Cook Illinois Quit Claim Deed in Trust

Description

How to fill out Illinois Quit Claim Deed In Trust?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It is a virtual collection of over 85,000 legal documents catering to both personal and professional requirements for various real-life scenarios.

All the files are correctly organized by field of usage and jurisdiction, making the search for the Cook Illinois Quit Claim Deed in Trust as swift and straightforward as 123.

Maintaining documentation organized and compliant with legal standards is highly significant. Take advantage of the US Legal Forms library to always have essential document templates readily available for any situation!

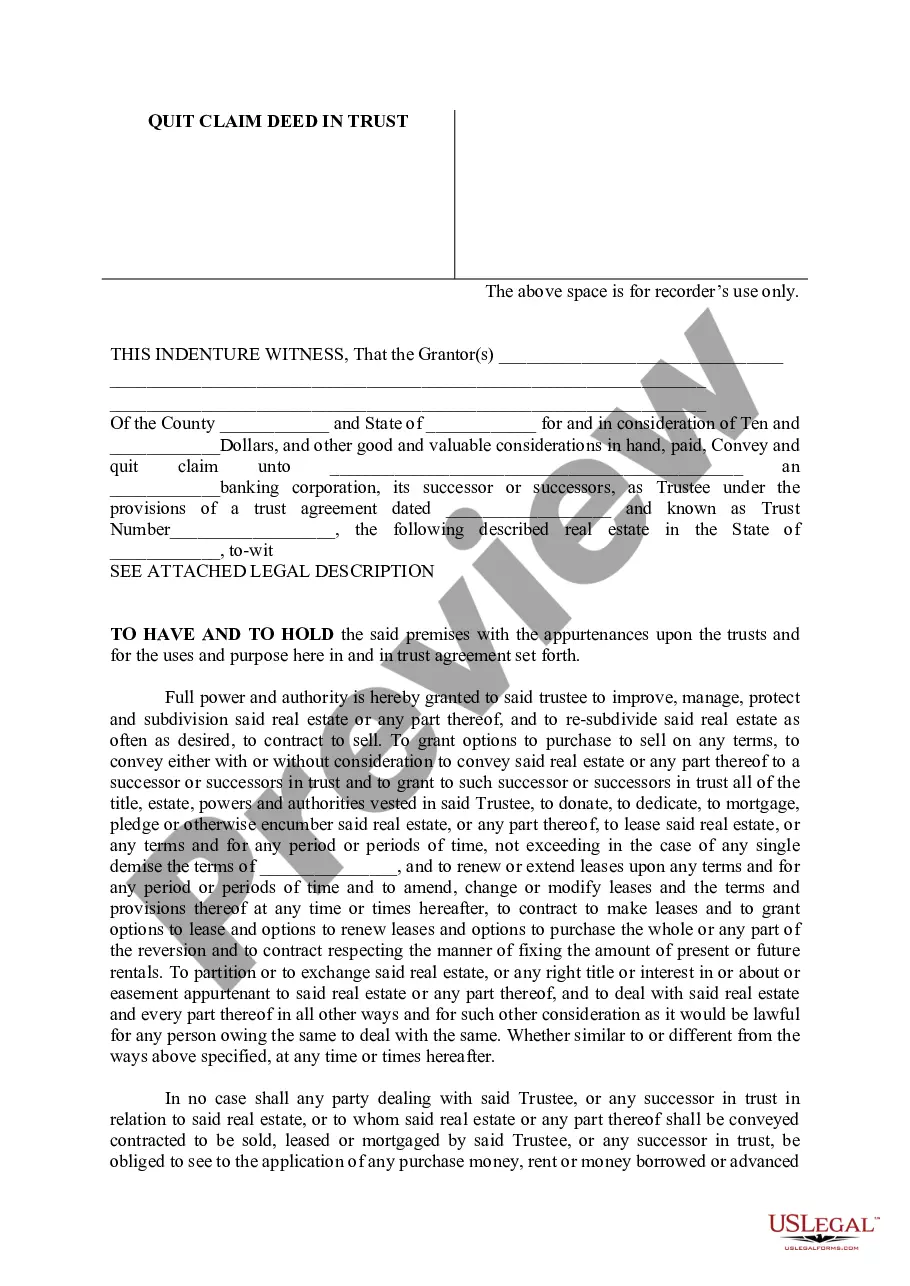

- Review the Preview mode and document description.

