.

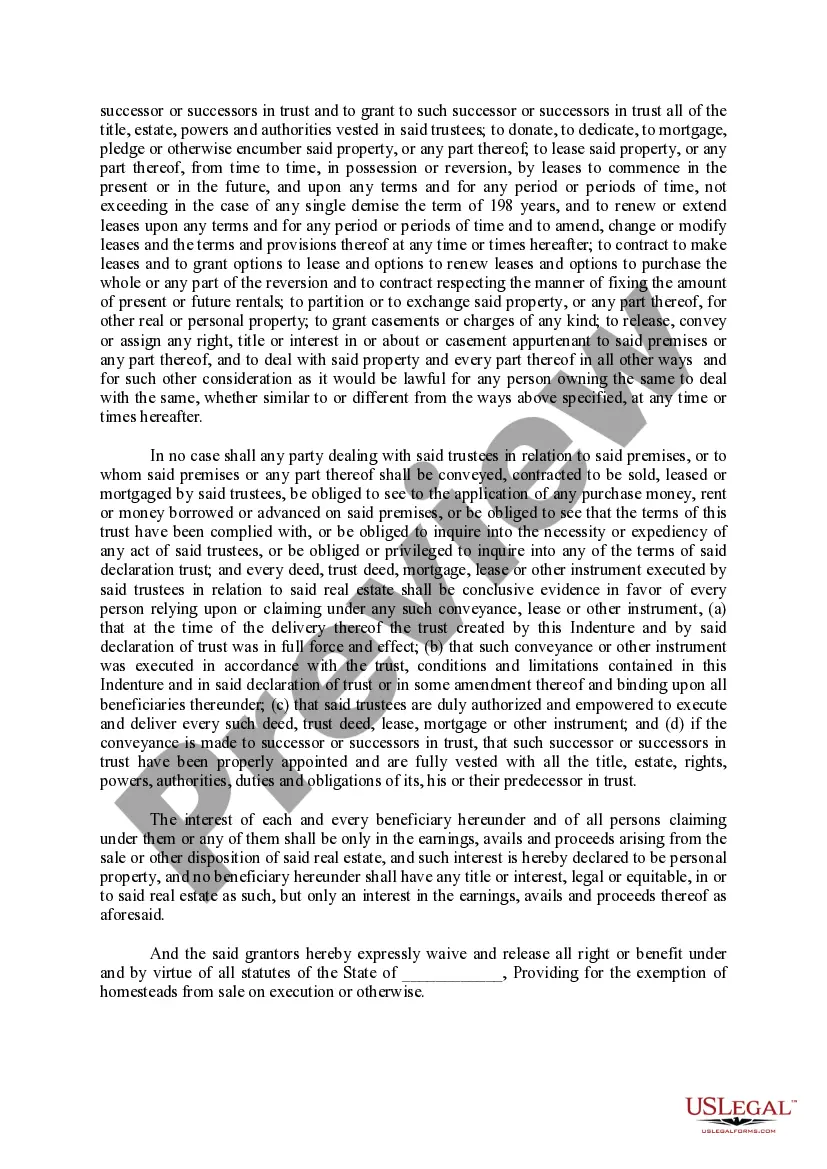

While a Cook Illinois Deed In Trust offers numerous advantages, there are some drawbacks to consider. Establishing and maintaining a trust can incur legal fees and administrative costs. Additionally, you may find that the process of transferring your property into the trust is somewhat complex. Always weigh these factors against the benefits to make an informed decision.