- Ensure you have selected the correct one that fulfills your requirements and fully aligns with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you encounter any discrepancies, use the Search tab above to locate the appropriate one.

- If it meets your needs, proceed to the next step.

Form popularity

FAQ

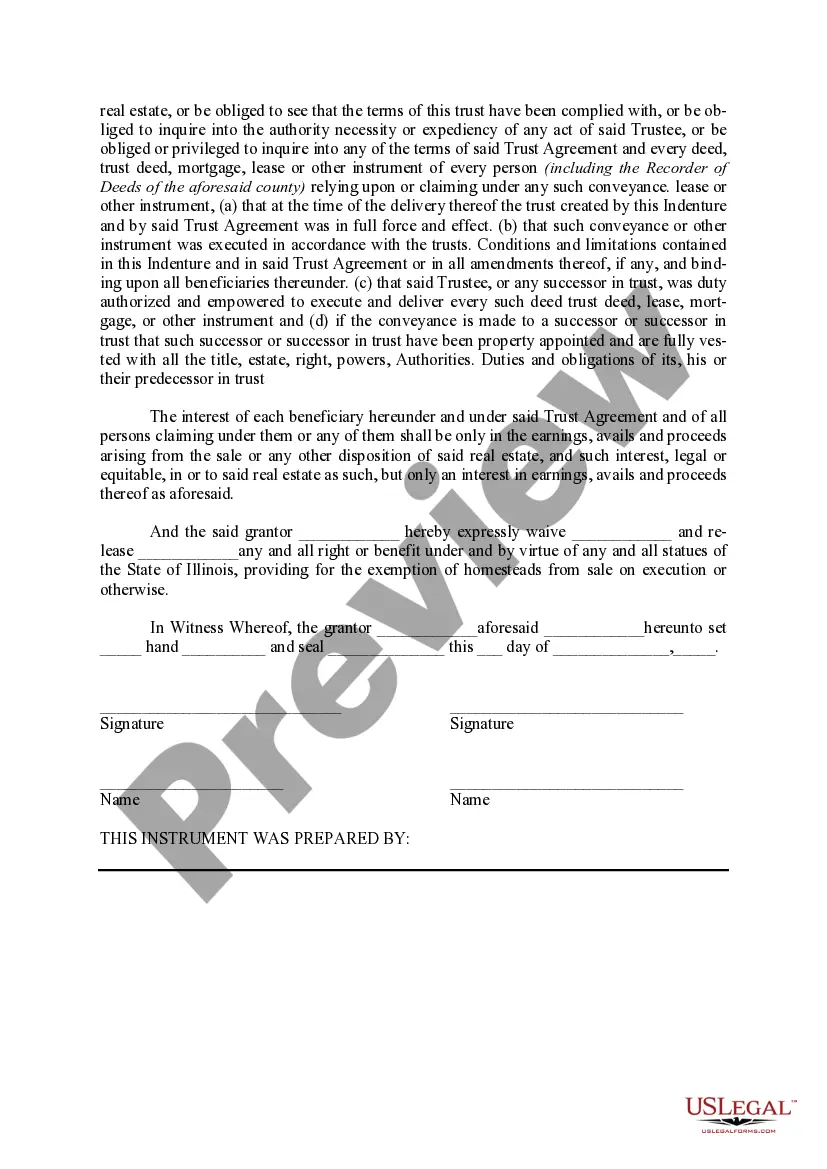

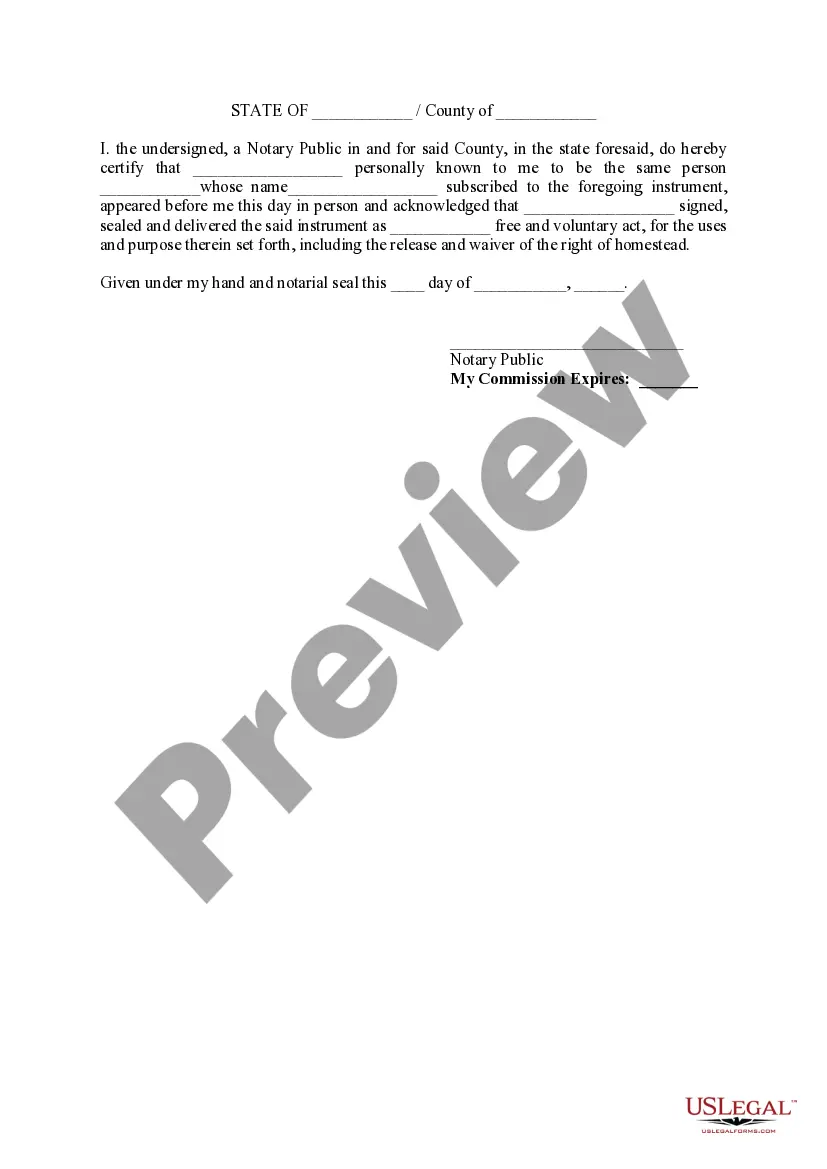

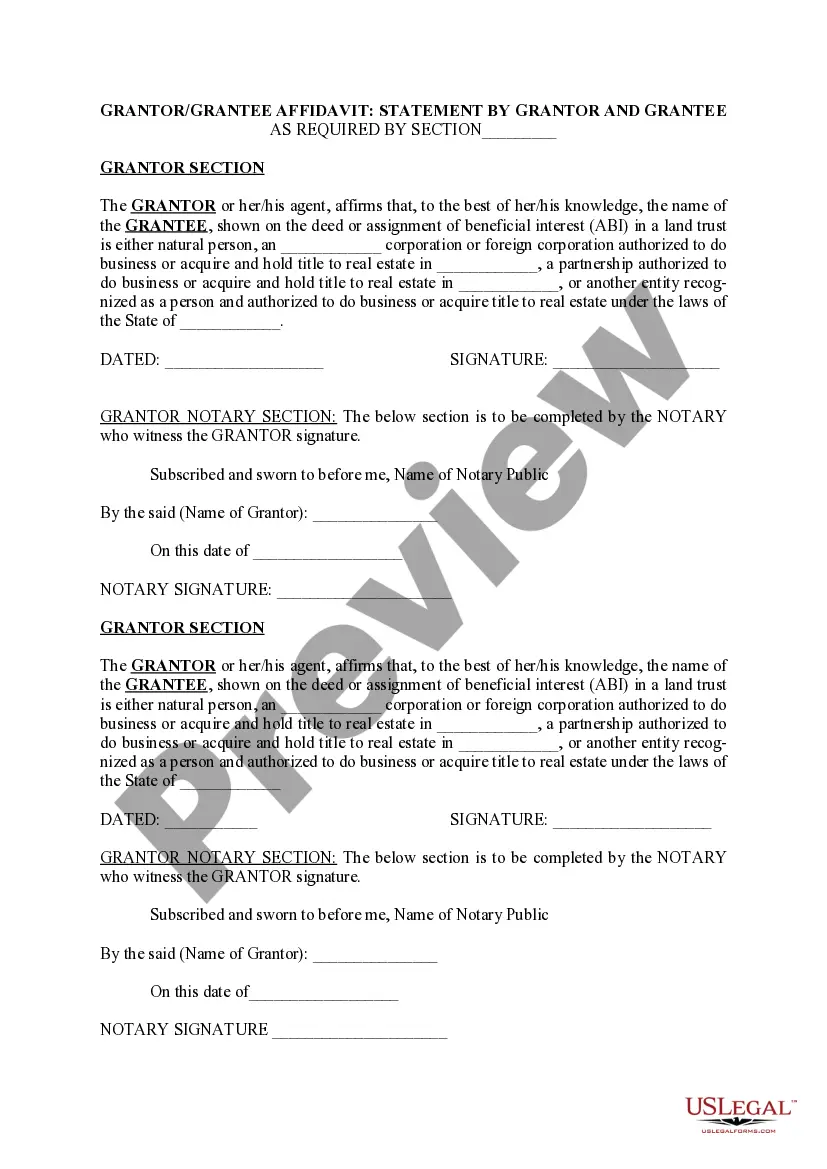

To record a quit claim deed in Cook County, you should first complete the deed form correctly. Then, take the signed document to the Cook County Recorder's Office, along with any required fees. Once filed, your Cook Illinois Quit Claim Deed in Trust will be officially recorded, solidifying the transfer of property and making it a public record, which helps ensure clarity in ownership.

One primary disadvantage of a quitclaim deed is that it does not guarantee clear ownership of the property. It simply transfers whatever interest the grantor has, which can sometimes lead to issues if the title has claims against it. When using a Cook Illinois Quit Claim Deed in Trust, it's essential to ensure all parties understand their rights and the implications of such a transfer to avoid future disputes.

Deciding between gifting a house or placing it in a trust depends on your personal circumstances. A trust can offer more control and can help avoid probate, while gifting a house may incur tax implications or affect Medicaid eligibility. Utilizing a Cook Illinois Quit Claim Deed in Trust allows for a seamless transfer of property while maintaining certain protections, making it a viable option for many.