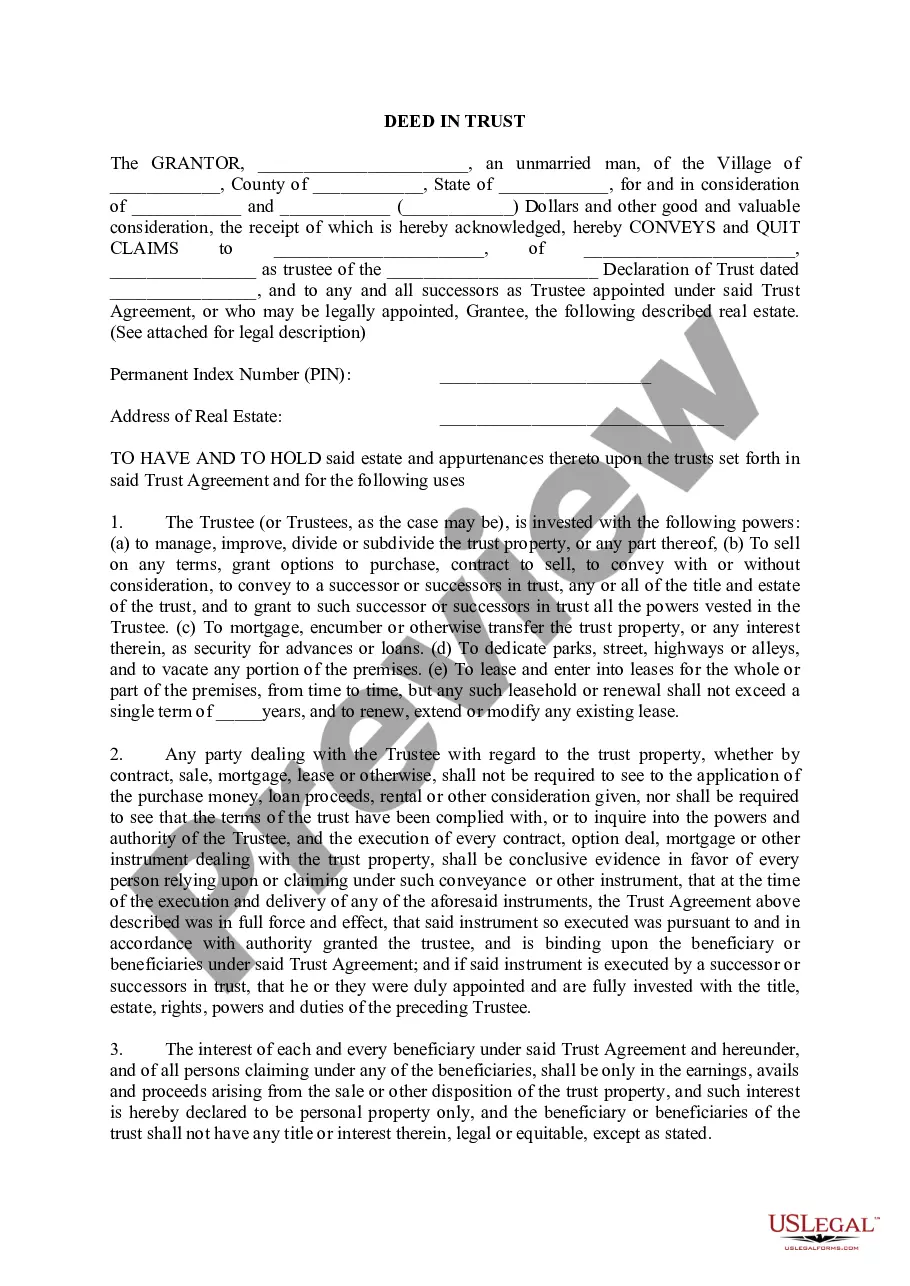

When a house is held in a Cook Illinois Deed In Trust, it does not go through probate upon your death. Instead, the trust terms dictate the property transfer, which can provide a smoother transition for your beneficiaries. This structure helps avoid delays and ensures your wishes are fulfilled as intended. Be sure to keep your trust updated to reflect your current wishes.

Deciding between a will and a Cook Illinois Deed In Trust depends on your specific circumstances. A will handles asset distribution after you pass away, but it goes through probate, which can take time. In contrast, a trust allows for quicker asset transfer without probate, providing both privacy and efficiency. Ultimately, your choice should align with your estate planning goals.