While placing property in a trust has many benefits, there are some disadvantages to consider. These include potential administrative costs and the loss of direct control over the asset. With a Cook Illinois Quit Claim Deed in Trust, you may face complexities during the transfer process. Additionally, it might not protect the property from creditors, so be sure to evaluate your specific needs.

Filling out an Illinois quit claim deed requires careful attention to detail. First, identify the grantor and grantee clearly, along with the property's legal description. When using a Cook Illinois Quit Claim Deed in Trust, specify the trust name as the grantee accurately. Once completed, ensure signatures are notarized before submission to the appropriate office.

To quit claim a property to a trust, you first need to create the trust document. After that, prepare a Cook Illinois Quit Claim Deed in Trust form, filling in the necessary details about the property and the trust. Finally, sign the deed and file it with the Cook County Recorder's Office, ensuring that your property is now held within the trust for your intended beneficiaries.

Individuals looking to transfer property ownership without a lot of legal hurdles often benefit the most from a quitclaim deed. This document allows family members or friends to quickly transfer property interests. Specifically, a Cook Illinois Quit Claim Deed in Trust can simplify the process when creating family trusts or estate plans. Therefore, it's perfect for those wanting to manage real estate with ease.

You can obtain a copy of your quit claim deed at the county recorder's office where the deed was filed. Alternatively, many counties offer online access to property records, making it easier to retrieve your Cook Illinois Quit Claim Deed in Trust. If you find the process challenging, using a trusted service like US Legal Forms can streamline it for you. This ensures you have all necessary documentation at your fingertips.

To obtain a copy of your house deed in Texas, visit the county clerk’s office where your property resides. They maintain all property records, including quit claim deeds. If you're looking for a simple way to access this information, you can also utilize online services like US Legal Forms. They can assist you in getting a copy of your Cook Illinois Quit Claim Deed in Trust or related documents effortlessly.

A quit claim deed in Texas remains valid as long as it is properly executed and recorded. These deeds transfer ownership without any guarantees, but once filed, the transfer is generally effective immediately. It's important to keep a copy of your Cook Illinois Quit Claim Deed in Trust or any similar document for your records. Always check with local law for any specific requirements or changes.