Creating a Cook Illinois Deed In Trust for your house may offer several benefits. It can streamline the transfer of your property upon your death, potentially avoiding probate delays. Additionally, a trust can provide privacy and protect your assets from certain creditors. However, each situation is unique, so it's wise to consult with a legal expert to determine if this option suits your needs.

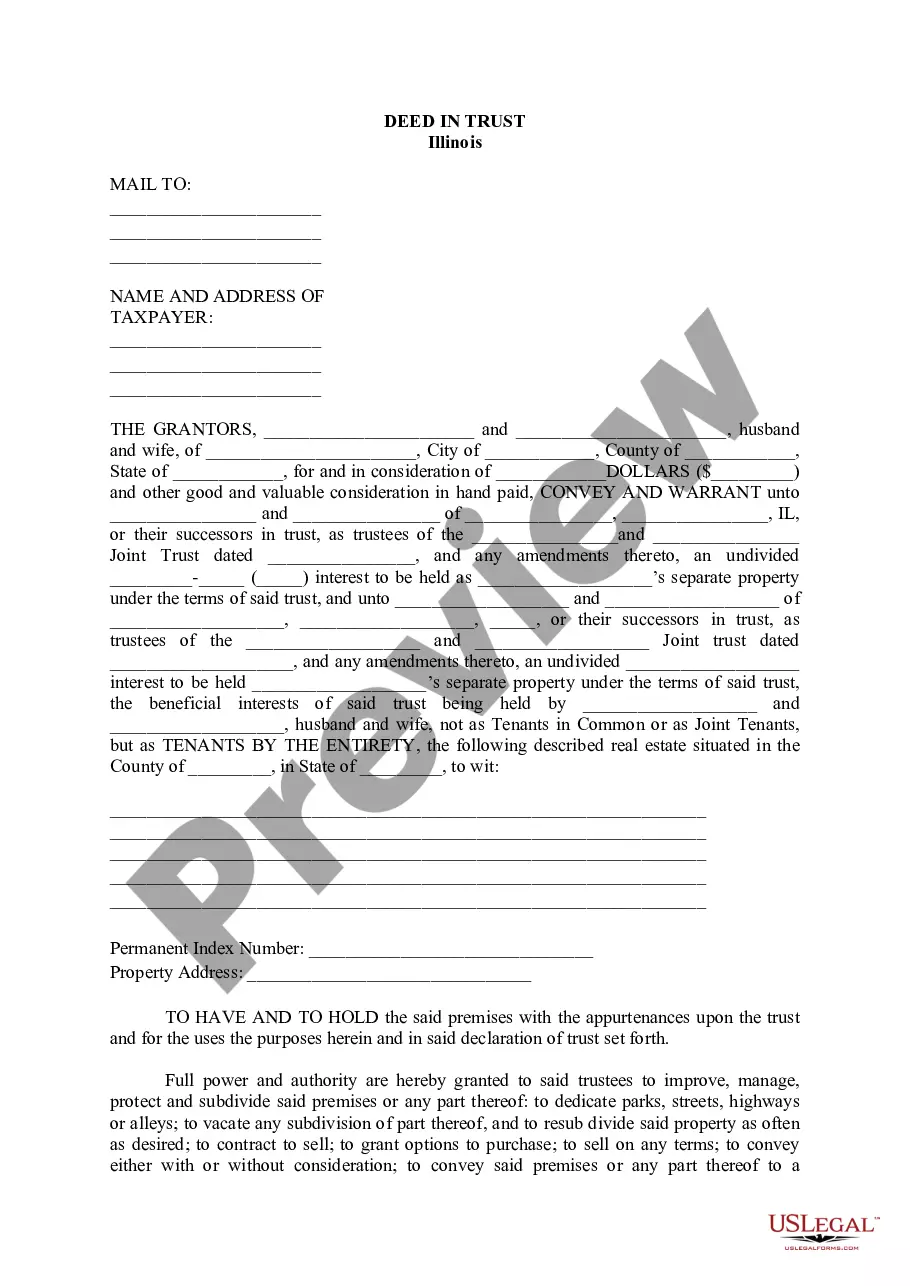

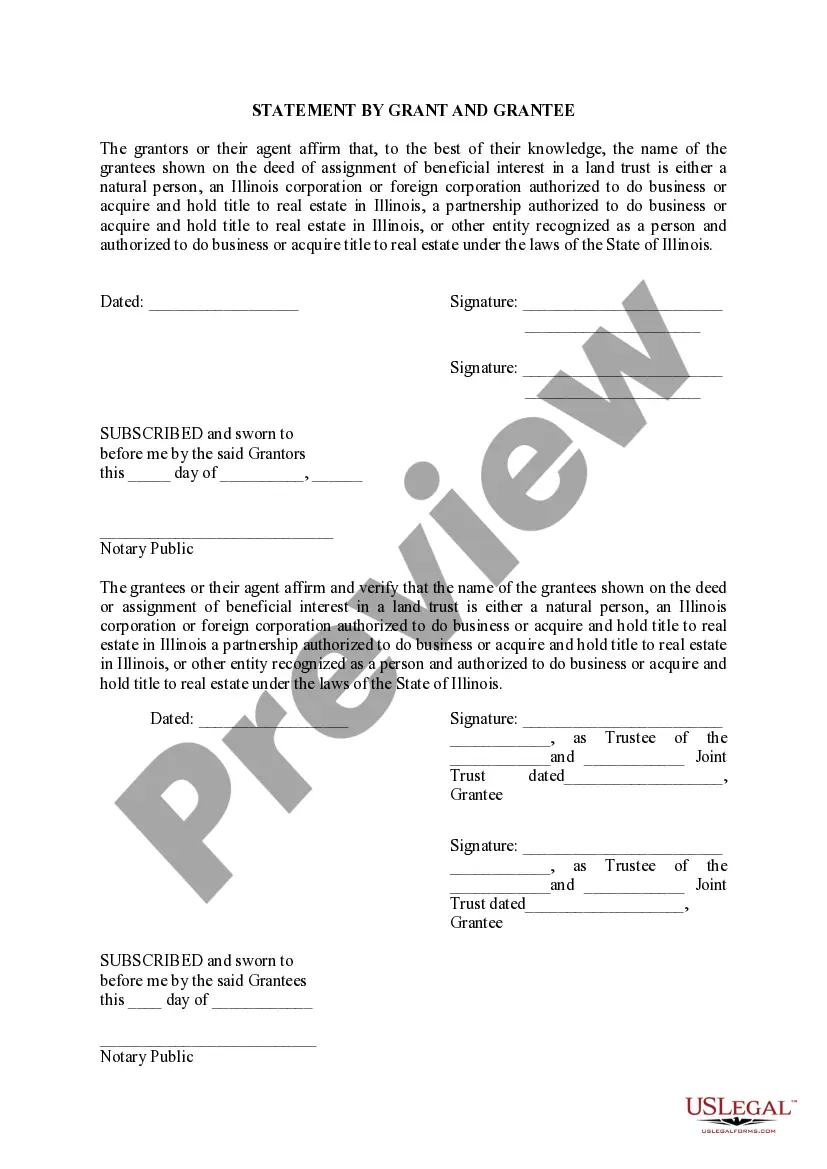

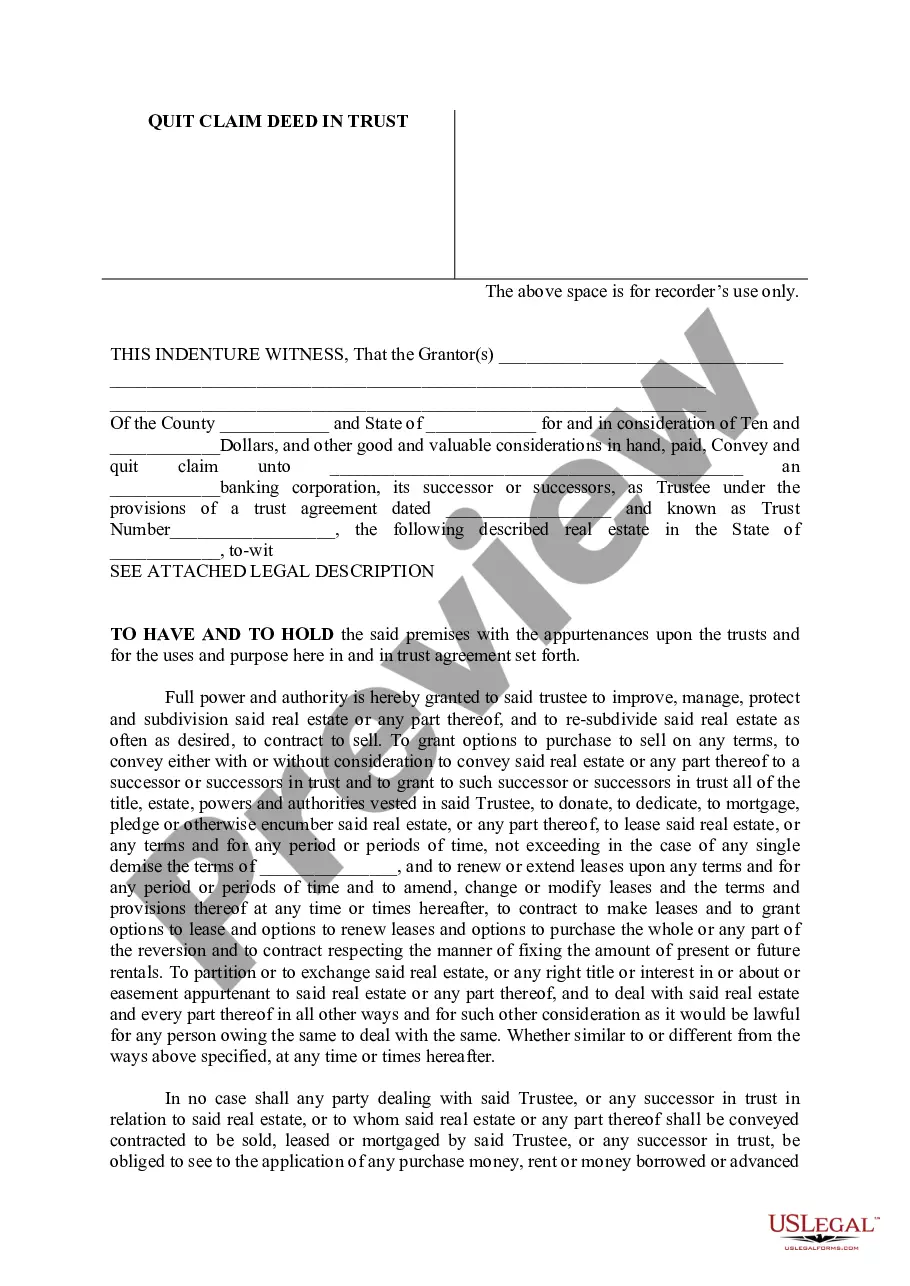

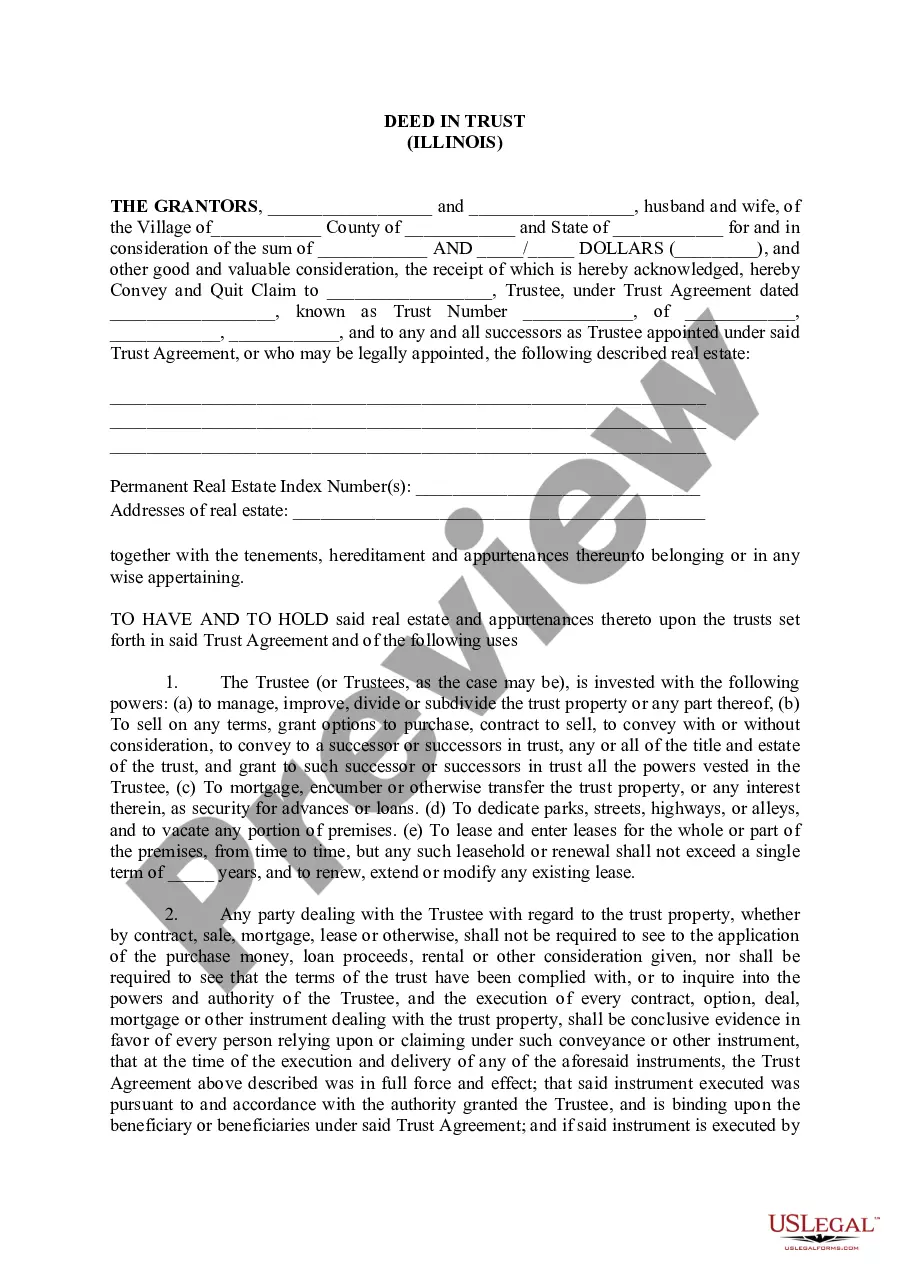

An example of a declaration of trust could start with the trustor declaring their intent to create a trust for specific purposes. It may include details like the trustor's name, description of the property, and the named trustee. This declaration clearly defines the relationship and authority granted by the Cook Illinois Deed In Trust.

A trust deed example typically includes the trustor transferring property to the trustee for the benefit of the beneficiary. It might state, 'John Doe, as trustor, conveys property located at 123 Elm St. to Jane Smith, as trustee, for the benefit of the family trust.' This framework illustrates how the Cook Illinois Deed In Trust operates in practice.